Embedded Security Market

Global Embedded Security Market Size, Share & Trends Analysis Report By Component Type (Hardware, Software, and Service), By Application (Authentication, Payment, Content Protection, Others), By End-User (Automotive, Healthcare, IT & Telecomm, Aerospace & Defense, Consumer Electronics, Others) Forecast Period 2020-2026 Update Available - Forecast 2025-2035

The global embedded security market is projected to grow at a considerable CAGR of around 7% during the forecast period (2020-2026). Embedded security solutions are used to secure embedded systems (programmable hardware) from external cyber threats. The high adoption of the embedded security owing to its offered advantages is a key factor driving its global market. The growing adoption of these systems for different applications in end-user industries is another major factor contributing towards the growth of the global embedded security market. In the consumer electronics industry, DVD players, video game consoles, mobile phones, MP3 players, digital cameras, microwave ovens, and GPS are the key appliances that include embedded systems to offer flexibility and efficiency to these appliances. In 2019, the number of smartphone users in the US was 0.3 million.

The increasing adoption rate of smartphones, laptops, video game consoles, and so on is anticipated to drive the demand of the embedded security market across the globe. In the healthcare industry, embedded systems are used for monitoring vital signs, for amplifying sounds in electronic stethoscopes, and in across every kind of imaging system, including MRIs, PET scans, and CT scans. In the aerospace industry, embedded systems are used in military aircraft for large radar systems. In the IT and Telecomm industry, telecommunications systems employ numerous embedded systems from telephone switches for the network to cell phones at the end-user. However, attack replication, dependability, industrial protocols, and remote deployment of these solutions are some major factors that may restrain the growth of the global embedded security market.

Segmental Outlook

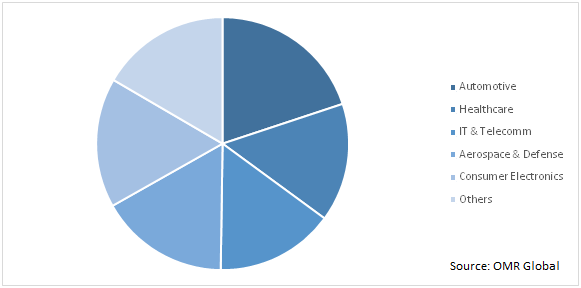

The global embedded security market is classified on the basis of component, application, and end-user. Based on component type, the market is segmented into hardware, software, and service. Hardware is anticipated to hold major market share based on component. The high usage of the hardware in making an embedded security solution is a key factor contributing to the growth of the market segment. Based on the application, the market is segmented into authentication, payment, content protection, others. Authentication is anticipated to hold considerable market share based on the deployment type. Based on end-user, the market is segmented into automotive, healthcare, it & Telecomm, aerospace & defense, consumer electronics, and others.

Automotive to exhibit considerable growth based on end-user

Black box, airbags, drive by wire, adaptive cruise control, anti-lock braking system, telematics, automatic parking, satellite radio, tire pressure monitor, traction control, in-vehicle entertainment system, navigational systems, and backup collision sensors are some of the major elements that make use of the embedded security solution in the automotive industry. The growing automotive industry along with the rapid adoption of new technologies such as advanced driver-assistance systems (ADAS) is anticipated to drive the growth of this market segment. According to Upstream Security's 2020 Global Automotive Cybersecurity info, from 2018 to 2019, there was a 99% increase in automotive cybersecurity incidents. The rising incidence of cyber threats in the industry is anticipated to promote the demand for such solutions in the industry, thereby driving the growth of the market segment.

