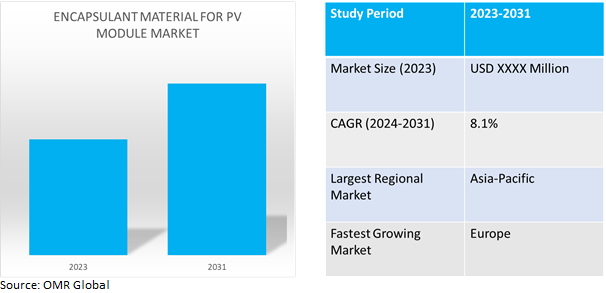

Encapsulant Material for PV Module Market

Encapsulant Material for PV Module Market Size, Share & Trends Analysis Report by Material Type (Ethylene Vinyl Acetate (EVA), Polyvinyl Butyral (PVB), Polyolefins (PO), Silicones, Ethylene Ionomers and Others (Ionomer, Thermoplastic Polyurethane (TPU), Polydimethylsiloxane (PDMS))),by End-use (Commercial, Industrial and Residential), and by Application (Monoficial PV Module and Bifacial PV Module)Forecast Period (2024-2031)

Encapsulant material for PV module market is anticipated to grow at a considerable CAGR of 8.1% during the forecast period (2024-2031).Encapsulation films are essential for safeguarding and guaranteeing the dependability and efficiency of solar cells. Their major job is to keep electrical and optical transmissivity intact and stop moisture from getting inside. Encapsulants are an essential stage in the production of solar cells as they present chances to increase efficiency in the manufacturing process of solar modules.

Market Dynamics

Growing subsidies and solar energy policies

The impact of solar energy policies and subsidies on solar industry is anticipated to be a potential opportunity for the global encapsulant material for PV module market. Encapsulants that shield photovoltaic (PV) modules from the elements and ensure long-term durability are in great demand due to the expanding usage of solar PV panels.It is projected that rising demand will propel market expansion in end-use sectors such as electronics, automotive, and renewable energy.

Increasing use of renewable energy sources

The global market for solar encapsulation is expanding as a result of the increasing use of renewable energy sources to minimize reliance on fossil fuels. In addition, several nations have started or are in the midst of starting programs and initiatives, along with putting various environmental laws into place, to encourage the use of renewable energy, which is fueling the industry's expansion. Since a number of nations have begun to take the lead in developing the solar power industry, and since other nations are expected to follow suit, solar power is expected to account for a sizeable portion of the global energy mix during the projected period. Long-term demand for solar encapsulation materials is therefore anticipated to be driven by this.

Market Segmentation

Our in-depth analysis of the global encapsulant material for PV module market includes the following segments by material type, end-use, and application:

- Based on material type, the market is sub-segmented into ethylene vinyl acetate (EVA), polyvinyl butyral (PVB), polyolefins (PO), silicones, ethylene ionomers and others (ionomer, thermoplastic polyurethane (TPU), polydimethylsiloxane (PDMS)).

- Based on end-use, the market is bifurcated into commercial, industrial and residential.

- Based on application, the market is divided into monoficial PV module and bifacial PV module.

Ethylene Vinyl Acetate (EVA) is Projected to Emerge as the Largest Segment

EVA hold major share in the global market. Currently, more than 80.0% of photovoltaic (PV) modules available today are covered by EVA. Due to its affordable cost and superior optical qualities, EVA is a copolymer that is frequently used to encapsulate solar modules. This thermoplastic polymer is utilized as an encapsulating agent in solar modules because it creates an insulating and sealing coating around the solar cells by heating the assembly. Its strong optical transmission, low water absorption qualities, high electrical resistance, low processing and cross-linking temperatures, superior adhesive capabilities, and high flexibility make it an attractive material utilized in solar modules.

Monoficial PV Module Sub-segment to Hold a Considerable Market Share

Monoficial module holds a considerable market share as producing and installing monofacial modules is less expensive than installing bifacial modules. Lower production costs are a result of the design's simplicity. Dueto their adaptability, monofacial modules have been positioned and oriented in many different ways. They can be used for a variety of purposes as they don't require any particular ground conditions or building configurations in order to capture rear-side sunlight. Monofacial modules simplify design, installation, and maintenance procedures; manufacturers, engineers, and installers have vast expertise with them.

Furthermore, it is simpler to forecast the energy output of monofacial modules and incorporate them into already-existing solar energy systems due to their well-established performance measures and standards. Monofacial modules are frequently used by investors, consumers, and regulatory agencies and have a significant market presence.

