Embedded Processor Market

Global Embedded Processor Market Size, Share & Trends Analysis Report by Type (Microprocessor, Micro-Controller, Digital Signal Processor, Embedded FPGA, Others) by Application (Batteries, Surveillance, Communication, Infrastructure, Digital Signage, Others) by End-User (Consumer Electronics, Automotive & Transportation, Industrial, Healthcare, IT & Telecom, Aerospace & Defense, Others) Forecast period (2021-2027) Update Available - Forecast 2025-2035

The global embedded processor market is anticipated to exhibit significant CAGR of 7.4% during the forecast period (2021-2027). The growing technological advancement in processor technology to make them more compact and reliable along with the tremendous growth in the consumer electronics, healthcare, and IT & telecom industries is driving global embedded processor market. In August 2021, Concurrent Technologies had introduced the TR K9x/6sd-RCx 3U VPX plug-in card (PIC) designed in alignment with the Sensor Open Systems Architecture (SOSA) Technical Standard. TR K9x/6sd-RCx embedded computing system is based on an 11th Gen Intel Core processor which has as many as four CPU cores mated with 16 gigabytes of soldered DDR4 DRAM with in-band error correction code for high-performance general-purpose compute tasks. Such advancements in embedded systems is further driving the global market.

Impact of COVID-19 pandemic on embedded processor industry

The COVID-19 outbreak has disrupted the supply chain of the global embedded processor industry. The pandemic has stapled the global embedded processor industry from suppressing demand to hitting the production of parts and subsystems. The governments of several nations have implemented partial or full nationwide lockdown which forced companies to suspend their production. Asian countries such as China, India, Thailand, Taiwan, and Philippines homes a significant amount of contract electronic manufacturers that cater to a wide range of OEMs globally.

The adverse impact of COVID-19 on these economies is likely to impact the production ability of these manufacturers, giving rise to a substantial decline in the supply of components. Several US, European, and Asian-based consumer electronics manufacturers rely on semi-finished products from China in order to produce finished good in their factories. Delays in such products result in the delay of production of finished goods which ultimately leads to lower capital utilization rates, higher average cost, and suboptimal financial performance.

Segmental Outlook

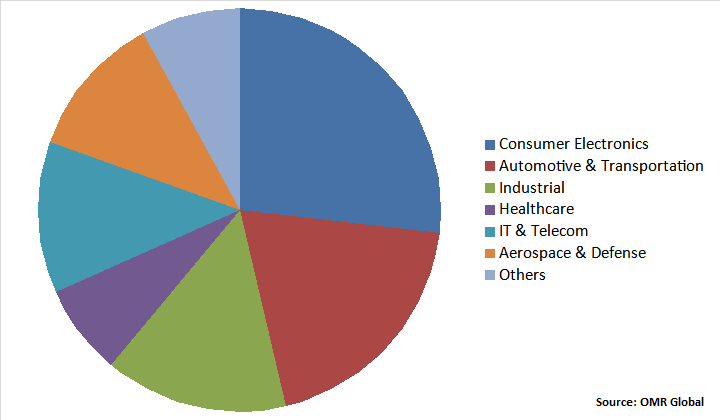

The embedded processor market is segmented on the basis of type, application, and end-user. Based on type, the embedded processor market is segmented into microprocessor, micro-controller, digital signal processor, embedded FPGA, and others. Based on application, the embedded processor market is segmented into batteries, surveillance, communication, infrastructure, digital signage, and others. Based on end-user, the market is segmented into consumer electronics, automotive & transportation, industrial, healthcare, IT& telecom, aerospace & defense, and others.

Consumer Electronics held Considerable Share based on End-user

The rising smartphone penetration, emergence of 5G technology, and growing trend for wearables across the globe, especially among the millennials and tech savvy consumers has accelerated the demand for consumer electronics. The embedded processors are the core part of consumer electronics; therefore the growing market for the consumer electronics across the globe is making huge contribution to the growth of this market segment.

