Fire Resistant Coatings Market

Fire Resistant Coatings Market Size, Share & Trends Analysis Report, By Technology (Solvent-Borne Fire Resistant Coatings and Water-Borne Fire Resistant Coatings), By Coating Type (Intumescent Fire Resistant Coatings and Cementitious Fire Resistant Coatings), By Resin Type (Silicon, Epoxy, Acrylic, Vinyl, and Others), By End-User (Building & Construction, Power, Transportation, Oil & Gas, and Others) Forecast Period (2025-2035)

Industry Overview

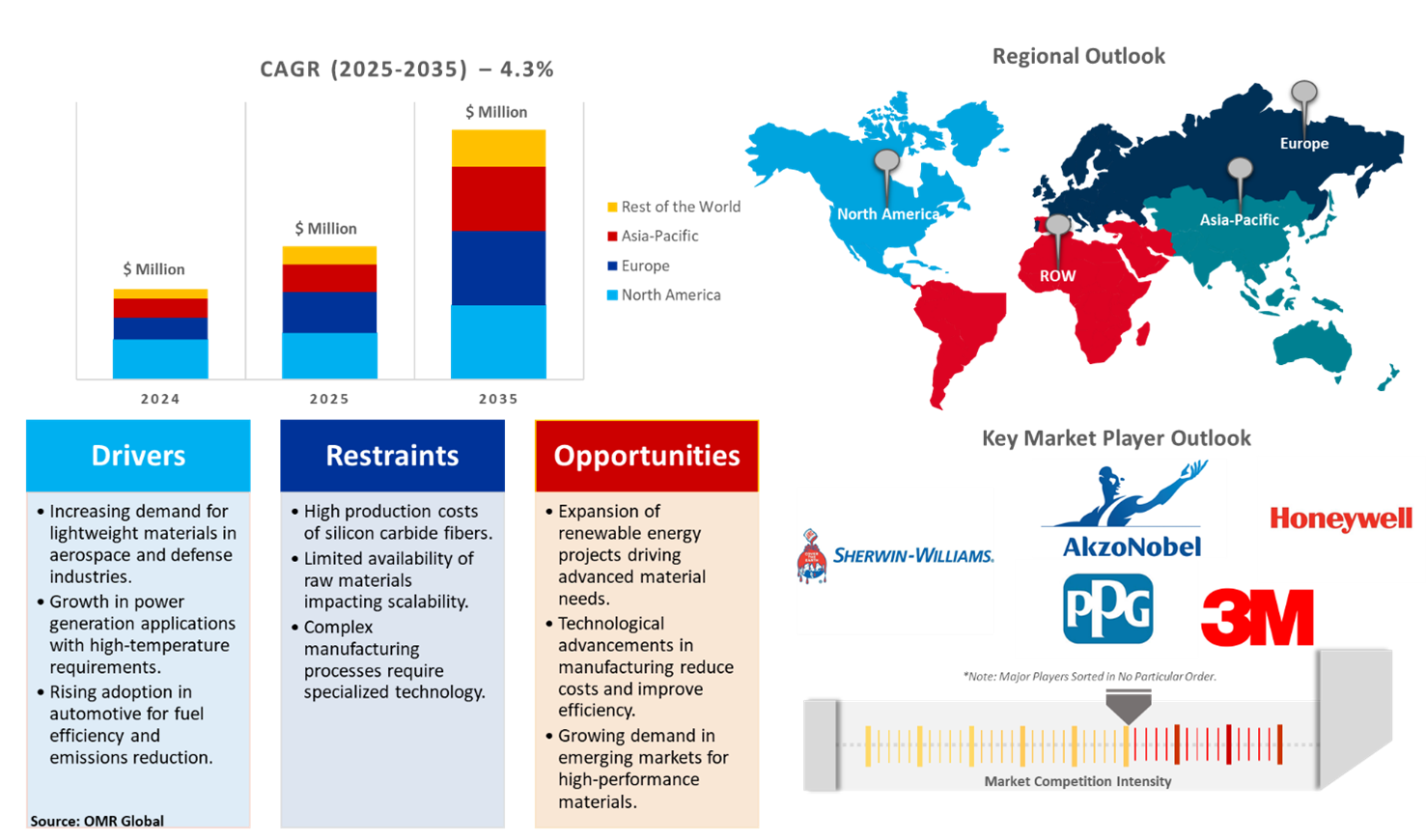

Global fire resistant coatings market was valued at $1,175 million in 2024 and is projected to reach $1,864 million by 2035, growing at a CAGR of 4.3% from 2025 to 2035. The market is primarily driven by increasingly stringent fire safety regulations, growing awareness about fire protection, and the development of advanced coating technologies. Innovations in fire-resistant coating formulations, such as the development of intumescent coatings and water-based products, have improved their performance and durability, attracting a larger customer base. Additionally, the rising demand from the automotive and aerospace sectors further fuels the market's growth, as these industries increasingly prioritize safety and innovation. In February 2023, PPG announced the launch of PPG STEELGUARD 951 coating, an epoxy intumescent fire protection coating designed to meet the demands of modern architectural steel, including up to three hours of cellulosic fire protection.

Market Dynamics

Rising Wildfire Incidents Drive the Demand for Fire-Resistant Coatings

Climate change contributes to the increased frequency and intensity of wildfires globally, with significant impacts on society and the environment. Although wildfires are a natural part of the global climate system, extreme wildfires are among one of the most striking signals of a changing climate. Fuelled by higher temperatures and drier conditions that burn fuels, larger wildfires are burning for longer periods globally. The global area burned reached 384 Mha in 2023. This total is substantially higher than in the past few years, including 2020 (351 Mha), 2021 (354 Mha) and 2022 (329 Mha). This condition led to a rise in demand for fire-resistant coatings. Firefree Coatings, Inc. offers Firefree Wildfire Exterior System, a coating that protects against wildfires in areas where cities meet wildlands. It's the first and only system that meets the ASTM fire & weatherization standards.

Growing Aircraft Fleet Drives Demand for Fire-Resistant Coatings in Aerospace

