Industrial Communication Market

Global Industrial Communication Market Size, Share & Trends Analysis Report, by Component (Hardware and Software and Services) by Communication Protocol (Fieldbus, Industrial Ethernet, and Wireless), by End-User (Automotive and Transportation, Oil & Gas, Food & Beverage, Water & Wastewater, and Others) and Forecast 2019-2025

The global industrial communication market is estimated to grow at a CAGR of around 10% during the forecast period. Industrial communication referred to as communication within an industry. To make the whole process smooth, industries are using industrial communication to transmit their data between different systems within the industry and it integrates different data networks. In short, industry communication is used in control systems to pass data between field devices and programmable logic controllers (PLCs), between different PLCs and personal computers used for operator interface, data processing & storage, or management information. With the introduction of industrial communication concepts in industrial application scenarios, industrial automation is undergoing a tremendous change.

To connect sensors, machines, and IT systems in a single enterprise an industrial communication are required. The rising adoption rate of IoT by various industries has generated the need for establishing a link between different devices and exchange data in a safe, secure, and efficient manner. In the era of the fourth industrial revolution industrial communication made it possible to gather and analyze data across machines in a flexible, faster, and efficient way to produce higher-quality products at reduced costs. This automation would increase the productivity of the manufacturing process and promote industrial communication market growth.

The rising rate of cyber security threats is restraining the growth of the global industrial communication market. Data breaching, virus attacks, and hacking are now major concerns for any industry. Malicious viruses can tamper any vital information from an industrial communication system. For these threats, many industries are still choosing the traditional manual communication method over the new automated industrial communication system. Besides this, the complexity of standardization of the equipment and the devices required to install the industrial communication system is also restraining the market growth.

There is no standardization of devices in this market. For instance, many vendors offer hardware systems required for industrial wireless sensor networks (IWSN), however, the end-user often need to deploy software from other vendors. The rising demand for wireless industrial communication networks is an opportunity for the growth of the global industrial communication market. Wireless technologies, such as WLAN, Wireless HART, Bluetooth smart, and ZigBee is opening up new growth opportunities for the industrial communication market.

Market Segmentation

The global industrial communication market is segmented based on the component, communication protocol, and end-user. Based on the component, the market is segmented into hardware and software and services. Based on the communication protocol, the market is segmented into Fieldbus, industrial ethernet, and wireless. Based on the end-user, the market is segmented into automotive and transportation, oil & gas, food & beverage, water & wastewater, and others.

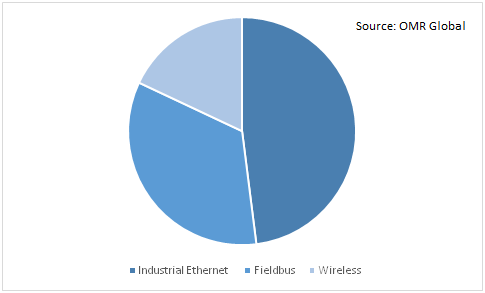

Industrial Ethernet held a significant share in the communication protocol segment

Industrial communication mostly works with the ethernet communication protocol system. It is mostly used in the office environment as it offers higher speed, increased connection distance, and the ability to connect more nodes. Technological innovation in the Ethernet communication protocol is one of the major driving factors that is propelling the growth of the global industrial communication market. For instance, in May 2018, Siemens AG launched Industrial Ethernet switches with special functions for the process industry. The firmware functions (Profinet S2 device, H-Sync, and configuration in Run/CiR/H-CiR) in interaction with the Simatic PCS 7 process control system make the new products suitable for the flexible, reliable, and high-performance networking of process automation devices.

Global Industrial Communication Market Share by Communication Protocol, 2018 (%)

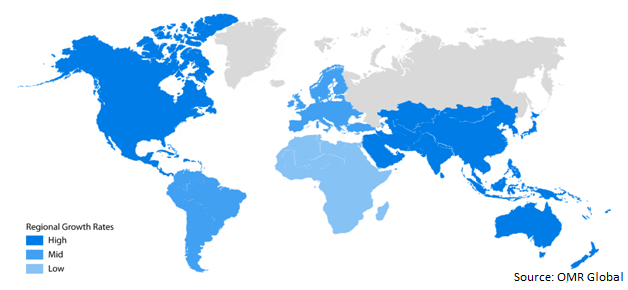

Regional Outlook

Geographically, the global industrial communication market is segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. North America is estimated to have a major contribution in the market in terms of share due to acceleration inthe growing manufacturing sector, food & beverage, and water & wastewater industry in this region. Further, technological advancements, an increase in demand for the industrial communication system and the attempt taken in the research and development of the industrial communication market and the existence of key players are propelling the global industrial communication market. Besides this, the Asia-Pacific region is the fastest-growing region in the market. Growing manufacturing sectors from China, Japan, and India are contributing to the growth of the industrial communication market. China is the global manufacturing hub for semiconductor and automotive manufacturers, where the industrial communication system is extensively used. Rapidly growing automotive industry in China and Japan is likely to create growth opportunities for the market players in this country.

