Human Immunoglobulin Market

Global Human Immunoglobulin Market Size, Share & Trends Analysis Report By Type (Liquid and Powder), and By Disease Indication (Infectious hepatitis and Measles) Forecast 2022-2028

The global human immunoglobulin market is anticipated to grow at a significant CAGR of 6.4% during the forecast period. Hypogammaglobulinemia is considered a problem with the immune system that prevents it from making enough antibodies that are known as immunoglobulins. So, a large increase in the prevalence of hypogammaglobulinemia disorders around the globe is a considered major factor that is driving the growth of the market. Additionally, COVID-19 infection is common in cancer patients, especially those with hematologic malignancies. Protective measures against COVID-19 infection were high in primary immunodeficiencies (PIDs) patients with hypogammaglobulinemia following Ig replacement medication, according to a study published in the Journal of Clinical Immunology 2021. COVID-19 infection was also a problem among female patients with primary immunodeficiencies and hypogammaglobulinemia which remained for a long period of time, therefore, it is anticipated that the infectious hepatitis market will grow in the future. For instance, in April 2019, the US Food and Drug Administration (FDA) has given approval to ADMA Biologics Inc.'s ASCENIV, a novel intravenous immunoglobulin for the treatment of primary humoral immunodeficiency disorder. Moreover, in May 2020, Octapharma AG US investigational new drug (IND) application for a phase three clinical trial on the efficacy and safety of Octagam 10% [Immune Globulin Intravenous (Human)] therapy in COVID-19 patients with severe disease progression was authorized by the US Food and Drug Administration (FDA).

Impact of COVID-19 Pandemic on Global Human Immunoglobulin Market

The COVID-19 had a favorable impact on the human immunoglobulin market, as there have been more research studies on immunoglobulins for providing effective treatment for COVID-19. In March 2021, according to the National Clinical Trials (NCT) Registry, there are currently around 50 immunoglobulin-based clinical trials in various stages of development in the US which have a positive impact on the market due to which it could lead to the development of new effective COVID-19 therapy in the near future.

Segmental Outlook

The global human immunoglobulin market is segmented based on the type and disease indication. Based on the type, the market is segmented into liquid and powder. Based on the disease indication, the market is sub-segmented into infectious hepatitis and Measles. Among these, the disease indication segment is anticipated to propel the growth of the market over the forecast period, owing to the growth in the prevalence of immunodeficiency illnesses, increasing immunoglobulin adoption, and expanded research and development activities.

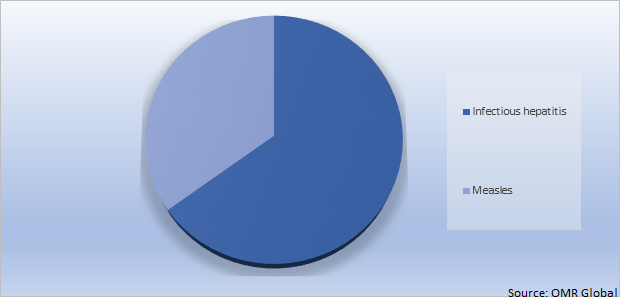

Global Human Immunoglobulin Market Share by Disease Indication, 2021 (%)

The Infectious hepatitis Segment is Anticipated to Hold a Prominent Share in the Global Human Immunoglobulin Market

Infectious hepatitis is anticipated to hold the largest share in the market. It is most commonly transmitted through the fecal-oral route, which occurs when someone comes into touch with feces from a person who has this disease. Hepatitis can be caused by excessive alcohol consumption, pollutants, certain drugs, and certain medical disorders. Hepatitis, on the other hand, is also frequently caused by a virus. Pegylated interferon and ribavirin are the most effective treatments for hepatitis. Pegylated interferon is given as an injection once a week, while ribavirin is taken twice daily. Additionally, chemotherapy is used to treat the patient. For instance, in 2020 large rises in hepatitis A were linked to continuous global illnesses caused by person-to-person transmission.