In December 2024, the Tata Group-owned Air India modernized and expanded its fleet, by announcing orders for an additional 10 A350 widebody aircraft alongside 90 single-aisle A320 Family aircraft. This move builds upon the 40 A350 and 210 A320 Family aircraft ordered in 2023, resulting in a total order book of 344 Airbus aircraft, which now includes six A350-900s already delivered. This increase in aircraft orders leads to the demand for fire-resistant coatings. These coatings are essential for aviation fire safety standards, protecting critical components from extreme heat, reducing flame spread, and enhancing passenger safety. Additionally, FireFree Inc. provides fire-resistant coatings and fireproof paints for steel and metal for a wide range of industries, including aerospace applications. Its products keep aircraft and other aerospace products safe with passive fire protection.

Market Segmentation

- Based on the technology, the market is segmented into solvent-borne fire-resistant coatings and water-borne fire-resistant coatings.

- Based on the coating type, the market is segmented into intumescent fire-resistant coatings and cementitious fire-resistant coatings.

- Based on the resin type, the market is segmented into silicon, epoxy, acrylic, vinyl, and others.

- Based on the end-user, the market is segmented into building & construction, power, transportation, oil & gas, and others.

Intumescent Coatings Segment to Lead the Market with the Largest Share

Construction projects are turning to steel as the core component. Steel enables strong and resilient buildings with wider spans and more open areas to be built more quickly, economically, and with a reduced environmental footprint. Protecting steel-framed buildings against fire is a vital part of the planning and construction process and safety features are generally a mix of active and passive mechanisms. Intumescent paints are applied to steel in thin layers and are inert at the normal operating temperature of a building. Once the temperature starts to rise above 200-250?C, the coating starts expanding to many times its original thickness (typically around 55 times) to insulate the steel beneath. The swelling is a result of a complex chemical reaction within the coating that comprises a mix of a binder system, catalysts, carbon sources, inorganic pigments, and blowing agents. Together, this creates an expanded char that incorporates millions of microscopic gas cavities within an inorganic and carbonaceous matrix. Intumescent coatings have a range of advantages which include:

- Good aesthetic finish and adaptability to the shape of steel, enable the steel to be exposed as well as protected.

- Ease of application, this reduces the application time and associated cost as well as the likelihood of defects.

- Coatings are applied as a compatible system of primer, intumescent, and topcoat, all of them tested together for fire and corrosion protection.

- Mechanical strength to avoid impact damage.

