Hydrogen Generation Market

Hydrogen Generation Market Size, Share & Trends Analysis Report by Technology (Steam Methane Reforming, Coal Gasification and Others), by Source (Natural Gas, Coal, Biomass and Water), and by Application (Methanol production, Ammonia Production, Petroleum Refining, Transportation, Power Generation and Others), Forecast Period (2023-2030)

Hydrogen generation market is anticipated to grow at a significant CAGR of 11.1% during the forecast period (2023-2030).The growing adoption of integrated green hydrogen coupled with the large scale generation of green hydrogen is the key factor supporting the growth of the market globally. Market players partnership helps to build the fundamental pillars of economic sustainability by driving decarbonisation of industry, power generation, mobility, and agriculture thereby mitigating climate change, and ensuring energy independence. The market players are also focusing on introducing hydrogen generation solutions that further bolster the market growth. For instance, in June 2022, Adani Group and Total Energies created the global green hydrogen ecosystem. Adani New Industries Ltd. to invest $50 Billion in green hydrogen. Through partnership to jointly create the global largest green hydrogen ecosystem. In this strategic alliance, Total Energies acquired a 25.0% minority interest in Adani New Industries Ltd (ANIL) from Adani Enterprises Ltd (AEL). However, the high cost of this technology may restrain its market growth.

Segmental Outlook

The global hydrogen generation market is segmented on the technology, source, and application. Based on the technology, the market is sub-segmented into steam methane reforming, coal gasification and others (auto thermal reforming). Based on the source, the market is sub-segmented into natural gas, coal, biomass and water. Further, on the basis ofapplication, the market is sub-segmented into methanol production, ammonia production, petroleum refining, transportation, power generation and others (energy storage).Among the technology, the steam methane reformingsub-segment is anticipated to hold a considerable share of the market owing to producing the highest yield of hydrogen. The efficiency of the steam reforming process is about 65.0% to 75.0%, among the highest of current commercially available production methods.

The Power Generation Sub-Segment is Anticipated to Hold a Considerable Share of the Global Hydrogen Generation Market

Among the application, the power generation sub-segment is expected to hold a considerable share of the global hydrogen generation market. The segmental growth is attributed to the growing influence of decarbonized society, several countries and regional market player around the globe have declared their intention to reduce their overall emissions of greenhouse gases to zero by 2050. For instance, in October 2021, Panasonic Corp. launched a pure hydrogen fuel cell generator, that generates power through a chemical reaction with high-purity hydrogen and oxygen in the air. Moreover, such power generation requires a system to store surplus power in storage batteries or via other methods and compensate for power shortages.

Regional Outlook

The global hydrogen generation market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold a prominent share of the market across the globe, owing to the increase in methanol production and ammonia production using steam methane reforming technology.

Global Hydrogen Generation Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Hydrogen Generation Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed todevelopment of lifecycle operation system to efficiency manage the hydrogen production, storage and utilization processes. For instance, in October 2023, Doosan Enerbility announced that it had commenced commercial operation of the Jeju Green Hydrogen Production Plant which is powered using wind energy. The 3.3MWJeju Green Hydrogen Production Plant is the largest green hydrogen plant in Korea, It is a national project with participation from nine companies and institutions, including Doosan Enerbility, and Jeju Energy Corp acting as the prime contractor.

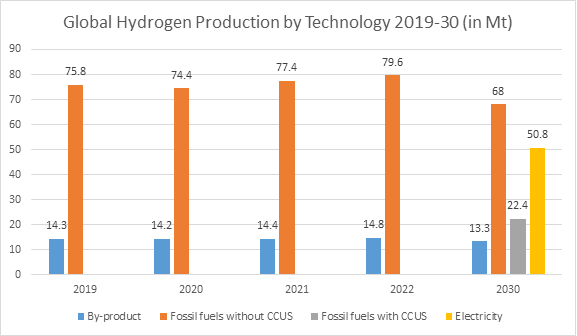

Global Hydrogen Production by Technology in the Net Zero Scenario, 2019-2030

Source: International Energy Agency

According to the International Energy Agency (IEA), in July 2023, Dedicated hydrogen production is primarily based on fossil fuel technologies, with around a sixth of the global hydrogen supply coming from “by-product” hydrogen, mainly in the petrochemical industry. In 2022, 70.0% of the energy requirement for dedicated hydrogen production was met with natural gas and around 30.0% coal (mostly used in China, which alone accounted for 90.0% of global coal consumption for hydrogen production). Low-emission hydrogen production represented less than 1.0% of total hydrogen production in 2022, despite growing 5.0% compared to 2021. This increase in low-emission hydrogen production results from 130?MW of electrolysis capacity and one project starting operation in China for hydrogen production from coal with CCUS entering into operation in 2022.

