HVDC Transmission Market

HVDC Transmission Market by Technology (Voltage Source Converter and Line Commutated Converter), by Type (Point-to-Point Transmission System, Back-to-Back System, and Multi Terminal System), by Application (Bulk Power Transmission, Interconnecting Grids, and Infeed Urban Areas) – Global Industry Share, Growth, Competitive Analysis and Forecast, 2025-2035

HVDC referred to as high voltage direct current which is a potential technology for bulk power transmission over long distances, with lower electrical losses and higher efficiency. It offers precise and instant control of the power flow. Once installed, it becomes an important part of the electrical power systems and improves reliability, stability, and transmission capacity. There are several factors contributing to market growth, such as rapid industrialization across the globe and significant demand for renewable energy sources. Rapid industrialization across the globe has been reported due to government initiatives for domestic manufacturing of goods. For instance, Made in China is an initiative aimed to make China leader in global high-tech manufacturing. CCP (Chinese Communist Party) has taken steps to shift focus towards significant production of energy, mining products, and consumer goods such as footwear and clothing, which constitute almost half of the country’s economy.

Such government initiatives are supporting industrialization and thereby, leading to an increase in the consumption of energy. As a result, this significantly increases the need for more facilities in transmission and interconnection systems at optimal cost, which in turn, surges the demand for HVAC (High voltage alternating current) and HVDC transmission systems. HVDC transmission systems are considered as a more efficient and economical way of power transmission as it can transport power efficiently and cost-effectively over long distances with reduced transmission lines rather than losses in AC systems. In addition, only two conductors are required for a single line in DC transmission, while in AC transmission, minimum of three conductors are required and for double circuit line, six conductors are required. Therefore, the HVDC transmission system is a cost-effective way to transmit power over long distances.

Segment Outlook:

The global HVDC transmission market is segmented on the basis of type, technology, and application. Based on type, the market is further classified into a point-to-point transmission system, back-to-back system, and multi-terminal system. Based on technology, the market is further segmented into voltage source converter (VSC) and line commutated converters (LCC) HVDC transmission. Further, on the basis of application, the market is segmented into bulk power transmission, interconnecting grids, and infeed urban areas.

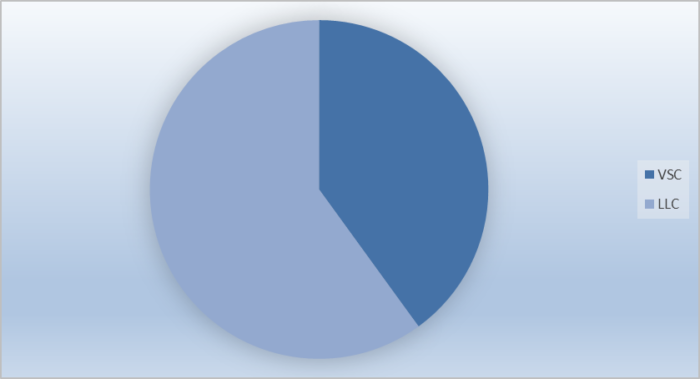

Global HVDC Transmission Market: By Technology Analysis

VSC HVDC Transmission is anticipated to witness significant growth during the forecast period. A significant shift towards VSC HVDC transmission systems was reported due to its benefits that can overcome certain problems. VSC HVDC can address traditional network concerns, including back-to-back AC system linking, bulk power transmission, voltage stability support, and asynchronous network interconnections. In addition, it enables optimal integration of large-scale renewable energy sources with the grid and large offshore/onshore wind farm. As a result, VSC HVDC transmission is a viable interconnection for large-scale offshore wind farms. In addition, rising demand for wind energy sources is anticipated to offer significant opportunity for VSC HVDC transmission as VSC converter technology can rapidly control both active and reactive power independently of one another. Furthermore, rising VSC HVDC projects are further anticipated to drive the market growth. For instance, in March 2017, Siemens AG and Sumitomo Electric received an order for VSC HVDC technology from Power Grid Corp. of India. This project is aimed at delivering uninterrupted, reliable power to Kerala, India.

