India Plastics Market

India Plastics Market Size, Share & Trends Analysis by Type (Thermoplastics, and Thermosets), and by Application (Packaging, Building & Construction, Automotive, Electrical & Electronics, Household, Leisure & Sports, Agriculture, and Others), Forecast Period (2025-2035)

Industry Overview

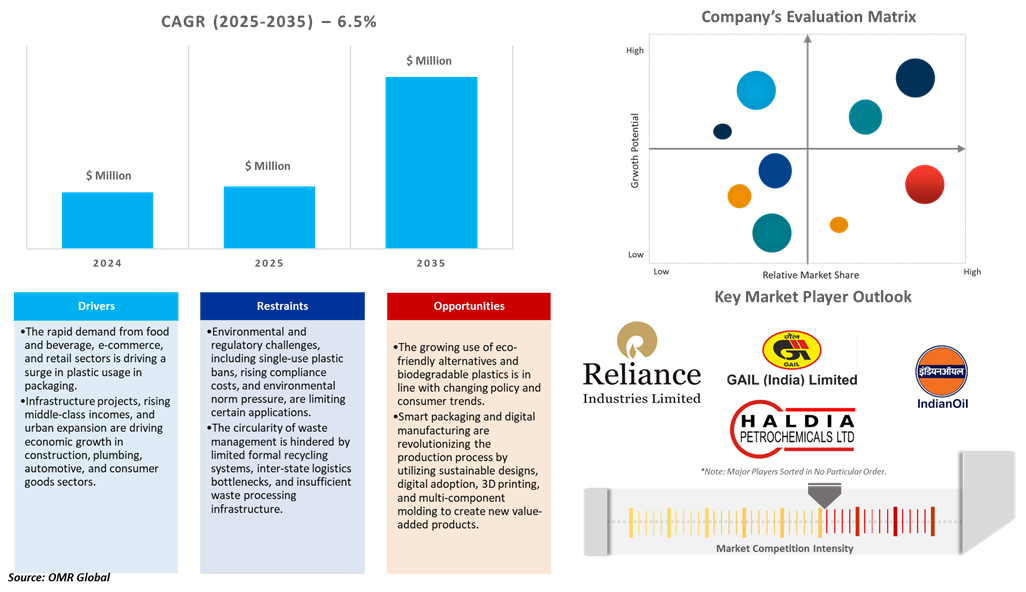

India plastics market was valued at $38,045 million in 2024 and is projected to reach $75,300 million by 2035, growing at a CAGR of 6.5% during the forecast period (2025–2035). The growing demand for plastic products across various industries, including FMCG, retail, agriculture, and e-commerce, is boosting market growth owing to scale advantages in exports. According to India’s Plastics Export Analysis, in August 2024, India's plastic exports reached $1,065 million, marking a 10.5% increase from $963 million in August 2023. From April to August 2024, the cumulative plastic export value was $5,018 million, compared to $4,704 million during the same period the previous year, reflecting a 6.7% growth.

Market Dynamics

Increasing Demand from Consumer Durables & Electronics

The increasing production and consumption of consumer durables and electronics such as refrigerators, washing machines, kitchen appliances, and televisions are driving demand for high-quality plastic parts and packaging materials. As per the India Brand Equity Foundation (IBEF), in May 2025, India's consumer durables segment is segmented into urban and rural segments, which are attracting international marketers. This industry includes a significant middle class, a large affluent segment, and a smaller poor segment, covering products such as consumer electronics and white goods such as fans, kitchen appliances, washing machines, televisions, and refrigerators. The Indian Appliance and Consumer Electronics Industry is projected to grow considerably, with its market size expected to nearly double from $9.09 billion in 2022 to approximately $21.18 billion by 2025. Additionally, electronics hardware production in India was valued at $87 billion in 2022.

Growth in the Packaging Industry

The packaging industry is experiencing growth due to the surge in demand for flexible and rigid packaging, fueled by e-commerce expansion, food processing, and consumer goods consumption. According to the India Brand Equity Foundation (IBEF), in April 2025, India's plastic exports totaled $10.34 billion, with the exports of plastic films & sheets, FIBC woven sacks, woven fabrics & tarpaulin, and packaging materials – flexible and rigid – increasing by 19.6%, 17.2%, and 10.1%, respectively, over the last year. Overall exports of plastic and plastic-related material in FY23 were $11.96 billion, down 10.4% from FY22's $13.35 billion. Plastic raw materials, the largest export segment, accounted for 27.76% of the overall exports and grew by 21.5%, whereas plastic films and sheets, the second largest category with 15.13%, fell 10.6% compared to last year.

Market Segmentation

- Based on the type, the market is segmented into thermoplastics and thermosets.

