Liquid Soap Market

Liquid Soap Market Size, Share & Trends Analysis Report by Product (Hand Wash, Body Wash, Face Wash, and Dish Wash), By Source (Natural/ Organic and Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Sales Channel, and Others) By End-User (Residential, Commercial, Hotels & Restaurants, Hospitals, and Others) Forecast Period (2025-2035)

Industry Overview

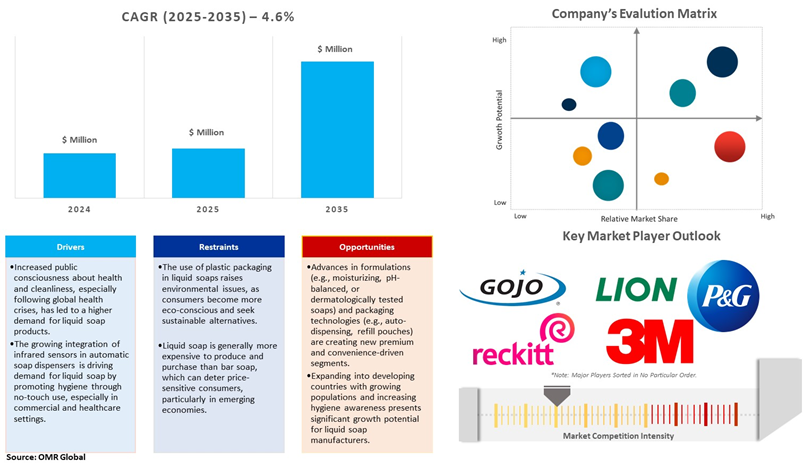

Liquid soap market value is projected to reach $40,445 million in 2035 from $24,850 million in 2024, witnessing a CAGR of 4.6% during the forecast period (2025-2035). Pivotal factors such as growing demand for hygienic skincare & wellness products, an increase in D2C distribution channel-based liquid soap brands, competitive pricing and multi-pack offers, the rapid expansion of the leisure tourism & hospitality industry, launching programs and promotions regarding personal grooming and skincare, technological integration in dispensers and shifting consumer inclination towards convenient & novel product formats are projected to drive market growth. According to the International Trade Administration (ITA), the rapid expansion of the leisure tourism and hospitality industry is significantly boosting demand in the liquid soap market. In 2022, the travel and tourism sector contributed $2.3 trillion to the US economy, accounting for 2.97% of the country’s GDP and supporting approximately 9.5 million jobs. This growth reflects increased activity in hotels, resorts, restaurants, and other public facilities where hygiene is paramount. As a result, there is a rising need for liquid soap in guest rooms and common areas.

Market Dynamics

Product Bundling as a Strategic Growth Driver

In this market, product bundling offering combined packages such as hand wash, body wash, and refills, is becoming a powerful strategy to attract value-conscious consumers. These multi-pack offers provide convenience and increase the Average Order Value (AOV), enhancing profitability for retailers. According to a McKinsey report, 35% of Amazon purchases stem from recommendations driven by product bundling, highlighting its effectiveness in driving consumer decisions. Hygiene remains a daily necessity, liquid soap brands are capitalizing on this trend by launching competitively priced family packs and combo deals, especially through e-commerce and D2C channels, to boost customer loyalty and repeat purchases. For instance, GOJO offers sealed, single-use soap refills bundled with specially designed dispensers, creating a closed system that prevents exposure during refilling. This bundled solution enhances hygiene by reducing the risk of bacterial contamination and also improves operational efficiency by lowering maintenance costs and downtime. Such bundled offerings provide a compelling value proposition for customers in sectors such as healthcare, hospitality, and education, where hygiene is critical. As a result, the move towards integrated soap and dispenser packages is driving demand and shaping purchasing decisions in the liquid soap market.

Strategic Hospitality Partnerships Fuel Demand for Liquid Soap Solutions

The market is witnessing a significant boost through strategic partnerships between leading hospitality chains and personal care brands. For instance, IHG Hotels & Resorts’ collaboration with Unilever to replace single-use bathroom miniatures with bulk-size amenities across 4,000+ hotels. This initiative supports sustainability goals and also enhances guest experience by offering premium, full-size Dove products, including hand wash and body wash. Such partnerships are driving large-scale procurement of liquid soap products, positioning them as essential amenities in the global hospitality industry, and accelerating market growth.

