IoT Microcontroller Market

IoT Microcontroller Market Size, Share & Trends Analysis Report by Product (8 Bit, 16 Bit, and 32 Bit), and by Application (Industrial Automation, Smart Homes, Consumer Electronics, and Smart Wearables) Forecast Period (2024-2031)

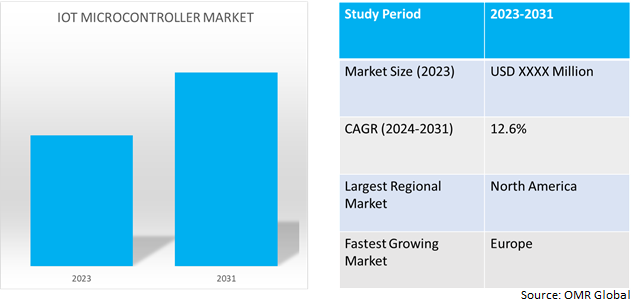

IoT microcontroller market is anticipated to grow at a CAGR of 12.6% during the forecast period (2024-2031). The growing adoption of IoT connections among consumer and enterprise sectors and the need for low-power, high-performance, and energy-efficient connected products are the key factors supporting the growth of the market globally. Network interfaces are used by microcontrollers to communicate locally with other devices and to send data to an Internet of Things application for analysis. Additionally, they are made to support a variety of network protocols, including Bluetooth, WI-Fi, and cellular networks like 4G and 5G.

Market Dynamics

Increasing Advancement in Wireless Technologies

Wireless microcontrollers, which enable network connectivity and inter-device communication. The market for wireless microcontrollers that enable various wireless protocols has been driven by the rising need for wearable technology, smart homes, and industrial automation. As the entire globe grows more interconnected, wireless technology is now required for the majority of applications. Wireless microcontrollers offer a dependable and effective means of communication between devices and the cloud, whether it be for smart cities, connected homes, or commercial and industrial automation.

Increasing Integration of Microcontrollers in Edge Computing Requirement

Microcontroller-oriented by transferring data analysis from the cloud to the device itself, edge computing enables local, real-time processing of part or all of the data right there on the device, at the source. Advances in power-efficient processing, which allow complicated data processing on small, battery-operated devices, are the driving force behind edge computing. Machine learning (ML) and artificial intelligence (AI) applications on IoT devices are made possible by this enhanced intelligence at the edge. Companies developing IoT applications have a lot of new opportunities as a result of intelligent edge microcontroller IoT devices.

Market Segmentation

Our in-depth analysis of the global IoT microcontroller market includes the following segments by product and application:

- Based on product, the market is sub-segmented into 8-bit, 16-bit, and 32-bit.

- Based on application, the market is sub-segmented into industrial automation, smart homes, consumer electronics, and smart wearables.

32 Bit is Projected to Emerge as the Largest Segment

Based on the product, the global IoT microcontroller market is sub-segmented into 8-bit, 16-bit, and 32-bit. Among these, the 32-bit sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of microcontrollers for IoT applications, the 32-bit MCU is the most suitable. It is inexpensive, widely utilized in industrial applications like high-end industrial sensor systems and building automation, and efficiently processes many peripherals. For instance, in November 2023, Renesas Electronics Corp. introduced a 32-bit RX MCU with a High-Speed, High-Precision Analog Front End for high-end industrial sensor systems. The latest addition, the RX23E-B, is a 32-bit device from its popular RX Family featuring a high-precision analog front end (AFE), specifically designed for systems that demand fast and accurate analog signal measurements.

Industrial Automation Sub-segment to Hold a Considerable Market Share

Based on application, the global IoT microcontroller market is sub-segmented into industrial automation, smart homes, consumer electronics, and smart wearables. Among these, the industrial automation sub-segment is expected to hold a considerable share of the market. The growing demand for microcontrollers in industrial automation is to boost productivity, increase operational efficiency, and simplify procedures. By integrating different systems and devices, IoT microcontrollers enable automation and provide real-time data monitoring and control. It enhances operational performance, optimizes resource usage, and decreases downtime. For instance, in November 2022, Infineon Technologies AG introduced the XMC7000 microcontroller (MCU) family for advanced industrial applications including industrial drives, electrical vehicle (EV) charging, two-wheel electrical vehicles, and robotics.

Regional Outlook

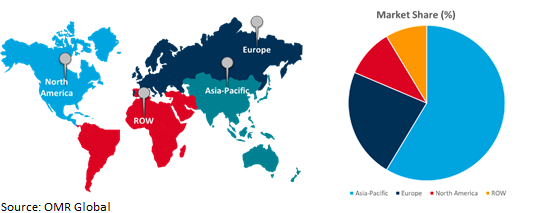

The global IoT microcontroller market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing adoption of IoT Devices in Europe

- Increasing demand for smart wearables and favorable government spending to promote smart city initiatives.

