Electric Vehicle (EV) Battery Cells Market

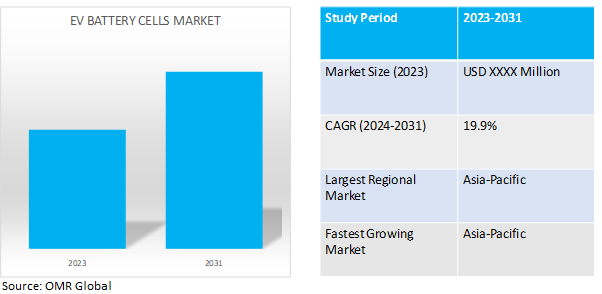

Electric Vehicle (EV) Battery Cells Market Size, Share & Trends Analysis Report by Type (Lithium-Ion Battery Cells, NI-MH Battery Cells, Patches, and Other), and by Application (PHEVs, HEVs, and BEVs) Forecast Period (2024-2031)

EV battery cells market is anticipated to grow at a significant CAGR of 19.9% during the forecast period (2024-2031). Electric vehicle (EV) battery cells are the fundamental building blocks of an EV battery pack. They are typically lithium-ion batteries that are designed to have a high power-to-weight ratio and energy density. EV battery cells can come in three formats: cylindrical, prismatic, and pouch.

Market Dynamics

EVs Take Charge: Fueled by Consumer Demand and Policy Shifts

A significant factor driving the growth of the EV battery cell market is the surging demand for EVs. For instance, the electric car market is experiencing rapid expansion, with sales surpassing 10 million in 2022. EVs accounted for 14.0% of all new car purchases in 2022, a significant increase from approximately 9.0% in 2021 and less than 5.0% in 2020. This upsurge can be attributed to several converging trends. The growing societal and consumer awareness regarding the detrimental effects of fossil fuels on air quality has driven a shift towards cleaner transportation alternatives, with EVs emerging as a frontrunner. Active implementation of government policies that incentivize EV purchases further aiding to the market demand. For instance, In Korea, the government incentivizes EV adoption by offering higher subsidies for vehicles with longer fully electric ranges. While the maximum incentives for passenger cars decreased slightly from KRW 7 million ($ 5,400) to KRW 6.8 million ($ 5,300) in 2023, consumers can still take advantage of additional local subsidies.

Battery Breakthroughs: Powering the Future of EVs

Advancements in battery technology are playing a pivotal role in propelling the EV battery cell market forward. These advancements are specifically focused on addressing key consumer concerns and enhancing the overall EV experience. The researchers are continuously improving the energy density of lithium-ion batteries, enabling EVs to travel longer distances on a single charge. For instance in April 2024,Talent New Energy unveils an automotive-grade, all-solid-state lithium metal battery prototype with a single cell capacity of 120 Ah and an energy density of 720 Wh/kg, setting new industry records. Compared to Nio's semi-solid-state battery, Talent's innovation doubles energy density, potentially offering EVs a range of 2,000 kilometres. Talent has achieved breakthroughs in key technologies for all-solid-state lithium batteries. Additionally, significant strides are being made in developing rapid charging technologies that can significantly reduce charging times, addressing a major hurdle for potential EV buyers. Furthermore, the cost per kilowatt-hour (kWh) of battery cells is steadily decreasing as production scales up. This price reduction makes EVs more price-competitive with traditional gasoline-powered vehicles, further accelerating their adoption.

Market Segmentation

Our in-depth analysis of the global EV Battery Cells includes the following segments byt ype and by application:

- Based on type, the market is sub-segmented intolithium-ionbattery cells, NI-MH battery cells, and other (solid-state batteries, sodium-ion batteries, redox flow batteries).

- Based on application, the market is augmented into PHEVs (Plug-in Hybrid Vehicles), HEVs (Hybrid Electric Vehicles), and BEVs (Battery Electric Vehicles).

Li-ion: The Powerhouse of the EV Battery Cell Market

Within the EV battery cell market, lithium-ion (Li-ion) cells reign supreme due to their impressive growth. Li-ion boasts a clear advantage over competitors like Ni-MH batteries by offering superior energy density. This translates to longer ranges for electric vehicles, a key factor for consumers. Additionally, Li-ion generally supports faster charging, addressing another major concern for EV users. Beyond current strengths, ongoing research promises even better Li-ion batteries with increased range, faster charging, and lower costs. With these advantages and dominance in EVs, Li-ion is expected to remain the driving force for the EV battery cell market's growth for years to come.

BEVs Surge Ahead: Leading the Charge in Battery Cell Demand

The BEV segment is the current growth champion in the EV battery cell market. Fueled by government incentives for zero-emission vehicles, BEVs are becoming a more attractive option for environmentally conscious consumers. Advancements in battery technology address range anxiety, a major concern for potential buyers. Additionally, the rapid build-out of charging infrastructure specifically caters to BEVs, further accelerating their adoption. For instance, in 2021, the US Bipartisan Infrastructure Law bolstered backing for EV charging, earmarking a total of $5.0 billion in funding from 2022 to 2026 through the National Electric Vehicle Infrastructure Formula Program. Additionally, $2.5 billion was allocated for competitive grants during the same period via the Charging and Fueling Infrastructure Discretionary Grant Program.

