Growlers Market

Growlers Market Size, Share, and Trends Analysis Report by Material (Ceramic, Glass, Metal, and Plastic), byApplication (Non-Alcoholic Beverages and Alcoholic Beverages), Forecast Period (2023–2030)

Growlers market is anticipated to grow at a considerable CAGR of 3.0% during the forecast period. The increased consumer demand for crafted beer, owing to its freshness and lack of preservatives, is propelling the growlers market. Additionally, advancements in transportation and packaging contribute to the positive effect on demand. Another primary aspect fueling the growth of the growlers market is changing customer demand for a diverse range of tastes and flavors. Nonetheless, the high cost of growlers in comparison to other alternatives contributes to the market's slow growth.

Segmental Outlook

The global growlers market is segmented by material and application. Based on material, the market is sub-segmented into ceramic, glass, metal, and plastic. Based on application, the market is sub-segmented into non-alcoholic beverages and alcoholic beverages. Among these,the alcoholic beverage segment uses growlers more often than the non-alcoholic segment. This is because growlers are commonly used to transport and store craft beer, which is a popular and growing segment of the beer market. While growlers are occasionally used for non-alcoholic beverages such as kombucha or cold brew coffee, their use in the alcoholic beverage segment is much more widespread.

The Glass Segment Holds a Prominent Share in the Global Growlers Market

Based on material, the market is sub-segmented into ceramic, glass, metal, and plastic. Among these, the glasssegment is anticipated to hold the largest market share during the forecast period. Glass growlers are the most popular in the market for several reasons. For instance, glass is an inert material that does not interact with the beer, ensuring that the flavor and quality of the beer are maintained. Secondly, glass is easy to clean and sanitize, making it a hygienic option for storing beer or other non-alcoholic beverages as well. Additionally, glass is reusable and recyclable, making it an eco-friendly option for packaging. Overall, these benefits have made glass growlers a popular choice for both brewers and consumers in the beer market.

Regional Outlook

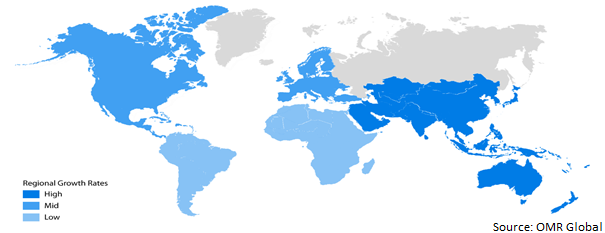

The global growlers market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the European region is expected to generate the highest market share. Additionally, the North American market is predicted to grow significantly, followed by the Asia-Pacific region.

Global Growlers Market Growth, by Region (2023-2030)

The European Region is Expected to Dominate the Global Growlers Market

The key factor that drives the region’s growlers market is alcohol consumption. Russia, Belarus, Moldova, and the Czech Republic are some of the top countries across the globe that consume huge amounts of alcohol every year. According to Alcohol.org’s data published in January 2023, Russians consume an average of 326 servings per person in a single year, more spirits than any of the other top GDP countries. Additionally, according to the World Health Organization, Belarus, a small landlocked country in Europe, consumes the greatest average number of liters of pure alcohol per capita. On average, its citizens consume 14.4 liters per year, over 1.5 times more than Americans. Due to this demand, there are a large number of growler companies in Europe, such as CraftBeer Growlers Ltd., The Malt Miller, and others.

Market Players Outlook

The major companies serving the global growlers market include Alpha Group, Ardagh Group SA, Berlin Packaging LLC, DrinkTanks, Fort Point Beer Company, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new feature launches to stay competitive in the market. For instance, in November 2021, Ardagh Group S.A. acquired Consol Holdings Proprietary Ltd. (Consol), Africa's top supplier of glass packaging, for $635 million in shares.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global growlersmarket. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Growlers Market by Material

4.1.1. Ceramic

4.1.2. Glass

4.1.3. Metal

4.1.4. Plastic

4.2. Global Growlers Market by Application

4.2.1. Non-Alcoholic Beverages

4.2.2. Alcoholic Beverages

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alpha Group

6.2. Ardagh Group SA

6.3. Berlin Packaging LLC

6.4. DrinkTanks

6.5. Fort Point Beer Company

6.6. Glass Solutions

6.7. GrowlerWerks, Inc.

6.8. GrowlerWerks, Inc.

6.9. Krome Brew

6.10. Novio Packaging BV

6.11. Orange Vessel

6.12. Saxco International, LLC

6.13. Southern Pines Growler Company

6.14. The Boelter Companies

6.15. Wm Croxson & Son Ltd.

6.16. Zenan

1. GLOBAL GROWLERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2022-2030 ($ MILLION)

2. GLOBAL GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CERAMIC GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL GLASS GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL METAL GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBALPLASTIC GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL GROWLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

8. GLOBAL GROWLERS FOR NON-ALCOHOLIC BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL GROWLERS FOR ALCOHOLIC BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL GROWLERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN GROWLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN GROWLERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2022-2030 ($ MILLION)

13. NORTH AMERICAN GROWLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. EUROPEAN GROWLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN GROWLERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2022-2030 ($ MILLION)

16. EUROPEAN GROWLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC GROWLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC GROWLERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC GROWLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. REST OF THE WORLD GROWLERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD GROWLERS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2022-2030 ($ MILLION)

22. REST OF THE WORLD GROWLERS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL GROWLERS MARKET SHARE BY MATERIAL, 2022 VS 2030 (%)

2. GLOBAL CERAMIC GROWLERS GROWLERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL GLASS GROWLERS GROWLERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL METAL GROWLERS GROWLERS BY MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL PLASTIC GROWLERS GROWLERS BY MARKET SHARE REGION, 2022 VS 2030 (%)

6. GLOBAL GROWLERS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

7. GLOBAL GROWLERS FOR NON-ALCOHOLIC BEVERAGES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL GROWLERS FOR ALCOHOLIC BEVERAGES MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL GROWLERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. US GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

12. UK GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD GROWLERS MARKET SIZE, 2021-2028 ($ MILLION)