Hypertension Drug Market

Hypertension Drug Market Size, Share & Trends Analysis Report Drug Type (Diuretics, ACE Inhibitors, Calcium Channel Blockers, Vasodilators, Beta-adrenergic Blockers, and Others), By Distribution Channel (Retail Pharmacy, Hospital Pharmacy, and E-Commerce),Forecast 2022-2028 Update Available - Forecast 2025-2035

The hypertension drug market is anticipated to grow at a significant CAGR of 4% during the forecast period. Hypertension is defined as a long-term medical condition that is caused by high pressure of blood in the arteries. Antihypertensive drug is used to treat patients with high blood pressure. The global hypertension drug market is growing due to the increasing incidence of hypertension globally. According to World Health Organization, more than 1.13 billion people are suffering from hypertension globally. Among them, only 1 in each 5 is cured or under control. Additionally, rise in awareness related to hypertension diseases, increase in geriatric patients and rise in inactive patients are the major factor boosting the market growth. The rise in research related to anti-hypertensive drugs to treat patients is expected to drive the global hypertension market growth in the forecast period. However, the cost of medicine can be a restraining factor for the market to grow as these kinds of drugs is prescribed for a long period of time. Anti-hypertension drugs such as calcium channel blockers and ACE inhibitors have some major side effects which will restrict the growth of global hypertension market in the forecast period.

Impact of COVID-19 Pandemic on Hypertension Drug Market

COVID-19 pandemic had a severe impact on people with comorbidity including hypertension. During the lockdown period, the lifestyle of patients with hypertension was severely impacted. According to a report by American College of Cardiology on July 2020, the hotspots of COVID-19 virus such as Wuhan, Lombardy, and New York City showed that people with hypertension were mostly affected among the other COVID-19 patients which in turn is expected to boost the growth of the global hypertension drugs market.

Segmental Outlook

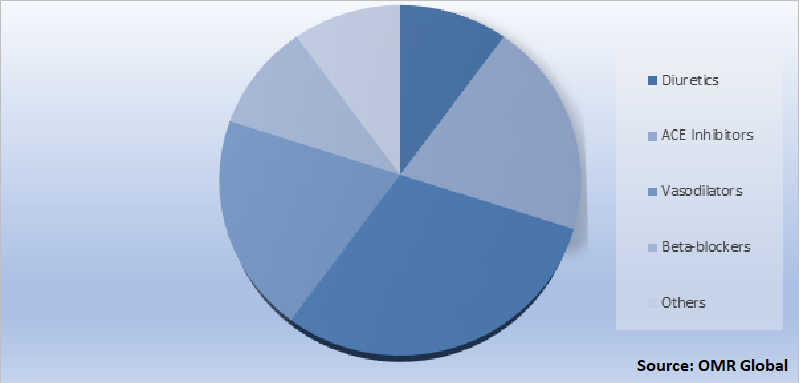

The hypertension drug market is segmented based on the drug type and distribution channel. Based on the drug type, the market is segmented into diuretics, ACE inhibitors, calcium channel blockers, vasodilators, beta-adrenergic blockers, and others. Amongst the drug type, calcium channel blocker is anticipated to hold the prominent share in the global hypertension market. Based on distribution channel, the market is segmented into retail pharmacy, hospital pharmacy, and E-commerce. The above-mentioned segments can be customized as per the requirements.?

Hypertension Drug Market Share by Drug Type, 2022 (%)

The Calcium Channel Blocker Drug is Anticipated to Hold a Prominent Share in the Hypertension Drug Market

The calcium channel blocker segment is anticipated to hold the major share in the global hypertension drug market. Sodium channel blockers are used to treat high blood pressure and other serious diseases. They are commonly used to reduce blood pressure by preventing calcium from entering heart and artery cells and lowering heart muscle excitability. It's also used to treat a variety of excessively fast heartbeats. The versatile application of calcium channel blocker drugs to treat fast heartbeats associated with hypertension is expected to drive the global hypertension drug market further.

Regional Outlooks

The hypertension drug market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North American hypertension drugs market is expected to hold a prominent share in the global hypertension drug market due to its well-developed healthcare infrastructure along with a huge number of patients diagnosed with hypertension and other cardiovascular diseases.

Hypertension Drug Market Growth, by Region 2022-2028

The North America Region is estimated to Hold the Major Share in the Hypertension drug Market

North America is anticipated to hold the major share in the hypertension drug market. This is due to their well-developed healthcare facilities in this region. According to the American Thoracic Society, More than 250,000 cases of the pulmonary disease occur each year only in the US. The easy availability of hypertension drugs due to the presence of major players including Johnson & Johnson Services, and Pfizer Inc. across the region also drives the hypertension drugs market across the region.

