Hydrogen Energy Storage Market

Hydrogen Energy Storage Market Size, Share & Trends Analysis Report By Technology (Compression, Liquefaction, and Material), by Storage Form (Solid, Liquid, and Gas), by Application (Stationary Power and Transportation), and by End-Users (Residential, Commercial and Industrial) Forecast Period (2024-2031)

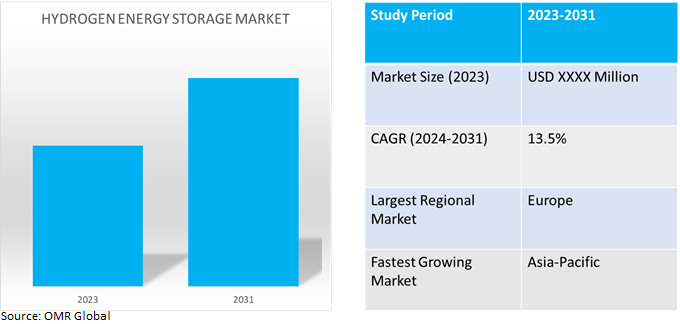

Hydrogen energy storage market is anticipated to grow at a significant CAGR of 13.5% during the forecast period (2024-2031).The market growth is attributed to the increasing demand for hydrogen energy storage in stationary power and transportation. According to the International Energy Agency (IEA), 2023, hydrogen demand will increase by more than 1.5 times to reach more than 150 Mt by 2030, with nearly 30.0% of that demand coming from new applications. Hydrogen energy storage provides the hydrogen needed to operate and heat fuel cells. The high gravimetric density and stability of the storage tanks make hydrogen suitable for long-term energy storage, including seasonal and annual storage.

Market Dynamics

Increasing Adoption of Hydrogen in Industrial Application

With the increasing adoption of hydrogen in industrial applications such as methanol production, steelmaking, concrete production, and oil refining, hydrogen is increasingly being used in outside-the-box ways to produce both old and new products. This includes industries like steelmaking, where hydrogen is being considered as a replacement for coal and other carbon-emitting fuels that are necessary for the process. Another potential use of hydrogen is in making concrete, which is a very carbon-energy-intensive process that is can be decarbonized by using hydrogen. Additionally, hydrogen is currently used in industrial processes, as rocket fuel, and in fuel cells for electricity generation and powering vehicles.

Growing Hydrogen Energy Storage Projects and Pilot Initiatives

Governments, energy businesses, and research institutes are investing in hydrogen energy storage projects and pilot efforts. The potential of hydrogen as a flexible energy carrier and storage medium is demonstrated by these initiatives, which range in size from small-scale demonstration projects to large-scale integrated systems. For instance, in March 2022, the Government of India, under the national hydrogen mission provided the development of a green hydrogen production capacity of at least 5 MMT (Million Metric Tonne) per annum with an associated renewable energy capacity addition of about 125 GW in the country.

Market Segmentation

Our in-depth analysis of the global hydrogen energy storage market includes the following segments technology, storage form, application, and end-users.

- Based on technology, the market is sub-segmented into compression, liquefaction, and material-based.

- Based on storage form, the market is sub-segmented into solid, liquid, and gas.

- Based on application, the market is sub-segmented into stationary power and transportation.

- Based on end-users, the market is sub-segmented into residential, commercial, and industrial.

Compression Technology is Projected to Emerge as the Largest Segment

Based on the technology, the global hydrogen energy storage market is sub-segmented into compression, liquefaction, and material-based. Among the secompression sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include compressed hydrogen used in road transportation fuel cell vehicles, hydrogen filling stations, and stationary power generation on-site. In addition, hydrogen is stored in cylinders using the compression technique for use in the chemical and manufacturing sectors. Owing to the high energy expense of liquefying hydrogen and the range loss experienced as cryogenic liquid hydrogen boils up over many days, compressed gas is favored over liquid hydrogen tanks.

Stationary Power Sub-segment to Hold a Considerable Market Share

Based on application, the global hydrogen energy storage market is sub-segmented into stationary power and transportation. Among these, the stationary power sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the increasing use of hydrogen energy storage in stationary power. Stationary fuel cells generate electricity through an electrochemical reaction, not combustion, providing clean, efficient, and reliable off-grid power to homes, businesses, telecommunications networks, utilities, and others. Many companies around the country are adopting fuel cells for primary and backup power including Adobe, Apple, AT&T, CBS, Coca-Cola, Cox Communications, Delmarva Power, eBay, Google, Honda, Microsoft, Target, and Walmart, among others.

Regional Outlook

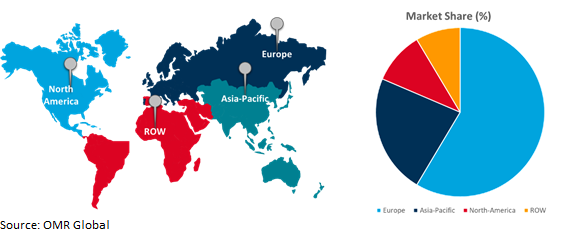

The global hydrogen energy storage market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Hydrogen Energy Storage in Asia-Pacific

- Rising energy use, swift urbanization, and a pressing need to reduce greenhouse gas emissions a contributing towards market growth, by providing viable solution to these issues. Industries such as transportation, with the introduction of fuel cell electric cars, or FCEVs, are driving market growth.

- According to the Economic Research Institute for ASEAN and East Asia, in January 2024, The proportion of renewable energy-based electricity generation is small, and ASEAN aims to grow its renewable energy capacity to 23.0% of primary energy consumption by 2025. The region still holds potential for future adaptation and transformation, to be guided by the right future development strategy and policies for its energy sector including hydrogen.

