Infectious Disease Drug Market

Global Infectious Disease Drug Market Size, Share & Trends Analysis Report by Disease Type (Bacterial Disease, Viral Disease, Fungal Disease, and Parasitic Disease), By Treatment Type (Antibacterial, Antiparasitic, Antiviral, Antifungal, and Others), and Forecast 2019-2025

The global infectious disease drug market is estimated to grow at a CAGR of over 4% during the forecast period. Infectious diseases are those which are caused by different organisms such as bacteria, virus, fungi, and parasites. Some of the majorly occurring diseases that create scope for the market include Hepatitis, Pneumonia, Malaria, HIV/AIDS, Tuberculosis, E. Coli, Dengue, Influenza, Measles, and Typhoid, among others such as COVID–19, Zica, and Ebola. Influenza is a viral infection that is transmitted easily from person to person. This virus circulates globally and has the potential to infect the person of any age group. According to the Centers for Disease Control and Prevention in the US, there were 7,000 confirmed cases of the flu in 2017.

HIV/AIDS is one of the most chronic diseases that result in a huge number of mortalities globally. The major reason behind this is inadequate access to HIV prevention care and treatment services. However, there is a rapid decline in new HIV infections among children (around 66% since 2000), attributed to the scale-up efforts for the prevention of mother-to-child transmission. In addition, Ebola virus disease (EVD) is another infectious disease that in recent years has become a great threat to humans globally. The 2014 Ebola epidemic in West Africa caused several mortalities and attracted global attention. Thus, the increased prevalence of such severe diseases is expected to create scope for the global infectious disease drug market during the forecast period.

Moreover, there are various diseases that are controlled by vaccinations such as measles and chickenpox. Thus, taking precautions including proper medication, sanitization, maintaining a clean environment, and preventive measures such as regular handwashing also helps to protect individuals from most infectious diseases, which may affect the growth of the market. Despite this, the shift towards personalized medicines is projected to provide ample opportunities for market growth in the near future.

Segmental Outlook

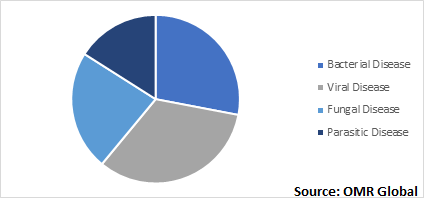

The global infectious diseases drug market is segmented on the basis of disease type and treatment type. Based on the disease type, the market is segmented into bacterial disease, viral disease, fungal disease, and parasitic disease. Based on the treatment type, the market is segmented into antibacterial, antiparasitic, antiviral, antifungal, and others.

Global Infectious Disease Drug Market, by Disease Type 2018 (%)

Disease Type Insights: Viral Disease Segment to Witness Significant Growth

Among the disease type, the viral disease segment is projected to witness significant growth in the market. The segmental growth is attributed to the increased prevalence of viral diseases such as HIV. According to the UNAIDS, there were around 37.9 million people affected with HIV in 2018, among which, 1.7 million people were newly infected with HIV. In 2018, around 79% of people knew their HIV and the remaining 21% still need access to HIV testing services. Such prevalence of HIV among the peoples is expected to provide scope for the market to grow in the near future.

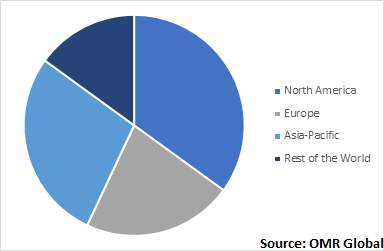

Regional Outlook

The global infectious disease drug market is geographically segmented as North America, Europe, Asia-Pacific and Rest of the World. The North American region is estimated to hold the most significant share in the global infectious disease drug market. This is attributed to the footprints of the major players in the market. Bristol-Myers Squibb Co., Eli Lilly & Co., Gilead Sciences Inc., Johnson & Johnson Co., Merck & Co. Inc., and Pfizer Inc. are some of the key players operating in the region. Further, enhanced healthcare infrastructure is driving the growth of the infectious disease drug market in the region during the forecast period.

