Insecticides Market

Insecticides Market Size, Share & Trends Analysis Report by Product Type (Organophosphates, Pyrethroids, Methyl Carbamates, Neonicotinoids, and Other Insecticides) and by Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and vegetables, and Others) Forecast Period (2024-2031)

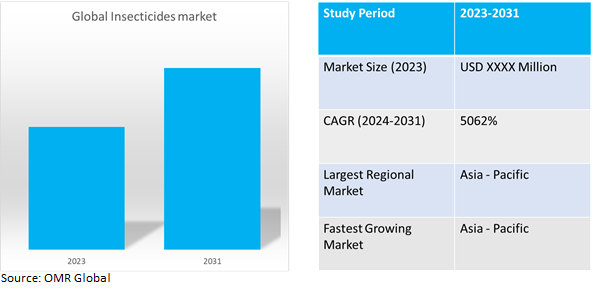

Insecticides market is anticipated to grow at a CAGR of 5.62% during the forecast period (2024-2031). Insecticides are chemical substances formulated to exterminate, repel, or regulate insect populations. They are utilized across agricultural, industrial, and domestic sectors to mitigate insect-related damage and ensure the efficacy of pest management strategies.

Market Dynamics

Feeding the World: How Rising Food Demand Fuels the Pesticide Market

The global pesticide market's growth is driven by the increasing demand for food, paralleling the rise in the world's population. According to the United Nations over the next three decades, the global population is projected to grow by approximately 2 billion individuals, rising from the current 8 billion to 9.7 billion by 2050 and potentially reaching a peak of nearly 10.4 billion around the mid-2080s. Farmers, frontline defenders in this battle, heavily rely on pesticides to safeguard crops from various threats. In a scenario of rampant pests like insects and diseases, crops suffer, yields drop, and food shortages loom. Pesticides serve as a shield, protecting crops and ensuring more reach maturity, bolstering the global food supply. This not only translates to more food available but also aids in meeting the demand surge driven by population growth.

VR Revolutionizes Driver Training: Redefining Realism and Broadening Horizons

The declining availability of agricultural land is a significant catalyst for the pesticide market's expansion. As the global population burgeons, the space for food cultivation shrinks, intensifying pressure on farmers to enhance yields. For instance, the estimated number of farms in the United States for 2023 stands at 1,894,950, reflecting a decline of 5,700 farms compared to 2022. Total land in farms, amounting to 878,560,000 acres, saw a decrease of 1,100,000 acres from the previous year. To counteract this challenge, minimizing crop losses becomes paramount. Pests such as insects and diseases pose a threat by decimating crops, leading to substantial yield reductions. Pesticides play a crucial role here, empowering farmers to safeguard their crops and ensure a larger portion survives until harvest. Picture a shrinking pie symbolizing available farmland; without effective pest control, a substantial portion of this pie would be lost. Pesticides enable farmers to salvage more of the pie, maximizing output on limited land. This proves vital for upholding food security amidst a growing population and diminishing land resources.

Market Segmentation

Our in-depth analysis of the global Insecticides market includes the following segments by and by application:

- Based on product type, the market is sub-segmented into organophosphates, pyrethroids, methyl carbamates, neonicotinoids, and other insecticides.

- Based on crop type the market is augmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and others.

The Rising Dominance of Neonicotinoids in the Insecticide Market

Neonicotinoids have witnessed a surge in demand owing to their extensive efficacy against pests, simple application methods, and prolonged effectiveness. Particularly favoured as seed treatments, they provide early-stage protection to crops from germination onwards, facilitating their widespread adoption across agricultural landscapes. According to the Center for Biological Diversity US, Neonicotinoids are widely used in the United States, especially on crops like corn and soybeans. They are the preferred insecticides for farmers due to their effectiveness, with most of the corn and a significant portion of soybeans treated with them. These attributes have positioned neonicotinoids as a prominent and swiftly expanding segment within the insecticide market. Their ease of use and consistent performance make them a preferred choice among farmers seeking comprehensive pest management solutions. The convenience and reliability offered by neonicotinoids continue to drive their popularity and market growth.

fruits and vegetables Insecticides Hold a Considerable Market Share

Among the crop types mentioned, fruits and vegetables often experience rapid growth in the insecticide market. This is because fruits and vegetables are highly susceptible to insect infestations and diseases, which can significantly affect their yield and quality. According to the Food and Agriculture Organization (FAO), the annual worldwide losses of vegetables attributed solely to insects are estimated to be around 15–20% during field production and approximately 18–20% during storage. Farmers often rely on insecticides to protect their fruit and vegetable crops from pests, thereby ensuring better harvests and higher profits. Additionally, the growing demand for fruits and vegetables, driven by factors such as population growth, changing dietary preferences, and increased awareness of health benefits, further contributes to the growth of the insecticide market in this segment.

