Indian Pharmaceutical Contract Manufacturing Market

Indian Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis Report by Category (Human Based Drugs, and Animals Based Drugs) by Type ( Sterile Manufacturing, Non-Sterile Manufacturing) by Product (Over-The-Counter (Otc) Drugs, Active Pharmaceutical Ingredients (Api), Finished Dosage Formulation (Solid Dose, Liquid Dose and Injectable Dose), Others (Nutritional Products and Packaging) by Services(Manufacturing Services, Non-Clinical Services Such as Supply Chain Management, and Research and Development) Forecast 2022-2028 Update Available - Forecast 2025-2035

The Indian pharmaceutical contract manufacturing market is anticipated to grow at a considerable CAGR of around 13.3% during the forecast period. Pharmaceutical companies have increasingly outsourced non-core activities intending to cut costs and focus on their capital management and management of research and marketing & sales. Many pharmaceutical companies have provided funding to Indian pharmaceutical contract manufacturers for manufacturing various drugs and active pharmaceutical ingredients (API). For instance, in May 2021, the global private equity (PE) investors are invested in Indian active pharmaceutical ingredients (API) firms for vaccine-related manufacturing, bulk pharmaceutical chemicals, and generic or bulk chemicals. API companies include Divis Laboratories, Laurus Labs, Granules India, Aarti Drugs, and Solara Active Pharma. Generic companies include Sun Pharmaceuticals, Aurobindo Pharma, Dr. Reddy’s Laboratories, Cipla, and Lupin. Moreover, according to the Indian Brand Equity Foundation (IBEF), the Indian Pharmaceutical sector is estimated to account for nearly 3.1 to 3.6% of the global pharmaceutical industry in terms of value and 10% in terms of volume. It reached $55 billion in 2020 and is expected to reach $100 billion by 2025.

Major factors contributing to the growth of the Indian pharmaceutical contract manufacturing market include increasing investments in the Indian pharmaceutical sector and government initiatives to promote the pharmaceutical sector and an increasing trend of outsourcing of healthcare services. The Indian Government has plans to incentivize bulk drug manufacturers, including both state-run and private companies, to encourage the ‘Make in India’ program and reduce dependence on imports of API, nearly 85% of which come from China. In addition, increasing pressure to minimize healthcare costs and the availability of a skilled workforce for low cost is another significant factor contributing to the market growth. However, stringent government regulations hinder market growth. Moreover, rising demand for low-cost services and increasing drug discovery are expected to create enormous opportunities for the Indian pharmaceuticals contract manufacturing market in near future.

Impact of COVID-19 Pandemic on Indian Pharmaceutical Contract Manufacturing Market

The age of the COVID-19 pandemic has a steady effect the healthcare sector. The pharmaceutical industry plays a very important role to produce quality healthcare services, especially during COVID-19 pandemics, when the medicines supply chain can be overwhelmed due to various reasons. India imports about 70-75% of APIs and key starting raw materials from China, the world’s leading producer and exporter of APIs by volume, for meeting the bulk requirements. Due to supply chain disruption, the cost has surged by 40-50% in India for medicines such as paracetamol, penicillin, and anti-asthma drugs, according to the report published by the University of New Mexico in January 2022.

In view of the COVID-19 pandemic situation, the Government of India takes important steps for removing the technical and financial barriers, which will spur the pharmaceutical industry to ramp up API production-thereby, reducing the dependency of the pharmaceutical industry with China.

Segmental Outlook

The Indian pharmaceutical contract manufacturing market can be segmented on the basis of category, type, product, and services. On the basis of category, the market is divided as human-based drugs and animals-based drugs. Based on type, the market is segmented into sterile manufacturing and non-sterile manufacturing. Based on the product, the market is bifurcated into OTC drugs, API, finished dosage forms include solid dose, liquid dose and injectable dose, and others such as nutritional products and packaging. Based on the services, the market is sub-divided as manufacturing services, non-clinical services and research and development. Among services, manufacturing segment is expected to be the highest revenue generating segment owing to growing medical device manufacturing. The growth of medical device manufacturing in emerging economies is expected to boost the manufacturing services segment.

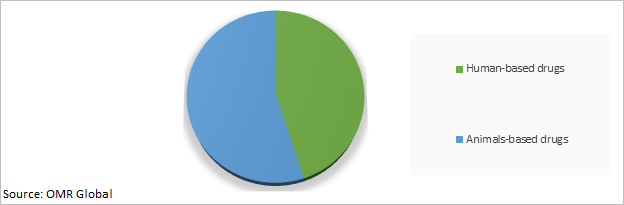

Indian Pharmaceutical Contract Manufacturing Market Share by Category, 2021 (%)

The Animals-Based drugs is expected to account for the Largest Share in the Indian Pharmaceutical Contract Manufacturing Market

The segment is mainly driven by the increasing investment in animal healthcare practices as the dairy sector is fully dependent on animals, and the approval of new products and vaccines related to the treatment of animal disorders is expected to fuel the growth of the segment over the forecast period. for instance, according to the Ministry of Fisheries, Animal, and Husbandry & Dairying, the Indian government has launched a scheme National Animal Disease Control Programme for FMD and Brucellosis with a financial outlay of $13.34 million for five years (2019-20 to 2023-24) by vaccinating 100% cattle, buffalo, sheep, goat and pig population for FMD and 100% bovine female calves of 4-8 months of age for brucellosis. Moreover, the Indian Federation of Animal Health Companies (INFAH), is an organization that works extensively to create awareness regarding disease control and effective treatment of animals. Owing to various initiatives of the government for treating animal health, and rising awareness associated with animal disease control, fueled the growth of the segment.

