Fiber Optic Preform Market

Fiber Optic Preform Market Size, Share & Trends Analysis Report by Process (Outside Vapor Deposition (OVD), Vapor Axial Deposition (VAD), Plasma Activated Chemical Vapor Deposition (PCVD), and Modified Chemical Vapor Deposition (MCVD)), by Product Type (Single-Mode, Multi-Mode, and Plastic Optical Fiber), and by End-User (Telecom, Oil & Gas, Military & Aerospace, BFSI, Medical, and Others) Forecast Period (2024-2031)

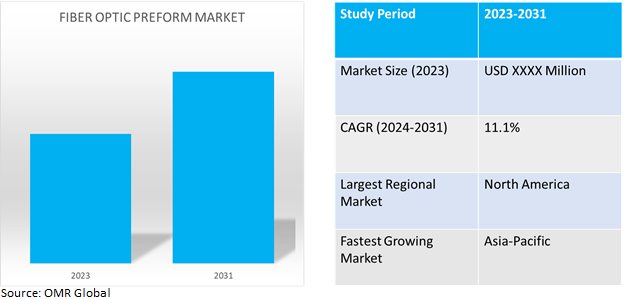

Fiber optic preform market is anticipated to grow at a CAGR of 11.1% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of fiber optic preform to enhance optical performance, increase data transmission rate and improve durability drives the growth of the market. Information technology and telecommunications are two of the main sectors that depend heavily on optical fiber network infrastructure. The main applications for fiber optics include flexible bundling, laser delivery systems, lighting, and light transmission. Advancements in fiber optic technology have resulted from extensive research and development, opening up a wide range of uses for optical fibers in the utilities, oil and gas, medical, and defense sectors.

Market Dynamics

Innovation in Coating Material and Deposition Technique

Increasing adoption of coating material and deposition technique increase the efficiency of fiber optic preform. Energy loss, catalytic behavior, refractive index, and mechanical strength are a few of the advantageous qualities that chemically altered optical fiber possesses to improve optical fiber technology. The developments in a variety of optical fiber-based technologies, including environmental monitoring, photodynamic treatment, tomography, sensing, imaging, optogenics, and magnetic resonance imaging, in light of the role played by chemically modified optical fibers. Fiber optic preforms are used to create optical fibers, that carry data quickly. Optical fibers are clear, flexible cables made of premium glass, plastic, and silica that function according to the principles of total internal light reflection.

Increasing Adoption of Automation and Process Optimization

The increasing adoption of fiber optic preform in automation and process optimization results in improve production efficiency, consistency, and cost-effectiveness. Increasing uses of advanced manufacturing techniques including modified chemical vapor deposition (MCVD) and plasma-enhanced chemical vapor deposition (PECVD) in fiber optic preform avoid corrosion in many dielectric and optical devices. The films deposited through PECVD, are used in semiconductor devices, solar cells, and optically active device applications due to their optical, mechanical, and electrical properties.

Market Segmentation

Our in-depth analysis of the global fiber optic preform market includes the following segments by process, product type, and end-users:

- Based on process, the market is sub-segmented into outside vapor deposition (OVD), vapor axial deposition (VAD), plasma activated chemical vapor deposition (PCVD), and modified chemical vapor deposition (MCVD).

- Based on product type, the market is sub-segmented into single-mode, multi-mode and plastic optical fiber.

- Based on end-users, the market is sub-segmented into telecom, oil & gas, military & aerospace, BFSI, medical, and others.

Vapor Axial Deposition (VAD) is Projected to Emerge as the Largest Segment

Based on the process, the global fiber optic preform market is sub-segmented into OVD, VAD, PCVD, and MCVD. Among these, VAD sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the ability of OVD to produce high-quality preforms with low attenuation and transmission characteristics. The main technique for producing the fiber preforms is the VAP. It entails getting rid of different stuff, including silica, on a revolving rod that is pulled in the end optical fiber. VAD is a process for producing large glass in huge quantities and has paved the path for the mass manufacture of optical fiber.