- According to the Gov.UK, in June 2021, The number of IoT devices in the UK is projected to grow to over 150 million in 2024 from 13 million in 2006. Consumer wearables and the white goods market account for over 40.0% of all IoT connections.

Global IoT Microcontroller Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of an enormous number of providers offering IoT microcontrollers. The key market players include Texas Instruments Inc., Silicon Laboratories, Inc., Intel Corp., Semiconductor Components Industries, LLC, Analog Devices, Inc., and others. The market growth is attributed to increased demand for electronic devices such as smartphones, computing devices, and other electronic devices. According to the United States Census Bureau, in April 2021, Smartphone ownership surpassed ownership of all other computing devices. Smartphones were present in 84.0% of households, while 78.0% of households owned a desktop or laptop. Additionally, the market player introducing wireless technology resulting increase in demand for IoT Microcontroller systems. For instance, in November 2023, Silicon Labs introduced intelligent wireless technology for a more connected IoT and announced the expansion of their microcontroller unit (MCU) development platform with a new family of 8-bit microcontrollers optimized for performance.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global IoT microcontroller market include Infineon Technologies AG, NXP Semiconductors N.V., Renesas Electronics Corp., STMicroelectronics N.V., and Texas Instruments Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In October 2023, Vitesco Technologies and Infineon intensified partnered for more efficiency in e-mobility. Vitesco Technologies uses the AURIX™ TC4x microcontroller family from Infineon in its next generation of master and zone controllers for electric-electronic vehicle architectures (E/E architectures) as well as in its new electrification system solutions.

- In December 2023, Microchip Technology launched its AVR® EB family of microcontrollers (MCUs) to offer a solution for addressing NVH and efficiency in a wide variety of cost-sensitive applications. To improve the smoothness of motor operations, reduce noise and increase efficiency at high speeds. These adjustments can be made on the fly, with near-zero latency, using the AVR EB MCU’s unique set of on-chip peripherals that enable multiple functions with minimal programming.

- In November 2023, STMicroelectronics introduced STM32WL3 long-range wireless microcontrollers for energy-efficient connectivity in smart metering, smart building, and industrial monitoring. The STM32WL3 wireless MCUs can help limit power consumption and prioritize activities. Adoption and use of these efficient MCUs can lead to improved user experience, service delivery, and reduced environmental footprint.

- In April 2022, Arm Ltd. offering new Arm Total Solutions expands high-performance microcontroller and application use cases with the latest Corstone subsystems for Cortex-M and Cortex-A. It includes Open-CMSIS-Pack, which is supported by 9,500 microcontrollers and 450 boards, enabling software vendors to easily scale their offerings across all of these devices.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global IoT microcontroller market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Infineon Technologies AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Renesas Electronics Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. STMicroelectronics N.V

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global IoT Microcontroller Market by Product

4.1.1. 8 Bit

4.1.2. 16 Bit

4.1.3. 32 Bit

4.2. Global IoT Microcontroller Market by Application

4.2.1. Industrial Automation

4.2.2. Smart Homes

4.2.3. Consumer Electronics

4.2.4. Smart Wearables

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Analog Devices, Inc.

6.2. Arduino S.r.l.

6.3. Arrow Electronics, Inc.

6.4. Espressif Systems

6.5. Holtek Semiconductor Inc.

6.6. Intel Corp.

6.7. Lattice Semiconductor Corp.

6.8. Marvell Technology, Inc.

6.9. NXP Semiconductors N.V.

6.10. ROHM CO., LTD.

6.11. Seiko Epson Corp.

6.12. Semiconductor Components Industries, LLC

6.13. Silicon Laboratories, Inc.

6.14. SparkFun Electronics

6.15. Texas Instruments Inc.

6.16. Toshiba Electronic Devices & Storage Corp.

6.17. XMOS Ltd.

1. GLOBAL IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL 8 BIT IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL 16 BIT IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 32 BIT IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL IOT MICROCONTROLLER FOR INDUSTRIAL AUTOMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL IOT MICROCONTROLLER FOR SMART HOMES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL IOT MICROCONTROLLER FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL IOT MICROCONTROLLER FOR SMART WEARABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

13. NORTH AMERICAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. EUROPEAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. EUROPEAN IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. REST OF THE WORLD IOT MICROCONTROLLER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL IOT MICROCONTROLLER MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL 8 BIT IOT MICROCONTROLLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL 16 BIT IOT MICROCONTROLLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 32 BIT IOT MICROCONTROLLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL IOT MICROCONTROLLER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL IOT MICROCONTROLLER FOR INDUSTRIAL AUTOMATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL IOT MICROCONTROLLER FOR SMART HOMES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL IOT MICROCONTROLLER FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL IOT MICROCONTROLLER FOR SMART WEARABLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL IOT MICROCONTROLLER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

13. UK IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)

25. THE MIDDLE EAST AND AFRICA IOT MICROCONTROLLER MARKET SIZE, 2023-2031 ($ MILLION)