Facade Market

Facade Market Size, Share & Trends Analysis Report by Raw Material (Glass, Wood, Metal, Ceramic, Polyvinyl Chloride (PVC), Stone, Concrete, and Others), and by Facade Type (Ventilated and Non-Ventilated), by Application (Interior and Exterior), and by End-User Industry (Commercial, Residential and Industrial), Forecast Period (2025-2035)

Industry Overview

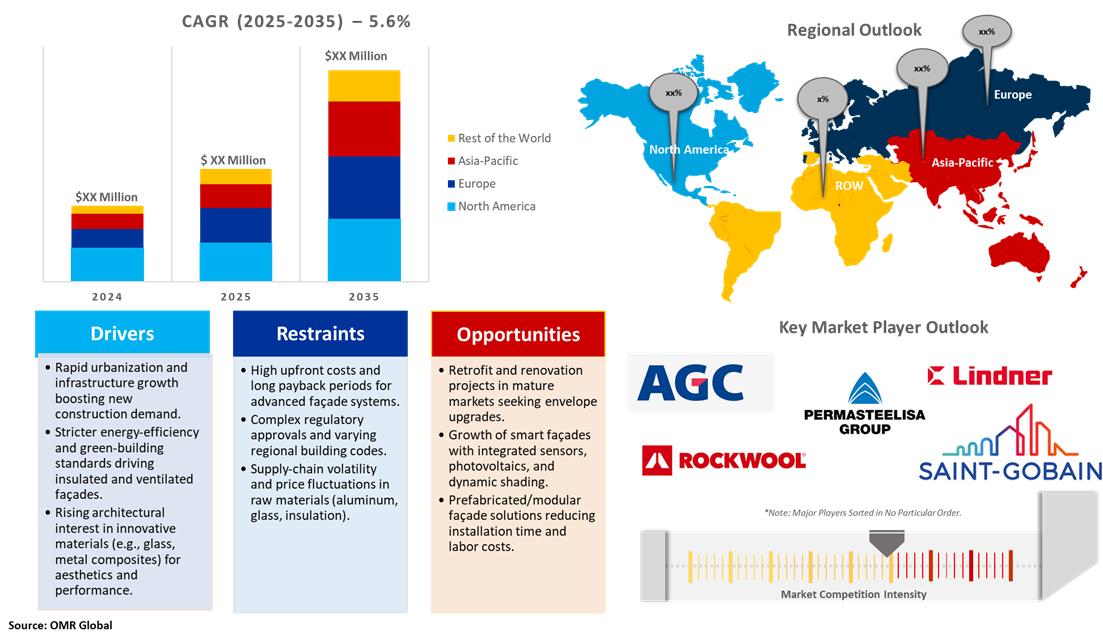

Facade market size reached $320 billion in 2024 and is projected to grow to $580 billion by 2035 at a CAGR of 5.6% during the forecast period (2025-2035). Industry growth is attributed to pivotal factors such as rising industrial, commercial, and residential construction activities, increasing concern towards energy efficiency, and external beautification aspects. It helps with the temperature management of the buildings, due to which the facade market players are developing weather-specific facades. The facades are primarily used in high-rise buildings and offices, including storefronts and residences. The role of the facade has increased in the construction sector, majorly due to the changing perception of consumers and the increasing deployment of facades in the exterior appearance of a building.

Market Dynamics

Rising Focus on Energy-Efficient and Sustainable Facades

The construction industry is one of the biggest energy consumers in the world, responsible for some 40% of global energy consumption and producing a substantial majority of all greenhouse gas emissions. Consequently, there is an increasing call for sustainable building design solutions that have the potential to cut energy usage and minimize the environmental footprint. For instance, Saint-Gobain offers COOL-LITE XTREME solar control glass that can reduce HVAC energy use by 30%. Additionally, according to the US Department of Energy, innovative facade systems can minimize both lighting and HVAC energy consumption more optimally while addressing occupant comfort requirements. Further, an estimated 1-2 quadrillion BTUs of energy could be saved annually if innovative facade systems are adopted across the commercial building sector.

