Emollient Market

Global Emollient Market Size, Share & Trends Analysis Report by Application (Skin Care, Hair Care, Cosmetics, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global emollient market is projected to grow at a CAGR of around 5% during the forecast period. Emollients are the ingredients that are present in various personal care products such as skin care, hair care, fragrances among others to provide moist, flexible, and soft skin and hair. These are non-cosmetic moisturizers and are available in the form of creams, lotions, ointments, and gels. In cosmetics, those substances that act as the sebum and lipids in the skin are called emollients. Emollients and moisturizing creams are used to break the dry skin cycle and to maintain the smoothness of the skin.

There are various oily materials used as emollients that have high skin occlusion properties and spread smoothly on the skin. For instance, hydrocarbons such as Vaseline and squalane, natural oils such as triglyceride, fatty acid esters, lanolin and its derivatives, sterol esters, aliphatic higher alcohol, fatty acids, and ceramides are often used as emollients.

The key factors that drive the growth of the global emollients market includes the increased use of personal care products across the globe. Further, the increased awareness among people regarding the use of natural plant and animal-based emollients, that are devoid of chemical modifications is likely to encourage the growth of the market during the forecast period.

Segmental Outlook

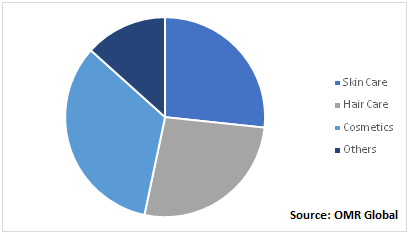

The global emollients market is segmented on the basis of application into skin care, hair care, cosmetics, and others. The increasing awareness of the people regarding harmful effects of chemicals present in cosmetics, skincare, and other personal care products coupled with the increasing shift of the consumer towards plant-derived emollients are driving the growth of the market.

Global Emollient Market by Applications, 2019 (%)

Cosmetics Segment to Significantly contribute to the Market Growth

Amongst the application segment of the market, the cosmetic segment is projected to hold a significant share over the forecast period. The segmental growth of the market is attributed to the increased trends of wellness and rapidly changing lifestyles of the people in developed as well as developing countries. The cosmetics industry is highly fragmented with the presence of a number of different products with different ingredients, such as inorganic/organic/herbal cosmetics. Based on these factors, the cosmetics industry is estimated to grow significantly during the forecast period, which in turn, tends to drive the growth of the emmolient market for cosmetic industry.

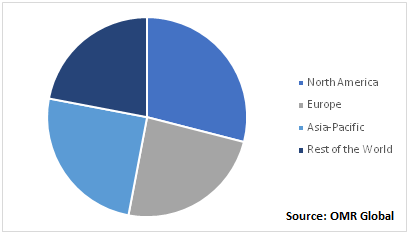

Regional Outlook

The global emollient market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is estimated to grow significantly during the forecast period. The growth of the region is attributed to the high demand for emollients generated by a large number of chemical industries, pharmaceutical industries, and cosmetic industries operating across the economies such as China, India, Japan, Thailand, South Korea, and others. Additionally, the rising trends of spa for skin care and hair care are also likely to boost the market growth in the countries such as Thailand, and Japan. Further, the European region is expected to hold a significant share in the market, owing to the presence of the key cosmetic brands and companies across the region.

Global Emollient Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global emollient market include Ashland Inc., BASF SE, Clariant International Ltd., Croda International Plc, Dow Chemical Co., Eastman Chemical Co., Evonik Industries AG, Lonza Group, Lubrizol Corp., and Solvay SA. These players are adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global emollient market.

For instance, in June 2017, BASF SE opened a new plant for emollients and waxes in Jinshan, Shanghai. The project is BASF’s largest investment in emollients production in Asia-Pacific. It complemented the company’s existing production of wax esters, emulsifiers, and primary surfactant in Jinshan, and further enhanced its local production. With this, the company aimed to better serve the growing personal care market in China and Asia-Pacific.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global emollient market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Emollient Market by Application

5.1.1. Skin Care

5.1.2. Hair Care

5.1.3. Cosmetics

5.1.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AAK Sweden AB

7.2. Ashland Inc.

7.3. BASF SE

7.4. Clariant International Ltd.

7.5. Croda International Plc

7.6. Dow Chemical Co.

7.7. Eastman Chemical Co.

7.8. Ego Pharmaceuticals

7.9. Evonik Industries AG

7.10. Innospec Inc.

7.11. Lonza Group AG

7.12. Lubrizol Corp.

7.13. Oleon NV

7.14. Sasol Ltd.

7.15. Solvay SA

7.16. Stearinerie Dubois

7.17. Stepan Co.

7.18. Vantage Specialty Ingredients, Inc.

1. GLOBAL EMOLLIENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL SKIN CARE EMOLLIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL HAIR CARE EMOLLIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL COSMETICS EMOLLIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER EMOLLIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL EMOLLIENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN EMOLLIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN EMOLLIENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

9. EUROPEAN EMOLLIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. EUROPEAN EMOLLIENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC EMOLLIENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC EMOLLIENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. REST OF THE WORLD EMOLLIENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL EMOLLIENT MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL EMOLLIENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

5. UK EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD EMOLLIENT MARKET SIZE, 2019-2026 ($ MILLION)