Financial Crimes Software Market

Global Financial Crimes Software Market Size, Share & Trends Analysis Report by Product (Cloud Based and On-Premises), and by Applications (Transaction Monitoring & Reporting, Customer Identity Management, and Other), and by End-User (BFSI, Aerospace & Defense, Healthcare, IT & Telecom, and Other) Forecast Period (2021-2027)

The global financial crimes software market is anticipated to grow at a significant CAGR of 9.5% during the forecast period (2021-2027). Nowadays, younger generation’s investors and users are showing interest towards digital or cashless transactions. Currently, the population across the countries are adopting digital and cashless transactions, owing to which financial sectors have been pushed to develop innovative, preventive, and efficient solutions for financial crime and fraud management. Thus, such factors is anticipated to propel the growth of the market across the globe. For Instance, in February 2021, Qatar regulator launches platform to monitor human understanding of financial crime. The digital assessment, which is available on mobile devices and laptops, results in regulating and enabling it to monitor compliance.

The surge in adoption of advanced technologies also increases the chance of various financial threats such as identity theft, cyberstalking, card skimming, money laundering, terrorist financing, insider dealing, and phishing. As the companies are increasingly adapt to emerging technologies, such as digital wallet service Apple Pay and Near Field Communication (NFC), the likelihood of hacks and data security breaches is rising. Hence, the companies are continuously focusing on developing various digtal payment software catering to reduce the risk of cyber related frauds, which will drive the growth of the market. For instance, in November 2021, ACI Worldwide launched Network Intelligence Technology catering to combat with real-time payment frauds. The technology will enable banks and other users to send the fraud signals through machine learning tools and technology.

Impact of COVID-19 Pandemic on Global Financial Crimes Software Market

The COVID-19 pandemic brought opportunites and threats as well. In the financial crime patterns, the physical crime was decreased and cybercrime increased. The cybercrime increased because due to the lockdown situation there was huge increment in adoption of technologies and consumer preferred to go digitally for payment options and the number of non-cash payments has increased significantly. The rise in non-cash payments via internet payments, prepaid cards, and mobile payments has created new gateways for cybercrime in recent days.

Segmental Outlook

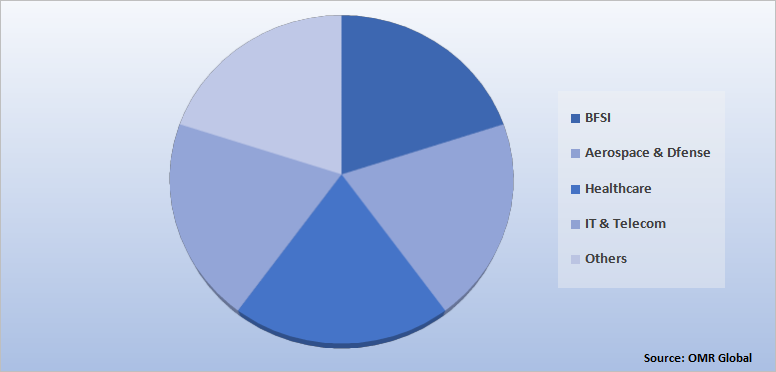

The global financial crimes software has been segmented based on the product, applications, and end-user. Based on the by product segment, the market is futher bifurcated into cloud based and on-premise. Based on the application, the market is sub-segmented as transaction monitoring & reporting, customer identity management, and others. The other applications include compliance and currency management. Further, based on the end-user, the market is augmented as BFSI, aerospace & defense, healthcare, IT & telecom, and others. The other end-user includes retail, securities, and financial institutions. Among these, cloud based financial crimes softwareis expected to drive growth of the maret. Owing to the high adoption of cloud services by the financial sector, implementation of network analytics to streamline fraud detection operations. The banking sector is also adopting cloud services to include more flexibility in its agile business model to meet changing customer needs. Cloud technology helps the banking sector to automatically assemble or integrate the resources to meet business demands.

Global Financial Crimes Software Market Share by End-User, 2020 (%)

The Other Segment is Anticipated to Hold the Major Share in the Global Financial Crimes Software Market

The others financial institution segement is expected to hold the major share in the global financial crime software market due to excessive demand for solutions against technology-driven crime and fraud prevention, which will drive the growth of the market. For Instance, in November 2021, Feedzai launches RiskOps platform to tackle financial crime software overload. RiskOps is a new approach to risk management that tackles more than just fincrime. RiskOps assists risk management teams stop fraud and money laundering, and include tools to comply with regulations and adhere to other revenue, operational, and compliance risk policies such as PSD2, GDPR, and TILA.

