Education Smart Display Market

Education Smart Display Market Size, Share & Trends Analysis Report by Product Type (Whiteboards, Video Call, Flat Panels, and Projector), by Display Technology (LCD, LED, and OLED), by Display Size (Small (Below 50 inches), Medium (50-70 inches), and Large (Above 70 inches)), and by Application (Classroom Teaching, Distance Learning, and Interactive Presentations) Forecast Period (2024-2031)

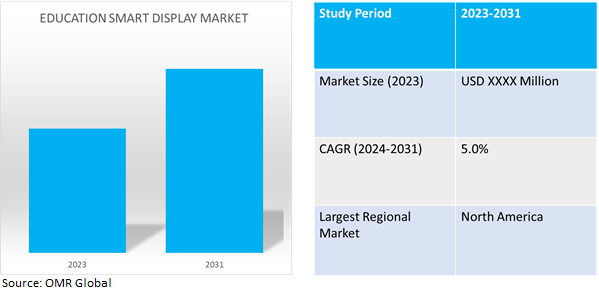

Education smart display market is anticipated to grow at a CAGR of 5.0% during the forecast period (2024-2031). The global education smart display market refers to the collective industry focused on interactive display systems designed for educational purposes. These displays incorporate advanced technologies to enhance teaching and learning experiences in classrooms and educational institutions worldwide.

Market Dynamics

Growing technological advancements

The continuous evolution of technology is a significant driver for the global education smart display market. The integration of advanced features, such as augmented reality and artificial intelligence, enhances the interactive learning experience, driving the demand for smart displays in educational institutions. Governments are investing in technology integration in education through various initiatives and funding programs, including grants, subsidies, and tax incentives for educational institutions. For instance, in October 2023, Bareilly became the first district of India to grant access to smart classrooms in all government schools. According to the official spokesman, the district boasts a total of 2,546 government schools, including 2,483 basic department schools and 63 government inter-colleges, all of which now have access to smart classes.

A rise in collaborative learning systems to drive the market

Globally, collaborative learning is a key driver of growth in the education smart display market, revolutionizing traditional classroom dynamics. Smart displays facilitate collaborative learning by enabling interactive group activities, real-time sharing of ideas, and simultaneous access to educational content. With features like touchscreen capabilities, digital whiteboarding, and multi-user support, smart displays encourage active participation and engagement among students. Collaborative learning fosters communication skills, teamwork, and critical thinking as students collaborate on projects, solve problems, and exchange knowledge. For instance, in January 2024, Sharp introduces the PN-LA series, the latest advancement in the AQUOS BOARD interactive display line. Combining a sleek design with high-performance touch capabilities, these displays prioritize IT security while offering flexibility. Packed with integrated software like Windows 11 Pro, SHARP Pen Software, and Sharp Touch Viewer, the PN-LA series ensures a versatile collaboration experience.

Market Segmentation

Our in-depth analysis of the global education smart display market includes the following segments by type, product, and technology:

- Based on product type, the market is sub-segmented into whiteboards, video calls, flat panels, and projectors.

- Based on display technology, the market is bifurcated into LCD, LED, and OLED.

- Based on display size, the market is augmented into small (below 50 inches), medium (50-70 inches), and large (above 70 inches).

- Based on application, the market is sub-segmented into classroom teaching, distance learning, and interactive presentations.

Whiteboards is Projected to Emerge as the Largest Segment

Based on the product type, the global education smart display market is sub-segmented into whiteboards, video calls, flat panels, and projectors. Among these, the whiteboards sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth is that it provides teachers with a versatile platform to present dynamic lessons, incorporating animations, videos, diagrams, and real-time content from the internet. This flexibility allows teachers to tailor their instruction to different learning styles and adapt to students' needs, creating a more personalized learning environment. LCD technology, used in interactive whiteboards, offers remote learning, annotation sharing, and accessibility, making it a practical choice for educational institutions with budget constraints.

LCD Sub-segment to Hold a Considerable Market Share

LCD technology has been a major contributor to the market growth, primarily due to affordability, durability, and versatility. A greater spectrum of educational institutions may afford LCD screens due to their huge cost reductions as compared to alternative solutions such as OLED. Their sturdy design ensures long-lasting use even under the rigors of classroom use. Regardless of the hardware selected, LCD smoothly integrates with various touch technologies, including capacitive and resistive, guaranteeing a responsive and fluid user experience. Without being constrained by technology constraints, this flexibility enables schools to select the solution that best suits their requirements and financial constraints. LCD-based displays can easily accommodate new features like sophisticated screen sharing, gesture recognition, and voice control, keeping educational smart displays at the forefront of learning technology. LCD panels are becoming even more appealing because of new developments like energy-efficient illumination and better color reproduction, guaranteeing a sustainable and visually engaging learning experience.

Regional Outlook

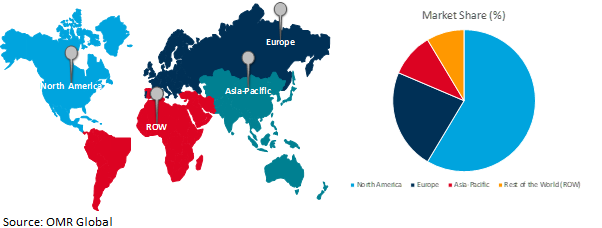

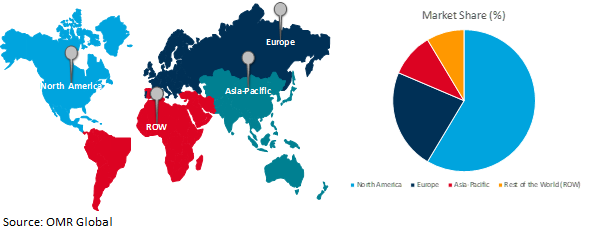

The global education smart display market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in education smart display

- China is the key investor and user of smart displays even the government is increasing investment in education

- South Korea has the presence of key manufacturers like Samsung, Sharp Corporation, and Panasonic leading to increased investment.