Global Hydrogen Energy Storage Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share owing to numerous prominent companies and hydrogen energy storage providers in the region such as ITM Power plc,Linde plc,Siemens Energy AG, and Air Liquide International SA among others. The growth is mainly attributed to the increased adoption of hydrogen energy storage in the residential, commercial, and industrial sectors. Additionally, collaborative efforts, government incentives, and international partnerships are further propelling the regional market growth. According to the European Commission, in January 2023, the EU Clean Hydrogen Partnership opened a EUR?195?million ($211.0 million) call for proposals to support projects for renewable hydrogen production, storage, and distribution solutions, and to stimulate the use of low-emission hydrogen in hard-to-abate sectors.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global hydrogen energy storage market include Air Liquide S.A., Doosan Corp., Linde plc, Plug Power Inc., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Honeywell partnered With the National Renewable Energy Lab on hydrogen fuel storage. The collaboration supports the commercialization of a cartridge-based hydrogen fuel storage solution for Uncrewed Aerial Vehicles (UAVs).

Recent Development

- In January 2024, Baker Hughes supported the growth of the hydrogen economy, as part of the company’s broader strategy in new energy. The new facility includes a test bench to allow full load testing, with complete fuel flexibility up to 100.0% hydrogen, and features a 300-bar pressure and 2,450 kg storage capacity.

- In March 2024, Plug Power Inc. launched multiple new products in the energy business including hydrogen storage tanks and a first-of-its-kind mobile liquid hydrogen refueler that is being delivered to customers. The company provides an 8 MW hydrogen fuel cell stationary power system for a backup power hybrid micro-grid. This has led to a public safety power shutoff in Calistoga, CA.

- In November 2021, the US Government signed into law the $1.2 trillion Bipartisan Infrastructure bill, the Infrastructure Investment and Jobs Act. This legislation includes a suite of hydrogen-specific provisions that will drive large-scale deployment and investment for this innovative industry in the US.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydrogen energy storage market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Air Liquide S.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Doosan Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Linde plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hydrogen Energy Storage Market by Technology

4.1.1. Compression

4.1.2. Liquefaction

4.1.3. Material Based

4.2. Global Hydrogen Energy Storage Market by Storage Form

4.2.1. Solid

4.2.2. Liquid

4.2.3. Gas

4.3. Global Hydrogen Energy Storage Market by Application

4.3.1. Stationary Power

4.3.2. Transportation

4.4. Global Hydrogen Energy Storage Market by End-Users

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.4.4. Utilities

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ballard Power Systems Inc.

6.2. Bloom Energy Corp.

6.3. Ceres Power Holdings plc

6.4. Chart Industries, Inc.

6.5. FuelCell Energy, Inc.

6.6. Green Hydrogen Systems

6.7. Hexagon Purus ASA

6.8. Hydrogenious LOHC Technologies GmbH

6.9. ITM Power PLC

6.10. McPhy Energy SA

6.11. Mitsubishi Heavy Industries, Ltd.

6.12. Nel ASA

6.13. Plug Power Inc.

6.14. PowerCell Sweden AB

6.15. Siemens AG

6.16. Snam SPA

6.17. Storengy SAS (Engie Group)

6.18. Topsoe A/S

6.19. Toshiba Energy Systems & Solutions Corp.

6.20. Worley

1. GLOBAL HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

2. GLOBAL HYDROGEN COMPRESSION ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HYDROGEN LIQUEFACTION ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HYDROGEN MATERIAL BASED ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY STORAGE FORM, 2023-2031 ($ MILLION)

6. GLOBAL SOLID HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LIQUID HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL GAS HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL HYDROGEN ENERGY STORAGE FOR STATIONARY POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL HYDROGEN ENERGY STORAGE FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

13. GLOBAL HYDROGEN ENERGY STORAGE FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL HYDROGEN ENERGY STORAGE FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL HYDROGEN ENERGY STORAGE FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY STORAGE FORM, 2023-2031 ($ MILLION)

20. NORTH AMERICAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

22. EUROPEAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

24. EUROPEAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY STORAGE FORM, 2023-2031 ($ MILLION)

25. EUROPEAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. EUROPEAN HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY STORAGE FORM, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

32. REST OF THE WORLD HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

33. REST OF THE WORLD HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

34. REST OF THE WORLD HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY STORAGE FORM, 2023-2031 ($ MILLION)

35. REST OF THE WORLD HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD HYDROGEN ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL HYDROGEN ENERGY STORAGE MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

2. GLOBAL HYDROGEN COMPRESSION ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HYDROGEN LIQUEFACTION ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HYDROGEN MATERIAL BASED ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HYDROGEN ENERGY STORAGE MARKET SHARE BY STORAGE FORM, 2023 VS 2031 (%)

6. GLOBAL SOLID HYDROGEN ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LIQUID HYDROGEN ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL GAS HYDROGEN ENERGY STORAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL HYDROGEN ENERGY STORAGE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL HYDROGEN ENERGY STORAGE FOR STATIONARY POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL HYDROGEN ENERGY STORAGE FOR TRANSPORTATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL HYDROGEN ENERGY STORAGE MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

13. GLOBAL HYDROGEN ENERGY STORAGE FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL HYDROGEN ENERGY STORAGE FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL HYDROGEN ENERGY STORAGE FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

18. UK HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA HYDROGEN ENERGY STORAGE MARKET SIZE, 2023-2031 ($ MILLION)