Laser Sensor Market

Laser Sensor Market Size, Share & Trends Analysis Report Market by Component (Hardware & Software, and Services), and by End-User Vertical (Electronics Manufacturing, Aviation, Construction, Automotive, and Others) Forecast Period (2023-2030)

Laser sensor market is anticipated to grow at a significant CAGR of 9.3% during the forecast period. The growing automation in end-user industries such as aviation, manufacturing, food & beverages, and automotive among others is a key factor driving the growth of the global laser sensor market. Laser distance sensors are intended for non-contact distance measurements: laser gauges for ranges up to 10 meters, laser distance sensors for ranges up to 3,000 meters. These sensors are commonly used in machine building and handling equipment for location and type classification.

In manufacturing industry, attaining stable and accurate measurements is essential to ensure reliable product values and error-free production. The laser sensor can be used on reflective surfaces, numerous materials, and colors. These sensors are incorporated with rough, independent housing, a linear imager, a pinpoint laser emitter. The ongoing development of new devices and technology innovation by key players, providing the integration of laser sensor are further attributing to market growth. However, high cost of laser sensor compared to conventional sensors due to advanced technology restrains its market growth.

Segmental Outlook

The global laser sensor market is segmented based on offering and end-user vertical. Based on component, the market is segmented into hardware & software and services. Based on end-user vertical, the market is segmented into electronics manufacturing, aviation, construction, automotive, and others which includes chemical and healthcare. Among the end-user vertical, the electronic manufacturing sub-segment is anticipated to witness a prominent growth over the coming years owing to the consistent requirement to ensure high-quality standards in the electronics industry.

Automotive Sub-Segment to Exhibit a Considerable Growth During the Forecast Period

The growing trend of autonomous vehicle has fuelled the demand for laser sensors in automotive sector. Autonomous cars use other sensors to see, notably radars and cameras, but laser vision is hard to match. Radars are reliable, however they lack the resolution required to detect things such as arms and legs. Cameras provide the detail, however it is necessary to use machine-learning-powered algorithms to translate 2-D photos into 3-D knowledge. In contrast, LiDAR provides hard, computer-friendly data in the form of precise measurements.

To cater the growing demand, market players are advancing their product portfolios. For instance, in June 2020, Mouser enhanced the lidar vision SPL S 1 L90 A and SPL S 4 L90 A lasers from Osram Opto Semiconductors. The high -power, infrared SMT components feature a 905 nm laser wavelength suitable for use in autonomous vehicles and other LiDAR applications. The lasers provide a typical output of 120W at 40A per channel, at up to 33% efficiency. The lasers feature low thermal resistance, enabling heat to dissipate quickly from components even when operating at high currents.

Apart from this, governments across the globe are also encouraging the deployment of ADAS features worldwide, which will drive the growth of the market. For instance, the US Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) published the Federal Automated Vehicles Policy related to highly-automated vehicles (HAV), which range from vehicles with advanced driver-assistance systems features to autonomous vehicles.

Regional outlooks

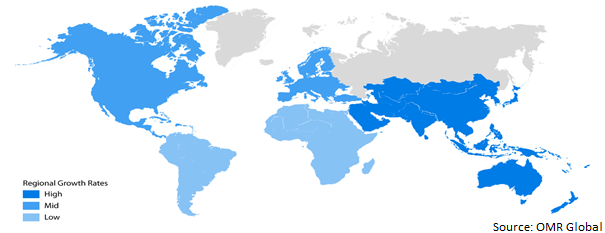

The global laser sensor market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, North America is anticipated to hold a prominent share in the global laser sensor market owing to the growing demand in exporting electronics equipment and growing end-user industries that are significant consumers of laser sensors such as defense, consumer electronics, and others.