- Based on the application, the market is segmented into packaging, building & construction, automotive, electrical & electronics, household, leisure & sports, agriculture, and others.

Packaging Segment to Lead the Market with the Largest Share

The Indian food processing sector is growing with rising demand for new and safe food packaging solutions, particularly in the sector of plastics packaging. For instance, in June 2025, UFlex launched FSSAI-approved single-pellet solution for food packaging using a blend of recycled PET with virgin PET to ensure high purity and stability. The solution is compatible with installed PET manufacturing lines, with no need to make new infrastructure investments in order to switch to rPET seamlessly. It aligns with FSSAI's definition of Food Contact Material-recycled PET (FCM-rPET) and complies with national and international safety standards like FDA approval.

- In September 2024, UFlex presented its enzyme-based biodegradable flexible packaging solutions and modified atmosphere packaging technology at World Food India, encouraging investments in the Indian food processing industry. The company additionally presented its modified atmosphere packaging technology, which extends the shelf life of fresh fruits and vegetables, reducing food waste. The company's role in developing sustainable packaging solutions for the FMCG sector.

Polypropylene (PP): A Key Segment in Market Growth

Polyethylene (PE), that is a light-weight thermoplastic made by polymerizing ethylene gas, is used extensively globally owing to its toughness, chemical and water resistance, and insulation value, making it suitable for demanding, flexible, and easily recyclable applications.

Moreover, High-performance plastic materials market expansion is mainly fuelled by expansion in the automotive, electrical & electronics, construction, and packaging industries. For instance, February 2025, Polyplastics introduced Plastron LFT RA627P, a green composite of polypropylene (PP) resin and long cellulose fiber. The product has low density, high specific rigidity, good impact strength, and superior damping for diverse applications such as audio components and industrial housings. The cellulose fiber component in the regenerated cellulose reduces the carbon footprint by 30% over 30% short glass fiber-reinforced PP resin. The material has the same exural modulus and increased specific rigidity over 30% short glass fiber-reinforced PP resin and provides a balance of these properties.

Market Players Outlook

The major companies operating in the India plastics market include GAIL (India) Ltd., Reliance Industries Ltd., Indian Oil Corporation Limited (IOCL), and Haldia Petrochemicals Ltd., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In January 2025, In January 2025, PolyCycl, a Chandigarh-based start-up, launched a unique plastic recycling technology in Bengaluru, transforming hard-to-recycle plastics into food-grade polymers, renewable chemicals, and sustainable fuels.

- In February 2023, Hindustan Unilever and UNDP India initiated a plastic circular economy project in India. The alliance focuses on establishing material recovery facilities for plastic waste recycling and promoting households to segregate their trash for effective collection and processing. The project extended to 20,000 Safai Saathis in primary urban hubs, enabling them to receive access to government welfare programs and other supporting schemes. The alliance is the first of its kind in India.

- In May 2025, India initiated mass mobilisation campaign against plastic pollution under Mission Lifestyle for Environment initiative. The major focus points are public education, reduction in usage, improvement in waste management, and formulating sustainable alternatives.

- In July 2025, India conducts first field trial on the use of waste plastic geocells for difficult terrain road construction, developed by Central Road Research Institute (CRRI) and Bharat Petroleum Corporation Limited (BPCL).

- In August 2025, DIC Corp. intended to construct a new facility for producing epoxy resins at its Chiba plant to cater to growing demand for materials utilized in semiconductor manufacturing. The new plant will achieve additional production capacity and implement new processes, improving DIC's competitiveness and guaranteeing world-class quality and increased productivity.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the India plastics market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• India Plastics Market Sales Analysis – Category | Type | Application ($ Million)

• India Plastics Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Plastics Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the India Plastics Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the India Plastics Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For the India Plastics Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – India Plastics Market Revenue and Share by Manufacturers

• India Plastics Category Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Reliance Industries Ltd.

4.2.1.1. Overview

4.2.1.2. Category Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. GAIL (India) Ltd.

4.2.2.1. Overview

4.2.2.2. Category Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Haldia Petrochemicals Ltd.

4.2.3.1. Overview

4.2.3.2. Category Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Indian Oil Corporation Limited (IOCL)

4.2.4.1. Overview

4.2.4.2. Category Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. India Plastics Market Sales Analysis By Type ($ Million)

5.1. Thermoplastics

5.1.1. Polyethylene (PE)

5.1.2. Polypropylene (PP)

5.1.3. Polystyrene (PS)

5.1.4. Polyvinylchloride (PVC)

5.1.5. Polyethylene Terephthalate (PET)

5.1.6. Others (Acrylonitrile Butadiene Styrene (ABS), Polymethyl Methacrylate (PMMA), Polycarbonate (PC), and Polyamide (PA / Nylon))

