Integrated Passive Devices (IPDs) Market

Integrated Passive Devices (IPDs) Market Size, Share & Trends Analysis Report by Passive Devices (Baluns, Filter, Couplers, Diplexers, and Customized IPDs), by Application (EMI and EMS protection IPD, RF IPD and Digital & Mixed-Signal IPD) and by End-User (Consumer Electronics, Automotive, IT & Telecommunication, Aerospace & Defense, Healthcare & Lifesciences and Others) Forecast Period (2024-2031)

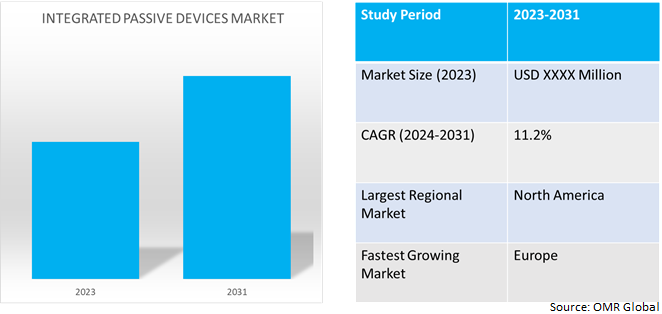

IPD market is anticipated to grow at a CAGR of 12.6% during the forecast period (2024-2031). The growing adoption of wireless communication technologies with increased demand for integrated passive devices in RF (Radio Frequency) applications, such as mobile devices, IoT devices, and 5G infrastructure drive the growth of the market. IPDs are being increasingly used in consumer electronics such as gaming systems, wireless speakers, routers, set-top boxes, drones, Wearable and hearable technology, smart TVs, and smart appliances.

Market Dynamics

Increasing Adoption of RF Front-End Modules

RF front-end module (FEM) is used to boost RF signals to extend a link's range, strength, and resilience. A high-resistivity substrate is used by the RF-integrated passive device (RF IPD) to integrate quality factor parts including capacitors and indicators. IPD technology can be used to construct a wide range of components, including power combiners/splitters, couplers, harmonic filters, impedance matching networks, and baluns. IPDs offer stand-alone items like filters and baluns in addition to foundry services. Their compatibility with various assembly modalities, such as wire bonding, microbumping, and CSP, allows them to be mounted as a complete RF module or on the main printed wiring board (PWB).

Advancement in IPDs using Through- Glass-Via (TGV) Substrate for High-frequency Applications

The demand for mobile high-speed connections is constantly increasing. IPDs made with glass thin films are growing more favored over those made using through-silicon-via (TSV) substrate. Glass substrate's high resistivity, low dielectric loss, high thermal stability, and tunable coefficient of thermal expansion led to its increasing use in the manufacturing of passive devices. Using Glass-Via (TGV) Substrate that offers high-frequency electrical properties, remarkable heat and chemical resistance, and high geometrical tolerances, glass has become a highly versatile substrate for a wide range of sensor and MEMS packaging applications, including electromechanical, thermal, optical, biomedical, and RF devices.

Market Segmentation

Our in-depth analysis of the global integrated passive devices market includes the following segments by passive devices, applications and end-users:

- Based on passive devices, the market is sub-segmented into baluns, filters, couplers, diplexers and customized IPDs.

- Based on application, the market is sub-segmented into EMI and EMS protection IPD, radiofrequency (RF) IPD and digital & mixed-signal IPD.

- Based on end-user, the market is sub-segmented into consumer electronics, automotive, IT & telecommunication, aerospace & defense, healthcare & life sciences and others (energy and utility).

EMI and EMS protection IPD is Projected to Emerge as the Largest Segment

Based on the application, the global integrated passive devices market is sub-segmented into EMI and EMS protection IPD, RF IPD and digital & mixed-signal IPD. Among these, the EMI and EMS protection IPD sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of customized solutions that are provided by EMS & EMI Protection IPDs, which protect delicate parts and guarantee peak performance in a range of gadgets, such as laptops, smartphones, automobile electronics, and industrial machinery. The increasing demand for electromagnetic interference (EMI) shielding and electrostatic discharge (EMS) protection solutions across diverse electronic applications. It is essential to reduce interference and provide protection against static electricity as electronic equipment gets denser and more compact. The ongoing development of electronics and the growing demand for reliable EMI and EMS protection. Robust protection measures offered by EMS & EMI Protection IPDs remain in high demand as sectors including consumer electronics, automotive, and telecommunications continue to evolve.

