Healthcare Interoperability Solutions Market

Global Healthcare Interoperability Solutions Market Size, Share & Trends Analysis Report by Level (Foundational, Structural, and Semantic), by Deployment Type (Cloud-Based and On-Premises), by End-Users (Hospitals and Diagnostic Centers, Ambulatory Surgical Centers, and Others), Forecast Period 2019-2025

The healthcare interoperability solutions market is anticipated to grow at a CAGR 8.2% during the forecast period. The factor such as increasing focus on patient care and government initiatives for improving the patient care experience is propelling the growth of the healthcare interoperability solutions market. Interoperability of systems, data access, and information exchange play an important role in enhancing health outcomes. Mobilizing data related to individual health across the spectrum of care providers in health organizations that enable coordinated and high-quality care which supports transparency efforts, payment reforms and the ability to manage their health. Therefore, advantages provided by healthcare data interoperability software boost the growth of the industry. The healthcare data interoperability is a platform that provides information about patient clinical history. This platform allows healthcare professionals to have access to accurate and comprehensive data.

The rising adoption of EHR (Electronic Medical Records) software in the developed and emerging regions has shown a positive impact on the growth of the healthcare interoperability solutions industry. The need for data interoperability software has growing due to rising need to offer effective healthcare services. Growing healthcare costs boost the demand for data interoperability software to aids healthcare organizations to access medical data of patients easily thereby decreasing the number of test and making easier for staff to co-ordinate in the organization. The various data interoperability solutions are largely deployed in different healthcare facilities such as hospitals and home medical centers. For instance, an e-prescribing interoperability solution offers providers of ambulatory surgical center services to electronically send prescriptions to drug stores. The lack of awareness related to healthcare data interoperability in emerging economies may hamper the growth of the healthcare interoperability solutions market over the forecast period.

Segmental Outlook

The market is segmented on the basis of level, deployment type, and end-user. Based on level, the market is segmented into semantic, structural and foundational. Structural is expected to have considerable market growth due to the high adoption of technology such as e-prescribing wherein the same data are utilized in pharmacists and prescribers. The semantic segment is expected to have a significant growth rate in the healthcare interoperability solutions market. Semantic aids healthcare professionals to exchange, interpret and use clinical information to offer proper treatment. It maintains the data which makes it reliable for the doctor to analyze information accurately.

Additionally, the semantic level of interoperability secured the electronic exchange of patient’s information in the diagnostic centers and hospitals that lead to being a cost-effective option. Therefore, the advantages provided by the semantic segment will drive the growth of the segment in the healthcare interoperability solutions market. Based on the deployment type, the market is sub-segmented into cloud-based and on-premises. Based on end-users the market is sub-segmented into hospitals and diagnostic centers and ambulatory surgical centers.

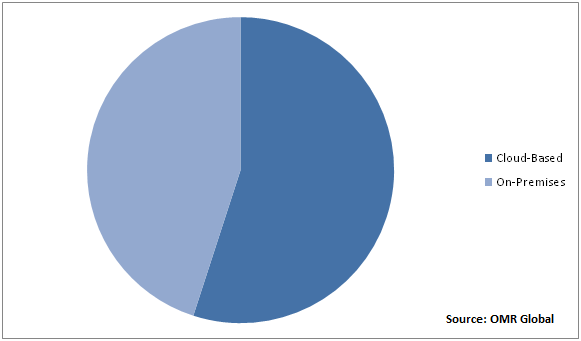

Cloud-Based healthcare interoperability solutions to hold the largest market share

Based on the deployment type, the market is segmented into cloud-based and on-premises. Cloud-Based is expected to have the largest market share in the market during the forecast period. The software aids secured exchange of data effectively within less duration and larger information exchange is possible with cloud-based software which is contributing to the growth of the segment. The cloud-based software has various benefits as compared to on-premises software. On-premise software aids transfer of information in various departments of single healthcare organizations whereas cloud-based aids exchange of data across the globe without interruptions. Therefore, doctors and diagnostics labs have a large preference for cloud-based software that boosts the growth of the segment.