Global Embedded Security Market Share by End-User, 2019 (%)

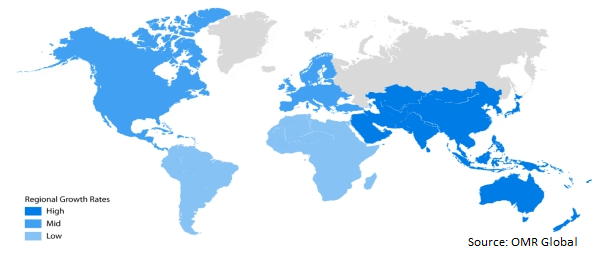

Regional Outlook

The global embedded security market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. North America is anticipated to hold a considerable market share during the forecast period. The presence of advanced IT infrastructure, an increase in the number of end-user verticals for the embedded security solution is the major factor attributing to the market share of the region. Further, the presence of key market players in the region is making a considerable contribution to the market share. The developed automobile industry of the region is further expected to flourish the growth of the embedded security market in the region.

Global Embedded Security Market Growth, by Region 2020-2026

Asia-Pacific to exhibit considerable growth during the forecast period 2020-2026

The presence of end-users in the region is driving the market in the region. Rapid investment in the development of novel electronic products along with the availability of major market players such as Samsung Electronics Co. Ltd. is some of the major factors propelling the growth of the global embedded security market. According to the Federation of Hong Kong Industries, China has the largest consumer electronics manufacturing bases across the globe. Japan is considered an advanced technological hub as it continuously invests in the R&D sector of the consumer electronics industry. The significant presence of the consumer electronics industry in the region is anticipated to support the growth of the embedded security market in the region.

Market Players Outlook

The major players of the embedded security market include Texas Instruments Inc., McAfee, LLC, Microchip Technology Inc., Infineon Technologies AG, Intellias Ltd., Karamba Security Ltd., Samsung Electronics Co., Idemia Group, Rambus Inc., Renesas Electronics Corp., ESCRYPT GmbH, Cisco Systems Inc., and so on. These players are actively adopting different growth strategies such as new product launch, partnerships, collaboration, and mergers and acquisition among others to remain competitive in the market place.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global embedded security market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ESCRYPT GmbH

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cisco Systems Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Texas Instrument, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. McAfee, LLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Infineon Technologies AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Embedded Security Market by Component

5.1.1. Hardware

5.1.2. Software and Service

5.2. Global Embedded Security Market by Application

5.2.1. Authentication

5.2.2. Payment

5.2.3. Content Protection

5.2.4. Others

5.3. Global Embedded Security Market by End-User

5.3.1. Automotive

5.3.2. Healthcare

5.3.3. IT & Telecomm

5.3.4. Aerospace & Defense

5.3.5. Consumer Electronics

5.3.6. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Cisco Systems, Inc.

7.2. ESCRYPT GmbH

7.3. IDEMIA Group

7.4. Infineon Technologies AG

7.5. Intellias, Ltd.

7.6. Karamba Security, Ltd.

7.7. McAfee, LLC

7.8. Microchip Technology, Inc.

7.9. Qualcomm Technologies, Inc.

7.10. Rambus, Inc.

7.11. Renesas Electronics Corp.

7.12. Samsung Electronics Co., Ltd.

7.13. Sectigo, Ltd.

7.14. STMicroelectronics N.V.

7.15. Texas Instruments, Inc.

7.16. Thales Group

1. GLOBAL EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

2. GLOBAL HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL SOFTWARE AND SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

5. GLOBAL AUTHENTICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

9. GLOBAL EMBEDDED SECURITY FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL EMBEDDED SECURITY FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL EMBEDDED SECURITY FOR IT & TELECOMM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL EMBEDDED SECURITY FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL EMBEDDED SECURITY FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL EMBEDDED SECURITY FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

15. NORTH AMERICA EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. NORTH AMERICAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. EUROPEAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPEAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

21. EUROPEAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. EUROPEAN EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. ASIA-PACIFIC EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

27. REST OF THE WORLD EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2019-2026 ($ MILLION)

28. REST OF THE WORLD EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

29. REST OF THE WORLD EMBEDDED SECURITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL EMBEDDED SECURITY MARKET SHARE BY COMPONENT, 2019 VS 2026 (%)

2. GLOBAL EMBEDDED SECURITY MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL EMBEDDED SECURITY MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL EMBEDDED SECURITY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. THE US EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

7. UK EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD EMBEDDED SECURITY MARKET SIZE, 2019-2026 ($ MILLION)