Fertility Drugs Market

Fertility Drug Market Size, Share & Trends Analysis Report by Gender Type (Female Fertility Treatment, and Male Fertility Treatment), by Treatment Type (Hormonal, In Vitro Fertilization (IVF), Intra Cytoplasmic Sperm Injection (ICSI), Intrauterine Insemination (IUI), and Alternative and Complementary Treatment), and by Infertility Type (Problem with Ovulating, Unexplained Infertility, Blocked or Damaged Tubes, Endometriosis, and Polycystic Ovarian Syndrome) Forecast Period (2024-2031)

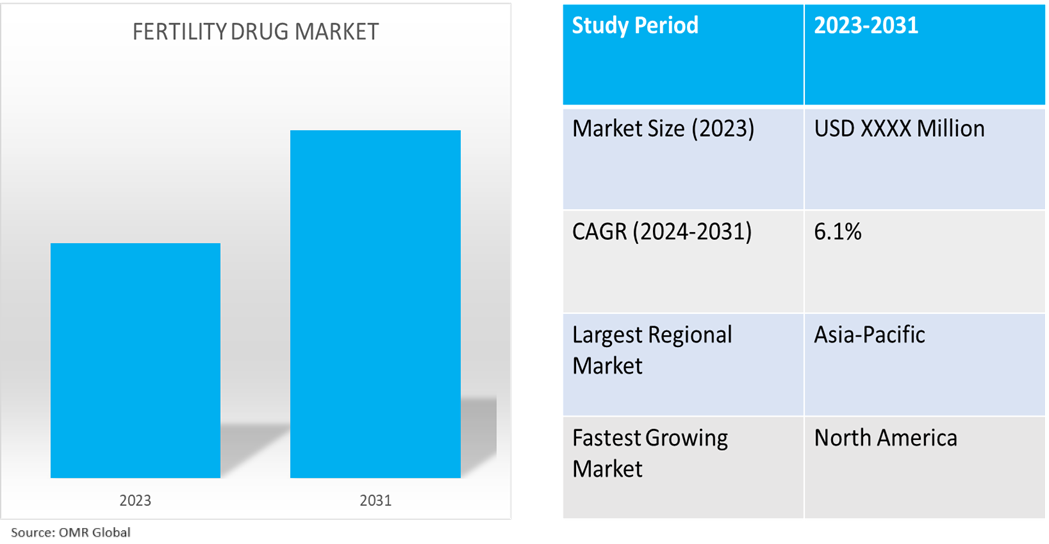

Fertility drug market is anticipated to grow at a CAGR of 6.1% during the forecast period (2024-2031). The global fertility drug market is influenced by a wide range of factors including rising infertility rates, demographic changes, advancements in reproductive technologies, and government support. These factors contribute to the market's growth and help ensure the safety and effectiveness of fertility treatments while promoting treatment accessibility and improved outcomes. Furthermore, the integration of AI and digital health technologies in fertility treatments has the potential to enhance diagnosis and personalize medicine for individuals seeking fertility support.

Market Dynamics

Increasing Infertility Rates

The demand for fertility treatments is rising as a result of delayed conceiving and lifestyle factors such as obesity, stress, smoking, and alcohol consumption that raise infertility rates. According to the World Health Organization, in April 2023, the statistical data shows that approximately 17.5% of adults globally, which is approximately 1 in 6 individuals, face infertility. These numbers emphasize the utmost need to enhance access to affordable and high-quality fertility care globally, as the prevalence of infertility remains consistent across regions. In high-income countries, the lifetime prevalence is recorded at 17.8%, while low- and middle-income countries report a slightly lower rate of 16.5%.

Rising Awareness and Acceptance

Increased public health campaigns have contributed to a growing recognition and knowledge of fertility treatments, resulting in improved awareness and access to various infertility treatment options. For instance, in February, EMD Serono launched its new Slim Pack fertility medication packaging, reducing its size by 40.0% for convenience and environmental impact. The new packaging, which is 100.0% recyclable, reduced the medication's global carbon footprint by 33.0%, improving portability, efficiency, and convenience for patients and customers.

Market Segmentation

- Based on gender type, the market is segmented into female fertility treatment and male fertility treatment.

- Based on treatment type, the market is segmented into hormonal, in vitro fertilization (IVF), intra cytoplasmic sperm injection (ICSI), intrauterine insemination (IUI), and alternative and complementary treatment.

- Based on the infertility type, the market is segmented into problems with ovulation, unexplained infertility, blocked or damaged tubes, endometriosis, and polycystic ovarian syndrome.

In Vitro Fertilization (IVF) Sub-segment to Hold a Considerable Market Share

High success rate, less invasive procedure, and ability of IVF treatment to prevent the transfer of genetic diseases are the key benefits of using IVF. The growing adoption of IVF among patients due to these benefits is a key factor driving the demand for fertility drugs in IVF treatment. According to the American Society for Reproductive Medicine (ASRM), in April 2024, the latest national and clinic-specific ART data from the Society for Assisted Reproductive Technology reveals an increase in the number of babies born from IVF, with 91,771 babies born in 2022 compared to 89,208 in 2021. This represents 2.5% of all births in the US. The data additionally shows a rise in the number of IVF and egg-freezing cycles, with a total of 389,993 IVF cycles and 29,803 egg-freezing cycles performed in 2022. The use of elective single embryo transfer (eSET) has also increased, resulting in a decrease in the overall multiple birth rate from 5.0% in 2021 to 4.0% in 2022.