Consumer Electronics Sub-segment to Hold a Considerable Market Share

Based on application, the global integrated passive devices market is sub-segmented into consumer electronics, automotive, IT & telecommunication, aerospace & defense, healthcare & life sciences and others (energy and utility). Among these, consumer electronics sub-segment is expected to hold a considerable share of the market. The growing demand for numerous electronic devices makes use of integrated passive components. These consist of RF modules, portable gadgets, and cell phones. IPDs come in a variety of forms and can be combined into a single circuit by simplifying its design and minimizing the number of connections needed. Furthermore, technological developments like smaller chips have made it possible for electronic equipment to get smaller, which has led to a rise in the popularity of consumer electronics like laptops, LED televisions, tablets, and mobile phones.

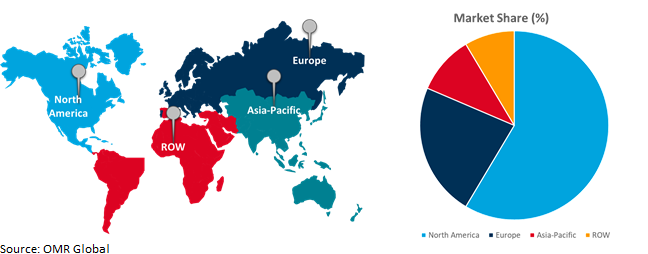

Regional Outlook

The global Integrated Passive Devices market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

An Increasing Integrated Passive Devices (IPD) Application in Europe

- The IPD integration has significantly improved the number of 5G terminal devices by providing performance and energy efficiency.

- According to the Gov.UK, in November 2023, long-term vision for wireless connectivity, including a new ambition for nationwide coverage of standalone 5G in all populated areas by 2030 and £40 million ($43.296 million) to create 5G innovation regions across the country.

Global Integrated Passive Devices Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of an enormous number of providers offering integrated passive devices. The key market players include Texas Instruments Inc., Silicon Laboratories, Inc., Intel Corp., Semiconductor Components Industries, LLC, Analog Devices, Inc., and others. The market growth is attributed to the increase in the semiconductor industry, the Internet of Things (IoT) is widely used with an increase in 5G connectivity. For instance, Semiconductor Components Industries, LLC, offers High-Q™ Integrated Passive Device (IPD) process technology from Onsemi offers a copper on high resistivity silicon platform ideal for the production of passive devices such as baluns, filters, couplers, and diplexers that are used in portable, wireless and RF applications.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global integrated passive devices market include Analog Devices, Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors N.V., STMicroelectronics N.V., and Texas Instruments Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In October 2023, TDK and LEM collaborated on next-generation TMR-based integrated passive device sensors for electrification applications. This collaboration further positions TDK’s TMR technology to succeed in the automotive and industrial markets, two sectors in which LEM brings deep expertise, especially in booming segments such as energy storage, motor drives, and solar inverters.

- In April 2023, Cadence Design Systems, Inc. introduced a new Cadence® EMX® Designer, an integrated passive device synthesis and optimization technology that delivers, in split seconds, design rule check (DRC)-clean parametric cells (PCells) and accurate electromagnetic (EM) models of passive devices.