Regional Outlooks

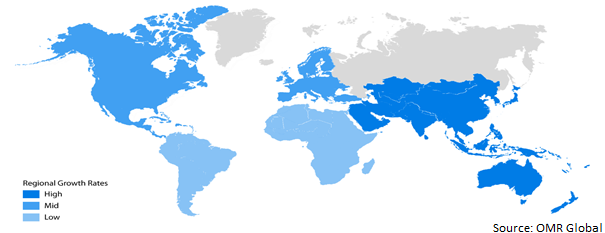

The global human immunoglobulin market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Europe’s regional human immunoglobulin market is expected to hold a prominent market share due to the presence of several key market players.

Global Human Immunoglobulin Market Growth, by Region 2022-2028

The Asia-Pacific Region is estimated to hold the Major Share in the Global Human Immunoglobulin Market

The Asia-Pacific is anticipated to hold a prominent share in the market due to an increase in the research and development of novel diseases. Additionally, the knowledge regarding plasma-related illness is now increasing after COVID-19 and immunoglobulins are increasing in India and China in the Asia Pacific area, owing to an increase in the number of people diagnosed with immunodeficiencies. For instance, in January 2020, ADMA Biologics, Inc., a manufacturer, and distributor of plasma-derived biologics had agreed to develop and provide plasma-derived intermediate fractions from ADMA's Immune Globulin (IG) manufacturing process for a five-year period. By offering fractioned plasma to a third party to produce their own therapeutic products using their own licensed manufacturing procedures, ADMA Biologics, Inc. will maximize revenue per liter of plasma fractionated in its plant.

Market Players Outlook

The major companies serving the global human immunoglobulin market include Baxter International Inc., CSL Ltd., Grifols S.A., Kedrion Biopharma Inc., Octapharma AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2019, ADMA Biologics, Inc. announced that the US Food and Drug Administration (FDA) had notified ADMA the licenses for BIVIGAM and Nabi-HB have been revoked from Biotest Pharmaceuticals Corp. (BPC) US License No. 1792 and transferred and issued to ADMA’s US License No. 2019.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global human immunoglobulin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on The Global Human Immunoglobulin Market

• Recovery Scenario of Global Human Immunoglobulin Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Baxter International Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. CSL Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Grifols S.A.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Kedrion Biopharma Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Octapharma AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Human Immunoglobulin Market by Type

4.1.1. Liquid

4.1.2. Powder

4.2. Global Human Immunoglobulin Market by Disease Indication

4.2.1. Infectious hepatitis

4.2.2. Measles

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Biotest AG

6.2. Bio Products laboratory Ltd.

6.3. CBPO

6.4. CNBG Co. Ltd.

6.5. GC Pharma

6.6. Hualan Bio

6.7. LFB Group Co. Ltd.

6.8. Sichuan Yuanda Shuyang Pharmaceutical Co. Ltd.

6.9. Shanghai RAAS

1. IMPACT OF COVID-19 ON GLOBAL HUMAN IMMUNOGLOBULIN MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HUMAN IMMUNOGLOBULIN MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL HUMAN IMMUNOGLOBULIN MARKET, 2022-2028 (%)

4. GLOBAL HUMAN IMMUNOGLOBULIN MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL LIQUID HUMAN IMMUNOGLOBULIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL POWDER HUMAN IMMUNOGLOBULIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL HUMAN IMMUNOGLOBULIN MARKET SHARE BY DISEASE INDICATION, 2021 VS 2028 (%)

8. GLOBAL INFECTIOUS HEPATITIS HUMAN IMMUNOGLOBULIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL MEASLES HUMAN IMMUNOGLOBULIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL HUMAN IMMUNOGLOBULIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

13. UK HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD HUMAN IMMUNOGLOBULIN MARKET SIZE, 2021-2028 ($ MILLION)