Increasing Urbanization and the Construction Industry

The rapid increase in world population and fast-paced urbanization are the foremost drivers for moving the facade market. As urban dwellers and cities expand, there is a corresponding increase in demand for new commercial, residential, and industrial buildings, directly influencing facade installation needs. This population growth is most evident in developing economies within the Asian-Pacific region, where China, India, and Japan are witnessing fast-paced construction. As per Our World in Data, in most of the high-income countries – such as Western Europe, the Americas, Australia, Japan, and the Middle East – over 80% of people are urban residents. In most upper-middle-income countries – throughout Eastern Europe, East Asia, North and South Africa, and South America – 50% to 80% of people do. Furthermore, the construction of commercial buildings and office spaces with an emphasis on energy efficiency is generating huge opportunities for facade manufacturers and installers. Also, growing infrastructure development and speedy industrialization are likely to drive market growth in the forecast period.

Market Segmentation

- Based on the raw material glass, the market is segmented into wood, metal, ceramic, polyvinyl chloride (PVC), stone, concrete, and others.

- Based on the facade type, the market is segmented into ventilated and non-ventilated.

- Based on the application, the market is segmented into exterior and interior.

- Based on the end-user Industry, the market is segmented into commercial, residential, and industrial.

Ventilated Facade to Hold Prominent Shares in the Global Facade Market

Among the facade types, the ventilated segment is estimated to hold a prominent market share in the global facade market. This is mainly owing to its benefits over non-ventilated facades such as energy-saving and providing rich aesthetics. This has increased the demand for ventilated façades for most buildings, and future construction. The market players are also focusing on the segment prominently by launching new innovative ventilated facade ideas and designs to gain an edge in the ongoing competition. For instance, in June 2021, Paroc published a well-insulated ventilated façade design, which offers guidelines for designing the ventilation of facades of diverse heights and for selecting the right windshield and thermal insulation products.

Regional Outlook

The global facade market is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Exhibit Significant Market Growth

The increasing construction of new commercial and industrial buildings in countries, including China, India, and Southeast Asia, is making a significant contribution to the regional market growth. China is the largest contributor to the regional market growth owing to the advancements in facade installation techniques, availability of labor, cost-effective materials, and rising investments in the construction industry. In addition, rapid urbanization in developing countries such as India, Japan, China, and South Korea is further driving the demand for facade installations in the region. For instance, in August 2022, Architecture studio Aedas unveiled its Dance of Light office skyscraper in Chongqing, China, with a twisted facade informed by the shape of the northern lights. The 180-meter-tall tower, which is situated on Xingfu Plaza in Chongqing's Jiangbei District, has two double-curved facades that give the structure the appearance of being twisted.

North America Holds Significant Market Share

Among all the regions, North America holds a significant share owing to the constant growth of the construction sector and increasing demand for solar facades. Urban spread continued in Canada’s urban centers as the population growth of many suburban cities outpaced the growth occurring elsewhere. Activity in the non-residential sector is projected to remain strong across the forecast period, given the high volume of large projects planned and underway in most regions of the country. Construction is a key contributor to Canada’s GDP. In 2022, there were 252 large infrastructure projects in Canada under development, which were valued at over $33.8 million. As of now, Canada has many projects in the works. Projects such as Industrial: Anthony Henday Business Park, Retail: The Mills (Halifax), and TD Terrace will further boost the facade market growth in the region. On the other hand, construction is also the main driver of the US economy. In the US, there were around 919,000 construction establishments during the first quarter of 2023. An estimated $2.1 trillion worth of structures are made annually by the construction industry, which employs 8.0 million people.

Market Players Outlook

The major companies operating in the global Facade market include AGC Inc. (AGC Group), Permasteelisa S.p.A, Apogee Enterprises, Inc., Rockwool International A/S, Kingspan Group, Lindner SE., Saint-Gobain India Pvt. Ltd. (Saint-Gobain Group), among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2025, Permasteelisa Group announced its expansion in North America through the acquisition of key business assets from Benson Industries, a leading U.S. subcontractor specializing in custom curtain wall and exterior cladding solutions. This strategic move significantly enhances Permasteelisa’s operational scale and reach across the region, strengthening its presence in several major markets. The combined capabilities of both companies will offer customers access to a more comprehensive range of global solutions and services.

- In March 2024, IHCC announced the partnership with Schüco for the establishment of a new division, this strategic expansion is set to revolutionize the façade landscape in the kingdom and also align with the contractor’s local content strategy. Additionally, this collaboration will utilize Schüco’s proficiency in façade system design and engineering to augment IHCC’s projects.