Global Embedded Processor Market Share by End-User, 2020 (%)

Regional Outlook

The global embedded processor market is further segmented on the basis of geography including North America, Europe, Asia-Pacific and Rest of the World. North America is anticipated to hold a considerable market share during the forecast period. Presence of advanced IT infrastructure, increase in number of end-user verticals for the embedded processors is the major factor attributing towards the market share of the region. Further, the presence of key market players in the region is making considerable contribution to the market share. The developed automobile industry of the region is further expected to flourish the growth of the embedded processor market in the region.

Global Embedded Processor Market Growth, by Region 2021-2027

Asia-Pacific will augment With the Significant Growth Rate in the Embedded Processor Market

The growing presence of end-user industries such as medical, consumer electronics, aerospace & defense among others across the region is a key factor driving the regional market. Rapid investment in the development of novel electronic products along with the availability of major market players such as Samsung Electronics Co. Ltd., are some other prominent factors contributing to the regional market. According to the Federation of Hong Kong Industries, China has the largest consumer electronics manufacturing bases across the globe. Japan is considered as advanced technological hub as it continuously invests in the R&D sector of consumer electronics industry. The significant presence of consumer electronics industry in the region is anticipated to support the growth of the embedded processor market in the region.

Market Players Outlook

The global embedded processor market is characterized by the presence of several market players that are catering to a wide range of customers across the globe. Some of the key vendors of embedded processor include Analog Devices Inc., Broadcom Corp., Infineon Technologies AG, Intel Corp., NXP Semiconductors N.V., Texas Instruments Inc., and so on. The key vendors of the embedded processor are adopting several growth strategies such as mergers & acquisition, collaboration, and partnership, and so on to remain competitive in the embedded processor market.

Recent Development

- In August 2021, Cyberon Corp. collaborated with Andes Technology on the edge-computing voice recognition solution. The strong demand for voice control in wearable devices, home appliances, IoT devices among others has promoted the companies to bring their D25F processor in market. The D25F is the RISC-V RVP-capable processor, and has the most complete ecosystem in development tools, libraries for DSP and neural networks, and audio/voice codec for these applications.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global embedded processor market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Embedded Processor Industry

• Recovery Scenario of Global Embedded Processor Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Impact of COVID on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Embedded Processor Market by Type

5.1.1. Microprocessor

5.1.2. Micro-Controller

5.1.3. Digital Signal Processor

5.1.4. Embedded FPGA

5.1.5. Others

5.2. Global Embedded Processor Market by End-User

5.2.1. Consumer Electronics

5.2.2. Automotive & Transportation

5.2.3. Industrial

5.2.4. Healthcare

5.2.5. IT& Telecom

5.2.6. Aerospace & Defense

5.2.7. Others

5.3. Global Embedded Processor Market by Application

5.3.1. Batteries

5.3.2. Surveillance

5.3.3. Communication

5.3.4. Infrastructure

5.3.5. Digital Signage

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 4D Systems Pty Ltd.

7.2. ADLINK Technology Inc.

7.3. Amulet Technologies, LLC

7.4. Analog Devices Inc.

7.5. Atmel Corp.

7.6. Broadcom Corp.

7.7. Cavium Inc.

7.8. GHI Electronics

7.9. GoodData Corp.

7.10. Infineon Technologies AG

7.11. Intel Corp.

7.12. Marvell Technology Group Ltd.

7.13. Microchip Technology Inc.

7.14. Mocana

7.15. NXP Semiconductors N.V.

7.16. Renesas Electronics Corp.

7.17. ROHM Co., Ltd.

7.18. Semiconductor Components Industries, LLC

7.19. STMicroelectronics

7.20. Texas Instruments Inc.

7.21. Xilinx, Inc.

1. GLOBAL EMBEDDED PROCESSOR MARKET BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL EMBEDDED MICROPROCESSOR MARKET BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL EMBEDDED MICRO-CONTROLLER MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL EMBEDDED DIGITAL SIGNAL PROCESSOR MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL EMBEDDED FPGA MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL EMBEDDED OTHER PROCESSOR MARKET BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL EMBEDDED PROCESSOR MARKET BY END-USER, 2020-2027 ($ MILLION)