According to the Centre for Disease Control and Prevention in the US, there were 7,000 confirmed cases of the flu in 2017, thus the increased cases of flu in the region demand the treatment, which in turn enhances the growth of the market. In addition, increased prevalence of infectious diseases and easy accessibility to technologically advanced instruments along with the presence of a large number of leading national clinical laboratories is the market driving aspects in the region. In addition, Asia-Pacific is projected to exhibit significant growth owing to the increased awareness among the peoples, especially in the emerging countries including India and China.

Global Infectious Disease Drug Market, by Region 2018 (%)

Market player Outlook

Some of the prominent players operating in the global infectious disease drug market include Amgen Inc., Boehringer Ingelheim GmbH, Bristol-Myers Squibb Co., Eli Lilly & Co., F. Hoffmann-La Roche Ltd., Gilead Sciences Inc., GlaxoSmithKline PLC, Johnson & Johnson Co., Merck & Co. Inc., Novartis AG, Pfizer Inc., and Sanofi SA, among others. These players are providing various drugs for various infectious diseases in the market. These manufacturers are adopting various strategies such as new product launches and approvals, merger and acquisition, partnerships and collaborations, and many others in order to thrive in a competitive environment. For instance, in June 2018, Gilead Sciences Inc. and Hookipa partnered and signed a licensing agreement for the development of immunotherapies against HIV and Hepatitis B. Through this agreement both the companies would together manufacture arenavirus-based vectors for clinical development by Gilead Sciences Inc.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global infectious disease drug market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. GlaxoSmithKline PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boehringer Ingelheim GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Eli Lilly & Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. F. Hoffmann-La Roche Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Merck & Co. Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Infectious Disease Drugs Market by Disease Type

5.1.1. Bacterial Disease

5.1.2. Viral Disease

5.1.3. Fungal Disease

5.1.4. Parasitic Disease

5.2. Global Infectious Disease Drugs Market by Treatment Type

5.2.1. Antibacterial

5.2.2. Antiparasitic

5.2.3. Antiviral

5.2.4. Antifungal

5.2.5. Others (Alternative Medicines)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie Inc.

7.2. Allergan Plc

7.3. Amgen Inc.

7.4. Bayer AG

7.5. BioCryst Pharmaceuticals, Inc.

7.6. Boehringer Ingelheim GmbH

7.7. Bristol-Myers Squibb Co.

7.8. Eli Lilly & Co.

7.9. F. Hoffmann-La Roche Ltd.

7.10. Gilead Sciences, Inc.

7.11. GlaxoSmithKline PLC

7.12. Johnson & Johnson Services, Inc.

7.13. Merck & Co. Inc.

7.14. Moderna Inc.

7.15. Novartis International AG

7.16. Novo Nordisk A/S

7.17. Pfizer Inc.

7.18. Sanofi SA

7.19. Takeda Pharmaceuticals Co. Ltd.

7.20. Teva Pharmaceuticals Industries Ltd.

1. GLOBAL INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BACTERIAL DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL VIRAL DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FUNGAL DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL PARASITIC DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY TREATMENT TYPE, 2018-2025 ($ MILLION)

7. GLOBAL ANTIBACTERIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ANTIPARASITIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ANTIVIRAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ANTIFUNGAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OTHER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY TREATMENT TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

18. EUROPEAN INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY TREATMENT TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY TREATMENT TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2018-2025 ($ MILLION)

23. REST OF THE WORLD INFECTIOUS DISEASE DRUGS MARKET RESEARCH AND ANALYSIS BY TREATMENT TYPE, 2018-2025 ($ MILLION)

1. GLOBAL INFECTIOUS DISEASE DRUGS MARKET SHARE BY DISEASE TYPE, 2018 VS 2025 (%)

2. GLOBAL INFECTIOUS DISEASE DRUGS MARKET SHARE BY TREATMENT TYPE, 2018 VS 2025 (%)

3. GLOBAL INFECTIOUS DISEASE DRUGS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD INFECTIOUS DISEASE DRUGS MARKET SIZE, 2018-2025 ($ MILLION)