Indian DiCalcium Phosphate market

Indian Dicalcium Phosphate Market Size, Share & Trends Analysis Report by Application (Poultry Feed, Cattle Feed, Swine Feed, Aquaculture, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The Indian dicalcium phosphate market is predicted to grow considerably at a CAGR of 15.2% during the forecast period. Inorganic phosphate is considered an essential nutrient in the animal feed industry. The most commonly used phosphate supplements include calcium phosphates that supply important minerals for the development of strong bones and teeth in pets, poultry, and other livestock animals. Calcium phosphates for animal feed comprise monocalcium phosphate (MCP), dicalcium phosphate (DCP), and tricalcium phosphate (TCP). Dicalcium phosphate (DCP) is a feed additive for animals that were synthesized from phosphate rock under the optimum condition of pH, the temperature of the reaction mixture, time of reaction, and acid concentration. It is in the form of white crystal powder or granular form, odorless and tasteless.

The major factor contributing to the growth of the Indian dicalcium phosphate market is the increasing growth of the poultry industry in India. There are various favorable government policies and regulations promoting the growth of the poultry industry in India. The government facilitated loans for farmers and individuals who are interested in animal husbandry and livestock businesses. Decades ago, banks were giving loans for establishing farms for eggs, poultry meat, and broiler production through small farms. As per the NABARD (National Bank for Agriculture and Rural Development) guidelines, the various allied scheme includes Poultry Venture Capital Fund Scheme. The poultry venture capital fund plan is a joint initiative between NABARD and the Ministry of Micro, Small, and Medium Enterprises to encourage poultry farming. The plan aims to boost the poultry sector by creating jobs and business opportunities in underserved communities. Further, the scheme aims at encouraging poultry farming, particularly in non-traditional states, and creates jobs in underserved areas, improving the production of chicken goods with a ready market throughout the country, improving the productivity of non-scientifically run operations by upgrading technology, providing quality meat to consumers in hygienic conditions, and improves hygienic sale of poultry meat and products in urban areas and neighborhood societies through poultry dressing and marketing outlets, improving productivity and promoting the rearing of other poultry species with high potentials, such as quails, ducks, and turkeys.

Impact of COVID-19 Pandemic on Indian Dicalcium Phosphate Market

The spread of COVID-19 has had an impact on manufacturing and building activity all over the world. For producers, logistical constraints and rethinking raw material requirements are becoming a concern. To rationalize production, the producers have relied on derived demand as an intermediary commodity. This is mostly due to the early COVID-19 lockdown in China, which is the world's biggest chemical production hub, having a substantial influence on chemical supply chains. The majority of the country's projects have come to a halt affecting the Indian dicalcium phosphate market. Supply and development are halted, resulting in losses for suppliers, dealers, and customers alike.

Segmental Outlook

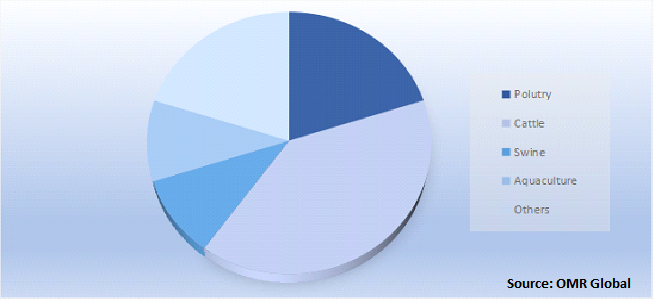

Indian dicalcium phosphate (feed grade) market is segmented based on livestock, which is classified into poultry feed, cattle feed, swine feed, aquaculture, and others (ruminants and pets). The cattle feed market is the potential market and is expected to create significant demand for the DCP supplements market. There are some pivotal factors involved in the growth of the cattle feed market which include rising adoption of foreign breeds, rise in meat consumption, increasing disposable income, and government support.

Indian Dicalcium Phosphate Equipment Market Share by Application, 2021 (%)

The Cattle Sub-Segment is Anticipated to Hold a Prominent Share in the Indian Dicalcium Phosphate Market

The cattle segment of the market is anticipated to hold a prominent share in the dicalcium phosphate market. According to the livestock census 2019, the number of cows in the country has increased by 18% in the last seven years, while the number of oxen has decreased by 30%. The total Bovine population (Cattle, Buffalo, Mithun, and Yak) is 302.79 million in 2019 which shows an increase of 1.0% over the previous census. The total number of cattle in the country is 192.49 million in 2019 showing an increase of 0.8 % over the previous Census. The female cattle (cows’ population) are 145.12 million, increased by 18.0% over the previous census (2012). The states in India with the maximum cattle population include West Bengal, Uttar Pradesh, and Madhya Pradesh, which contribute more than 35% of India’s total livestock population.

Market Players Outlook

The key players in the Indian dicalcium phosphate market include Koninklijke DSM N.V., Antera Agro Chem., and Bamni Proteins Ltd. among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, geographical expansion, and collaborations to stay competitive in the market.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Key companies operating in the Indian dicalcium phosphate market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Indian Dicalcium Phosphate Industry

- Recovery Scenario of Indian Dicalcium Phosphate Industry

- 1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1. Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on key players

4. Market Segmentation

4.1.Indian Dicalcium Phosphate Market by Application

4.1.1.Poultry Feed

4.1.2.Cattle Feed

4.1.3.Swine Feed

4.1.4.Aquaculture

4.1.5.Others

5.Company Profiles

5.1.Aarti Industries Pvt. Ltd.

5.2.Antera Agro Chem

5.3.Bamni Proteins Ltd.

5.4.Dhan Lakshmi Phosphates

5.5.Hindustan phosphates Pvt. Ltd.

5.6.Koninklijke DSM N.V

5.7.K.P.R. Agrochem Ltd.

5.8.M/S Vatjat Pharma Foods Pvt. Ltd.

5.9.Mitushi Biopharma

5.10.Pioneer Jellice India Pvt Ltd.

5.11.Ratnadeep Chemicals Supplier

5.12.Shree Vissnu Scientific Co.

5.13Vishnu Priya Chemicals Pvt. Ltd.

1.INDIAN DICALCIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

2.INDIAN DICALCIUM PHOSPHATE FOR POULTRY FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

3.INDIAN DICALCIUM PHOSPHATE FOR CATTLE FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

4.INDIAN DICALCIUM PHOSPHATE FOR SWINE FEED MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5.INDIAN DICALCIUM PHOSPHATE FOR AQUACULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6.INDIAN DICALCIUM PHOSPHATE FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON INDIAN DICALCIUM PHOSPHATE MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON INDIAN DICALCIUM PHOSPHATE MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF INDIAN DICALCIUM PHOSPHATE MARKET, 2021-2028 (%)

4. INDIAN DICALCIUM PHOSPHATE MARKET SHARE BY APPLICATION, 2021-2028 (%)