Electric Fuse Market

Electric Fuse Market by Type (Cartridge & Plug Fuse, Power Fuse & Fuse Link, Distribution Cut-outs), by Voltage (Low Voltage and High Voltage), by End-User (Industrial, Residential, Commercial, Transportation, and Others) – Industry Size, Share, Global Trends, Competitive Analysis and Forecast, 2019 to 2025

Electric fuse market has significant market size owing to its application as a safety device in an electrical circuit. It is used as a prot`The flow of high current through a wire for which it is not designed and manufactured can cause heating, melting or burning which can lead to severe accidents of fire. In order to avoid such condition, an electrical fuse is used in the circuit. The electric fuse is used to maintain the electrical circuit at the desired current level. Whenever the current gets higher than the allowed the fuse to get melts and breaks the connection and saves the whole circuit. The major factors which are driving the electric fuse market are increasing infrastructural development and rising demand for luxurious vehicles. Infrastructural development at residential places, commercial places as well as utilities will augment the need for electric equipment directly and so electric fuses. Rising usage of luxurious products in the vehicles are also rising the need for electrical equipment in a vehicle. At present, 30% of the whole cost of vehicles is associated with the electronics equipment. High adoption of the smart grid is also expected to augment the market. However, fast adoption of the circuit breaker is hampering the growth of the market during the forecast period.

Segmental Outlook

An electric fuse can be AC fuse and DC fuse. The global electric fuse market is segmented on the basis of type, voltage, and end-user. By type, the market has been segmented into cartridge & plug fuse, power fuse & fuse link, and distribution cut-outs. It is estimated that the distribution cutout is expected to show a significant growth rate during the forecast period. By voltage, the market is segmented into low voltage and high voltage electric fuse. Low voltage fuses mainly involve cartridge type, liquid type HRC, expulsion type fuse. A low voltage fuse includes cartridge type fuse, Drop out fuse, rewireable type fuse and switch fuse.

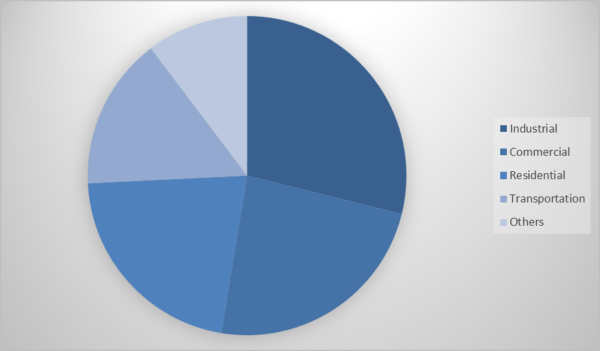

Global Electric Fuses Market Share by End-User, 2018 (%)

By end-user market, Transportation segment is expected to be fastest in the global electric fuses market

By end-user, the market is segmented into industrial, residential, commercial, transportation, and others. It is expected that the transportation sector is expected to show lucrative growth during the forecast period. It is due to the continuously rising demand for the luxurious features in the vehicle which include automatic gearing system, electronic stability system, a navigation system, and so on. Rising electronic equipment in the vehicles will augment the electronic product market and hence electric fuse industry. Vehicle sales are on the rise continuously and especially high-end cars. As per the International Organization of Motor Vehicle Manufacturers, in 2017, more than 96.8 million were sold globally as compared to 93.9 million in 2016 with a growth of 3.1% year-on-year basis. Rising trend of an electric vehicle is expected to contribute significantly in the market.

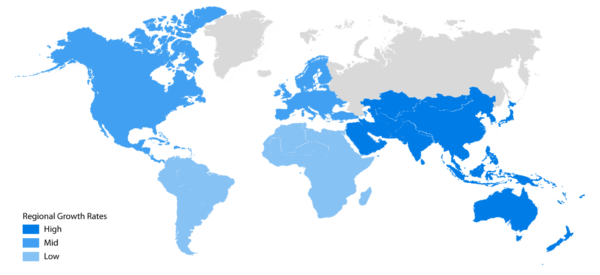

Regional Outlook

The global electric fuse market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is expected to have a significant share due to huge investment in infrastructure, especially in the commercial sector. There is significant market share in the Europe attributed to high adoption of the advanced power grid and strict government regulation. Further, African countries are also expected to have a considerable growth in the market due to continuous infrastructure development in the region.