Global Laser Sensor Market Growth, by Region 2023-2030

The Asia-Pacific Region to Hold a Considerable Share in the Global Laser Sensor Market

Among all the regions, the Asia-Pacific region is expected to hold a considerable share of the global laser sensor market owing to the higher volume of vehicle production in major countries, including India, China, and Japan, along with lower manufacturing and labor costs across the region. According to the India Brand Equity Foundation (IBEF), India’s annual production of automobiles in FY22 was 22.93 million including both passenger and commercial vehicle. India is presently the 6th biggest passenger vehicle manufacturer globally and the 2nd leading commercial vehicle developer. India is also a prominent auto exporter and has strong export growth expectations for the near future. In addition, several initiatives by the Government of India such as the Automotive Mission Plan 2026, scrappage policy, and production-linked incentive scheme in the Indian market are expected to make India one of the global leaders in the two-wheeler and four-wheeler market by 2022.

Automotive sector creates high demand for laser sensors to measure distant objects. The need for displacement, printing logos, barcodes and other multiple products has further driven the demand for laser sensors in automotive sector. Therefore, the growing automotive sector of the region is further driving the regional laser sensor market.

Market Players Outlook

The major companies serving the global laser sensor market include Keyence Corp., Baumer Electric AG, SmartRay GmbH, Micro-Epsilon Messtechnik GmbH & Co. KG, and IFM Electronics GmbH among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in June 2020, Infowork collaborated with Hyundai Motors to develop the Frequency Modulated Continuous Wave (FMCW) technology, a sensor for self-driving vehicles. The FMCW LiDAR under development is a sensor that uses a laser to determine the distance between objects and models their surroundings with precise 3D images.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global laser sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baumer Electric AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Keyence Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SmartRay GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Laser Sensor Market by Component

4.1.1. Hardware & Software

4.1.2. Services

4.2. Global Laser Sensor Market by End-User Vertical

4.2.1. Electronics Manufacturing

4.2.2. Aviation

4.2.3. Construction

4.2.4. Automotive

4.2.5. Others (Chemical, Healthcare)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Coherent, Inc.

6.2. Corning Incorporated

6.3. Dimetix AG

6.4. First Sensor AG

6.5. IFM Electronic GmbH

6.6. IPG Photonics Corp.

6.7. Jenoptik AG

6.8. Lumibird

6.9. Micro-Epsilon Messtechnik GmbH & Co. KG

6.10. MTI Instruments Inc.

6.11. Omron Corp.

6.12. Optex Co. Ltd.

6.13. Panasonic Corp.

6.14. Rockwell Automation Inc.

6.15. Schmitt Industries Inc.

1. GLOBAL LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL LASER SENSOR HARDWARE & SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL LASER SENSOR SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL LASER SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2022-2030 ($ MILLION)

5. GLOBAL LASER SENSOR FOR ELECTRONICS MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL LASER SENSOR FOR AVIATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL LASER SENSOR FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL LASER SENSOR FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL LASER SENSOR FOR OTHER END-USER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL LASER SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

13. NORTH AMERICAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2022-2030 ($ MILLION)

14. EUROPEAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

16. EUROPEAN LASER SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC LASER SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2022-2030 ($ MILLION)

20. REST OF THE WORLD LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD LASER SENSOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

22. REST OF THE WORLD LASER SENSOR MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2022-2030 ($ MILLION)

1. GLOBAL LASER SENSOR MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

2. GLOBAL LASER SENSOR HARDWARE & SOFTWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL LASER SENSOR SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL LASER SENSOR MARKET SHARE BY END-USER VERTICAL, 2022 VS 2030 (%)

5. GLOBAL LASER SENSOR FOR ELECTRONICS MANUFACTURING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL LASER SENSOR FOR AVIATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL LASER SENSOR FOR CONSTRUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL LASER SENSOR FOR AUTOMOTIVE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL LASER SENSOR FOR OTHER END-USER VERTICAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL LASER SENSOR MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

13. UK LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD LASER SENSOR MARKET SIZE, 2022-2030 ($ MILLION)