Global HVDC Transmission Market Share by Technology, 2018 (%)

Source: OMR Global

Regional Outlook

Geographically, the global HVDC transmission market is further segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. Rising electricity consumption, a significant rise in power transmission projects and growing demand for VSC HVDC transmission systems are supporting the market growth in these regions.

Global HVDC Transmission Market Growth by Region, 2019-2025

Source: OMR Global

Asia-Pacific is estimated to witness lucrative growth in the market during the forecast period

Asia-Pacific is anticipated to grow significantly during the forecast period due to a significant rise in the demand for renewable energy sources and a rising number of UHVDC (ultra-high voltage direct current) projects in the region. For instance, in August 2018, ABB Ltd. enables world’s highest UHVDC link in China. Southwest China is embarking on large grid development projects to transmit clean energy to the country. The 800 kV Dianxibei-Guangdong UHVDC transmission link is operated by the grid operators in China, such as China Southern Power Grid Company Ltd. These grid operators will transmit clean hydropower to Shenzhen, which is one of the highly dense urbanized regions globally. ABB Ltd. has provided DC capacitors, valve components, live-tank breakers, transformer brushings, and dead-tank breakers deployed at the Dongfang station in Guangdong province and the Xinsong converter station in Yunnan province. The company’s UHVDC technologies will enable China to efficiently and reliably transport a significant amount of clean, renewable energy over larger distances.

Competitive Landscape

The major players in the market include ABB Ltd., General Electric Co., Siemens AG, Hitachi Ltd., and Mitsubishi Electric Corp. There is a significant rise in HVDC transmission projects to overcome the challenge of power transmission over long distances, which in turn, is contributing to the rise in the revenue generation of these market players.

Recent Developments

- In February 2018, General Electric Co. awarded a $320 million contract through its joint venture, KAPES, by Korea Electric Power Corporation (KEPCO). This is intended to offer equipment and expertise to deliver a 4 GW HVDC transmission link from the power complex at South Korea. As the country is facing a challenge of offering efficient energy to densely populated areas, this project will increase the reliability and stability of the Korean electrical transmission grid by adding new routes for power supply. GE has successfully delivered three HVDC reference projects in South Korea in the past. This new project will strengthen GE position in South Korea.

- In January 2017, Bharat Heavy Electricals Ltd in partnership with ABB Ltd. secured a landmark contract from Power Grid Corp. of India Ltd. This is intended for setting up a + 800 kV, 6,000 MW HVDC Link between the Western Region Grid (Raigarh, Chattisgarh) and the Southern Region Grid (Pugalur, Tamil Nadu).

The Report Covers

- Annualized market revenues ($ billion) for each market segment.

- Market value data analysis from 2018 to 2019 and forecast to 2025.

- Company share and market share data for global HVDC transmission market.

- Global corporate-level profiles of key companies operating within the global HVDC transmission market. Based on the availability of data for the category and country, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Investment strategies by identifying the key market segments expected to register strong growth in the near future.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Hitachi Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mitsubishi Electric Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global HVDC Transmission Market by Type

5.1.1. Point-to-Point System

5.1.2. Back-to-Back System

5.1.3. Multi Terminal System

5.2. Global HVDC Transmission Market by Technology

5.2.1. Voltage Source Converter (VSC)

5.2.2. Line Commutated Converters (LCC)

5.3. Global HVDC Transmission Market by Application

5.3.1. Bulk Power Transmission

5.3.2. Interconnecting Grids

5.3.3. Infeed Urban Areas

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. American Superconductor Corp.

7.3. ATCO Ltd.

7.4. Bharat Heavy Electricals Ltd.

7.5. C-EPRI Electric Power Engineering Co., Ltd.

7.6. General Electric Co.

7.7. Hitachi Ltd.

7.8. HVDC Technologies Ltd.

7.9. Mitsubishi Electric Corp.

7.10. Nexans

7.11. NGK Insulators, Ltd.

7.12. NKT A/S

7.13. NR Electric Co., Ltd.

7.14. Prysmian Group

7.15. Reinhausen GmbH

7.16. Schneider Electric SE

7.17. Siemens AG

7.18. Sumitomo Electric Industries, Ltd.

7.19. TDK Corp.

7.20. Toshiba Corp.

7.21. TransGrid Solutions, Inc.

7.22. Transmission Developers, Inc.