Regional Outlooks

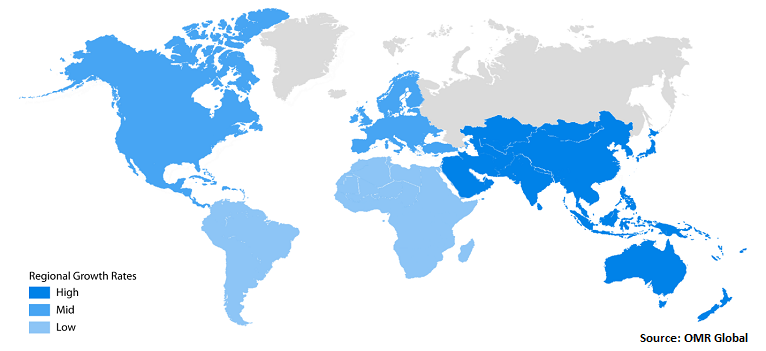

The global financial crimes software market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Financial Crimes Software Market Growth, by Region 2021-2027

The North America Region Holds the Major Share in the Global Financial Crimes Software Market

The North America region is expected to holds the prominent market share in the global financial crimes market over the forecast period . Due to the presence of prominent players across countries including the US and Canada. The presence of a large number of banks is also expected to drive the adoption of financial crimes software solutions in the region in the near future. Additionally, the rapid increase in number of mergers and takeovers among the financial crimes vendors to implement artificial intelligence (AI), which is expected to drive market growth. For Instance, in April 2020, IBM & Fenergo Joined forces to fight financial crime. IBM planned to build on this work to assist clients in integrating AI-driven insights from its financial crimes insights series of solutions into Fenergo's CLM solution.

Market Players Outlook

The major companies serving the global financial crimes software market include ACI Worldwide, Capgemini Services SAS, Dell Technologies, Inc., IBM Corp., Oracle, Lexisnexis, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2020, Computer Services, Inc. (CSI) has partnered with Featurespace, a leading provider of Enterprise Financial Crime prevention software, to launch a holistic anti-money laundering (AML) solution such as WatchDOG AML.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global financial crimes software market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Financial Crimes Software Market

• Recovery Scenario of Global Financial Crimes Software Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. ACI Worldwide

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Capgemini Services Sas

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dell Technologies, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Oracle

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Financial Crimes Software Market By Product

4.1.1. Cloud Based

4.1.2. On-Premise

4.2. Global Financial Crimes Software Market By Applications

4.2.1. Transaction Monitoring& Reporting

4.2.2. Customer Identity Management

4.2.3. Others (Compliance Management)

4.3. Global Financial Crimes Software Market ByEnd-User

4.3.1. BFSI

4.3.2. Aerospace &Defense

4.3.3. Healthcare

4.3.4. IT & Telecom

4.3.5. Others (Retail and Securities)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abrigo

6.2. AML360

6.3. Bae Systems Plc

6.4. China Software And Technical Services Co., Ltd.

6.5. Eastnets

6.6. Experian Information Solutions, Inc

6.7. Feedzai

6.8. Featurespace Ltd.

6.9. Fico

6.10. Fiserv, Inc.

6.11. Lexisnexis

6.12. Nice Ltd.

6.13. Riking Software System Co. Ltd.

6.14. Sas Institute Inc.

6.15. Sungard Availability Services Lp

6.16. The Global Treasurer

6.17. Verafin

1. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

2. GLOBAL CLOUD BASED FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ON-PREMISE FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

5. GLOBAL FINANCIAL CRIMES SOFTWARE FOR TRANSACTION MONITORING& REPORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL FINANCIAL CRIMES SOFTWARE FOR CUSTOMER IDENTITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL FINANCIAL CRIMES SOFTWARE FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

9. GLOBAL FINANCIAL CRIMES SOFTWARE IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL FINANCIAL CRIMES SOFTWARE IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL FINANCIAL CRIMES SOFTWARE IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL FINANCIAL CRIMES SOFTWARE IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL FINANCIAL CRIMES SOFTWARE IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

17. NORTH AMERICAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

18. NORTH AMERICAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

19. EUROPEAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. EUROPEAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

21. EUROPEAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

22. EUROPEAN FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

27. REST OF THE WORLD FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

29. REST OF THE WORLD FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2020-2027 ($ MILLION)

30. REST OF THE WORLD FINANCIAL CRIMES SOFTWARE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL FINANCIAL CRIMES SOFTWARE MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL FINANCIAL CRIMES SOFTWARE MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL FINANCIAL CRIMES SOFTWARE MARKET, 2021-2027 (%)

4. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. GLOBAL CLOUD BASED FINANCIAL CRIMES SOFTWARE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL ON-PREMISE FINANCIAL CRIMES SOFTWARE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET SHARE BY APPLICATIONS, 2020 VS 2027 (%)

8. GLOBAL FINANCIAL CRIMES SOFTWARE FOR TRANSACTION MONITORING & REPORTING MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL FINANCIAL CRIMES SOFTWARE FOR CUSTOMER IDENTITY MANAGEMENT MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL FINANCIAL CRIMES SOFTWARE FOR OTHER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL FINANCIAL CRIMES SOFTWARE MARKET SHARE BY END-USER, 2020 VS 2027 (%)

12. GLOBAL FINANCIAL CRIMES SOFTWARE IN BFSI MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL FINANCIAL CRIMES SOFTWARE IN AEROSPACE & DEFENSE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL FINANCIAL CRIMES SOFTWARE IN HEALTHCARE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL FINANCIAL CRIMES SOFTWARE IN IT & TELECOM MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL FINANCIAL CRIMES SOFTWARE IN OTHER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. US FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

19. UK FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

20. FRANCE FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

22. ITALY FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

23. SPAIN FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF EUROPE FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

25. INDIA FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

26. CHINA FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

27. JAPAN FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD FINANCIAL CRIMES SOFTWARE MARKET SIZE, 2020-2027 ($ MILLION)