Market Players Outlook

The major companies serving the hydrogen generation market include Air Liquide India, Linde plc, Air Products and Chemicals, Inc., ITM Power, Siemens Energy, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2020, Iberdrola and Fertiberia launched the largest plant producing green hydrogen for industrial use in Europe. Both companies have signed an agreement that triggers an investment of 150 million euros ($161 million), to construct the largest plant to produce green hydrogen for industrial use in Europe.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydrogen generation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Air Liquide

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Air Products and Chemicals, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Linde plc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hydrogen Generation Market by Technology

4.1.1. Steam Methane Reforming

4.1.2. Coal Gasification

4.1.3. Others (Auto Thermal Reforming)

4.2. Global Hydrogen Generation Market by Source

4.2.1. Natural Gas

4.2.2. Coal

4.2.3. Biomass

4.2.4. Water

4.3. Global Hydrogen Generation Market by Application

4.3.1. Methanol production

4.3.2. Ammonia Production

4.3.3. Petroleum Refining

4.3.4. Transportation

4.3.5. Power Generation

4.3.6. Others (Energy storage)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ballard Power Systems

6.2. Ceres Power

6.3. Cummins Inc.

6.4. Enapter

6.5. FuelCell Energy

6.6. GinerELX

6.7. Green Hydrogen Systems

6.8. Heliocentris Energy Solutions AG

6.9. ITM Power

6.10. McPhy Energy S.A.

6.11. NelASA.

6.12. Plug Power Inc.

6.13. Proton OnSite

6.14. Re-Fire Technology

6.15. SGH2 Energy Global Corp.

6.16. Siemens Energy

6.17. Toshiba Energy Systems & Solutions Corp.

6.18. Uniper SE

1. GLOBAL HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

2. GLOBAL STEAM METHANE REFORMING HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL COAL GASIFICATION HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL OTHERS HYDROGEN GENERATION TECHNOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

6. GLOBAL NATURAL GAS HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL COAL HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BIOMASS HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL WATER HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. GLOBAL HYDROGEN GENERATION FOR METHANOL PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL HYDROGEN GENERATION FOR AMMONIA PRODUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL HYDROGEN GENERATION FOR PETROLEUM REFINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL HYDROGEN GENERATION FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL HYDROGEN GENERATION FOR POWER GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL HYDROGEN GENERATION FOR OTHERS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

20. NORTH AMERICAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

21. NORTH AMERICAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. EUROPEAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

24. EUROPEAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

25. EUROPEAN HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. ASIA- PACIFIC HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

28. ASIA- PACIFIC HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

29. ASIA- PACIFIC HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

30. REST OF THE WORLD HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

31. REST OF THE WORLD HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

32. REST OF THE WORLD HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

33. REST OF THE WORLD HYDROGEN GENERATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL HYDROGEN GENERATION MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

2. GLOBAL STEAM METHANE REFORMING HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL COAL GASIFICATION HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL OTHERS HYDROGEN GENERATION TECHNOLOGY MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL HYDROGEN GENERATION MARKET SHARE BY SOURCE, 2022 VS 2030 (%)

6. GLOBAL NATURAL GAS HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL COAL HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL BIOMASS HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL WATER HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL HYDROGEN GENERATION MARKET SHARE ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. GLOBAL HYDROGEN GENERATION FOR METHANOL PRODUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL HYDROGEN GENERATION FOR AMMONIA PRODUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL HYDROGEN GENERATION FOR PETROLEUM REFINING MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL HYDROGEN GENERATION FOR TRANSPORTATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL HYDROGEN GENERATION FOR POWER GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL HYDROGEN GENERATION FOR OTHERS APPLICATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL HYDROGEN GENERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. US HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

19. CANADA HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

20. UK HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

21. FRANCE HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

22. GERMANY HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

23. ITALY HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

24. SPAIN HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF EUROPE HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

26. INDIA HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

27. CHINA HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

28. JAPAN HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

29. SOUTH KOREA HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF ASIA-PACIFIC HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD HYDROGEN GENERATION MARKET SIZE, 2022-2030 ($ MILLION)