Telecom Sub-segment to Hold a Considerable Market Share

Based on end-users, the global fiber optic preform market is sub-segmented into telecom, oil & gas, military & aerospace, BFSI, medical and others. Among these, the telecom sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the growing adoption of fiber optic preform in Information technology and telecommunications sectors that with optical fiber network infrastructure. The growing fiber-rich network architecture has led to a rise in the need for fiber optic connections. For instance, in August 2022, Corning Inc. expanding its manufacturing capacity for optical cable based on a long-term partnership with AT&T. Corning built a new cable manufacturing facility in Gilbert, Arizona, located in the Greater Phoenix region, adding approximately 250 jobs and extending Corning's strategic investments in optical fiber, cable, and connectivity solutions to meet record demand. The new facility is Corning’s latest in a series of investments in fiber and cable manufacturing totaling more than $500 million since 2020.

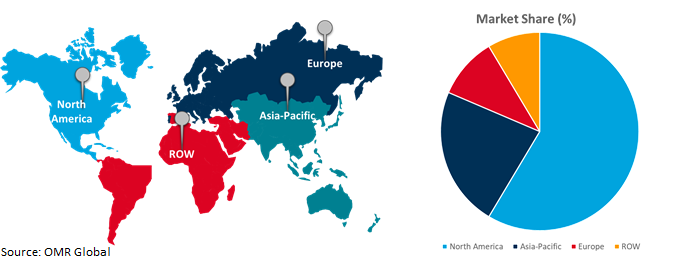

Regional Outlook

The global fiber optic preform market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Fiber Optic Preform in Asia-Pacific

- The increasing adoption of fiber optic preform with digital transformation and strong growth of telecom and other end-user industries in the emerging countries such as China, India, Japan, South Korea drive the growth of market.

- Growing need for fiber optic perform in the telecommunications infrastructure owing to growing smartphone adoption, 4G and 5G network growth, and growing demand for internet connectivity. The demand for the fiber optical preforms utilized in these systems has increased as a result.

Global Fiber Optic Preform Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent technology companies and fiber optic preform provider in the region. In North America, Broadband-intensive communication based on fiber optic networks has been made possible by the numerous advancements in the telecommunications sector. Optical fibers are used in the telecommunications, oil and gas, aerospace, defense, railroad, and healthcare industries. For instance, in March 2023, CommScope expanded the production of fiber-optic cable to connect additional communities and underserved areas and increase broadband rollout across the U.S. In addition, it launched the new HeliARC fiber optic cable, primarily designed to cater to the deployment needs of rural areas.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global fiber optic preform market include Corning Inc., Fujikura Ltd., Prysmian S.p.A, Shin-Etsu Chemical Co., Ltd., Sumitomo Electric Industries, Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In February 2024, YOFC introduced Its "X-Band" Optical Fibre Brand - China's Optical fibre and cable enterprises. To respond to the demands of 5G and F5G technology development, YOFC introduced its product portfolio of X-Band optical fibres. X-Band fibres set themselves apart from others on the market with higher brand value in terms of performance, quality and connectivity.

- In January 2024, Sumitomo Electric Industries, Ltd. introduced newly designed section with information on fiber optics products. The products introduced in this new section are widely used in the 5G networks and data centers that form the infrastructure of telecommunications. The new fiber optics products, including new products such as the 2C Z-PLUS™ Fiber ULL.

- In January 2024, OFS, introduced new LaserWave® Dual-Band OM4+ multimode optical fiber to complement their existing OM4 and OM5 products that lead the industry in bandwidth, attenuation and geometry performance. LaserWave Dual-Band OM4+ is a cost-effective premium fiber optimized for bidirectional (BiDi) applications to support the next generation of high-density and low-power multimode links.