However, Asia-Pacific is anticipated to hold the fastest-growing share in the global hypertension drugs market. This is due to the increasing cases of hypertension disease in this region. According to WHO, an estimation of 270 million people has hypertension alone in China. Additionally, government and NGO initiatives to increase the awareness of hypertension across this region are also driving the market growth. Their main aim is to educate the patients to increase their awareness of hypertension and its connection to other cardiovascular and pulmonary diseases across the region.

Market Players Outlook

The major companies serving the hypertension drug market include AstraZeneca Plc., Bayers AG, Daiichi Sankyo Company Ltd., Novartis International AG, Pfizer Inc., and many more. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches for the advancement of the product, to stay competitive in the market. For instance, In December 2019, Bayer AG announced their FDA approval for the device designation to artificial intelligence software for Chronic Thromboembolic Pulmonary Hypertension pattern recognition.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the hypertension drug market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on The Global hypertension drug market

- Recovery Scenario of Global hypertension drug market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. AstraZeneca Plc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Bayers AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DAIICHI SANKYO COMPANY Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Novartis International AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Pfizer Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global hypertension drug market by Drug Type

4.1.1. Diuretics

4.1.2. ACE Inhibitors

4.1.3. Calcium Channel Blockers

4.1.4. Vasodilators

4.1.5. Beta-adrenergic Blockers

4.1.6. Others

4.2. Global Hypertension Drug Market by Distribution Channel

4.2.1. Retail Pharmacy

4.2.2. Hospital Pharmacy

4.2.3. E-Commerce

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Boehringer Ingelheim International GmbH

6.2. Boryung Co. Ltd.

6.3. Cipla Inc.

6.4. F. Hoffman La. Roche Ltd.

6.5. GlaxoSmithKline

6.6. Gilead Sciences, Inc.

6.7. JW Pharmaceutical

6.8. Johnson & Johnson Services

6.9. Merck KGaA

6.10. Sanofi

6.11. Teva Pharmaceutical Industries Ltd.

6.12. Takeda pharmaceutical Co. Ltd.

1. GLOBAL HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2021 - 2028 ($ MILLION)

2. GLOBAL DIURETICS HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

3. GLOBAL ACE INHIBITORS HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

4. GLOBAL CALCIUM CHANNEL BLOCKER HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

5. GLOBAL VASODILATORS HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

6. GLOBAL BETA-BLOCKERS HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

7. GLOBAL OTHERS HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

8. GLOBAL HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021 - 2028 ($ MILLION)

9. GLOBAL RETAIL PHARMACY HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

10. GLOBAL HOSPITAL PHARMACY HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

11. GLOBAL E-COMMERCE HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2021 - 2028 ($ MILLION)

12. GLOBAL HYPERTENSION DRUG MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021 - 2028 ($ MILLION)

13. NORTH AMERICAN HYPERTENSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021 - 2028 ($ MILLION)

14. NORTH AMERICAN HYPERTENSION MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021 - 2028 ($ MILLION)

15. EUROPEAN HYPERTENSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021 - 2028 ($ MILLION)

16. EUROPEAN HYPERTENSION MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021 - 2028 ($ MILLION)

17. ASIA-HYPERTENSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021 - 2028 ($ MILLION)

18. ASIA-PACIFIC HYPERTENSION MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021 - 2028 ($ MILLION)

19. REST OF THE WORLD HYPERTENSION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021 - 2028 ($ MILLION)

20. REST OF THE WORLD HYPERTENSION MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021 - 2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HYPERTENSION DRUG MARKET, 2021 - 2028($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HYPERTENSION DRUG MARKET BY SEGMENT, 2021 - 2028($ MILLION)

3. RECOVERY OF GLOBAL HYPERTENSION DRUG MARKET, 2021-2027 (%)

4. GLOBAL HYPERTENSION DRUG MARKET SHARE BY DRUG TYPE, 2021 VS 2028 (%)

5. GLOBAL DIURETICS HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL ACE INHIBITORS HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL CALCIUM CHANNEL BLOCKER HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL VASODILATORS HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL BETA-BLOCKERS HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL OTHERS HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL HYPERTENSION DRUG MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

12. GLOBAL RETAIL PHARMACY HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL HOSPITAL PHARMACY HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL E-COMMERCE HYPERTENSION DRUG MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

16. CANADA GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

17. UK GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

18. FRANCE GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

19. GERMANY GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

20. ITALY GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

21. SPAIN GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

22. REST OF EUROPE GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

23. INDIA GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

24. CHINA GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

25. JAPAN GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

26. REST OF ASIA-PACIFIC GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)

27. REST OF THE WORLD GLOBAL HYPERTENSION DRUG MARKET SIZE, 2021 - 2028($ MILLION)