High Purity Gas Market

High Purity Gas Market Size, Share & Trends Analysis Report, By Product (High Atmospheric Gases, Noble Gases, Carbon Gases, and Others), By Function (Insulation, Illumination, and Cooling), By End-User Industry (Metal Production, Oil and Gas, Chemical, Electronics, Medical & Healthcare, Food & Beverage, Aerospace, Automotive, and Others), Forecast Period (2022-2028)

High purity gas market is anticipated to grow at a CAGR of 6.2% during the forecast period. Technological advancements, industrialization, and increasing demand from various end-use industries such as healthcare, consumer products, automotive, and aerospace & defense are some key factors driving the growth of the market. Additionally, the rising demand for gases in semiconductors and recycling metals across the globe is a key factor in the surging demand for high purity gases. For instance, in May 2022, China-based Suzhou Oxygen Plant Co., Ltd. (SOPC) started up a new nitrogen plant to produce high-purity nitrogen and oxygen to supply critical gases for Shanghai’s semiconductor industry. However, the high cost of processing gases and supply chain disruption due to geopolitical challenges are major constraints for global high purity gases.

Segmental Outlook

The global high purity gas market is segmented based on product, function, and end-user industry. Based on product, the market is classified into high atmospheric gases and others. Based on function, the market is classified into insulation, illumination, and cooling. Based on the end-user industry, the market is classified into metal production, oil and gas, chemical, electronics, medical & healthcare, food & beverage, aerospace, automotive, and others.

Electronics Segment is Expected to hold the Significant Share in the Global High Purity Gas Market During the Forecast Period.

The growth of the semiconductor industry globally has been driven largely by the demand for smartphones. The continued expansion of products, integration of advanced technology such as AI, IoT and 5G networks, and the rapid growth in the automotive and industrial electronics sector are some of the key factors driving the demand for high purity gas in the electronics segment. As the industry continues to grow, the demand for high-purity gases and chemicals is also raising. High purity gases such as oxygen, argon, hydrogen, helium, and carbon dioxide are essential at every process step and tool for semiconductor and display manufacturing. It is well-known fact that gas impurities are detrimental to device processing and performance. Major players are continuously increasing their capacity and expanding their presence across the globe to meet the surging demand for high-purity gases.

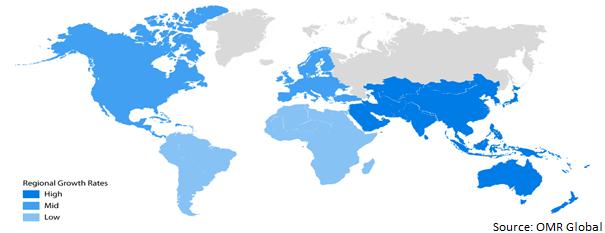

Regional Outlook

The global high purity gas market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North American region is expected to hold a potential share in the market. The growing demand of high purity gas in the manufacturing and electronic sector owing to the ease of doing business is driving the growth of the market in the region. For instance, in June 2022, Showa Denko Concludes MOU with SK Inc. to cooperatively Produce High-purity gases for semiconductors in North America.

Global High Purity Gas Market Growth, by Region 2022-2028

Market Players Outlook

The major companies serving the global high purity gas market include Praxair Inc. Air Products and Chemicals Inc., Air Liquide S.A., Linde plc, and Advanced Specialty Gases. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in April 2022, Air Products Inc. signed a Long-term Industrial Gases Supply Agreement with World-Leading Semiconductor Manufacturer in Asia. As per the agreement, Air Products San Fu Co. Ltd will invest $900 Million in Ultra-high Purity Industrial Gas Facilities Supplying Customer’s Advanced Fabs in Kaohsiung.