- Flexible to adjust to structural movements such as vibrations, expansion, and contraction caused by temperature differences and load changes.

Building & Construction: A Key Segment in Market Growth

India's construction sector stands as a cornerstone of the nation's economic strategy, pivotal in addressing critical infrastructure needs and providing substantial employment opportunities. Infrastructure construction and real estate assets such as offices, retail, housing, and data centers have been the major focus areas for both the government and the private sector. According to Invest India, in the fiscal year 2024-25, the government boosted its capital expenditure by 11.1% to $133 billion, equivalent to 3.4% of the GDP. Such investments are poised for growth within the construction sector, fostering the development of modern infrastructure nationwide. This growth in infrastructure development fuels the demand for fire-resistant coatings to meet evolving safety standards, in high-rise buildings, commercial properties, and critical data infrastructure, where fire safety compliance is supreme.

Regional Outlook

The global fire-resistant coating market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

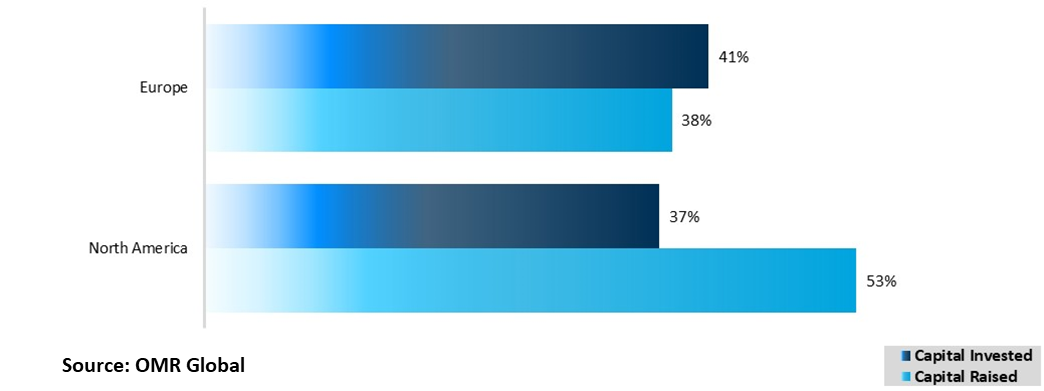

Growing Investment in the Infrastructure Accelerates Demand for Fire-Resistant Coating in Europe and North America

According to Global Infrastructure Hub based on Realfin data, in 2022, for the first time, private infrastructure capital invested grew by 64%, outpacing the growth in private infrastructure capital raised by 15%. The vast majority of capital raised 91% and invested 78% by funds in 2022 was concentrated in North America and Europe. With the rising inflationary pressures and risk aversion coupled with intensified government plans for infrastructure investments, the private capital raised for infrastructure increased sharply to a record level of $166 billion in 2022, while the aggregate capital raised for all asset classes declined. This upward trend in infrastructure investment directly boosts the demand for fire-resistant coatings, which are essential in large-scale construction and infrastructure projects to meet fire safety codes and regulations.

Private Infrastructure Capital Raised And Invested By Funds by Region, 2022 (% )

Asia Pacific region is the fastest growing in the Market.

Asia-Pacific is anticipated to exhibit significant in the market during the forecast period. The significant growth in transportation projects in the emerging economies of the region is a key factor in driving the regional market growth. These developments demand enhanced safety measures, including the integration of fire-resistant coatings for tunnels, bridges, and railway systems. For instance, in March 2024, Central Japan Railway Co. announced that it has given up its plan to launch a high-speed maglev train between Tokyo and Nagoya in 2027 amid long-running environmental opposition in Shizuoka Prefecture, pushing back the schedule possibly to 2034 or later. Similarly, India’s central and state governments have rapidly built and expanded metro rail systems across cities as a competitive public transport alternative. Over $25 billion has been invested in metro rail projects since 2010.

Market Players Outlook

The major companies operating in the global fire-resistant coating market include 3M Co., Akzo Nobel N.V., Honeywell International Inc., The Sherwin-Williams Company, and PPG Industries Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In February 2023, Huntsman launched three new products at the European Coatings Show (ECS), showcasing its team’s ingenuity and the confidence formulators gained from creating coatings with its chemistries. The products unveiled at ECS 2023 included the POLYRESYST IC6005 polyurethane system – a novel intumescent coating developed for the construction industry that provided passive fire performance alongside strong protective properties. Designed for use on a variety of substrates, the POLYRESYST IC6005 polyurethane system offered improved chemical resistance, water resistance, and durability.

