Electric Enclosure Market

Global Electric Enclosure Market Size, Share & Trends Analysis Report, By Material (Metallic and Non-Metallic), By Vertical (Energy and Utilities, Industrial, IT and Telecommunication, Process Industries, and Other) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global electric enclosure market is estimated to grow at a CAGR of 4.8% during the forecast period. Some pivotal factors encouraging market growth include the rising industrialization across the globe and increasing adoption in the renewable energy sector. With the decline in costs associated with renewable energy, the alternative energy industry is witnessing rapid growth. Business owners and consumers are shifting towards renewable energy sources in the form of wind, solar, hydropower, and other renewable sources. With the rising importance of alternative energy, it is required that design engineers offer safe and reliable protection for the advanced electrical components that are utilized to operate solar panels and wind turbines.

Solar power plants consist of several electrical equipment that must be protected ranging from solar power inverters to switchboards. Therefore, electrical enclosures are required to ensure the suitable operation of equipment. The enclosures must be durable to resist weather hazards, temperature extremes, UV radiation, and potential sea spray from coastal settings. For solar power plants, outdoor electronic enclosures are primarily used, more particularly, non-metallic enclosures. Non-metallic enclosures are designed from materials including polycarbonate, durable plastic that offers a comprehensive range of benefits that make them ideal for solar power applications.

Plastic enclosures are corrosion-resistant, lightweight, durable, affordable, and easily modified to fulfill the particular design requirements for solar power applications. A waterproof and weatherproof enclosure is ideally suited for solar power applications, as it offers required protection against UV radiation protection, rain, sleet, and snow. Further, NEMA 6P-rated enclosures can be submerged in water and are water-resistant, which makes them an ideal choice for hydropower facilities. NEMA 6P-rated enclosure is watertight which makes it appropriate for the protection of valuable electrical equipment and maintains operations running at peak efficiency.

Market Segmentation

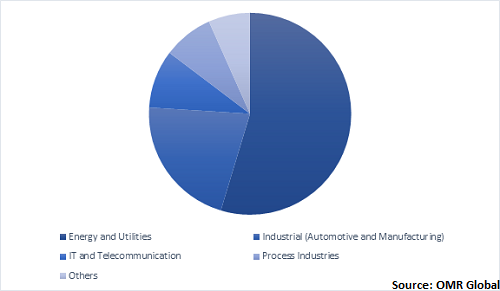

The market is segmented based on material and vertical. Based on material, the market is classified into metallic and non-metallic. Based on vertical, the market is classified into energy and utilities, industrial, it and telecommunication, process industries, and others.

Energy and Utilities to Witness Potential Share in the Vertical Segment

Electrical enclosure is utilized for the protection of electrical equipment including power distribution systems, power generators, transmitters, and other electrical equipment. Transmitters, power distribution systems and power generators utilize electrical enclosures. The enclosures are used as a cabinet for mounting switches, displays, and knobs and to protect the equipment from several environmental changes as well as to prevent electric shock. In a biomass plant, electric enclosures add a degree of protection against harsh chemicals. The wind/solar enclosure has one major objective which is to protect the batteries from the external environment. Storage enclosures are situated in potentially harsh settings, the design must support easy access to components and batteries while protecting the contents from weather.

Global Electric Enclosure Market Share by Vertical, 2019 (%)

Regional Analysis

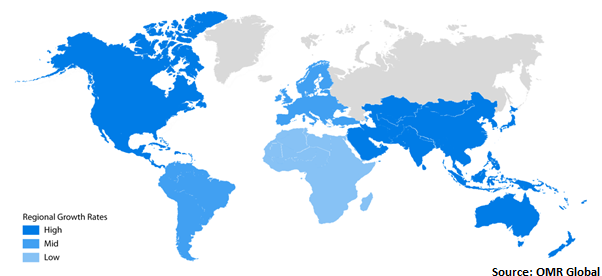

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America is anticipated to hold a potential share in the market owing to the rising industrial automation and increasing developments in power infrastructure. North American manufacturers are adopting large-scale automation, connectivity, and human-robot collaboration to push forward the concept of Industry 4.0. Enclosures aim to protect electronic control and electrical systems. Therefore, rising industrial automation could significantly drive market growth in the region. However, Asia-Pacific is estimated to grow at the fastest CAGR during the forecast period owing to the rising industrialization and growing energy and power industry in the region.

Global Electric Enclosure Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include ABB Ltd., Schneider Electric SE, Legrand SA, Rittal GmbH & Co. KG, and Hubbell Inc. Mergers and acquisitions and partnerships and collaborations are considered as some vital strategies adopted by the market players to expand their share in the marketplace. For instance, in September 2019, nVent Electric plc declared the acquisition of Eldon Holding AB, a European-based enclosures business. nVent offers advanced solutions for protection, connection, and management of heat in and communication equipment, critical electronics, and control and power through its nVent SCHROFF and nVent HOFFMAN brands. The acquisition of Eldon complements the nVent enclosures business. nVent has been concentrated on reinforcing its digital capabilities to serve customers with a velocity which aligns very well with this strategy.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric enclosure market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Schneider Electric SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Legrand SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Rittal GmbH & Co. KG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hubbell Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Electric Enclosure Market by Material

5.1.1. Metallic

5.1.2. Non-Metallic

5.2. Global Electric Enclosure Market by Vertical

5.2.1. Energy and Utilities

5.2.2. Industrial (Automotive and Manufacturing)

5.2.3. IT and Telecommunication

5.2.4. Process Industries

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Adalet/Scott Fetzer Co.

7.3. Allied Moulded Products, Inc.

7.4. Austin Electrical Enclosures

7.5. AZZ, Inc.

7.6. Eaton Corp.

7.7. Emerson Electric Co.

7.8. Fibox Oy Ab

7.9. Hammond Manufacturing, Ltd.

7.10. Hubbell, Inc.

7.11. Klassen Custom Fabrication, Inc.

7.12. Legrand SA

7.13. Leviton Manufacturing, Ltd.

7.14. nVent Electric plc

7.15. OMEGA Engineering Inc.

7.16. Pentair plc

7.17. Rittal GmbH & Co. KG

7.18. Saginaw Control and Engineering

7.19. Schneider Electric SE

7.20. Socomec Group

1. GLOBAL ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL METALLIC ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL NON-METALLIC ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

5. GLOBAL ELECTRIC ENCLOSURE IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ELECTRIC ENCLOSURE IN ENERGY AND UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ELECTRIC ENCLOSURE IN IT AND TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ELECTRIC ENCLOSURE IN PROCESS INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ELECTRIC ENCLOSURE IN OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

14. EUROPEAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

16. EUROPEAN ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

20. REST OF THE WORLD ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL ELECTRIC ENCLOSURE MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL ELECTRIC ENCLOSURE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019 VS 2026 (%)

3. GLOBAL ELECTRIC ENCLOSURE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ELECTRIC ENCLOSURE MARKET SIZE, 2019-2026 ($ MILLION)