- In January 2024, EUROBOND and RHEINZINK collaborated to redefine facades in India with the launch of a revolutionary self-healing architectural solution. This transformative initiative combines EUROBOND's two-decade legacy in architectural innovation with RHEINZINK's 175-year heritage as the world's leading manufacturer of this self-healing material.

- In November 2023, Fenesta inaugurated a cutting-edge façade fabrication facility in Hyderabad. This marks Fenesta’s entry into the façade segment. Furthermore, Fenesta in a recent move has joined hands with Inventure Metal Products Industries LLC, a player in the United Arab Emirates’ façade industry. Under this partnership, Inventure will provide comprehensive technical expertise covering façade design, manufacturing, and installation.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global facade market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Facades Market Sales Analysis – Raw Material | Facade Type | Application | End-User Industry ($ Million)

• Facades Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Facades Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Facades Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Facades Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Facades Market Revenue and Share by Manufacturers

• Facades Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. AGC Inc. (AGC Group)

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Permasteelisa S.p.A

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Apogee Enterprises, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Saint-Gobain Group

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Rockwool International A/S

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Facades Market Sales Analysis By Raw Material ($ Million)

5.1. Glass

5.2. Wood

5.3. Metal

5.4. Ceramic

5.5. Polyvinyl Chloride (PVC)

5.6. Stone

5.7. Concrete

5.8. Others

6. Global Facades Market Sales Analysis By Facade Type ($ Million)

6.1. Ventilated

6.2. Non-Ventilated

7. Global Facades Market Sales Analysis By Application ($ Million)

7.1. Interior

7.2. Exterior

8. Global Facades Market Sales Analysis By End-User Industry ($ Million)

8.1. Commercial

8.2. Residential

8.3. Industrial

9. Regional Analysis

9.1. North American Facades Market Sales Analysis – Raw Material | Application | Facade Type | End-User Industry ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Facades Market Sales Analysis – Raw Material | Application | Facade Type | End-User Industry ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Facades Market Sales Analysis – Raw Material | Application | Facade Type | End-User Industry ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Facades Market Sales Analysis – Raw Material | Application | Facade Type | End-User Industry ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. ArcelorMittal Construction India

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Alcoafacades Llc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. AGC Group

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Alumicor Ltd.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Apogee Enterprises Inc.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Casalgrande Padana S.p.A.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Dumaplast

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. FG Glass Industries Pvt. Ltd.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Gresmanc Group

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Jiangsu Paneltek Ceramic Co., Ltd.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Kawneer (Arconic Corporation)

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Kingspan Group

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Metaguise

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Mosa Holding BV

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Permasteelisa S.p.A

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. PORCELANOSA Grupo A.I.E.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Reynaers Aluminium NV

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Rockpanel (ROCKWOOL Group)

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Saint-Gobain S.A.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Sobha Ltd.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. Schüco Global

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. TONALITY GmbH

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Wilkerson Facades

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. Wienerberger group

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

1. Global Facade Market Research And Analysis By Raw Material, 2024-2035 ($ Million)

2. Global Glass Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Wood Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Metal Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Ceramic Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global PVC Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Stone Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Concrete Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Other Raw Material-Based Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Facade Market Research And Analysis By Application, 2024-2035 ($ Million)

11. Global Interior Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Exterior Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Facade Market Research And Analysis By Facade Type, 2024-2035 ($ Million)

14. Global Ventilated Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Non-Ventilated Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Facade Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

17. Global Commercial Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Residential Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Industrial Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Facade Market Research And Analysis By Region, 2022-2030 ($ Million)