5.2. Thermosets

5.2.1. Polyurethane (PUR)

5.2.2. Epoxy Resins

5.2.3. Phenolic Resins

5.2.4. Acrylic Resins

5.2.5. Others (Melamine Formaldehyde (MF), Urea Formaldehyde (UF), and Unsaturated Polyester Resins (UPR))

6. India Plastics Market Sales Analysis By Application ($ Million)

6.1. Packaging

6.2. Building & Construction

6.3. Automotive

6.4. Electrical & Electronics

6.5. Household, Leisure & Sports

6.6. Agriculture

6.7. Others (Healthcare & Medical Devices, Furniture & Fixtures, Industrial Machinery, and Textiles & Fibers)

7. Company Profiles

7.1. Arkema Group

7.1.1. Quick Facts

7.1.2. Company Overview

7.1.3. Product Portfolio

7.1.4. Business Strategies

7.2. BASF SE

7.2.1. Quick Facts

7.2.2. Company Overview

7.2.3. Product Portfolio

7.2.4. Business Strategies

7.3. Chemplast Sanmar Ltd

7.3.1. Quick Facts

7.3.2. Company Overview

7.3.3. Product Portfolio

7.3.4. Business Strategies

7.4. Covestro AG

7.4.1. Quick Facts

7.4.2. Company Overview

7.4.3. Product Portfolio

7.4.4. Business Strategies

7.5. DCW Ltd.

7.5.1. Quick Facts

7.5.2. Company Overview

7.5.3. Product Portfolio

7.5.4. Business Strategies

7.6. DIC Corp.

7.6.1. Quick Facts

7.6.2. Company Overview

7.6.3. Product Portfolio

7.6.4. Business Strategies

7.7. DuPont de Nemours, Inc.

7.7.1. Quick Facts

7.7.2. Company Overview

7.7.3. Product Portfolio

7.7.4. Business Strategies

7.8. Formosa Plastics Corp.

7.8.1. Quick Facts

7.8.2. Company Overview

7.8.3. Product Portfolio

7.8.4. Business Strategies

7.9. GAIL (India) Ltd.

7.9.1. Quick Facts

7.9.2. Company Overview

7.9.3. Product Portfolio

7.9.4. Business Strategies

7.10. Haldia Petrochemicals Ltd.

7.10.1. Quick Facts

7.10.2. Company Overview

7.10.3. Product Portfolio

7.10.4. Business Strategies

7.11. Hexcel Corp.

7.11.1. Quick Facts

7.11.2. Company Overview

7.11.3. Product Portfolio

7.11.4. Business Strategies

7.12. INEOS AG

7.12.1. Quick Facts

7.12.2. Company Overview

7.12.3. Product Portfolio

7.12.4. Business Strategies

7.13. Indian Oil Corporation Limited (IOCL)

7.13.1. Quick Facts

7.13.2. Company Overview

7.13.3. Product Portfolio

7.13.4. Business Strategies

7.14. Jindal Films Groups

7.14.1. Quick Facts

7.14.2. Company Overview

7.14.3. Product Portfolio

7.14.4. Business Strategies

7.15. Kingfa Science & Technology (India) Ltd.

7.15.1. Quick Facts

7.15.2. Company Overview

7.15.3. Product Portfolio

7.15.4. Business Strategies

7.16. LG Chem, Ltd.

7.16.1. Quick Facts

7.16.2. Company Overview

7.16.3. Product Portfolio

7.16.4. Business Strategies

7.17. Lanxess AG

7.17.1. Quick Facts

7.17.2. Company Overview

7.17.3. Product Portfolio

7.17.4. Business Strategies

7.18. Lotte Chemical Corp.

7.18.1. Quick Facts

7.18.2. Company Overview

7.18.3. Product Portfolio

7.18.4. Business Strategies

7.19. Mitsubishi Corporation Plastics Ltd.

7.19.1. Quick Facts

7.19.2. Company Overview

7.19.3. Product Portfolio

7.19.4. Business Strategies

7.20. Polyplastics Group

7.20.1. Quick Facts

7.20.2. Company Overview

7.20.3. Product Portfolio

7.20.4. Business Strategies

7.21. Reliance Industries Ltd.

7.21.1. Quick Facts

7.21.2. Company Overview

7.21.3. Product Portfolio

7.21.4. Business Strategies

7.22. Saudi Basic Industries Corp.

7.22.1. Quick Facts

7.22.2. Company Overview

7.22.3. Product Portfolio

7.22.4. Business Strategies

7.23. Shin-Etsu Chemical Co., Ltd.

7.23.1. Quick Facts

7.23.2. Company Overview

7.23.3. Product Portfolio

7.23.4. Business Strategies

7.24. Sumitomo Chemical Co., Ltd.

7.24.1. Quick Facts

7.24.2. Company Overview

7.24.3. Product Portfolio

7.24.4. Business Strategies

7.25. The Dow Chemical Co.

7.25.1. Quick Facts

7.25.2. Company Overview

7.25.3. Product Portfolio

7.25.4. Business Strategies

1. India Plastics Market Research and Analysis By Type, 2024-2035 ($ Million)

