Laser Cladding Market

Laser Cladding Market Size, Share & Trends Analysis Report by Type (Acoustic laser, CO2 laser, Diode laser, and Fiber laser), by Material (Carbides & Carbide Blends, Cobalt-Based Alloys, Iron-Based Alloys, and Nickel-Based Alloys), and by End-User (Aerospace & Defense, Automotive, Agriculture, Energy & Power, and Oil & Gas) Forecast Period (2024-2031)

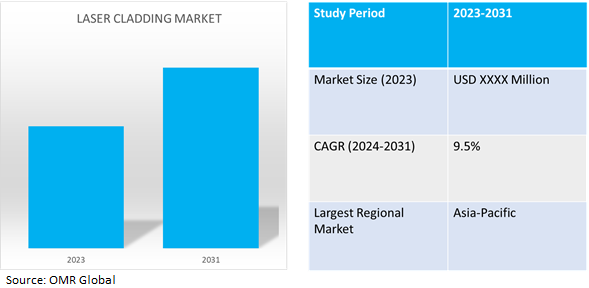

Laser cladding market is anticipated to grow at a CAGR of 9.5% during the forecast period (2024-2031). Laser cladding, an advanced surface modification technique, involves precisely depositing a layer of material onto a substrate using a laser as the heat source. Widely applied across various industries, this process serves purposes such as surface hardening, repair, and enhancing component properties.

Market Dynamics

Increasing adoption in the automotive and aviation industry

An increasing trend in the automotive and aviation sectors' use of laser cladding applications is anticipated to propel global revenue growth. High-strength steel is being used by the auto industry to construct vehicles that are lighter overall and meet higher durability standards. This will lead to increased fuel efficiency because it can be challenging to cut high-strength steel, the aviation industry frequently uses laser cladding.

Automated laser cladding has proven to produce better quality and yields when welding aircraft engine components. Repair costs and financial return rank first and second, respectively, when it comes to automated laser cladding machine customers' selection of laser cladding tools and methods. Additionally, the application of automated laser cladding has the potential to significantly reduce maintenance expenses and offer an attractive financial return.

Rising use of fiber lasers in laser cladding applications

Globally, the industrial sector is now the largest market size for fiber lasers; much of the action right now is at the kilowatt-class power level. Their use in automotive tasks is very fascinating, to construct cars that surpass durability standards and are relatively light for improved fuel efficiency, the automotive industry is shifting to high-strength steel; the problem is in how to cut the high-strength steel. This circumstance makes use of fiber lasers. For example, conventional machine tools have trouble making holes in this kind of steel, whereas fiber lasers can cut these holes fast.

Market Segmentation

Our in-depth analysis of the global laser cladding market includes the following segments by type, material, and end-user:

- Based on type, the market is sub-segmented into acoustic laser, co2 laser, diode laser, and fiber laser.

- Based on material, the market is bifurcated into carbides & carbide blends, cobalt-based alloys, iron-based alloys, and nickel-based alloys.

- Based on end-users, the market is sub-segmented into aerospace & defense, automotive, agriculture, energy & power, and oil & gas.

Diode Laser is Projected to Emerge as the Largest Segment

Based on the type, the global laser cladding market is sub-segmented into acoustic laser, co2 laser, diode laser, and fiber laser. Among these, the diode laser sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its several advantages over other types of lasers including their compact size, energy efficiency, and cost-effectiveness. Due to these features, diode lasers are a more attractive option for laser cladding applications, especially in sectors where cost, flexibility, and accuracy are important factors. Advancements in diode laser technology, including increased power output and better beam quality, make them ideal for laser cladding processes. The increasing demand in industries like automotive, aerospace, and medical devices is driving their adoption, indicating significant growth.

Cobalt-Based Alloys Sub-segment to Hold a Considerable Market Share

Cobalt-based alloys are expected to grow significantly in the laser cladding market due to their exceptional properties, which make them suitable for a variety of applications. These alloys are well-suited for usage in challenging operating environments because of their exceptional strength at high temperatures, resistance to wear and corrosion, and thermal conductivity. The need for cobalt-based alloys as cladding materials is expected to increase as laser cladding becomes more prevalent in industries including oil and gas, aerospace, and automotive for surface protection and component replacement. Cobalt-based alloys are ideal for biocompatibility, and resistance to fretting and galling, and are increasingly used in medical devices, implants, and laser cladding due to their superior properties.