Regional Outlook

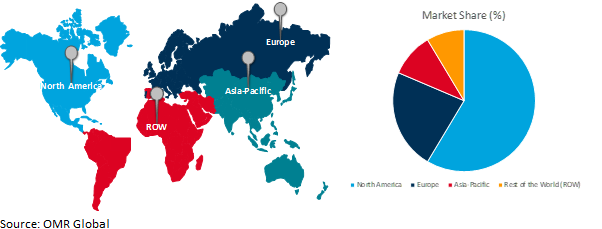

The global Insecticides market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Insecticides Market Growth by Region 2024-2031

Asia Pacific: Exploring the Surge in Demand and Growth of the Insecticide Market

Asia Pacific positions out as both the largest and fastest-growing market for insecticides. The region is home to some of the world's most populous countries, such as China and India, where agriculture plays a significant role in the economy. For instance, according to the National Bureau of Statistics of China, in 2022, the agricultural and related industries in China contributed $2.9 billion in added value, representing 16.24 % of the country's gross domestic product (GDP). This marked a 0.19 percentage point increase compared to the preceding year. The vast agricultural lands in these countries require extensive pest management measures, leading to a high demand for insecticides. Asia-Pacific countries cultivate a wide range of crops, including rice, wheat, corn, sugarcane, fruits, and vegetables. This diversity of crops creates a diverse pest population, necessitating various insecticides to combat them effectively. Moreover, Asia-Pacific countries cultivate a wide range of crops, including rice, wheat, corn, sugarcane, fruits, and vegetables. This diversity of crops creates a diverse pest population, necessitating various insecticides to combat them effectively.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Insecticides market include BASF SE, Bayer Crop Science Ltd, Rallis India Limited, Syngenta Crop Protection AG, and The Dow Chemical Company among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2023, Bayer CropScience and Crystal Crop Protection Limited launched Curbix Pro & Kollar (Insecticides), aiding Indian paddy growers against plant hoppers. The partnership aims to enhance crop protection practices, addressing the significant issue of pest attacks in paddy cultivation. The products feature dual active ingredients targeting plant hoppers, potentially reducing crop losses, and boosting yields.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Insecticides market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bayer Crop Science Ltd

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Rallis India Limited

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Syngenta Crop Protection AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Dow Chemical Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Insecticides by Product Type

4.1.1. Organophosphates

4.1.2. Pyrethroids

4.1.3. Methyl Carbamates

4.1.4. Neonicotinoids

4.1.5. Other Insecticides (Spinosyn insecticides, Diatomaceous earth, Biochemical insecticides, and Insect growth regulators (IGRs)

4.2. Global Insecticides by Crop Type

4.2.1. Cereals and Grains

4.2.2. Oilseeds & Pulses

4.2.3. Fruits & Vegetables

4.2.4. Others (Spices, Beverage crops, Fibers, Industrial crops)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

7. Adama Agricultural Solutions Ltd

8. American Vanguard Corporation

9. Bharat Rasayan Ltd

10. Dhanuka Agritech Ltd

11. FMC Corporation

12. Godrej Agrovet Ltd

13. IFFCO-MC Crop Science Pvt. Ltd.

14. Isagro SPA

15. Meghmani Organics Ltd.

16. Nufarm Limited

17. PI Industries Limited

18. Sumitomo Chemical Co. Ltd

19. UPL Limited

1. GLOBAL INSECTICIDES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE BY REGION, 2023-2031 ($ MILLION)

2. GLOBAL ORGANOPHOSPHATES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PYRETHROIDS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL METHYL CARBAMATES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL NEONICOTINOIDS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INSECTICIDES MARKET RESEARCH AND ANALYSIS BY CROP TYPE BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CEREALS AND GRAINS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL OILSEEDS & PULSES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL FRUITS & VEGETABLES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OTHER CROPS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL INSECTICIDES RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN INSECTICIDES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN INSECTICIDES RESEARCH AND ANALYSIS BY PRODUCT 2023-2031 ($ MILLION)

15. NORTH AMERICAN INSECTICIDES RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

16. EUROPEAN INSECTICIDES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN INSECTICIDES RESEARCH AND ANALYSIS BY PRODUCT 2023-2031 ($ MILLION)

18. EUROPEAN INSECTICIDES RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC INSECTICIDES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA- PACIFIC INSECTICIDES RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. ASIA- PACIFIC INSECTICIDES RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD INSECTICIDES RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. REST OF THE WORLD INSECTICIDES RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. REST OF THE WORLD INSECTICIDES RESEARCH AND ANALYSIS BY CROP TYPE, 2023-2031 ($ MILLION)

1. GLOBAL INSECTICIDES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL ORGANOPHOSPHATES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL PYRETHROIDS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL METHYL CARBAMATES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL NEONICOTINOIDS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL INSECTICIDES RESEARCH AND ANALYSIS BY CROP TYPE, 2023 VS 2031 (%)

8. GLOBAL CEREALS AND GRAINS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL OILSEEDS & PULSES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL FRUITS & VEGETABLES INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL OTHER CROPS INSECTICIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL INSECTICIDES RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. US INSECTICIDES SIZE, 2023-2031 ($ MILLION)

14. CANADA INSECTICIDES SIZE, 2023-2031 ($ MILLION)

15. UK INSECTICIDES SIZE, 2023-2031 ($ MILLION)

16. FRANCE INSECTICIDES SIZE, 2023-2031 ($ MILLION)

17. GERMANY INSECTICIDES SIZE, 2023-2031 ($ MILLION)

18. ITALY INSECTICIDES SIZE, 2023-2031 ($ MILLION)

19. SPAIN INSECTICIDES SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE INSECTICIDES SIZE, 2023-2031 ($ MILLION)

21. INDIA INSECTICIDES SIZE, 2023-2031 ($ MILLION)

22. CHINA INSECTICIDES SIZE, 2023-2031 ($ MILLION)

23. JAPAN INSECTICIDES SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA INSECTICIDES SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC INSECTICIDES SIZE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD INSECTICIDES S031 ($ 2031 ($ MILLION)