- In April 2022, Henkel launched two new protective coating products, Loctite EA 9400 and Loctite FPC 5060 – that are designed to shield EV battery housings against heat and fire in case of a thermal runaway. Designed for automated mass production, they can both be applied by ‘spray’ or ‘flat stream’ nozzles, and both are compatible with common automated dispensing systems. They also both cure at room temperature. Loctite EA 9400 is a two-component, epoxy-based coating. It has been designed to be applied in a thin layer that adds only a little weight to the battery.

- In April 2022, Jotun launched SteelMaster 1200HPE, a high-performance epoxy intumescent coating providing up to 120 minutes of protection against cellulosic fires. Engineered to protect structural steel of public spaces, including airports, hotels, train stations, school buildings, stadiums, and malls, this build, 100% solids epoxy product combines fire protection with weather resistance up to C5 environments.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global fire-resistant coating market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Fire Resistant Coatings Market Sales Analysis – Technology | Coating Type | Resin Type | End-User ($ Million)

• Fire Resistant Coatings Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Fire Resistant Coatings Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Fire Resistant Coatings Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Fire Resistant Coatings Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Fire Resistant Coatings Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Fire Resistant Coatings Market Revenue and Share by Manufacturers

• Fire Resistant Coatings Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. 3M Co.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Akzo Nobel N.V.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Honeywell International Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. The Sherwin-Williams Company

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. PPG Industries Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Fire Resistant Coatings Market Sales Analysis by Technology ($ Million)

5.1. Solvent-Borne Fire Resistant Coatings

5.2. Water-Borne Fire Resistant Coatings

6. Global Fire Resistant Coatings Market Sales Analysis by Coating Type ($ Million)

6.1. Intumescent Fire Resistant Coatings

6.2. Cementitious Fire Resistant Coatings

7. Global Fire Resistant Coatings Market Sales Analysis by Resin Type ($ Million)

7.1. Silicon

7.2. Epoxy

7.3. Acrylic

7.4. Vinyl

7.5. Other

8. Global Fire Resistant Coatings Market Sales Analysis by End-User Industry ($ Million)

8.1. Building & Construction

8.2. Power

8.3. Transportation

8.4. Oil & Gas

8.5. Others

9. Regional Analysis

9.1. North American Fire Resistant Coatings Market Sales Analysis – Technology | Coating Type | Resin Type | End-User |Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Fire Resistant Coatings Market Sales Analysis – – Technology | Coating Type | Resin Type | End-User |Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Fire Resistant Coatings Market Sales Analysis – Technology | Coating Type | Resin Type | End-User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Fire Resistant Coatings Market Sales Analysis – Technology | Coating Type | Resin Type | End-User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Albi Protective Coatings

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Benjamin Moore & Co

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Carboline

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Contego International Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. ETEX Group

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Feukem India Pvt. Ltd.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Hempel A/S

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Hubexo North UK Ltd.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Ibtikar Fire Proofing

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Isolatek International

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Jotun

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. No-Burn, Inc.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Protexion

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Prowood Finishes

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. RPM International Inc

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Sika AG

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Sirca S.p.A

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Synthomer plc

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Teknos Group Oy

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Tremco Illbruck

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

1. Global Fire Resistant Coatings Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Solvent-Borne Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Water-Borne Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Fire Resistant Coatings Market Research And Analysis By Coating Type, 2024-2035 ($ Million)

5. Global Intumescent Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Cementitious Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Fire Resistant Coatings Market Research And Analysis By Resin Type, 2024-2035 ($ Million)

8. Global Silicon-Based Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Epoxy Based Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Acryl Based Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Vinyl Based Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Other Resin-Based Fire Resistant Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Fire Resistant Coatings Market Research And Analysis By End-User, 2024-2035 ($ Million)

14. Global Fire Resistant Coatings For Building & Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Fire Resistant Coatings For Power Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Fire Resistant Coatings For Transportation Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Fire Resistant Coatings For Oil & Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Fire Resistant Coatings For Other End-Users Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Fire Resistant Coatings Market Research And Analysis By Geography, 2024-2035 ($ Million)