21. North American Facade Market Research And Analysis By Country, 2024-2035 ($ Million)

22. North American Facade Market Research And Analysis By Raw Material, 2024-2035 ($ Million)

23. North American Facade Market Research And Analysis By Facade Type, 2024-2035 ($ Million)

24. North American Facade Market Research And Analysis By Application, 2024-2035 ($ Million)

25. North American Facade Market Research And Analysis By End-User, 2024-2035 ($ Million)

26. European Facade Market Research And Analysis By Country, 2024-2035 ($ Million)

27. European Facade Market Research And Analysis By Raw Material, 2024-2035 ($ Million)

28. European Facade Market Research And Analysis By Application, 2024-2035 ($ Million)

29. European Facade Market Research And Analysis By Facade Type, 2024-2035 ($ Million)

30. European Facade Market Research And Analysis By End-User, 2024-2035 ($ Million)

31. Asia-Pacific Facade Market Research And Analysis By Country, 2024-2035 ($ Million)

32. Asia-Pacific Facade Market Research And Analysis By Raw Material, 2024-2035 ($ Million)

33. Asia-Pacific Facade Market Research And Analysis By Facade Type, 2024-2035 ($ Million)

34. Asia-Pacific Facade Market Research And Analysis By Application, 2024-2035 ($ Million)

35. Asia-Pacific Facade Market Research And Analysis By End-User, 2024-2035 ($ Million)

36. Rest Of The World Facade Market Research And Analysis By Region, 2024-2035 ($ Million)

37. Rest Of The World Facade Market Research And Analysis By Raw Material, 2024-2035 ($ Million)

38. Rest Of The World Facade Market Research And Analysis By Facade Type, 2024-2035 ($ Million)

39. Rest Of The World Facade Market Research And Analysis By Application, 2024-2035 ($ Million)

40. Rest Of The World Facade Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Facade Market Share By Raw Material, 2024 Vs 2035 (%)

2. Global Glass Facade Market Share By Region, 2024 Vs 2035 (%)

3. Global Wood Facade Market Share By Region, 2024 Vs 2035 (%)

4. Global Metal Facade Market Share By Region, 2024 Vs 2035 (%)

5. Global Ceramic Facade Market Share By Region, 2024 Vs 2035 (%)

6. Global PVC Facade Market Share By Region, 2024 Vs 2035 (%)

7. Global Stone Facade Market Share By Region, 2024 Vs 2035 (%)

8. Global Concrete Facade Market Share By Region, 2024 Vs 2035 (%)

9. Global Facade Market Share By Facade Type, 2024 Vs 2035 (%)

10. Global Ventilated Facade Market Share By Region, 2024 Vs 2035 (%)

11. Global Non-Ventilated Facade Market Share By Region, 2024 Vs 2035 (%)

12. Global Facade Market Research And Analysis By Application, 2024 Vs 2035 (%)

13. Global Interior Facade Market Share By Region, 2024 Vs 2035 (%)

14. Global Exterior Facade Market Share By Region, 2024 Vs 2035 (%)

15. Global Facade Market Share By End-User, 2024 Vs 2035 (%)

16. Global Commercial Facade Market Share By Region, 2024 Vs 2035 (%)

17. Global Residential Facade Market Share By Region, 2024 Vs 2035 (%)

18. Global Industrial Facade Market Share By Region, 2024 Vs 2035 (%)

19. Global Facade Market Share By Region, 2024 Vs 2035 (%)

20. US Facade Market Size, 2024-2035 ($ Million)

21. Canada Facade Market Size, 2024-2035 ($ Million)

22. UK Facade Market Size, 2024-2035 ($ Million)

23. France Facade Market Size, 2024-2035 ($ Million)

24. Germany Facade Market Size, 2024-2035 ($ Million)

25. Italy Facade Market Size, 2024-2035 ($ Million)

26. Spain Facade Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Facade Market Size, 2024-2035 ($ Million)

28. India Facade Market Size, 2024-2035 ($ Million)

29. China Facade Market Size, 2024-2035 ($ Million)

30. Japan Facade Market Size, 2024-2035 ($ Million)

31. Australia And New Zealand Facades Market Size, 2024-2035 ($ Million)

32. ASEAN Economies Facades Market Size, 2024-2035 ($ Million)

33. South Korea Facade Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Facade Market Size, 2024-2035 ($ Million)

35. Latin America Facade Market Size, 2024-2035 ($ Million)

36. Middle East And Africa Facade Market Size, 2024-2035 ($ Million)

FAQS

The size of the Facade market in 2024 is estimated to be around $320 billion.

North American holds the largest share in the Facade market.

Leading players in the Facade market include AGC Inc. (AGC Group), Permasteelisa S.p.A, Apogee Enterprises, Inc., Rockwool International A/S, Kingspan Group, Lindner SE., Saint-Gobain India Pvt. Ltd. (Saint-Gobain Group), among others.

Facade market is expected to grow at a CAGR of 5.6% from 2025 to 2035.

The Facade Market is growing due to rising demand for energy-efficient buildings, urbanization, and advanced architectural aesthetics.