Endometriosis Sub-segment to Hold a Considerable Market Share

The demand for fertility preservation is on the rise owing to increased awareness among endometriosis patients about options such as egg freezing before surgical procedures. In March 2024, Bourn Hall launched a comprehensive Endometriosis Fertility Service, providing specialist advice for women requiring fertility treatment or preservation before surgery. This service addresses the painful condition affecting 5.0-10.0% of women of reproductive age, causing heavy periods, bowel and urinary symptoms, and chronic pelvic pain. Such developments are further aiding the growth of this market segment.

Regional Outlook

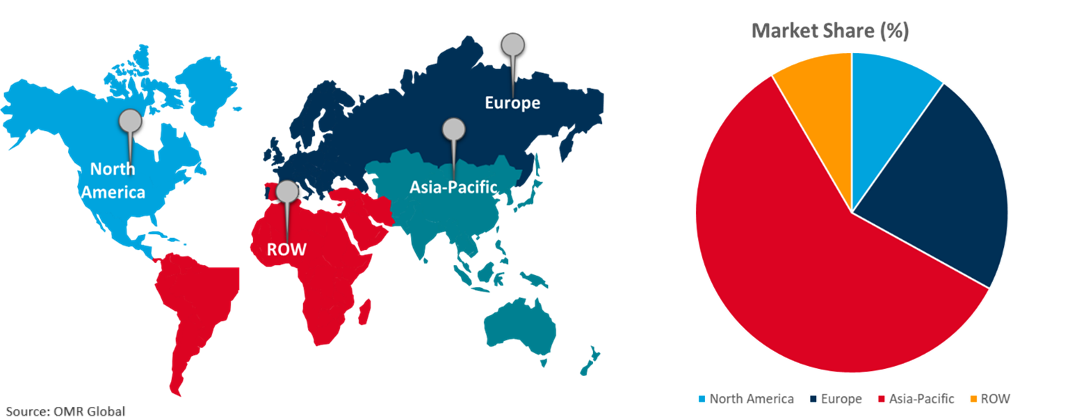

The global fertility drug market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Rates Of Infertility In North America Region

Rapidly increasing rates of infertility are driving demand for fertility therapies, such as LH surge inhibitors, as patients seek less invasive and more convenient solutions. To cater to this growing market demand, key players are adopting several growth strategies. For instance, in February 2024, Lupin launched the Ganirelix Acetate injection in the US, a generic fertility treatment approved by the US FDA. The single-dose prefilled syringe inhibits premature Luteinizing Hormone (LH) surges during controlled ovarian hyperstimulation, a treatment equivalent to Organon USA LLC's reference-listed drug.

Global Fertility Drug Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

The healthcare infrastructure in developing regions is enhancing access to fertility treatments and introducing a growing number of fertility clinics and specialized healthcare providers. According to the National Center for Biotechnology Center, in October 2023, the study revealed that the rate of infertility among women who have been married for at least five years and are currently in a union is 18.7 per 1,000. The prevalence of infertility tends to rise as the duration of marriage decreases. When examining the data at a state level, it was observed that regions such as Goa, Lakshadweep, and Chhattisgarh have the highest rates of infertility.?

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the fertility drug market include Bayer AG, Merck & Co., Inc., Pfizer Inc., Johnson & Johnson Services, Inc., and Novartis AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in February 2024, Fertility Centers of New England (FCNE) acquired Fertility Solutions, a renowned fertility clinic in Massachusetts and Rhode Island, marking a significant milestone in expanding patient access to advanced fertility treatments and enhancing patient care.

The Report Covers-

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fertility drug market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bayer AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck & Co., Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Pfizer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fertility Drug Market by Gender Type

4.1.1. Female Fertility Treatment

4.1.2. Male Fertility Treatment

4.2. Global Fertility Drug Market by Treatment Type

4.2.1. Hormonal

4.2.2. In Vitro Fertilization(IVF)

4.2.3. Intra Cytoplasmic Sperm Injection(ICSI)

4.2.4. Intrauterine Insemination(IUI)

4.2.5. Alternative and Complementary Treatment

4.3. Global Fertility Drug Market by Infertility Type

4.3.1. Problem with Ovulating

4.3.2. Unexplained Infertility

4.3.3. Blocked or Damaged Tubes

4.3.4. Endometriosis

4.3.5. Polycystic Ovarian Syndrome

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AbbVie Inc.