Global Industrial Communication Market Growth,by Region 2019-2025

Competitive Landscape

The major players that are providing industrial communication systems include Sick AG, OMRON Corp., Schneider ElectricSE, Belden, Inc., Moxa Inc., Siemens AG, Rockwell Automation, Inc., ABB Ltd., GE Grid Solutions, LLC, Cisco Systems, Inc., and others.Range of industrial communication systems provided by these key players including fiber sensor, photoelectric sensor, displacement sensor, level switch, basic switch, safety laser scanner, terminal relay, and others. These players adopt various strategies in order to compete in the global market. For instance, in December 2019, OMRON Corp. introduced MOS FET Relay Module G3VM-21MT with the solid-state relay in "T-type Circuit Structure". It contributes to reducing the maintenance frequency of test equipment and improving the productivity of electronic components.

In January 2018, OMRON Corporation introduced a new communication system with artificial intelligence, robotics automation, and sensor control at the 2018 Consumer Electronic Show (CES).

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global industrial communication market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB, Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. OMRONCorp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Schneider Electric SE

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Bosch Rexroth AG (Unit of Robert Bosch GmbH)

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Industrial Communication Market by Component

5.1.1. Hardware

5.1.2. Software and Services

5.2. Global Industrial Communication Market by Communication Protocol

5.2.1. Fieldbus

5.2.2. Industrial Ethernet

5.2.3. Wireless

5.3. Global Industrial Communication Market byEnd-User

5.3.1. Automotive and Transportation

5.3.2. Oil & Gas

5.3.3. Food & Beverage

5.3.4. Water & Wastewater

5.3.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aaeon Technology. Inc.

7.2. ABB, Ltd.

7.3. Aclara Technologies LLC

7.4. Advantech Co., Ltd.

7.5. Belden Inc.

7.6. Bosch Rexroth AG (Unit of Robert Bosch GmbH)

7.7. Cisco Systems, Inc.

7.8. GE Grid Solutions, LLC

7.9. HMS Industrial Networks

7.10. HoneywellInternational, Inc.

7.11. IFM Electronic GmbH

7.12. Mitsubishi Electric Corp.

7.13. Moxa, Inc.

7.14. OMRON Corp.

7.15. Rockwell Automation, Inc.

7.16. Schneider Electric SE

7.17. Sick AG

7.18. Siemens AG

7.19. Telefonaktiebolaget LM Ericsson

7.20. Turck, Inc.

1. GLOBAL INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

2. GLOBAL INDUSTRIAL COMMUNICATION HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INDUSTRIAL COMMUNICATION SOFTWARE AND SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMMUNICATION PROTOCOL, 2018-2025 ($ MILLION)

5. GLOBAL FIELDBUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INDUSTRIAL ETHERNET MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL WIRELESS COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

9. GLOBAL INDUSTRIAL COMMUNICATION FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL INDUSTRIAL COMMUNICATION FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL INDUSTRIAL COMMUNICATION FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL INDUSTRIAL COMMUNICATION FOR OTHER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

17. NORTH AMERICAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMMUNICATION PROTOCOL, 2018-2025 ($ MILLION)

18. NORTH AMERICAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. EUROPEAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

21. EUROPEAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMMUNICATION PROTOCOL, 2018-2025 ($ MILLION)

22. EUROPEAN INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMMUNICATION PROTOCOL, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

27. REST OF THE WORLD INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

28. REST OF THE WORLD INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2018-2025 ($ MILLION)

29. REST OF THE WORLD INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY COMMUNICATION PROTOCOL, 2018-2025 ($ MILLION)

30. REST OF THE WORLD INDUSTRIAL COMMUNICATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL INDUSTRIAL COMMUNICATION MARKET SHARE BY COMPONENT, 2018 VS 2025 (%)

2. GLOBAL INDUSTRIAL COMMUNICATION MARKET SHARE BY COMMUNICATION PROTOCOL, 2018 VS 2025 (%)

3. GLOBAL INDUSTRIAL COMMUNICATION MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL INDUSTRIAL COMMUNICATION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

7. UK INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD INDUSTRIAL COMMUNICATION MARKET SIZE, 2018-2025 ($ MILLION)