2. India Thermoplastics Plastics Market Research and Analysis, 2024-2035 ($ Million)

3. India Polyethylene (PE) Plastics Market Research and Analysis, 2024-2035 ($ Million)

4. India Polypropylene (PP) Plastics Market Research and Analysis, 2024-2035 ($ Million)

5. India Polystyrene (PS) Plastics Market Research and Analysis, 2024-2035 ($ Million)

6. India Polyvinylchloride (PVC) Plastics Market Research and Analysis, 2024-2035 ($ Million)

7. India Other Thermoplastics Plastics Market Research and Analysis, 2024-2035 ($ Million)

8. India Thermosets Plastics Market Research and Analysis, 2024-2035 ($ Million)

9. India Polyurethane (PUR) Plastics Market Research and Analysis, 2024-2035 ($ Million)

10. India Epoxy Resins Plastics Market Research and Analysis, 2024-2035 ($ Million)

11. India Phenolic Resins Plastics Market Research and Analysis, 2024-2035 ($ Million)

12. India Acrylic Resins Plastics Market Research and Analysis, 2024-2035 ($ Million)

13. India Other Thermosets Plastics Market Research and Analysis, 2024-2035 ($ Million)

14. India Plastics Market Research and Analysis By Application, 2024-2035 ($ Million)

15. India Plastics In Packaging Market Research and Analysis, 2024-2035 ($ Million)

16. India Plastics In Building & Construction Market Research and Analysis, 2024-2035 ($ Million)

17. India Plastics In Automotive Market Research and Analysis, 2024-2035 ($ Million)

18. India Plastics In Electrical & Electronics Market Research and Analysis, 2024-2035 ($ Million)

19. India Plastics In Household, Leisure & Sports Market Research and Analysis, 2024-2035 ($ Million)

20. India Plastics In Agriculture Market Research and Analysis, 2024-2035 ($ Million)

21. India Plastics In Other Application Market Research and Analysis, 2024-2035 ($ Million)

1. India Plastics Market Share By Type, 2024 Vs 2035 (%)

2. India Thermoplastics Plastics Market Share, 2024 Vs 2035 (%)

3. India Polyethylene (PE) Plastics Market Share, 2024 Vs 2035 (%)

4. India Polypropylene (PP) Plastics Market Share, 2024 Vs 2035 (%)

5. India Polystyrene (PS) Plastics Market Share, 2024 Vs 2035 (%)

6. India Polyvinylchloride (PVC) Plastics Market Share, 2024 Vs 2035 (%)

7. India Polyethylene Terephthalate (PET) Plastics Market Share, 2024 Vs 2035 (%)

8. India Thermosets Plastics Market Share, 2024 Vs 2035 (%)

9. India Polyurethane (PUR) Plastics Market Share, 2024 Vs 2035 (%)

10. India Epoxy Resins Plastics Market Share, 2024 Vs 2035 (%)

11. India Phenolic Resins Plastics Market Share, 2024 Vs 2035 (%)

12. India Acrylic Resins Plastics Market Share, 2024 Vs 2035 (%)

13. India Other Thermosets Plastics Market Share, 2024 Vs 2035 (%)

14. India Plastics Market Share By Application, 2024 Vs 2035 (%)

15. India Plastics In Packaging Market Share, 2024 Vs 2035 (%)

16. India Plastics In Building & Construction Market Share, 2024 Vs 2035 (%)

17. India Plastics In Automotive Market Share, 2024 Vs 2035 (%)

18. India Plastics In Electrical & Electronics Market Share, 2024 Vs 2035 (%)

19. India Plastics In Household, Leisure & Sports Market Share, 2024 Vs 2035 (%)

20. India Plastics In Agriculture Market Share, 2024 Vs 2035 (%)

21. India Plastics In Other Application Market Share, 2024 Vs 2035 (%)

FAQS

The size of the India Plastics market in 2024 is estimated to be around $38,045 million.

Leading players in the India Plastics market include GAIL (India) Ltd., Reliance Industries Ltd., Indian Oil Corporation Limited (IOCL), and Haldia Petrochemicals Ltd., among others.

India Plastics market is expected to grow at a CAGR of 6.5% from 2025 to 2035.

The growth of the India plastics market is driven by rapid urbanization, expanding packaging and automotive industries, and increasing demand for lightweight and durable materials.