- In April 2023, TDK Corp. introduced integrated passive components for automotive, industrial, and medical applications, power electronics, intelligent motion, renewable energy, and energy management. These include the most diverse capacitor technologies for DC link applications, inductors, protection devices, and reference designs.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global integrated passive devices (IPD) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Analog Devices, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NXP Semiconductors N.V

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. STMicroelectronics N.V

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Integrated Passive Devices Market by Passive Device

4.1.1. Baluns

4.1.2. Filter

4.1.3. Couplers

4.1.4. Diplexers

4.1.5. Customized IPDs

4.2. Global Integrated Passive Devices Market by Application

4.2.1. EMI (Electromagnetic Interference) and EMS (Electromagnetic Susceptibility) protection IPD

4.2.2. Radiofrequency (RF) IPD

4.2.3. Digital & Mixed-Signal IPD

4.3. Global Integrated Passive Devices Market by End-Users

4.3.1. Consumer Electronics

4.3.2. Automotive

4.3.3. IT & Telecommunication

4.3.4. Aerospace & Defense

4.3.5. Healthcare & Lifesciences

4.3.6. Others (Energy and Utility)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AVX Corp.

6.2. Infineon Technologies AG

6.3. Johanson Technology, Inc.

6.4. KOA Speer Electronics, Inc.

6.5. Mini-Circuits

6.6. Murata Manufacturing Co., Ltd.

6.7. Nordic Semiconductor

6.8. Qorvo, Inc.

6.9. Samsung Electro-Mechanics Co., Ltd.

6.10. Semiconductor Components Industries, LLC

6.11. Silicon Laboratories, Inc.

6.12. Skyworks Solutions, Inc.

6.13. Taiwan Semiconductor Manufacturing Company Ltd.

6.14. TAIYO YUDEN CO., LTD.

6.15. TDK Corp.

6.16. Texas Instruments Inc.

6.17. Würth Elektronik Group

6.18. Yageo Corp.

1. GLOBAL INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY PASSIVE DEVICES, 2023-2031 ($ MILLION)

2. GLOBAL BALUNS INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FILTER INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL COUPLERS INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DIPLEXERS INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CUSTOMIZED INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL INTEGRATED PASSIVE DEVICES FOR EMI AND EMS PROTECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INTEGRATED PASSIVE DEVICES FOR RADIOFREQUENCY (RF) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL INTEGRATED PASSIVE DEVICES FOR DIGITAL & MIXED-SIGNAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

12. GLOBAL INTEGRATED PASSIVE DEVICES FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL INTEGRATED PASSIVE DEVICES FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL INTEGRATED PASSIVE DEVICES FOR IT & TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL INTEGRATED PASSIVE DEVICES FOR AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL INTEGRATED PASSIVE DEVICES FOR HEALTHCARE & LIFESCIENCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL OTHER INTEGRATED PASSIVE DEVICES END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY PASSIVE DEVICES, 2023-2031 ($ MILLION)

21. NORTH AMERICAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

23. EUROPEAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY PASSIVE DEVICES, 2023-2031 ($ MILLION)

25. EUROPEAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. EUROPEAN INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY PASSIVE DEVICES, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

31. REST OF THE WORLD INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY PASSIVE DEVICES, 2023-2031 ($ MILLION)

33. REST OF THE WORLD INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD INTEGRATED PASSIVE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL INTEGRATED PASSIVE DEVICES MARKET SHARE BY PASSIVE DEVICES, 2023 VS 2031 (%)

2. GLOBAL BALUNS INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FILTER INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL COUPLERS INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DIPLEXERS INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CUSTOMIZED INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL INTEGRATED PASSIVE DEVICES MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL INTEGRATED PASSIVE DEVICES FOR EMI AND EMS PROTECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INTEGRATED PASSIVE DEVICES FOR RADIOFREQUENCY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL INTEGRATED PASSIVE DEVICES FOR DIGITAL & MIXED-SIGNAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL INTEGRATED PASSIVE DEVICES MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

12. GLOBAL INTEGRATED PASSIVE DEVICES FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL INTEGRATED PASSIVE DEVICES FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL INTEGRATED PASSIVE DEVICES FOR IT & TELECOMMUNICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL INTEGRATED PASSIVE DEVICES FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL INTEGRATED PASSIVE DEVICES FOR HEALTHCARE & LIFESCIENCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL OTHER INTEGRATED PASSIVE DEVICES END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL INTEGRATED PASSIVE DEVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. UK INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)

33. THE MIDDLE EAST AND AFRICA INTEGRATED PASSIVE DEVICES MARKET SIZE, 2023-2031 ($ MILLION)