Geriatric Medicine Market

Global Geriatric Medicine Market Size, Share & Trends Analysis Report by Therapeutic (Analgesic, Anticoagulant, Antihypertensive, Antidiabetic, and Others) and by Condition (Cardiovascular Diseases (CVDs), Diabetes, Neurological, Cancer, Respiratory, and Others) and Forecast 2020-2026

The global geriatric medicine market is growing at a significant CAGR of around 6.1% during the forecast period (2020-2026). The market is driven by the significant rise in the geriatric population base across the globe. According to the World Health Organization (WHO), the geriatric population is expected to get double by 2050, when compared to 2000. Globally, in 2000, the proportion of the people aged over 65 years were 11.0% of the global population, and these statistics are expected to reach 22.0% by 2050. In turn, the geriatric population is expected to reach 2 billion by 2050, as compared to 605 million in 2010. Similarly, the people aged over 80 years or older are expected to get quadrupled to 395 million from 2000 to 2050. With such a rise in the geriatric population base, the prevalence of chronic diseases and age-related disorders, such as osteoporosis and CVDs will gain traction during the forecast period. To cater the increasing patient base, the demand for geriatric medicine will rise during the forecast period. However, the less drug approvals for the geriatric medicines and imposition of several rules and regulations are some factors that impede the geriatric medicine market across the globe.

Segmental Outlook

The geriatric medicine market is classified on the basis of therapeutics and conditions. Based on therapeutics, the market is segmented into analgesic, anticoagulant, antihypertensive, antidiabetic, and others. Based on condition, the market is segregated into CVDs, diabetes, neurological, cancer, respiratory, and others.

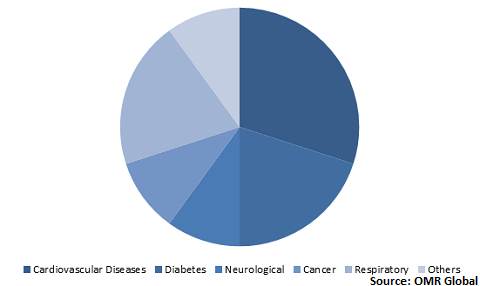

Global Geriatric Medicine Market Share by Condition, 2019 (%)

Global geriatric medicine market is driven by rising cardiovascular diseases

The cardiovascular disease is one of the leading cause of mortalities in elderly population. According to the National Institute of Aging, the adults aged 65 years and above are more likely to develop CVD as compared to young sub-ordinates. Aging changes the function of blood vessels and heart, which ultimately leads to the development of CVDs, such as stroke, hypertension, cardiac arrest, and heart attack. In order to cater the increasing cardiac population base, the government organizations are taking necessary steps for CVD awareness. For instance, China PEACE Million Persons Project was established by the Ministry of Finance in 2014. It is a continuous government-funded initiative with the aim of enrolling 5 million people to improve CVD risk factors in China.

Regional Outlook

The global geriatric medicine market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global geriatric medicine market. The US plays the critical role in geographic contribution of North America in global geriatric medicine market. As per the Population Reference Bureau (PRB), the number of Americans aged 65 and older is projected to nearly double from 52 million in 2018 to 95 million by 2060, and their share of the total population will rise from 16% to 23%. Older age is a primary risk factor for hypertension, diabetes, and respiratory disorders. Therefore, the rising geriatric population base and associated health disorders drives the geriatric medicine market in the region.

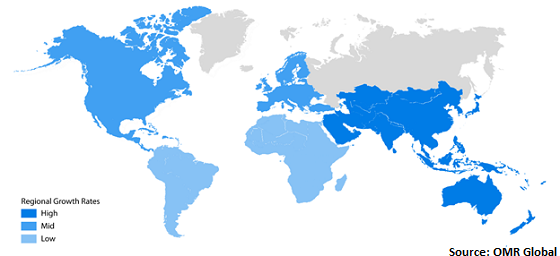

Global Geriatric Medicine Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global geriatric medicine market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. The market in the region is driven by the rising geriatric population along with the continuous growth in the healthcare expenditure. China is the second-largest economy after the US and has the world’s largest population (1.4 billion), followed by India (1.3 billion) as per data provided by the World Bank in 2020. Both, China and India hold 40% of the total world population share. As the population of India and China grows, its expanding share of older adults is particularly notable. The United Nations Population Division projects that India’s population age 50 years and older will reach 34% by 2050. Between 2010 and 2050, the share of people aged over 65 and older is expected to increase from 5% to 14%, while the share in the oldest age group (80 and older) will triple from 1% to 3%. Such projected growth in the geriatric population will expectedly spur the growth of the geriatric medicine market in Asia-Pacific during the forecast period.

Market Players Outlook

The key players in the geriatric medicine market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global geriatric medicine market include Pfizer Inc., Bristol-Myers Squibb Co., Abbott Laboratories, Eli Lilly and Co., Boehringer Ingelheim GmbH, and AstraZeneca PLC. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global geriatric medicine market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Pfizer Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bristol-Myers Squibb Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Abbott Laboratories

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Eli Lilly and Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Boehringer Ingelheim GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Geriatric Medicine Market by Therapeutic

5.1.1. Analgesic

5.1.2. Anticoagulant

5.1.3. Antihypertensive

5.1.4. Antidiabetic

5.1.5. Others (Statins and Antipsychotic)

5.2. Global Geriatric Medicine Market by Condition

5.2.1. Cardiovascular Diseases (CVDs)

5.2.2. Diabetes

5.2.3. Neurological

5.2.4. Cancer

5.2.5. Respiratory

5.2.6. Others (Arthritis and Osteoporosis)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Amgen Inc.

7.3. Astellas Pharma Inc.

7.4. AstraZeneca PLC

7.5. Boehringer Ingelheim GmbH

7.6. Bristol-Myers Squibb Co.

7.7. Cipla Ltd.

7.8. Eli Lilly and Co.

7.9. GlaxoSmithKline PLC

7.10. Johnson & Johnson Services Inc.

7.11. Merck & Co., Inc.

7.12. Novartis AG

7.13. Pfizer Inc.

7.14. Sanofi SA

7.15. Teva Pharmaceutical Industries Ltd.

1. GLOBAL GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

2. GLOBAL ANALGESICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ANTICOAGULANT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ANTIHYPERTENSIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ANTIDIABETIC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY CONDITION, 2019-2026 ($ MILLION)

8. GLOBAL GERIATRIC MEDICINE FOR CVD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL GERIATRIC MEDICINE FOR DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL GERIATRIC MEDICINE FOR NEUROLOGICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL GERIATRIC MEDICINE FOR CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL GERIATRIC MEDICINE FOR RESPIRATORY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER CONDITIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

17. NORTH AMERICAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY CONDITION, 2019-2026 ($ MILLION)

18. EUROPEAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

20. EUROPEAN GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY CONDITION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY CONDITION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2019-2026 ($ MILLION)

25. REST OF THE WORLD GERIATRIC MEDICINE MARKET RESEARCH AND ANALYSIS BY CONDITION, 2019-2026 ($ MILLION)

1. GLOBAL GERIATRIC MEDICINE MARKET SHARE BY THERAPEUTICS, 2019 VS 2026 (%)

2. GLOBAL GERIATRIC MEDICINE MARKET SHARE BY CONDITION, 2019 VS 2026 (%)

3. GLOBAL GERIATRIC MEDICINE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD GERIATRIC MEDICINE MARKET SIZE, 2019-2026 ($ MILLION)