Household Robots Market

Household Robots Market Size, Share & Trends Analysis Report by Type (Domestic, Entertainment, and Leisure), by Component (Hardware, Software, and Service), by Application (Vacuuming & Mopping, Lawn Mowing, Pool Cleaning, and Companionship), and by Distribution Channel (Online and Offline) Forecast Period (2024-2031)

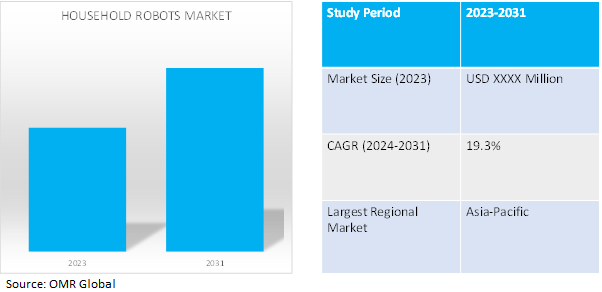

Household Robots market is anticipated to grow at a CAGR of 19.3% during the forecast period (2024-2031). Household Robots can perform duties like cleaning the floor, pool, windows, lawn and can connect to wi-fi networks efficiently used for various purposes, including training, counseling, and entertainment.

Market Dynamics

Rising technological advancement driving market growth

An important turning point in the development of home robots is the continuous growth of Artificial Intelligence (Al) technologies. Businesses are working towards creating new robot models with sophisticated features and capabilities. The market is witnessing a transition from single-task robots (like vacuum cleaners) to multi-tasking robots like the Samsung Jet Bot Al+, which has features like item detection and self-emptying. Furthermore, niche robots catering to certain requirements like pet sitting, senior citizen support, and amusement are developing. For instance, in October 2021, AIRROBO, the smart home appliance brand with a focus on AI-enabled technologies, supported by world-leading AI and humanoid robotic company, UBTECH Robotics, AIRROBO launched its two new products — the AIRROBO Robot Vacuum T10+ and the AIRROBO Robot Vacuum T9. It provides users with a 45-day hands-free cleaning experience and an allergy-friendly environment when it comes to cleaning.

Rising Demand for robots in the domestic sector

Globally, the increasing need for automation and smart homes, along with advancements in technology, are driving growth in this market. One of the primary growth drivers in the domestic segment is the reduction in costs as the cost of manufacturing robotics technology has decreased over the years due to advancements in materials, production processes, and economies of scale. This reduction in costs has made domestic robots more affordable for consumers also domestic robots optimize space utilization, and improve the overall living standards in urban environments. Lower manufacturing costs translate to more affordable domestic robots for consumers and as prices decrease, a wider range of households can afford to purchase these robots, leading to increased adoption rates and market growth.

Market Segmentation

Our in-depth analysis of the global household robots market includes the following segments by type, component, application, and distribution channel:

- Based on Type, the market is sub-segmented into domestic, entertainment, and leisure.

- Based on Component, the market is bifurcated into hardware, software, and service.

- Based on Application, the market is augmented into vacuuming & mopping, lawn mowing, pool cleaning, and companionship.

- Based on the Distribution Channel, the market is bifurcated into online and offline.

Service Component is Projected to Emerge as the Largest Segment

Based on the components, the global household robots market is sub-segmented into hardware, software, and service. Among these, the service sub-segment is expected to hold the largest share of the market. This segment aims to provide ongoing assistance and improvements beyond the initial purchase like customer support which involves assisting customers regarding product inquiries, troubleshooting, technical support, and general guidance. It could be through online resources, dedicated helplines, chat support, or even in-person assistance in some cases. Maintenance and repair which includes services related to maintaining the robot's functionality, including software updates, hardware repairs, or replacements if necessary. Some companies offer warranties or service contracts that cover maintenance or repairs for a specific period after purchase.

Vacuuming & Mopping Sub-segment to Hold a Considerable Market Share

The integration of technologies such as deep learning & artificial neural networks into mopping machines increases the efficiency of self-driven robots. Manufacturers are constantly innovating, equipping robots with features such as improved navigation, object recognition, Al-powered mapping, and self-emptying capabilities. These advancements make them more efficient, user-friendly, and appealing to consumers. For instance, in December 2023, Samsung Electronics announced that it would unveil a new vacuum cleaner lineup with advanced AI at CES 2024. The Bespoke Jet Bot Combo, a vacuum and mop robot cleaner, will bring enhanced AI features and steam cleaning to realize an easier cleaning experience for users.

Regional Outlook

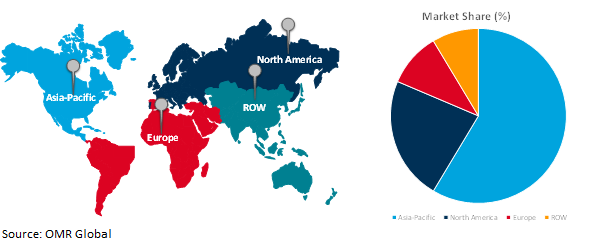

The global household robots market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in household robots market

- Germany is the key investor in household robots based products around the globe.