Market Players Outlook

The major companies serving the Indian pharmaceutical contract manufacturing market are Dishman Group, Dr Reddy’s Laboratories Ltd., Gracure Pharmaceuticals Ltd., Jubilant Pharmova Ltd., Piramal Group, Divis Laboratories Ltd., Dupen Laboratories, Finecure Pharmaceuticals Ltd., Green Cross Remedies, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Carlyle and Viyash Life Sciences Pvt ltd announced a partnership to establish an integrated generic pharmaceutical platform in India. With this acquisition, Viyash served API in both regulated and semi-regulated markets.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Key companies operating in the Indian pharmaceutical contract manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Indian Pharmaceutical Contract Manufacturing Market

• Recovery Scenario of Indian Pharmaceutical Contract Manufacturing Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key CompanyAnalysis

3.1.1. Dishman Group

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Dr Reddy’s Laboratories Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Gracure Pharmaceuticals Ltd.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Jubilant Pharmova Ltd.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Piramal Group

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Indian Pharmaceutical Contract Manufacturing Market by Category

4.1.1. Human Based Drugs

4.1.2. Animals Based Drugs

4.2. Indian Pharmaceutical Contract Manufacturing Market by Type

4.2.1. Sterile Manufacturing

4.2.2. Non-Sterile Manufacturing

4.3. Indian Pharmaceutical Contract Manufacturing Market by Product

4.3.1. Over-the-Counter (Otc) Drugs

4.3.2. Active Pharmaceutical Ingredients (Api)

4.3.3. Finished Dosage Formulation (Solid Dose, Liquid Dose and Injectable Dose)

4.3.4. Others (Nutritional Products And Packaging)

4.4. Indian Pharmaceutical Contract Manufacturing by Services

4.4.1. Manufacturing Services

4.4.2. Non-Clinical Services such as Supply Chain Management

4.4.3. Research and Development

5. Company Profiles

5.1. Agrata Biotech Ltd.

5.2. Ankur Drugs and Pharma Ltd.

5.3. Aurobindo Pharma

5.4. BDR Pharmaceuticals Internationals Pvt. Ltd.

5.5. Ceegolabs Pvt Ltd.

5.6. Ciron Drugs & Pharmaceuticals Pvt. Ltd.

5.7. Contract Pharmaceuticals Ltd.

5.8. Cosway Biosciences

5.9. Cubic Lifesciences Pvt Ltd.

5.10. Daffohils Laboratories Pvt Ltd.

5.11. Divis Laboratories Ltd.

5.12. Dupen Laboratories

5.13. Finecure Pharmaceuticals Ltd.

5.14. Green Cross Remedies

5.15. Hiral Labs Ltd.

5.16. Korten Pharmaceuticals Pvt. Ltd.

5.17. Kosher Pharmaceutical Pvt. Ltd.

5.18. Kremoint Pharma Pvt. Ltd.

5.19. Logos Pharma

5.20. Maxchem Pharmaceuticals Pvt Ltd.

5.21. Maxnova Healthcare

5.22. Medipaams India Pvt. Ltd.

5.23. Medisys Biotech Private Ltd.

5.24. Nikol Formulation Pvt. Ltd.

5.25. Nutragen Pharma Pvt Ltd.

5.26. Nvron Life Science Ltd.

5.27. Orlife Healthcare

5.28. Pharma Contract Manufacturing

5.29. Pharmasynth Formulations Ltd.

5.30. Radico Remedies

5.31. Renown Pharmaceuticals Pvt Ltd.

5.32. Sain Medicaments Pvt. Ltd

5.33. Sakar Healthcare Pvt. Ltd.

5.34. Sava Healthcare Ltd.

5.35. Sigma Softgel & Formulation

5.36. Smith&Kenner Pharmaceuticals Pvt Ltd.

5.37. Swiss Biotech Association

5.38. Synokem Pharmaceuticals Ltd.

5.39. Tuttsan Pharma Pvt. Ltd.

5.40. Vibcare Pharma Pvt. Ltd.

5.41. Vital Therapeutics & Formulations Pvt. Ltd.

5.42. Wellona Pharm

5.43. Yash Pharma Laboratories Pvt. Ltd.

1. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2021-2028($ MILLION)

2. INDIAN HUMAN BASED DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

3. INDIAN ANIMALS BASED DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

4. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028($ MILLION)

5. INDIAN STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

6. INDIAN NON-STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

7. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028($ MILLION)

8. INDIAN OTC DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

9. INDIAN API MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

10. INDIAN FINISHED DOSAGE FORMULATION MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

11. INDIAN OTHERS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

12. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2021-2028($ MILLION)

13. INDIAN MANUFACTURING SERVICES MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

14. INDIAN NON-CLINICAL SERVICES MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

15. INDIAN RESEARCH AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

1. IMPACT OF COVID-19 ON INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2021-2028 (%)

4. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY CATEGORY, 2021 VS 2028 (%)

5. INDIAN HUMAN BASED DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. INDIAN ANIMALS BASED DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY TYPE, 2021 VS 2028 (%)

8. INDIAN STERILE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. INDIAN NON-STERILE MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

11. INDIAN OTC DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. INDIAN API MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. INDIAN FINISHED DOSAGE FORMULATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. INDIAN OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. INDIAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY SERVICES, 2021 VS 2028 (%)

16. INDIAN MANUFACTURING SERVICESMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. INDIAN NON-CLINICAL SERVICESMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. INDIAN RESEARCH AND DEVELOPMENTMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)