Harbor Deepening Market

Global Harbor Deepening Market Size, Share & Trends Analysis Report, by Application (Capital Dredging, Trade Maintenance, Coastal Protection, and Urban Development), by End-User (Government Organizations, Private Organizations, Oil & Gas Companies, and Mining & Energy Companies), and Forecast, 2019-2025

The global harbor deepening market is estimated to grow at a CAGR of 2.5% during the forecast period. The major factors contributing to the growth of the market include the rising funding for harbor deepening projects and significant growth in the oil & gas industry. A significant rise in the number of harbor deepening projects was reported globally owing to the increasing focus on international trade across the globe. For instance, in June 2018, the Charleston Harbor deepening project was allocated $49 million in federal funds in the Army Corps of Engineers’ FY 2018 work plan. This would enable dredging work to continue as S.C. Ports Authority is looking for more funding for future contracts.

In this project, the next step will be the deepening of the Wando River and Charleston Harbor from 45 feet to 52 feet by 2021. This will create more depth for containerships that accesses the three-berth Wando Welch Terminal in Mount Pleasant and enabling them to move at any time of day, not just during high tides. The Charleston Harbor deepening is one of the highly strategic priorities for the state of South Carolina. The Southeast requires a 52-foot harbor for effectively managing the large containerships at the East Coast.

Further, in September 2019, the Florida Department of Transportation (FDOT) has awarded JAXPORT an additional $35.3 million in funding for the Jacksonville Harbor Deepening project. This financing is intended for exercising the second phase of the US Army Corps of Engineers’ contract B. This will deepen the project’s next 2.5 miles. Up to the present time, the state of Florida has led approximately $71.5 million for harbor deepening. This funding, along with increased financial support from a private tenant and the federal government, will facilitate the project two years ahead of schedule with expected completion in 2023. These kinds of ongoing projects are supporting to drive the growth of the harbor deepening market. However, certain factors are restricting the market growth, which includes the shortage of trained and qualified personnel, inadequate dredger repair capabilities across the countries, and lack of inadequate investigation techniques.

Segment Outlook

The global harbor deepening market is segmented into application and end-user. Based on the application, the market is classified into capital dredging, trade maintenance, coastal protection, and urban development. Based on end-user, the market is classified into government organizations, private organizations, oil & gas companies, and mining & energy companies.

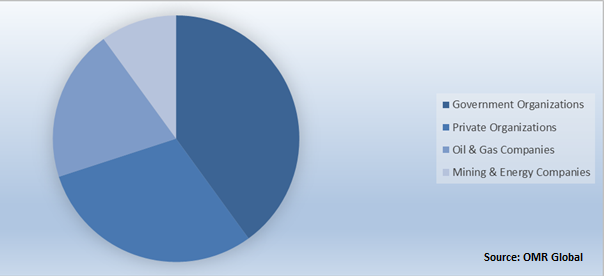

Global Harbor Deepening Market: By End-User

Government organizations are anticipated to hold a significant share in the market in 2018. The increasing number of government projects to enhance port and coastal infrastructure and achieve strong maritime trade linkages is fueling the growth of harbor deepening market in government segment. As per the International Maritime Organization (IMO), 90% of the global trade is carried through the sea. Therefore, governments across the globe are focusing on enhancing their maritime transport infrastructure. As a result, the growth in harbor deepening projects has been witnessed to conduct smooth trade operations.

There are several governments backed harbor deepening projects reported over the years across the countries, including the US, Ukraine, and Germany. For instance, in June 2019, China Harbor Engineering Company Ltd. (CHEC), in partnership with the Ukrainian Sea Ports Authority, has finished the dredging project at the Chernomorsk seaport. The project is intended to increase the competitiveness of Ukraine’s port's in the Black Sea and enable private and state stevedoring companies functioning in the port to attract new cargo traffic.

In 2018, CHEC was chosen as the contractor in open bidding and has supported the Ukrainian Sea Ports Authority save nearly $1.5 million in this dredging project. Such kinds of government projects to promote maritime trade operations are primarily attributing to the investment in harbor deepening by the government organizations.

Global Harbor Deepening Market Share by End-User, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global harbor deepening market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. China Harbour Engineering Co. Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Great Lakes Dredge & Dock Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Jan De Nul Group

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Royal Boskalis Westminster N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Van Oord nv

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Recent Developments

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Harbor Deepening Market by Application

5.1.1. Capital Dredging

5.1.2. Trade Maintenance

5.1.3. Coastal Protection

5.1.4. Urban Development

5.2. Global Harbor Deepening Market by End-User

5.2.1. Government Organizations

5.2.2. Private Organizations

5.2.3. Oil & Gas Companies

5.2.4. Mining & Energy Companies

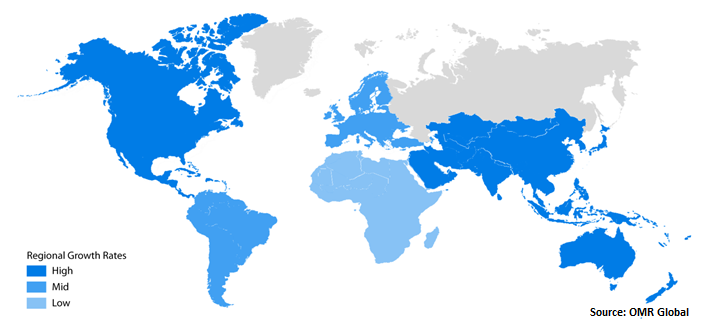

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3R, Inc.

7.2. Adani Ports and Special Economic Zone, Ltd.

7.3. American Underwater Services, Inc.

7.4. Beckett Rankine

7.5. BuildChester, Ltd.

7.6. China Harbour Engineering Co., Ltd.

7.7. DEME (Dredging, Environmental and Marine Engineering N.V.)

7.8. Dredging Corporation of India, Ltd. (DCI)

7.9. DSC Dredge, LLC

7.10. Dutra Group

7.11. Evosun Maldives Pvt. Ltd.sdn bhd

7.12. Great Lakes Dredge & Dock Corp.

7.13. Hyundai Engineering & Construction Co. Ltd.

7.14. Jacksonville Port Authority (JAXPORT)

7.15. Jan De Nul Group

7.16. Manson Construction Co.

7.17. Norfolk Dredging Co.

7.18. Penta Ocean Construction Co., Ltd.

7.19. Royal Boskalis Westminster N.V.

7.20. Toa Corp.

7.21. Van Oord N.V.

1. GLOBAL HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL CAPITAL DREDGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL TRADE MAINTENANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION0

4. GLOBAL COASTAL PROTECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL URBAN DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025($ MILLION)

6. GLOBAL HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

7. GLOBAL GOVERNMENT ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL PRIVATE ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL OIL & GAS COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025

10. GLOBAL MINING & ENERGY COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025

11. NORTH AMERICA HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICA HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. NORTH AMERICA HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

14. EUROPEAN HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. EUROPEAN HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. REST OF THE WORLD HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025($ MILLION)

21. REST OF THE WORLD HARBOR DEEPENING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025($ MILLION)

1. GLOBAL HARBOR DEEPENING MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL HARBOR DEEPENING MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL HARBOR DEEPENING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

6. UK HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD HARBOR DEEPENING MARKET SIZE, 2018-2025 ($ MILLION)