Global Education Smart Display Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rising EdTech investments and the increasing adoption of digital learning solutions. Government initiatives like the E-Rate program and state grants provide crucial funding while growing EdTech investments from private entities further fuel market growth. The rising emphasis on personalized learning creates a fertile ground for smart displays integrating Artificial Intelligence (Al) powered features that cater to individual student needs. Furthermore, collaborative learning strategies are gaining traction, perfectly aligning with smart display's ability to facilitate group projects and real-time feedback. This shift aligns with the digital transformation sweeping through U.S. schools, where smart displays bridge the gap between traditional and digital learning environments.

For instance, in July 2023, Newline Interactive U.S.-based company introduced the DV Series, a large-format Direct View LED display available in sizes 120", 150", and 180". With a sleek bezel-less design and lightweight structure, this all-in-one display integrates power supplies, speakers, and control systems, streamlining installation and reducing maintenance. The DV Series guarantees unparalleled visual performance, making it a standout choice for impactful displays in diverse settings.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global education smart display market include Samsung Electronics, Sony Corporation, Panasonic Holdings Corporation, Senses Electronics Pvt. Ltd., and Teachmint Application, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in November 2023, SMART Technologies revealed the long-awaited SMART Board RX series interactive display, presenting a groundbreaking solution to elevate interactive learning in educational settings. Featuring customizable tools and a dedicated emphasis on accessibility, this cutting-edge display aims to empower both educators and students

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global education smart display market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Panasonic Holdings Corporation

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Samsung Electronics

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sony Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Education Smart Display Market by Product Type

4.1.1. Whiteboards

4.1.2. Video Call

4.1.3. Flat Panels

4.1.4. Projector

4.2. Global Education Smart Display Market by Display Technology

4.2.1. LCD

4.2.2. LED

4.2.3. OLED

4.3. Global Education Smart Display Market by Display Size

4.3.1. Small (Below 50 inches)

4.3.2. Medium (50-70 inches)

4.3.3. Large (Above 70 inches)

4.4. Global Education Smart Display Market by Application

4.4.1. Classroom Teaching

4.4.2. Distance Learning

4.4.3. Interactive Presentations

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Barco NV

6.2. BenQ Corporation

6.3. CYBERNETYX Group

6.4. Christie Digital Systems Canada Inc.

6.5. GLOBUS Infocom Limited

6.6. LG Electronics Inc.

6.7. Newline Interactive Inc.

6.8. Optoma Group

6.9. Primeview Global

6.10. Promethean Limited.

6.11. Sharp NEC Display Solutions

6.12. SMART Technologies

6.13. Smartboards.Com

6.14. Senses Electronics Pvt. Ltd.,

6.15. Teachmint Application

6.16. ViewSonic

1. GLOBAL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL WHITEBOARDS IN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL VIDEO CALL IN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FLAT PANELS IN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PROJECTOR IN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY TECHNOLOGY, 2023-2031 ($ MILLION)

7. GLOBAL EDUCATION SMART DISPLAY FOR LED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL EDUCATION SMART DISPLAY FOR LCD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL EDUCATION SMART DISPLAY FOR OLED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY SIZE, 2023-2031 ($ MILLION)

11. GLOBAL SMALL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL MEDIUM EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL LARGE EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. GLOBAL EDUCATION SMART DISPLAY FOR CLASSROOM TEACHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL EDUCATION SMART DISPLAY FOR DISTANCE LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL EDUCATION SMART DISPLAY FOR INTERACTIVE PRESENTATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY TECHNOLOGY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY SIZE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY TECHNOLOGY, 2023-2031 ($ MILLION)

27. EUROPEAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY SIZE, 2023-2031 ($ MILLION)

28. EUROPEAN EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY TECHNOLOGY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY SIZE, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

36. REST OF THE WORLD EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY TECHNOLOGY, 2023-2031 ($ MILLION)

37. REST OF THE WORLD EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY DISPLAY SIZE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD EDUCATION SMART DISPLAY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL EDUCATION SMART DISPLAY MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL WHITEBOARDS IN EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL VIDEO CALL IN EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FLAT PANELS IN EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PROJECTOR IN EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL EDUCATION SMART DISPLAY MARKET SHARE BY DISPLAY TECHNOLOGY, 2023 VS 2031 (%)

7. GLOBAL EDUCATION SMART DISPLAY FOR LED MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL EDUCATION SMART DISPLAY FOR LCD MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL EDUCATION SMART DISPLAY FOR OLED MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL EDUCATION SMART DISPLAY MARKET SHARE BY DISPLAY SIZE, 2023 VS 2031 (%)

11. GLOBAL SMALL EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL MEDIUM EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL LARGE EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL EDUCATION SMART DISPLAY MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

15. GLOBAL EDUCATION SMART DISPLAY FOR CLASSROOM TEACHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL EDUCATION SMART DISPLAY FOR DISTANCE LEARNING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL EDUCATION SMART DISPLAY FOR INTERACTIVE PRESENTATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL EDUCATION SMART DISPLAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

21. UK EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)

33. MIDDLE EAST AND AFRICA EDUCATION SMART DISPLAY MARKET SIZE, 2023-2031 ($ MILLION)