Global Electric Fuse Market Growth, by Region 2019-2025

Asia-Pacific shows lucrative growth in market

It is expected that the Asia-Pacific is expected to grow significantly market during the forecast period. Major countries which will contribute to the market in the Asia Pacific are China, India, and Japan. Continues development toward the availability of electricity due to infrastructural development is one of the major factors rising demand for an electric fuse in the region. The automotive market is also expected to grow at a significant rate in this region which will further propel the growth of the market in the region. Other populous countries such as Indonesia and Bangladesh will also provide a significant market in the region.

Market Players Outlook

The major players that contribute to the growth of the global electric fuses market include ABB Ltd., Bel Fuse Inc., Eaton Corp., G&W Electric Co., Hubbell Inc., Legrand SA, Littelfuse, Inc., Mersen Corporate Services SAS, S&C Electric Company, Schneider Electric SE, Schurter, Inc., and Siemens AG. These market players are contributing to the market by adopting various market approaches which include merger and acquisition, partnership with government, innovate techniques for infrastructure development in order to gain a strong position in the market.

Recent Activities

- In January 2019, Mersen Corporate Services SAS has launched new Modulostar fuse-disconnector for applications with power cylindrical low voltage fuses. The product is simpler, compact and robust as compared to their earlier products.

- In December 2018, Schurter Inc. has extended its product portfolio of the SHF 6.3×32 Series Ceramic Fuses. The company now offers in 19 rated currents ranging from 500 mA to 32 A. The new included current rating are 500 mA, 630 mA, and 800 mA versions.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global electric fuse market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB, Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Mersen France La Mure SAS

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Littelfuse, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Eaton Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Bel Fuse, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Electric Fuse Market by Type

5.1.1. Cartridge & Plug Fuse

5.1.2. Power Fuse & Fuse Link

5.1.3. Distribution Cut-outs

5.2. Global Electric Fuse Market by Voltage

5.2.1. Low Voltage

5.2.2. High Voltage

5.3. Global Electric Fuse Market by End-User

5.3.1. Industrial

5.3.2. Residential

5.3.3. Commercial

5.3.4. Transportation

5.3.5. Others (Military)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB, Ltd.

7.2. Bel Fuse, Inc.

7.3. Eaton Corp.

7.4. Fusepro Corp.

7.5. G&W Electric Co.

7.6. Havells India, Ltd.

7.7. Hubbell Inc.

7.8. Legrand SA

7.9. Littelfuse, Inc.

7.10. Mersen Corporate Services SAS

7.11. Mitsubishi Electric Corp.

7.12. Panasonic Electronic Devices Co., Ltd.

7.13. Polytronics Technology Corp.

7.14. S&C Electric Co.

7.15. Schneider Electric SE

7.16. SCHURTER Holding AG

7.17. Siemens AG

7.18. SOC Corp.

7.19. TE Connectivity, Ltd.

7.20. ZheJiang Zhiguang Fuse Co., Ltd.

1. GLOBAL ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY TYPE 2018-2025 ($ MILLION)

2. GLOBAL CARTRIDGE & PLUG FUSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL POWER FUSE & FUSE LINK MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DISTRIBUTION CUT-OUTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY VOLTAGE 2018-2025 ($ MILLION)

6. GLOBAL LOW VOLTAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL HIGH VOLTAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY END-USER 2018 -2025 ($ MILLION)

9. GLOBAL INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. NORTH AMERICAN ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. NORTH AMERICAN ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2018-2025 ($ MILLION)

17. NORTH AMERICAN ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

18. EUROPE ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. EUROPE ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. EUROPE ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2018-2025 ($ MILLION)

21. EUROPE ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

22. ASIA PACIFIC ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. ASIA PACIFIC ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

24. ASIA PACIFIC ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2018-2025 ($ MILLION)

25. ASIA PACIFIC ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

26. REST OF WORLD ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

27. REST OF WORLD ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2018-2025 ($ MILLION)

28. REST OF WORLD ELECTRIC FUSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL ELECTRIC FUSE MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL ELECTRIC FUSE MARKET SHARE BY VOLTAGE, 2018 VS 2025 (%)

3. GLOBAL ELECTRIC FUSE MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL ELECTRIC FUSE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ELECTRIC FUSE MARKET SIZE, 2018-2025 ($ MILLION)