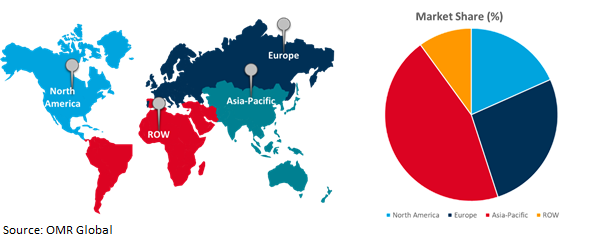

Regional Outlook

The global encapsulant material for PV module market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in solar energies

- Italy is witnessing large investments in solar energy infrastructure due to the country's focus on sustainable development and its attractive government incentives.

- European region has a great development potential due to its rapid adoptionof renewable energy.

Global Encapsulant Material for PV Module Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific is anticipated to have the fastest CAGR during the forecast period and held the largest share in the global market. The rise of solar energy installations in the Asia-Pacific region is being driven by reasons such as the region's growing energy consumption, legislation that are supportive of the industry, and initiatives to reduce carbon emissions. With this rise has come an increase in the needs for encapsulant films to protect and improve the performance of solar panels. Asia-Pacific's developing nations, particularly China, are the world's primary solar panel manufacturers.

Furthermore, the export-focused approach fuels the need for encapsulant films to satisfy both local and global market demands. Solar power and other renewable energy sources are becoming more and more popular as people become more conscious of environmental issues and the need to reduce carbon emissions. The dependability and efficiency of solar installations are guaranteed by encapsulant films. Large sums of money are invested in solar energy infrastructure in the region. As solar projects are built and extended, this investment contributes to the growth of the encapsulant film industry.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global encapsulant material for PV module market include Expafol SLU, Brentwood Private Equity, LLC, Exxon Mobil, Dow Chemical Company, LyondellBasell Industries N.V. and Celanese Corp. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global encapsulant material for PV module market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Brentwood Private Equity LLC.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Expafol SLU

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Exxon Mobil

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Encapsulant Material for PV Module Market by Material Type

4.1.1. Ethylene Vinyl Acetate (EVA)

4.1.2. Polyvinyl Butyral (PVB)

4.1.3. Polyolefins (PO)

4.1.4. Silicones

4.1.5. Ethylene Ionomers

4.1.6. Others (Ionomer, Thermoplastic Polyurethane (TPU), Polydimethylsiloxane (PDMS))

4.2. Global Encapsulant Material for PV Module Market by End-use

4.2.1. Commercial

4.2.2. Industrial

4.2.3. Residential

4.3. Global Encapsulant Material for PV Module Market by Application

4.3.1. Monoficial PV Module

4.3.2. Bifacial PV Module

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Abengoa, S.A.

6.2. Betterial Film Technologies

6.3. Braskem SA

6.4. Celanese Corp.

6.5. Dow Chemical Company

6.6. LyondellBasell Industries N.V.

6.7. Mitsui Chemicals Inc.

6.8. Sumitomo Chemical Co. Ltd.

6.9. Topray Solar

1. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ETHYLENE VINYL ACETATE (EVA) FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL POLYVINYL BUTYRAL (PVB) FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL POLYOLEFINS (PO) FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SILICONES FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ETHYLENE IONOMERS FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHERS MATERIALS FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

9. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR RESIDENTIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR MONOFICIAL PV MODULEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR BIFACIAL PV MODULEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. EUROPEAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

23. EUROPEAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFICENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

26. ASIA-PACIFICENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

27. ASIA-PACIFICENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD ENCAPSULANT MATERIAL FOR PV MODULE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET SHARE BY MATERIAL TYPE, 2023 VS 2031 (%)

2. GLOBAL ETHYLENE VINYL ACETATE (EVA) FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL POLYVINYL BUTYRAL (PVB) FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL POLYOLEFINS (PO) FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SILICONES FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ETHYLENE IONOMERS FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER MATERIALS FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET SHAREBY END-USE, 2023 VS 2031 (%)

9. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR COMMERCIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR INDUSTRIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR RESIDENTIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR MONOFICIAL PV MODULEMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE FOR BIFACIAL PV MODULEMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ENCAPSULANT MATERIAL FOR PV MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

18. UK ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC ENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICAENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICAENCAPSULANT MATERIAL FOR PV MODULE MARKET SIZE, 2023-2031 ($ MILLION)