Regional Outlook

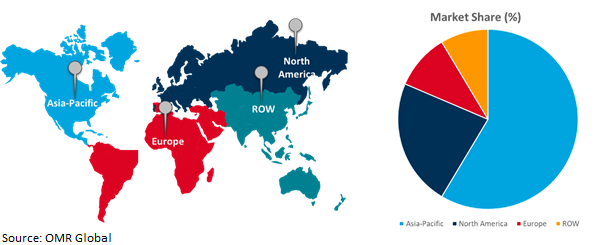

The global laser cladding market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in laser cladding market

- The UK is inclining more towards laser cladding to improve wear resistance in objects.

Global Laser Cladding Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to its widespread adoption in industries such as aerospace, automotive, and oil & gas. The region's advanced manufacturing capabilities, combined with increased investments in R&D, drive innovation in laser cladding technologies. Furthermore, the emphasis on sustainable manufacturing practices and the need for efficient repair & refurbishment solutions add to the demand for laser cladding in Asia-Pacific’s industrial landscape. Several government- and private-funded startups have emerged for the development of advanced laser cladding applications.

Increasing R&D investments in laser technologies and growing manufacturing and electronics sectors, coupled with the high population density, are expected to drive the growth of the laser cladding market in the region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global laser cladding market include Curtiss-Wright Corp., Coherent Corp., JENOPTIK AG, LaserBond Ltd, Lumentum Holdings Inc., OC Oerlikon Management AG, and Curtiss-Wright Corporation, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in August 2021, TRUMPF and STARMATIK, the Italian specialist for robotic automation of sheet metal processing machines, entered into a strategic partnership for bending machine automation. STARMATIK will be able to supply specific modular solutions for TRUMPF's Smart Factory solutions that take into account the general trend toward automation. Customers benefit from the expertise of both companies, which generally means a significant process acceleration in production compared to standard solutions.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laser cladding market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Laser Cladding Market by Type

4.1.1. Acoustic laser

4.1.2. CO2 laser

4.1.3. Diode laser

4.1.4. Fiber laser

4.2. Global Laser Cladding Market by Material

4.2.1. Carbides & Carbide Blends

4.2.2. Cobalt-Based Alloys

4.2.3. Iron-Based Alloys

4.2.4. Nickel-Based Alloys

4.3. Global Laser Cladding Market by End-User

4.3.1. Aerospace & Defense

4.3.2. Automotive

4.3.3. Agriculture

4.3.4. Energy & Power

4.3.5. Oil & Gas

4.3.6. Other

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.5. Latin America

5.6. Middle East and Africa

6. Company Profiles

6.1. Alabama Specialty Products Inc.

6.2. Coherent Corp.

6.3. Curtiss-Wright Corp.

6.4. Efesto LLC

6.5. Fraunhofer USA’s Center Midwest CMW

6.6. Hayden Corporation

6.7. Hoganas AB

6.8. IPG Photonics Corp.

6.9. JENOPTIK AG

6.10. Kondex Corp.

6.11. LaserBond Ltd

6.12. LaserStar Technologies Corp.

6.13. Lincoln Laser Solutions

6.14. Lumentum Holdings Inc.

6.15. OC Oerlikon Management AG

6.16. Perco, LLC

6.17. TLM Laser

1. GLOBAL LASER CLADDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ACOUSTIC LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CO2 LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIODE LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FIBER LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LASER CLADDING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

7. GLOBAL CARBIDES & CARBIDE BLENDS FOR LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL COBALT-BASED ALLOYS FOR LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL IRON-BASED ALLOYS FOR LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NICKEL-BASED ALLOYS FOR LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LASER CLADDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL LASER CLADDING IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL LASER CLADDING IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL LASER CLADDING IN AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL LASER CLADDING IN ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL LASER CLADDING IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

21. NORTH AMERICAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. EUROPEAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

25. EUROPEAN LASER CLADDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC LASER CLADDING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC LASER CLADDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC LASER CLADDING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC LASER CLADDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

30. REST OF THE WORLD LASER CLADDING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD LASER CLADDING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD LASER CLADDING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

33. REST OF THE WORLD LASER CLADDING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL LASER CLADDING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ACOUSTIC LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CO2 LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIODE LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FIBER LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LASER CLADDING MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

7. GLOBAL CARBIDES & CARBIDE BLENDS FOR LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL COBALT-BASED ALLOYS FOR LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL IRON-BASED ALLOYS FOR LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NICKEL-BASED ALLOYS FOR LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LASER CLADDING MARKET SHARE BY END-USER, 2023 VS 2031 (%)

12. GLOBAL LASER CLADDING IN AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL LASER CLADDING IN AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL LASER CLADDING IN AGRICULTURE MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL LASER CLADDING IN ENERGY & POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL LASER CLADDING IN OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL LASER CLADDING MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

20. UK LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA LASER CLADDING MARKET SIZE, 2023-2031 ($ MILLION)