Healthcare Insurance Market

Global Healthcare Insurance Market Size, Share & Trends Analysis Report, By Provider (Private and Public), By Time Period (Life Time Insurance and Term Insurance), and by End-User (Individual and Corporate), Forecast Period (2021-2027)

The global healthcare insurance market is anticipated to grow at a significant CAGR of 6.4 % during the forecast period. Health insurance protects and insured individuals against financial losses arising during medical emergencies. The major factor that drives the growth of the market includes growing health awareness, and improving healthcare infrastructure across the globe. For instance, In June 2021, gross written premiums of health insurance companies in the non-life insurance sector increased by 32.25% YoY (for the FY period up to August 2021) to $ 4.04 billion, driven by rising demand for health insurance products amid the COVID-19 pandemic.

Another factor includes, the growing cost of healthcare and high medical inflation rates are continuously growing the healthcare insurance market. For instance, as per the Pasco County Community Health Assessment 2019, Survey respondents were asked about their ability to access needed health care services. Nearly 23% reported that they did not receive needed health care in the past year due to cost or accessibility, and 30% reported the same for needed dental care. About 25% of respondents reported utilizing the emergency room in the past year, yet nearly 60% of those respondents went to the ER for non-urgent health care needs.

Additionally, the rising pervasiveness of chronic diseases is also driving the healthcare insurance market. For instance, according to national healthcare expenditure, Hospital expenditures grew 6.4% to $1,270.1 billion in 2020, slightly faster than the 6.3% growth in 2019, and Physician & clinical services expenditures grew 5.4% to $809.5 billion in 2020, faster growth than the 4.2% in 2019.

Impact of COVID-19 Pandemic on Global Healthcare Insurance Market

The impact of COVID-19 has created a positive impact on the healthcare insurance market. People are investing in healthcare plans due to the COVID-19 pandemic. Nowadays, People are realizing to stay financially protected, taking a healthcare plan is a better option. Also, service providers are offering customized plans and services to stay in the competition. The companies are also covering COVID-19 in their insurance policies.

The providers are using AI and digital tools to gradually move towards an efficient and digitally integrated ecosystem. These advanced platforms are allowing insured individuals to pay online with different models. Online portals, telemedicine, predictive & behavioral analytics are allowing providers to focus on customer expectations and reduce the cost of healthcare with great transparency.

Segmental Outlook

The global healthcare insurance market is segmented based on provider, time period, and end-user. Based on the provider, the market is segmented into private and public. Based on the time period segment, the market is sub-segmented into lifetime insurance, and term insurance. Based on the end-user segment, the market is bifurcated into individual and corporate.

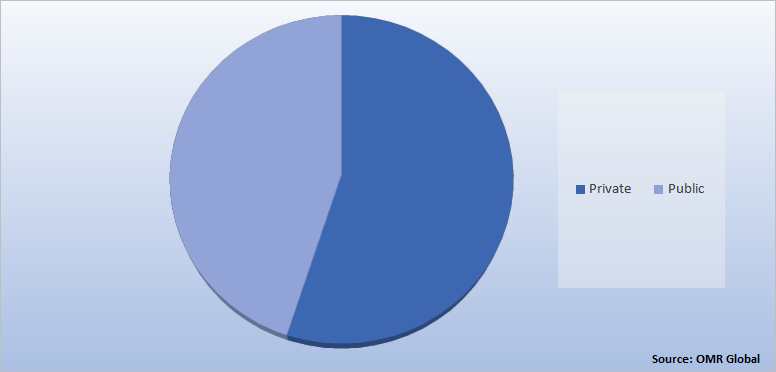

Global Healthcare Insurance Market Share by Provider, 2020 (%)

The Private Segment Holds the Major Share in the Global Healthcare Insurance Market

The private segment holds the major share in the healthcare insurance market. The increasing number of private players that offer customized products are driving the healthcare insurance market. People who are not covered by the government or any insurance program purchase from private healthcare insurance players, which is also contributing to the growth in private sectors. For instance, according to the India brand equity Foundation (IBEF), the market share of private sector companies in the general and health insurance market increased from 47.97% in 2019 to 48.03% in 2020.

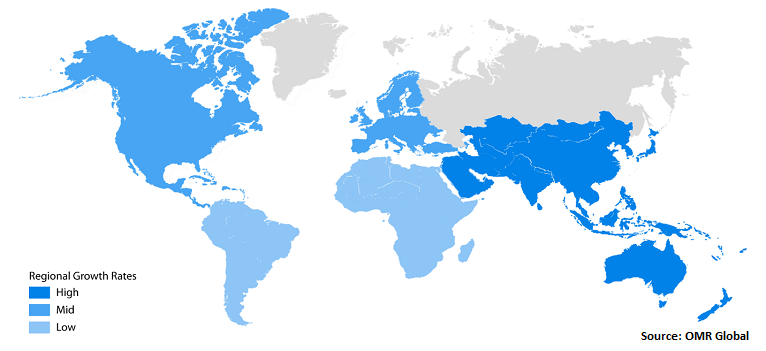

Regional Outlooks

The global healthcare insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

Global Healthcare Insurance Market Growth, by Region 2021-2027

The North America Region Holds the Major Share in the Global Healthcare Insurance Market

