Insulated Gate Bipolar Transistors (IGBTs) and Thyristors Market

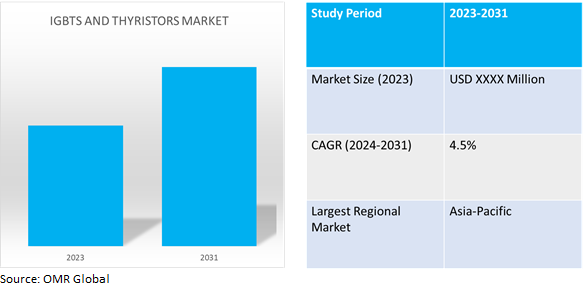

Insulated Gate Bipolar Transistors (IGBTs) and Thyristors Market Size, Share & Trends Analysis Report by Packaging Type (Discrete and Module), by Voltage (Low Voltage IGBTs, Medium Voltage IGBTs, and High Voltage IGBTs), and by Application (Power Transmission Systems, Renewable Energy, Rail Traction Systems, Uninterruptible Power Supply (UPS), and Others (Electric and Hybrid Electric Vehicles)) Forecast Period (2024-2031)

IGBTs and thyristors market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). IGBTs and Thyristors are two types of semiconductor devices with three terminals and both of them are used to control currents. Both devices have a controlling terminal called ‘gate’, but have different principals of operation.

Market Dynamics

Renewable energy consumption

These days, wind and solar power are the main growth drivers for thyristors and IGBTs. The need for effective power conversion and control technologies that may be utilized to connect renewable energy systems with the current grid has increased as a result of the global shift towards cleaner energy sources. They transform the direct current generated by solar panels and wind turbines into useful alternating current that travels over transmission lines, IGBTs, and thyristors are essential components in renewable energy applications. IGBTs and thyristors facilitate grid stability by managing power fluctuations, ensuring smooth transitions, and preventing grid disturbances during renewable energy injection.

Rising urbanization and infrastructure development

Globally, the market for IGBTs and thyristors is expanding quickly as a result of infrastructural development and urbanization. An approach to addressing the world's increasing urban population is the implementation of modern infrastructure, including energy grids, intelligent buildings, and transportation networks. These infrastructures will require sophisticated power electronic technologies to have effective energy management, control, and distribution. Industrial automation, smart grids, renewable energy systems, and Electric Vehicles (EVs) are a few crucial uses for IGBTs and thyristors.

Market Segmentation

Our in-depth analysis of the global IGBTs and thyristors market includes the following segments by packaging type, voltage, and application:

- Based on packaging type, the market is sub-segmented into discrete and module.

- Based on voltage, the market is segmented into low-voltage IGBTs, medium-voltage IGBTs, and high-voltage IGBTs.

- Based on application, the market is segmented into power transmission systems, renewable energy, rail traction systems, UPS, and others.

Power Transmission Systems Sub-segment to Hold a Considerable Market Share

Power transmission systems hold a considerable market share due to increasing demand for efficient and reliable power transmission and distribution solutions. In addition to handling greater voltages and lowering transmission losses, IGBTs and Thyristors can be used to control and convert power transmission more effectively. Due to the global drive towards the integration of renewable energy, the implementation of smart grids, and the electrification of transportation, there is an increasing need for modern power transmission systems equipped with thyristors and IGBTs.

Regional Outlook

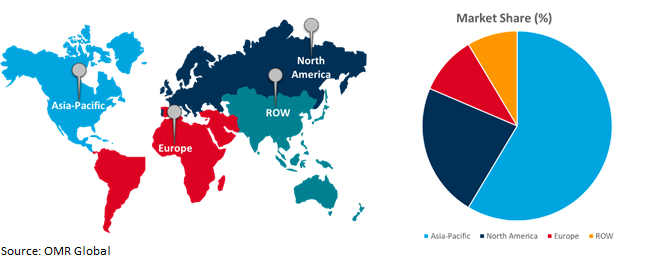

The global IGBTs and thyristors market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in IGBTs and thyristors market

- Germany has the presence of key companies that specialize in the design and production of IGBTs and thyristors, leveraging its expertise in semiconductor technology and power management which is driving the market growth.

Global IGBTs and Thyristors Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the region's fast industrialization and urbanization which has raised the demand for industrial automation and electrical infrastructure, which in turn boosted the requirement for IGBTs and thyristors in a variety of applications, including voltage regulators, motor drives, and power electronics converters. Furthermore, the adoption of these chips in EVs and HEVs is being driven by improvements in transportation networks and rising car ownership in nations like China, South Korea, Japan, and South Korea.