In August 2020, Linde, a leading global industrial gases and engineering company, announced that its US subsidiary, Praxair Inc., will begin operating under the Linde name after the successful merger of Praxair Inc. and Linde AG. According to the company's combined product and service portfolios, they will offer customers more options to improve operational efficiency and plan for future growth.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global high purity gas market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Praxair Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Air Products and Chemicals Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Air Liquide S.A.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Linde plc

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Advanced Specialty Gases

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global High Purity Gas Market by Product

4.1.1. High Atmospheric Gases

4.1.2. Noble Gases

4.1.3. Carbon Gases

4.1.4. Others (Halogen, Chlorine, and Fluorine)

4.2. Global High Purity Gas Market by Function

4.2.1. Insulation

4.2.2. Illumination

4.2.3. Cooling

4.3. Global High Purity Gas Market by END-USER INDUSTRYr Industry

4.3.1. Metal Production

4.3.2. Oil & Gas

4.3.3. Chemical

4.3.4. Electronics

4.3.5. Medical & Healthcare

4.3.6. Food & Beverage

4.3.7. Aerospace

4.3.8. Automotive

4.3.9. Others?

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advanced Specialty Gases Inc.

6.2. Airgas Inc.

6.3. Deluxe Industrial Gases

6.4. Gulf Cryo

6.5. Matheson Tri-Gas Inc.

6.6. Nexair LLC.

6.7. Praxair Inc.

6.8. Taiyo Nippon Sanso Corp.

6.9. Universal Industrial Gases, Inc.

6.10. Yingde Gases Group

1. GLOBAL HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL HIGH ATMOSPHERIC GASES RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CARBON GASES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL NOBLE GASES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CARBON GASES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OTHER HIGH PURITY GASES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY FUNCTION , 2021-2028 ($ MILLION)

8. GLOBAL HIGH PURITY GAS FOR INSULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL HIGH PURITY GAS FOR ILLUMINATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL HIGH PURITY GAS FOR COOLING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL HIGH PURITY GAS FOR METAL PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL HIGH PURITY GAS FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL HIGH PURITY GAS FOR CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL HIGH PURITY GAS FOR ELECTRONIC MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL HIGH PURITY GAS FOR MEDICAL & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL HIGH PURITY GAS FOR FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL HIGH PURITY GAS FOR AEROSPACE MARKET RESEARCH AND ANALYSIS FOR OTHERS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL HIGH PURITY GAS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL HIGH PURITY GAS FOR OTHER END-USER INDUSTRYR INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. NORTH AMERICAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

23. NORTH AMERICAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY FUNCTION , 2021-2028 ($ MILLION)

24. NORTH AMERICAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

25. EUROPEAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

27. EUROPEAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY FUNCTION , 2021-2028 ($ MILLION)

28. EUROPEAN HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY FUNCTION , 2021-2028 ($ MILLION)

32. ASIA-PACIFIC HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

35. REST OF THE WORLD HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY FUNCTION , 2021-2028 ($ MILLION)

36. REST OF THE WORLD HIGH PURITY GAS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

1. GLOBAL HIGH PURITY GAS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL HIGH ATMOSPHERIC GASES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL CARBON GASES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL NOBLE GAS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL OTHER HIGH PURITY GASES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL HIGH PURITY GAS MARKET SHARE BY FUNCTION , 2021 VS 2028 (%)

7. GLOBAL HIGH PURITY GAS FOR INSULATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL HIGH PURITY GAS FOR ILLUMINATION MARKET SHARE FOR COOLING BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL HIGH PURITY GAS FOR COOLING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL HIGH PURITY GAS MARKET SHARE BY END-USER INDUSTRY, 2021 VS 2028 (%)

11. GLOBAL HIGH PURITY GAS FOR METAL PRODUCTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL HIGH PURITY GAS FOR OIL & GAS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL HIGH PURITY GAS FOR CHEMICAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL HIGH PURITY GAS FOR ELECTRONIC MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL HIGH PURITY GAS FOR MEDICAL & HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL HIGH PURITY GAS FOR FOOD & BEVERAGE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. \GLOBAL HIGH PURITY GAS FOR AEROSPACE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL HIGH PURITY GAS FOR AUTOMOTIVE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL HIGH PURITY GAS FOR OTHER END-USER INDUSTRIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL HIGH PURITY GAS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. US HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

22. CANADA HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

23. UK HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

24. FRANCE HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

25. GERMANY HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

26. ITALY HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

27. SPAIN HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF EUROPE HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

29. INDIA HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

30. CHINA HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

31. JAPAN HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

32. SOUTH KOREA HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF ASIA-PACIFIC HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD HIGH PURITY GAS MARKET SIZE, 2021-2028 ($ MILLION)