Esoteric Testing Market

Esoteric Testing Market Size, Share & Trends Analysis Report by Test Type (Infectious Disease Testing, Oncology Testing, Endocrinology Testing, Genetic Testing, Toxicology, Neurology Testing, and Others), By Technology (Enzyme-linked Immunosorbent Assay, Chemiluminescence Immunoassay, Mass Spectrometry, DNA Sequencing, Flow Cytometry, Others), and by End-User (Hospital-based Laboratories and Independent and Reference Laboratories) Forecast Period (2024-2031)

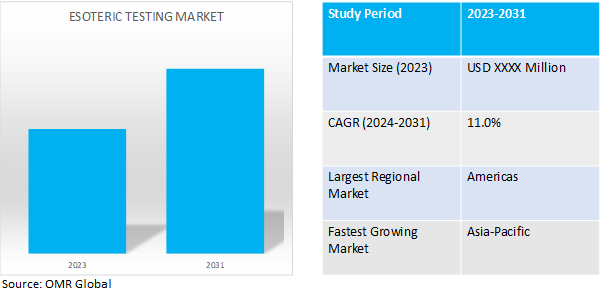

Esoteric testing market is anticipated to grow at a CAGR of 11.0% during the forecast period (2024-2031). Esoteric testing, which analyzes rare molecules or substances, can help diagnose conditions accurately, leading to early intervention, proper treatment, and improved patient outcomes. The esoteric testing market growth is driven by the increasing prevalence of cancer and infectious diseases along with the growing demand for diagnosis of rare diseases to identify complex medical conditions and guide personalized treatment.

Market Dynamics

Growing Innovations in the Diagnostic Industry

Globally, there is a considerable increase in the prevalence of chronic diseases, which in turn spurred growth and innovations in the diagnostic industry. The market has witnessed a significant demand for esoteric testing coupled with growth in research activities contributing to the market growth. For instance, in June 2023, SRL Diagnostics launched a state-of-the-art reference laboratory in Chennai, India. The laboratory is expanded over 20,000 sq ft along with the capability to conduct more than 1 lakh tests monthly, including routine tests, esoteric tests, and genetic tests.

Additionally, technological advancements, such as the development of more fast and accurate esoteric testing methods & instruments further drive the market growth. For instance, in July 2023, Novatein Biosciences launched its Human Anti-Carbamylated Protein Antibody (Anti-CarP) ELISA Kit. This kit is designed to facilitate innovative research in protein carbonylation and its implications in various pathophysiological conditions.

Increasing Prevalence of Cancer & Infectious Diseases

The steadily rising prevalence of cancer and various infectious diseases such as HIV, strep throat, and others is another factor supporting the esoteric testing demand globally. According to the World Health Organization (WHO), globally, around 39.0 million people were living with HIV at the end of 2022. Furthermore, since the epidemic, over 85.6 million people have been infected with HIV. Apart from this, as per the same source, cancer was estimated to be the leading cause of fatalities globally, accounting for 10 million fatalities in 2022. In addition, about 2.3 million and 2.2 million people worldwide were diagnosed with breast cancer and lung cancer, respectively.

Market Segmentation

Our in-depth analysis of the global esoteric testing market includes the following segments by test type, technology, and end-user:

- Based on test type, the market is sub-segmented into infectious disease testing, oncology testing, endocrinology testing, genetic testing, toxicology testing, neurology testing, and other testing (immunology testing).

- Based on technology, the market is sub-segmented into enzyme-linked immunosorbent assay, chemiluminescence immunoassay, mass spectrometry, DNA sequencing, flow cytometry, and others (radioimmunoassays, real-time polymerase chain reaction (PCR).

- Based on end-user, the market is bifurcated into hospital-based laboratories and independent and reference laboratories

Infectious Diseases is Projected to Emerge as the Largest Segment

The growth is supported owing to the surging prevalence of infectious diseases around the globe along with the growing development of advanced and innovative esoteric testing kits for diagnosing respiratory diseases. For instance, in March 2024, Launch Diagnostics introduced the VirClia Lotus Chemiluminescence instrument for infectious diseases serology. It is a mono-test solution that allows the laboratory to run esoteric and low-volume infectious serology tests. Moreover, the US Food and Drug Administration (US FDA) has also approved several home kit solutions for almost every age group with symptoms of respiratory viral infection consistent with COVID-19. Some of the approved kits include LabCorp COVID-19+Flu+RSV, LabCorp Seasonal Respiratory Virus RT-PCR DTC, LabCorp COVID-19+Flu+RSV, and others.

Regional Outlook

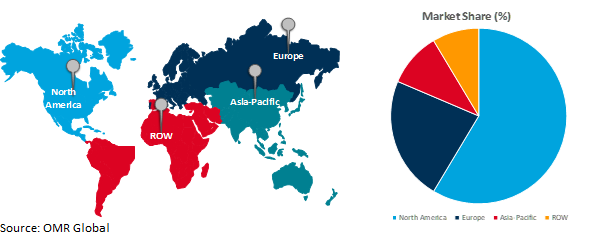

The global esoteric testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Rapidly Growing Healthcare Infrastructure Among the Asia-Pacific Economies

As per the report published by NITI Aayog Investment Grid, there are nearly 600 investment opportunities worth $32 billion in the country’s hospital and medical infrastructure sub-sector. Additionally, in the field of diagnostic testing, the country has immense potential to bolster domestic manufacturing of advanced and innovative test kits.