- In January 2024, Prysmian and Telstra collaborated to expand optical cable manufacturing plant in Australia, to build the industry-leading fibre optic cable required for Telstra’s intercity fibre network, with advanced technology that aims to reduce the environmental impact of the project.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fiber optic preform market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Corning Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dun & Bradstreet Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fujikura Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Sumitomo Electric Industries, Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Fiber Optic Preform Market by Process

4.1.1. Outside Vapor Deposition (OVD)

4.1.2. Vapor Axial Deposition (VAD)

4.1.3. Plasma Activated Chemical Vapor Deposition (PCVD)

4.1.4. Modified Chemical Vapor Deposition (MCVD)

4.2. Global Fiber Optic Preform Market by Product Type

4.2.1. Single-Mode

4.2.2. Multi-Mode

4.2.3. Plastic Optical Fiber

4.3. Global Fiber Optic Preform Market by End-Users

4.3.1. Telecom

4.3.2. Oil & Gas

4.3.3. Military & Aerospace

4.3.4. BFSI

4.3.5. Medical

4.3.6. Others (Railway)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Avient Corp.

6.2. Bandweaver Technologies Ltd.

6.3. Coherent Corp.

6.4. FiberHome Telecommunication Technologies Co., Ltd.

6.5. G&H Group

6.6. HENGTONG GROUP CO., LTD.

6.7. Heraeus Business Solutions GmbH

6.8. Humanetics Innovative Solutions, Inc.

6.9. LEONI AG

6.10. Nexans S.A.

6.11. NKT Photonics A/S

6.12. OFS Fitel, LLC

6.13. Prysmian S.p.A

6.14. Rosendahl Nextrom GmbH

6.15. Shin-Etsu Chemical Co., Ltd.

6.16. Thorlabs, Inc.

6.17. Yangtze Optical Fiber and Cable Co., Ltd. (YOFC)

1. GLOBAL FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

2. GLOBAL FIBER OPTIC PREFORM BASED ON OUTSIDE VAPOR DEPOSITION (OVD) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FIBER OPTIC PREFORM BASED ON VAPOR AXIAL DEPOSITION (VAD) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FIBER OPTIC PREFORM BASED ON PLASMA ACTIVATED CHEMICAL VAPOR DEPOSITION (PCVD) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FIBER OPTIC PREFORM BASED ON MODIFIED CHEMICAL VAPOR DEPOSITION (MCVD) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

7. GLOBAL SINGLE-MODE FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SINGLE-MODE FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MULTI-MODE FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PLASTIC FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

12. GLOBAL FIBER OPTIC PREFORM FOR TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL FIBER OPTIC PREFORM FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL FIBER OPTIC PREFORM FOR MILITARY & AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL FIBER OPTIC PREFORM FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL FIBER OPTIC PREFORM FOR MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL FIBER OPTIC PREFORM FOR OTHERS END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

21. NORTH AMERICAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

23. EUROPEAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

25. EUROPEAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

31. REST OF THE WORLD FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

33. REST OF THE WORLD FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD FIBER OPTIC PREFORM MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL FIBER OPTIC PREFORM MARKET SHARE BY PROCESS, 2023 VS 2031 (%)

2. GLOBAL FIBER OPTIC PREFORM BASED ON OUTSIDE VAPOR DEPOSITION (OVD) MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FIBER OPTIC PREFORM BASED ON VAPOR AXIAL DEPOSITION (VAD) MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL FIBER OPTIC PREFORM BASED ON PLASMA ACTIVATED CHEMICAL VAPOR DEPOSITION (PCVD) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FIBER OPTIC PREFORM BASED ON MODIFIED CHEMICAL VAPOR DEPOSITION (MCVD) MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL FIBER OPTIC PREFORM MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

7. GLOBAL SINGLE-MODE FIBER OPTIC PREFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL MULTI-MODE FIBER OPTIC PREFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PLASTIC FIBER OPTIC PREFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL FIBER OPTIC PREFORM MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

11. GLOBAL FIBER OPTIC PREFORM FOR TELECOM MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL FIBER OPTIC PREFORM FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL FIBER OPTIC PREFORM FOR MILITARY & AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL FIBER OPTIC PREFORM FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL FIBER OPTIC PREFORM FOR MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL FIBER OPTIC PREFORM FOR OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL FIBER OPTIC PREFORM MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

20. UK FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)

32. THE MIDDLE EAST AND AFRICA FIBER OPTIC PREFORM MARKET SIZE, 2023-2031 ($ MILLION)