The presence of key companies in the Asia-Pacific region is also driving the demand for IGBTs and thyristor products such as Fuji Electric Co., Ltd. which is headquartered in Japan and is known for its extensive portfolio of power semiconductor devices and solutions. The company specializes in the design, manufacturing, and distribution of IGBTs and thyristors for various industrial & commercial applications. The regional market expansion can be credited to the growing need for proficient power transmission systems to fulfill the escalating demand for power supply in the sub-continent.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global IGBTs and thyristors market include Infineon Technologies AG, Mitsubishi Electric Corp., STMicroelectronics N.V., Toshiba Electronic Devices & Storage Corp., Hitachi, Ltd., and Littelfuse, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2023, Nexperia entered into the IGBT market with a flexible range of 600 V devices, offering medium-speed (M3) and high-speed (H3) switching capabilities. These IGBTs feature a carrier-stored trench-gate advanced Field-stop (FS) construction, providing low conduction and switching losses with high ruggedness.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global IGBTs and thyristors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Infineon Technologies AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Mitsubishi Electric Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. STMicroelectronics N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Toshiba Electronic Devices & Storage Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global IGBTs and Thyristors Market by Packaging Type

4.1.1. IGBT and Thyristors Discrete

4.1.2. IGBT and Thyristors Module

4.2. Global IGBTs and Thyristors Market by Voltage

4.2.1. Low Voltage IGBTs and Thyristors

4.2.2. Medium Voltage IGBTs and Thyristors

4.2.3. High Voltage IGBTs and Thyristors

4.3. Global IGBTs and Thyristors Market by Application

4.3.1. Power Transmission Systems

4.3.2. Renewable Energy

4.3.3. Rail Traction Systems

4.3.4. Uninterruptible Power Supply (UPS)

4.3.5. Others (Electric and Hybrid Electric Vehicles)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABB, Ltd.

6.2. Darrah Electric Company

6.3. Diodes, Inc.

6.4. Dow Inc.

6.5. Dynex Semiconductor, Ltd.

6.6. Fuji Electric Co., Ltd.

6.7. Hitachi, Ltd.

6.8. KYOCERA Corporation

6.9. Littelfuse, Inc.

6.10. Microchip Technology, Inc.

6.11. New Jersey Semiconductor Products Inc

6.12. Nexperia BV

6.13. Renesas Electronics Corporation

6.14. ROHM Co., Ltd.

6.15. SanRex Corp.

6.16. SEMIKRON Group

6.17. Silicon Power Corp.

6.18. StarPower Europe AG

6.19. Vishay Intertechnology, Inc.

1. GLOBAL IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL IGBTS AND THYRISTORS DISCRETE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL IGBTS AND THYRISTORS MODULE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2023-2031 ($ MILLION)

5. GLOBAL LOW VOLTAGE IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MEDIUM VOLTAGE IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HIGH VOLTAGE IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL IGBTS AND THYRISTORS FOR POWER TRANSMISSION SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL IGBTS AND THYRISTORS FOR RENEWABLE ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL IGBTS AND THYRISTORS FOR RAIL TRACTION SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL IGBTS AND THYRISTORS FOR UPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL IGBTS AND THYRISTORS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2023-2031 ($ MILLION)

22. EUROPEAN IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD IGBTS AND THYRISTORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL IGBTS AND THYRISTORS MARKET SHARE BY PACKAGING TYPE, 2023 VS 2031 (%)

2. GLOBAL IGBTS AND THYRISTORS DISCRETE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL IGBTS AND THYRISTORS MODULE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL IGBTS AND THYRISTORS MARKET SHARE BY VOLTAGE, 2023 VS 2031 (%)

5. GLOBAL LOW VOLTAGE IGBTS AND THYRISTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MEDIUM VOLTAGE IGBTS AND THYRISTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HIGH VOLTAGE IGBTS AND THYRISTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL IGBTS AND THYRISTORS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL IGBTS AND THYRISTORS FOR POWER TRANSMISSION SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL IGBTS AND THYRISTORS FOR RENEWABLE ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL IGBTS AND THYRISTORS FOR RAIL TRACTION SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL IGBTS AND THYRISTORS FOR UPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL IGBTS AND THYRISTORS FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL IGBTS AND THYRISTORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA IGBTS AND THYRISTORS MARKET SIZE, 2023-2031 ($ MILLION)