20. North American Fire Resistant Coatings Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American Fire Resistant Coatings Market Research And Analysis By Technology, 2024-2035 ($ Million)

22. North American Fire Resistant Coatings Market Research And Analysis By Coating Type, 2024-2035 ($ Million)

23. North American Fire Resistant Coatings Market Research And Analysis By Resin Type, 2024-2035 ($ Million)

24. North American Fire Resistant Coatings Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. European Fire Resistant Coatings Market Research And Analysis By Country, 2024-2035 ($ Million)

26. European Fire Resistant Coatings Market Research And Analysis By Technology, 2024-2035 ($ Million)

27. European Fire Resistant Coatings Market Research And Analysis By Coating Type, 2024-2035 ($ Million)

28. European Fire Resistant Coatings Market Research And Analysis By Resin Type, 2024-2035 ($ Million)

29. European Fire Resistant Coatings Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. Asia-Pacific Fire Resistant Coatings Market Research And Analysis By Country, 2024-2035 ($ Million)

31. Asia-Pacific Fire Resistant Coatings Market Research And Analysis By Technology, 2024-2035 ($ Million)

32. Asia-Pacific Fire Resistant Coatings Market Research And Analysis By Coating Type, 2024-2035 ($ Million)

33. Asia-Pacific Fire Resistant Coatings Market Research And Analysis By Resin Type, 2024-2035 ($ Million)

34. Asia-Pacific Fire Resistant Coatings Market Research And Analysis By End-User, 2024-2035 ($ Million)

35. Rest Of The World Fire Resistant Coatings Market Research And Analysis By Country, 2024-2035 ($ Million)

36. Rest Of The World Fire Resistant Coatings Market Research And Analysis By Technology, 2024-2035 ($ Million)

37. Rest Of The World Fire Resistant Coatings Market Research And Analysis By Coating Type, 2024-2035 ($ Million)

38. Rest Of The World Fire Resistant Coatings Market Research And Analysis By Resin Type, 2024-2035 ($ Million)

39. Rest Of The World Fire Resistant Coatings Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Fire Resistant Coatings Market Share By Technology, 2024 Vs 2035 (%)

2. Global Fire Resistant Coatings Market Share By Coating Type, 2024 Vs 2035 (%)

3. Global Fire Resistant Coatings Market Share By Resin Type, 2024 Vs 2035 (%)

4. Global Fire Resistant Coatings Market Share By End-User, 2024 Vs 2035 (%)

5. Global Fire Resistant Coatings Market Share By Geography, 2024 Vs 2035 (%)

6. Global Solvent-Borne Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

7. Global Water-Borne Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

8. Global Intumescent Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

9. Global Cementitious Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

10. Global Silicon-Based Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

11. Global Epoxy-Based Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

12. Global Acrylic Based Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

13. Global Vinyl Based Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

14. Global Other Resin-Based Fire Resistant Coatings Market Share By Region, 2024 Vs 2035 (%)

15. Global Fire Resistant Coatings For Building & Construction Market Share By Region, 2024 Vs 2035 (%)

16. Global Fire Resistant Coatings For Power Market Share By Region, 2024 Vs 2035 (%)

17. Global Fire Resistant Coatings For Transportation Market Share By Region, 2024 Vs 2035 (%)

18. Global Fire Resistant Coatings For Oil & Gas Market Share By Region, 2024 Vs 2035 (%)

19. Global Fire Resistant Coatings For Other End-Users Market Share By Region, 2024 Vs 2035 (%)

20. US Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

21. Canada Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

22. UK Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

23. France Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

24. Germany Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

25. Italy Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

26. Spain Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

28. India Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

29. China Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

30. Japan Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

31. South Korea Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

33. ASEAN Economies Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

35. Rest Of The World Fire Resistant Coatings Market Size, 2024-2035 ($ Million)

FAQS

The size of the Fire Resistant Coatings market in 2024 is estimated to be around $1,175 million.

Asia Pacific holds the largest share in the Fire Resistant Coatings market.

Leading players in the Fire Resistant Coatings market include 3M Co., Akzo Nobel N.V., Honeywell International Inc., The Sherwin-Williams Company, and PPG Industries Inc., among others.

Fire Resistant Coatings market is expected to grow at a CAGR of 4.3% from 2025 to 2035.

Rising construction activities and stringent fire safety regulations are key factors driving the growth of the Fire Resistant Coatings Market.