- The UK is shifting towards adding more safety features which leads to increased adoption of household robots.

Global Household Robots Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising demand for household robots. Asia Pacific countries, particularly Japan, South Korea, China, and Singapore, are known for their advancements in technology. These nations have been at the forefront of robotics research and development, fostering a conducive environment for innovation in household robotics. Growing interest from consumers in Singapore for robotic vacuums has led to new players entering the market space. Even in countries such as Japan, where the initial adoption was slower than expected, the market for robotic vacuums is projected to witness significant growth potential. For instance, in May 2023, A Japanese artificial intelligence startup launched a robot for home use capable of delivering items in response to verbal commands, such as bringing dishes and condiments to the dining room table or books and drinks to the sofa. The rectangular robot called Kachaka, developed by Tokyo-based Preferred Robotics Inc., attaches to the bottom of a specially designed table fitted with caster wheels.

Chinese companies are reducing their production costs for household robots by establishing large production facilities. As more people are living in China, compact robotic vacuum cleaners or household robots are becoming more popular in densely crowded, cramped cities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Household Robots market include Honda Motor Co., Ltd., Husqvarna Group, iRobot Corporation, Indiegogo, Inc., and LG Electronics Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2022, Amazon announced it had agreed to acquire the vacuum cleaner maker iRobot for approximately $1.7 billion, scooping up another company to add to its collection of smart home appliances amid broader concerns from anti- monopoly and privacy advocates about Amazon's market power and ability to gain deeper insights into consumers' lives.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global household robots market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Honda Motor Co., Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Husqvarna Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. iRobot Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Household Robots Market by Type

4.1.1. Domestic

4.1.2. Entertainment

4.1.3. Leisure

4.2. Global Household Robots Market by Component

4.2.1. Hardware

4.2.2. Software

4.2.3. Service

4.3. Global Household Robots Market by Application

4.3.1. Vacuuming & Mopping

4.3.2. Lawn Mowing

4.3.3. Pool Cleaning

4.3.4. Companionship

4.4. Global Household Robots Market by Distribution Channel

4.4.1. Online

4.4.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Blue Frogg Robotics SAS

6.2. Dolphin Robotics & Automation

6.3. Indiegogo, Inc.

6.4. LG Electronics Inc.

6.5. Maytronics Ltd.

6.6. Neato Robotics, Inc.

6.7. Robomow

6.8. SoftBank Robotics Group

6.9. Samsung

6.10. Panasonic Group

6.11. Roborock Inc.

6.12. ILIFE

6.13. Bobsweep Inc.

6.14. SharkNinja Operating LLC

6.15. Karcher

6.16. John Deere Group

1. GLOBAL HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL HOUSEHOLD ROBOTS IN DOMESTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HOUSEHOLD ROBOTS IN ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HOUSEHOLD ROBOTS IN LEISURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

6. GLOBAL HOUSEHOLD ROBOTS FOR HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HOUSEHOLD ROBOTS FOR SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HOUSEHOLD ROBOTS FOR SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL VACUUMING & MOPPING IN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LAWN MOWING IN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL POOL CLEANING IN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL COMPANIONSHIP IN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

15. GLOBAL HOUSEHOLD ROBOTS IN ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL HOUSEHOLD ROBOTS IN OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

21. NORTH AMERICAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

23. EUROPEAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

26. EUROPEAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. EUROPEAN HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

33. REST OF THE WORLD HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD HOUSEHOLD ROBOTS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL 2023-2031 ($ MILLION)

1. GLOBAL HOUSEHOLD ROBOTS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL HOUSEHOLD ROBOTS IN DOMESTIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HOUSEHOLD ROBOTS IN ENTERTAINMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HOUSEHOLD ROBOTS IN LEISURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HOUSEHOLD ROBOTS MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

6. GLOBAL HOUSEHOLD ROBOTS FOR HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HOUSEHOLD ROBOTS FOR SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HOUSEHOLD ROBOTS FOR SERVICE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL HOUSEHOLD ROBOTS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL VACUUMING & MOPPING IN HOUSEHOLD ROBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LAWN MOWING IN HOUSEHOLD ROBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL POOL CLEANING IN HOUSEHOLD ROBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL COMPANIONSHIP IN HOUSEHOLD ROBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL HOUSEHOLD ROBOTS MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

15. GLOBAL HOUSEHOLD ROBOTS IN ONLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL HOUSEHOLD ROBOTS IN OFFLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL HOUSEHOLD ROBOTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

20. UK HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA HOUSEHOLD ROBOTS MARKET SIZE, 2023-2031 ($ MILLION)