Regional Outlook

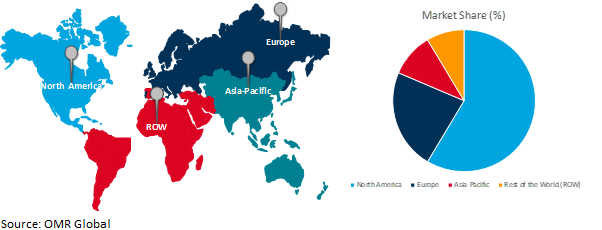

The global EV battery cells market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global EV Battery Cells Growth by Region 2024-2031

Asia-Pacific Dominance in the Global EV Battery Cell Market

The Asia-Pacific region has become a dominant force in the EV battery cell market, holding both the largest market share and experiencing the fastest growth. Several factors fuel this dual leadership. Firstly, countries like China, Japan, and South Korea are seeing a dramatic rise in electric vehicle (EV) purchases. According to Global EV Outlook 2023, the electric car market has witnessed remarkable expansion, with sales surpassing 10 million in 2022. Electric vehicles (EVs) constituted 14% of total new car sales, up from approximately 9% in 2021 and less than 5% in 2020. China remained the leading market, comprising about 60% of global EV sales. China has already surpassed its 2025 target for new energy vehicle sales, with over half of the world's electric cars now on its roads.This surge translates to a massive need for battery cells to keep up with EV production. Secondly, these same countries are global leaders in manufacturing both EVs and batteries. As their production capabilities for both vehicles and their power source climb, the demand for battery cells at every stage of the process, from raw materials to finished vehicles, explodes. Additionally, many Asian governments are actively promoting EV adoption through subsidies and infrastructure development. This creates a supportive environment for both EV production and the battery cell manufacturers supplying them. This creates a positive feedback loop – rising EV demand drives battery cell production, which in turn makes EVs more accessible, leading to even faster EV adoption.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global EV battery cells includebyd Company Ltd., Hitachi, Ltd., Panasonic Holdings Corporation, SAMSUNG SDI CO., LTD, SK Innovation Co Ltd, and Tata Sons Private Limitedamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Tata Group signed a deal with the Gujarat government to build a $1.6 billion lithium-ion cell factory, aligning with India's EV supply chain ambitions. The plant, slated to start in less than three years, targets an initial capacity of 20 GWh, expandable in the future. Tata Motors' investment echoes JLR's $19 billion electrification plan.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global EV battery cells based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BYD Company Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Panasonic Holdings Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. SAMSUNG SDI CO.,LTD

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. SK Innovation Co Ltd

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Tata Sons Private Limited

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Key Strategy Analysis

4. Market Segmentation

4.1. Global EV Battery Cells by Type

4.1.1. Lithium-Ion Battery Cells

4.1.2. NI-MH Battery Cells

4.1.3. Other (Solid-state batteries, Sodium-ion batteries, Redox flow batteries)

4.2. Global EV Battery Cells by Application

4.2.1. PHEVs (Plug-in Hybrid Vehicles)

4.2.2. HEVs (Hybrid Electric Vehicles)

4.2.3. BEVs (Battery Electric Vehicles)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. AESC Group

6.2. Amara Raja Energy & Mobility Limited.

6.3. American Battery Solutions Inc.

6.4. Contemporary Amperex Technology Co., Limited.

6.5. EXIDE INDUSTRIES LTD.

6.6. Farasis Energy Europe GmbH

6.7. Shanghai Electric

6.8. Sunwoda Electronic Co., Ltd

6.9. SVOLT Energy Technology (Europe) GmbH (Baoding Great Wall Holding)

1. GLOBAL EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBALCELLSLITHIUM-ION EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NI-MH BATTERY EV CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OTHEREV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBALPHEVs BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HEVs BATTERY CELLSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BEVs BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBALEV BATTERY CELLS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN EV BATTERY CELLS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN EV BATTERY CELLS RESEARCH AND ANALYSIS BYTYPE 2023-2031 ($ MILLION)

12. NORTH AMERICAN EV BATTERY CELLS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. EUROPEAN EV BATTERY CELLS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN EV BATTERY CELLS RESEARCH AND ANALYSIS BYTYPE2023-2031 ($ MILLION)

15. EUROPEAN EV BATTERY CELLS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC EV BATTERY CELLS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA- PACIFIC EV BATTERY CELLS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. ASIA- PACIFIC EV BATTERY CELLS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD EV BATTERY CELLS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. REST OF THE WORLD EV BATTERY CELLS RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD EV BATTERY CELLS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY TYPECHANNEL, 2023 VS 2031 (%)

2. GLOBALLITHIUM-ION EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL NI-MH EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL OTHER EV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL EV BATTERY CELLS RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL PHEVsEV BATTERY CELLSMARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL HEVsEV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL BEVsEV BATTERY CELLS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL EV BATTERY CELLS RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. US EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

11. CANADA EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

12. UK EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

13. FRANCE EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

14. GERMANY EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

15. ITALY EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

16. SPAIN EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

18. INDIA EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

19. CHINA EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

20. JAPAN EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC EV BATTERY CELLS SIZE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD EV BATTERY CELLS S031 ($ 2031 ($ MILLION)