6.2. Baxter International, Inc.

6.3. Eli Lilly and Co.

6.4. Endo, Inc.

6.5. F. Hoffmann-La Roche Ltd.

6.6. Ferring International Center S.A.

6.7. Gedeon Richter Plc.

6.8. Ipsen Pharma.

6.9. Johnson & Johnson Services, Inc.

6.10. LEADIANT BIOSCIENCES, INC.

6.11. Lupin Pharmaceutical, Inc.

6.12. Novartis AG

6.13. Noven Pharmaceuticals, Inc.

6.14. ObsEva SA

6.15. Procter and Gamble España SA

6.16. Progyny, Inc.

6.17. Sanofi SA

6.18. Solvay SA

6.19. Takeda Pharmaceutical Co. Ltd.

6.20. Teva Pharmaceutical Industries Ltd.

1. Global Fertility Drug Market Research And Analysis By Gender Type, 2023-2031 ($ Million)

2. Global Female Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Male Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Fertility Drug Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

5. Global Hormonal Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global In Vitro Fertilization Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Intra Cytoplasmic Sperm Injection Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Intrauterine Insemination Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Alternative And Complementary Treatment Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Fertility Drug Market Research And Analysis By Infertility Type, 2023-2031 ($ Million)

11. Global Fertility Drug For Problem With Ovulating Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Fertility Drug Unexplained Infertility Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Fertility Drug For Blocked Or Damaged Tubes Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Fertility Drug For Endometriosis Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Fertility Drug For Polycystic Ovarian Syndrome Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

17. North American Fertility Drug Market Research And Analysis By Country, 2023-2031 ($ Million)

18. North American Fertility Drug Market Research And Analysis By Gender Type, 2023-2031 ($ Million)

19. North American Fertility Drug Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

20. North American Fertility Drug Market Research And Analysis By Infertility Type, 2023-2031 ($ Million)

21. European Fertility Drug Market Research And Analysis By Country, 2023-2031 ($ Million)

22. European Fertility Drug Market Research And Analysis By Gender Type, 2023-2031 ($ Million)

23. European Fertility Drug Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

24. European Fertility Drug Market Research And Analysis By Infertility Type, 2023-2031 ($ Million)

25. Asia-Pacific Fertility Drug Market Research And Analysis By Country, 2023-2031 ($ Million)

26. Asia-Pacific Fertility Drug Market Research And Analysis By Gender Type, 2023-2031 ($ Million)

27. Asia-Pacific Fertility Drug Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

28. Asia-Pacific Fertility Drug Market Research And Analysis By Infertility Type, 2023-2031 ($ Million)

29. Rest Of The World Fertility Drug Market Research And Analysis By Region, 2023-2031 ($ Million)

30. Rest Of The World Fertility Drug Market Research And Analysis By Gender Type, 2023-2031 ($ Million)

31. Rest Of The World Fertility Drug Market Research And Analysis By Treatment Type, 2023-2031 ($ Million)

32. Rest Of The World Fertility Drug Market Research And Analysis By Infertility Type, 2023-2031 ($ Million)

1. Global Fertility Drug Market Share By Gender Type, 2023 Vs 2031 (%)

2. Global Female Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

3. Global Male Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

4. Global Fertility Drug Market Share By Treatment Type, 2023 Vs 2031 (%)

5. Global Hormonal Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

6. Global In Vitro Fertilization Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

7. Global Intra Cytoplasmic Sperm Injection Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

8. Global Intrauterine Insemination Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

9. Global Alternative and Complementary Treatment Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

10. Global Fertility Drug Market Share By Infertility Type, 2023 Vs 2031 (%)

11. Global Fertility Drug For Problem With Ovulating Market Share By Region, 2023 Vs 2031 (%)

12. Global Fertility Drug For Unexplained Infertility Market Share By Region, 2023 Vs 2031 (%)

13. Global Fertility Drug For Blocked Or Damaged Tubes Market Share By Region, 2023 Vs 2031 (%)

14. Global Fertility Drug For Endometriosis Market Share By Region, 2023 Vs 2031 (%)

15. Global Fertility Drug For Polycystic Ovarian Syndrome Market Share By Region, 2023 Vs 2031 (%)

16. Global Fertility Drug Market Share By Region, 2023 Vs 2031 (%)

17. US Fertility Drug Market Size, 2023-2031 ($ Million)

18. Canada Fertility Drug Market Size, 2023-2031 ($ Million)

19. UK Fertility Drug Market Size, 2023-2031 ($ Million)

20. France Fertility Drug Market Size, 2023-2031 ($ Million)

21. Germany Fertility Drug Market Size, 2023-2031 ($ Million)

22. Italy Fertility Drug Market Size, 2023-2031 ($ Million)

23. Spain Fertility Drug Market Size, 2023-2031 ($ Million)

24. Rest Of Europe Fertility Drug Market Size, 2023-2031 ($ Million)

25. India Fertility Drug Market Size, 2023-2031 ($ Million)

26. China Fertility Drug Market Size, 2023-2031 ($ Million)

27. Japan Fertility Drug Market Size, 2023-2031 ($ Million)

28. South Korea Fertility Drug Market Size, 2023-2031 ($ Million)

29. Rest Of Asia-Pacific Fertility Drug Market Size, 2023-2031 ($ Million)

30. Latin America Fertility Drug Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Fertility Drug Market Size, 2023-2031 ($ Million)