Global Healthcare Interoperability Solutions Market Share by Deployment Type, 2018 (%)

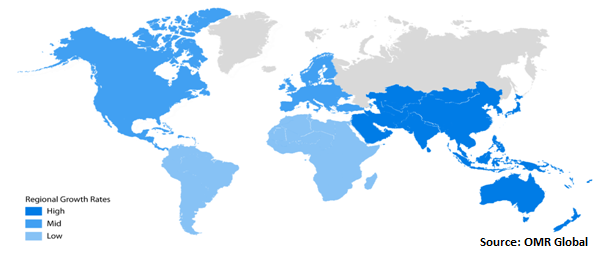

Regional Outlook

The global healthcare interoperability solutions market is further segmented based on geography including North America, Europe, Asia-Pacific and Rest of the World.North America is anticipated to have the largest market share in the market due to the introduction of favorable government policies pertaining to the profitable use of EHR software in data interoperability. Moreover, large scale spending by the government for effective healthcare digitization and secured data swapping across the healthcare sector have shown a positive impact on the growth of the region. The growing number of clinics and hospitals in the US fuel the growth of the healthcare interoperability solutions market.

Global Healthcare Interoperability Solutions Market Growth, by Region 2019-2025

Asia-Pacific will augment with the fastest rate in the market

The market in Asia-Pacific is expected to be the fastest-growing region mainly owing to growth in medical tourism activities along with the rising need for high-quality healthcare amenities in emerging economies such as China and India. Furthermore, large patient population pools in the region in the requirement of effective data exchange in pharmacies, clinics, and hospitals.

Market Players Outlook

The major players of the healthcare interoperability solutions market include Allscripts Health Solution, Inc., Ciox Health, Epic System Corp., Experian Health, Cerner Corp., Jitterbit, Inc., InterSystems Corp.,Koninklijke Philips N.V., Oracle Corp., Orion Health Group, Ltd., iNTERFACEWARE, Inc. and Infor, Inc.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare interoperability solutions market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. CompanyShare Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cerner Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Allscripts Healthcare Solutions, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke Philips N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Jitterbit, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Epic System Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Healthcare Interoperability SolutionsMarket by Level

5.1.1. Foundational

5.1.2. Structural

5.1.3. Semantic

5.2. Global Healthcare Interoperability SolutionsMarket by Deployment Type

5.2.1. Cloud-based

5.2.2. On-premise

5.3. Global Healthcare Interoperability SolutionsMarket by End-User

5.3.1. Hospitals and Diagnostic Centers

5.3.2. Ambulatory Surgical Centers

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AllscriptsHealthcare, LLC

7.2. Cerner Corp.

7.3. Ciox Health

7.4. Edifecs, Inc.

7.5. Epic System Corp.

7.6. Experian Information Solutions, Inc.

7.7. Google, LLC

7.8. IBM Corp.

7.9. Infor, Inc.

7.10. iNTERFACEWARE, Inc.

7.11. InterSystems Corp.

7.12. Jitterbit, Inc.

7.13. Koninklijke Philips N.V.

7.14. NXGNManagement, LLC

7.15. Optum,Inc.

7.16. Oracle Corp.

7.17. Orion HealthGroup, Ltd.

7.18. OSP Labs

7.19. Qventus, Inc.

7.20. Redox, Inc.

7.21. Smith Medical, Inc. (A Division of Business Smiths Group PLC)

7.22. ViSolve, Inc.

1. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY LEVEL, 2018-2025 ($ MILLION)

2. GLOBAL FOUNDATIONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL STRICTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL SEMANTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

6. GLOBAL CLOUD BASED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ON-PREMISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

9. GLOBAL HOSPITAL AND DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. NORTH AMERICA HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY LEVEL, 2018-2025 ($ MILLION)

13. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

15. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY LEVEL, 2018-2025 ($ MILLION)

17. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

18. EUROPE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY LEVEL, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

23. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY LEVEL, 2018-2025 ($ MILLION)

24. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2018-2025 ($ MILLION)

25. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY LEVEL, 2018 VS 2025 (%)

2. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY DEPLOYMENT TYPE, 2018 VS 2025 (%)

3. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. THE US HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

12. ROE HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONSMARKET SIZE, 2018-2025 ($ MILLION)