Recently, in November 2023, Esoteric II was incorporated in Singapore as an investment holding company to be the holding company for India Grid Trust. It is an affiliate of KKRPost the preferential allotment in September 2023, Esoteric’s stake stands at 22.7%.

Global Esoteric Testing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, the North American region is expected to hold a major share of the global market. The region holds a huge population base of geriatric and chronic disease people. According to the Oxford Academic, Canada is an older country with a percentage of the population aged 65 years and above (17.7%) than in the US. Additionally, it has the highest percentage of its population aged above 85 years (2.7%). The size of this age group is an important indicator of the overall need for healthcare in the older population.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global esoteric testing market include Laboratory Corp. (Labcorp)/ Laboratory Corp. of America, OPKO Health, Inc., Quest Diagnostics, F. Hoffmann-La Roche Ltd., and Mayo Clinic (Mayo Foundation for Medical Education and Research), among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, ARUP Laboratories partnered with Medicover to release a new companion diagnostic and gene therapy in the European Union. Earlier in collaboration with BioMarin Pharmaceutical Inc. developed AAV5 DetectDx , a diagnostic kit that aids in the selection of adult patients with severe hemophilia A who are eligible for treatment with ROCTAVIAN™

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global esoteric testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Laboratory Corp. (Labcorp)/ Laboratory Corp. of America

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. OPKO Health, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Quest Diagnostics

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Esoteric Testing Market by Test Type

4.1.1. Infectious Disease Testing

4.1.2. Oncology Testing

4.1.3. Endocrinology Testing

4.1.4. Genetic Testing

4.1.5. Toxicology Testing

4.1.6. Neurology Testing

4.1.7. Other Testing (Immunology Testing)

4.2. Global Esoteric Testing Market by Technology

4.2.1. Enzyme-linked Immunosorbent Assay

4.2.2. Chemiluminescence Immunoassay

4.2.3. Mass Spectrometry

4.2.4. DNA Sequencing

4.2.5. Flow Cytometry

4.2.6. Others (Radio Immunoassays, Real Time Polymerase Chain Reaction (PCR))

4.3. Global Esoteric Testing Market by End-User

4.3.1. Hospital-based Laboratories

4.3.2. Independent and Reference Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ARUP Laboratories

6.2. Athena Esoterix, LLC

6.3. Augusta University (Georgia Esoteric and Molecular Laboratory)

6.4. bioMONTR® Labs, a division of McClernon LLC

6.5. Eurofins Scientific

6.6. F. Hoffmann-La Roche Ltd.

6.7. Fulgent Genetics, Inc.

6.8. Grifols International, S.A.

6.9. H.U. Group Holdings, Inc.

6.10. Kindstar Globalgene Technology, Inc.

6.11. Mayo Clinic (Mayo Foundation for Medical Education and Research)

6.12. Nordic Laboratories (Nordic Group)

6.13. Sonic Healthcare Ltd.

6.14. Stanford Health Care

6.15. Thyrocare Technologies Ltd.

1. GLOBAL ESOTERIC TESTING MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ESOTERIC INFECTIOUS DISEASE TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ESOTERIC ONCOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ESOTERIC ENDOCRINOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ESOTERIC GENETIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ESOTERIC TOXICOLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ESOTERIC NEUROLOGY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER ESOTERIC TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ESOTERIC TESTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

10. GLOBAL ESOTERIC TESTING FOR ENZYME-LINKED IMMUNOSORBENT ASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ESOTERIC TESTING FOR CHEMILUMINESCENCE IMMUNOASSAY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ESOTERIC TESTING FOR MASS SPECTROMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ESOTERIC TESTING FOR DNA SEQUENCING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ESOTERIC TESTING FOR FLOW CYTOMETRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ESOTERIC TESTING FOR OTHER TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ESOTERIC TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

17. GLOBAL ESOTERIC TESTING BY HOSPITAL-BASED LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ESOTERIC TESTING FOR INDEPENDENT AND REFERENCE LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

27. EUROPEAN BIOREFINERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC BIOREFINERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

32. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

35. REST OF THE WORLD BIOREFINERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ESOTERIC TESTING MARKET SHARE BY TEST TYPE, 2023 VS 2031 (%)

2. GLOBAL ESOTERIC INFECTIOUS DISEASE TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ESOTERIC ONCOLOGY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ESOTERIC ENDOCRINOLOGY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ESOTERIC GENETIC TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ESOTERIC TOXICOLOGY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ESOTERIC NEUROLOGY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHER ESOTERIC TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ESOTERIC TESTING MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

10. GLOBAL ESOTERIC TESTING FOR ENZYME-LINKED IMMUNOSORBENT ASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ESOTERIC TESTING FOR CHEMILUMINESCENCE IMMUNOASSAY MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ESOTERIC TESTING FOR MASS SPECTROMETRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ESOTERIC TESTING FOR DNA SEQUENCING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ESOTERIC TESTING FOR FLOW CYTOMETRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ESOTERIC TESTING FOR OTHER TECHNOLOGIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ESOTERIC TESTING MARKET SHARE BY END-USER, 2023 VS 2031 (%)

17. GLOBAL ESOTERIC TESTING FOR HOSPITAL-BASED LABORATORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ESOTERIC TESTING FOR INDEPENDENT AND REFERENCE LABORATORIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL BIOREFINERY MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. US BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

22. UK BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)

34. THE MIDDLE EAST AND AFRICA BIOREFINERY MARKET SIZE, 2023-2031 ($ MILLION)