North American region holds the major share in the global healthcare insurance market due to high healthcare expenditure coupled with high GDP. For instance, according to the health system tracker, Wealthy countries, including the US, tend to spend more per person on health care and related expenses than lower-income countries. However, even as a high-income country, the US spends more per person on health than comparable countries. Health spending per person in the US was $10,966 in 2019, which was 42% higher than Switzerland, the country with the next highest per capita health spending. Additionally, tthe average amount spent on health per person in comparable countries ($5,697) is roughly half that of the US ($10,966).

Market Players Outlook

The major companies serving the global healthcare insurance market include Aetna Inc, Bupa, Centene Corp., Cigna Corp., Humana, Aviva Plc, Allianz, Highmark Inc, Prudential Plc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2019, Max Bupa Health Insurance will be rebranded as Niva Bupa Health Insurance owing to a change in shareholding pattern. Niva Bupa Health Insurance plans to become a ?2,500 crore entity by FY21-22 and maintain strong growth in the market, a company release said Friday. The rebranding will not impact customers and its partners.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global healthcare insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact Of Covid-19 On the Global Healthcare Insurance Market

• Recovery Scenario of Global Healthcare Insurance Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Aetna Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. British United Provident Association Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Centene Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cigna Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Humana Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Healthcare Insurance Market by Provider

4.1.1. Private

4.1.2. Public

4.2. Global Healthcare Insurance Market by Time Period

4.2.1. Life Time Insurance

4.2.2. Term Insurance

4.3. Global Healthcare Insurance Market by End-User

4.3.1. Individual

4.3.2. Corporate

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AIA Group Ltd.

6.2. Assicurazioni Generali S.p.A.

6.3. Anthem Inc.

6.4. Aviva Plc

6.5. Allianz

6.6. Berkshire Hathaway Inc.

6.7. China Life Insurance Company

6.8. CVS health

6.9. Equitable Holdings Inc.

6.10. Health Care Service Corp.

6.11. Highmark Inc.

6.12. International Medical Group, Inc.

6.13. Jubilee Holdings Ltd.

6.14. Kaiser Foundation Health Plan, Inc.

6.15. Prudential Plc.

6.16. United HealthCare Services, Inc.

6.17. Zurich

1. GLOBAL HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY PROVIDER, 2020-2027 ($ MILLION)

2. GLOBAL PRIVATE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL PUBLIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY TIME PERIOD, 2020-2027 ($ MILLION)

5. GLOBAL LIFE TIME INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL TERM INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

8. GLOBAL HEALTHCARE INSURANCE FOR INDIVIDUAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL HEALTHCARE INSURANCE FOR CORPORATE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY PROVIDER, 2020-2027 ($ MILLION)

13. NORTH AMERICAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY TIME PERIOD, 2020-2027 ($ MILLION)

14. NORTH AMERICAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

15. EUROPEAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY PROVIDER, 2020-2027 ($ MILLION)

17. EUROPEAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY TIME PERIOD, 2020-2027 ($ MILLION)

18. EUROPEAN HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY PROVIDER, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY TIME PERIOD, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

23. REST OF THE WORLD HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY PROVIDER, 2020-2027 ($ MILLION)

25. REST OF THE WORLD HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY TIME PERIOD, 2020-2027 ($ MILLION)

26. REST OF THE WORLD HEALTHCARE INSURANCE MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HEALTHCARE INSURANCE MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HEALTHCARE INSURANCE MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL HEALTHCARE INSURANCE MARKET, 2021-2027 (%)

4. GLOBAL HEALTHCARE INSURANCE MARKET SHARE BY PROVIDER, 2020 VS 2027 (%)

5. GLOBAL HEALTHCARE INSURANCE FOR PROVIDER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL HEALTHCARE INSURANCE FOR PUBLIC MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL OTHERS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL HEALTHCARE INSURANCE MARKET SHARE BY TIME PERIOD, 2020 VS 2027 (%)

9. GLOBAL HEALTHCARE INSURANCE FOR LIFE TIME INSURANCE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL HEALTHCARE INSURANCE FOR TERM INSURANCE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL HEALTHCARE INSURANCE MARKET SHARE BY END-USER, 2020 VS 2027 (%)

12. GLOBAL HEALTHCARE INSURANCE FOR INDIVIDUAL MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL HEALTHCARE INSURANCE FOR CORPORATE MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL HEALTHCARE INSURANCE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

17. UK HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD HEALTHCARE INSURANCE MARKET SIZE, 2020-2027 ($ MILLION)