8. GLOBAL EMBEDDED PROCESSOR FOR CONSUMER ELECTRONICS MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL EMBEDDED PROCESSOR FOR AUTOMOTIVE & TRANSPORTATION MARKET BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL EMBEDDED PROCESSOR FOR INDUSTRIAL MARKET BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL EMBEDDED PROCESSOR FOR HEALTHCRAE MARKET BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL EMBEDDED PROCESSOR FOR IT& TELECOM MARKET BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL EMBEDDED PROCESSOR FOR AEROSPACE & DEFENSE MARKET BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL EMBEDDED PROCESSOR FOR OTHER END-USER MARKET BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL EMBEDDED PROCESSOR MARKET BY APPLICATION, 2020-2027 ($ MILLION)

16. GLOBAL EMBEDDED PROCESSOR FOR BATTERIES MARKET BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL EMBEDDED PROCESSOR FOR SURVEILLANCE MARKET BY REGION, 2020-2027 ($ MILLION)

18. GLOBAL EMBEDDED PROCESSOR FOR COMMUNICATION MARKET BY REGION, 2020-2027 ($ MILLION)

19. GLOBAL EMBEDDED PROCESSOR FOR INFRASTRUCTURE MARKET BY REGION, 2020-2027 ($ MILLION)

20. GLOBAL EMBEDDED PROCESSOR FOR DIGITAL SIGNAGE MARKET BY REGION, 2020-2027 ($ MILLION)

21. GLOBAL EMBEDDED PROCESSOR FOR OTHER APPLICATION MARKET BY REGION, 2020-2027 ($ MILLION)

22. GLOBAL EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

23. NORTH AMERICAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

24. NORTH AMERICAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

25. NORTH AMERICAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

26. NORTH AMERICAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. EUROPEAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

28. EUROPEAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

29. EUROPEAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

30. EUROPEAN EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

31. ASIA-PACIFIC EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

32. ASIA-PACIFIC EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

33. ASIA-PACIFIC EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

34. ASIA-PACIFIC EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

35. REST OF THE WORLD EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

36. REST OF THE WORLD EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

37. REST OF THE WORLD EMBEDDED PROCESSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL EMBEDDED PROCESSOR MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL EMBEDDED PROCESSOR MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL EMBEDDED PROCESSOR MARKET, 2021-2027 (%)

4. GLOBAL EMBEDDED PROCESSOR MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL EMBEDDED PROCESSOR MARKET SHARE BY END-USER, 2020 VS 2027 (%)

6. GLOBAL EMBEDDED PROCESSOR MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

7. GLOBAL EMBEDDED PROCESSOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (%)

8. GLOBAL EMBEDDED PROCESSOR MICROPROCESSOR MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL EMBEDDED PROCESSOR MICRO-CONTROLLER MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL CONSUMER ELECTRONICS MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL AUTOMOTIVE & TRANSPORTATION MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL EMBEDDED PROCESSOR FOR BATTERIES MARKET BY REGION, 2020 VS 2027 (%)

13. GLOBAL EMBEDDED PROCESSOR FOR SURVEILLANCE MARKET BY REGION, 2020 VS 2027 (%)

14. GLOBAL EMBEDDED PROCESSOR FOR COMMUNICATION MARKET BY REGION, 2020 VS 2027 (%)

15. GLOBAL EMBEDDED PROCESSOR FOR INFRASTRUCTURE MARKET BY REGION, 2020 VS 2027 (%)

16. GLOBAL EMBEDDED PROCESSOR FOR DIGITAL SIGNAGE MARKET BY REGION, 2020 VS 2027 (%)

17. GLOBAL EMBEDDED PROCESSOR FOR OTHERS MARKET BY REGION, 2020 VS 2027 (%)

18. US EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

19. CANADA MARKET EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

20. UK EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

23. FRANCE EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF EUROPE EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

26. INDIA EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

27. CHINA EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

28. JAPAN EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OFASIA-PACIFIC EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF WORLD EMBEDDED PROCESSOR MARKET SIZE, 2020-2027 ($ MILLION)