Market Segmentation

- Based on the product, the market is segmented into hand wash, body wash, face wash, and dish wash.

- Based on the source, the market is segmented into natural/ organic and conventional.

- Based on the distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, online sales channels, and others.

- Based on the end-user, the market is segmented into residential, commercial, hotels & restaurants, hospitals, and others.

Hand wash Segment to Lead the Market with the Largest Share

The hand wash segment of the global liquid soap market is witnessing robust growth, driven by increasing awareness of the critical role hand hygiene plays in public health and infection prevention. According to the World Health Organization (WHO), effective hand hygiene can save millions of lives annually when practiced at key moments during health care delivery. It is a vital health intervention and also a cost-effective measure that offers high returns on investment. Governments, healthcare institutions, and civil society organizations (CSOs) are playing an active role in promoting handwashing practices as a frontline defense against infections and antimicrobial resistance. The WHO’s World Hand Hygiene Day 2023 spotlighted the importance of community-driven initiatives, with CSOs championing hygiene awareness at local, national, and international levels. As a result, the demand for hand wash products has surged, particularly in healthcare, hospitality, and education sectors where hand hygiene is paramount.

Product Innovation and Dermatological Customization Driving Growth in Face Wash Segment

The growing emphasis on developing face care products for diverse skin conditions and regional preferences is emerging as a significant driver in this market. Companies are increasingly adopting a localized and dermatologically informed approach to product development, especially in fast-growing overseas markets such as Southeast Asia. For instance, in Indonesia a country characterized by a hot and humid climate consumers face unique skin challenges such as acne, dryness, and UV-induced aging. In response, manufacturers such as Lion Corporation, in collaboration with local affiliates PT. Lion Wings introduced specialized face washes under the POISE brand that target brightening, sebum control, acne care, and antibacterial needs. This strategic alignment with consumer preferences through functional ingredient selection and region-specific R&D is boosting demand for facial liquid soaps.

Regional Outlook

The global liquid soap market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

The Asia-Pacific Region is projected to be the Fastest Growing in the Market.

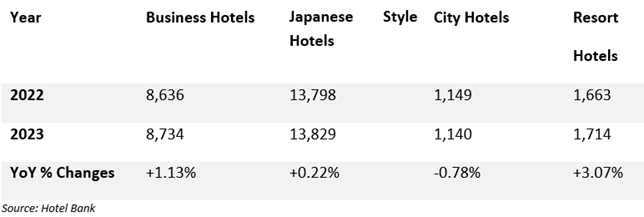

The Asia-Pacific region is witnessing the fastest growth in this market, primarily driven by the flourishing hotel and resort industry. In Japan, the number of resort hotels increased by 3.07% year-on-year in 2023, while city hotels and business hotels also witnessed steady growth. Japanese-style hotels, or ryokan, traditionally located in tourist destinations, are increasingly being established in urban areas to accommodate the rising influx of inbound travelers. These establishments, which frequently feature hot spring (onsen) facilities and on-site restaurants, place a high emphasis on guest hygiene and comfort. The expanding inventory of hotel rooms, such as the 2.06% increase in resort hotel rooms and 2.05% rise in business hotel rooms, directly translates into greater demand for liquid hand wash, body wash, and face wash.

Japan Number of Hotels and Hotel Rooms by Category

Growing Health-Driven Initiatives and Hygiene Awareness in North America

North America is expected to dominate due the comprehensive health initiatives and robust public-private partnerships that emphasize hygiene and preventive care. For instance, campaigns like Hope is in Your Hands, a collaborative effort by Walgreens, Safeguard (a Procter & Gamble brand), and the health-focused non-profit organization Americares aims to provide 10 million handwashing experiences to underserved communities across the US. This demonstrates the region’s proactive approach toward improving public hygiene. Such programs reflect a well-established culture of hygiene awareness, driven by both corporate responsibility and public health advocacy.

Market Players Outlook

The major companies operating in the global liquid soap market include GOJO Industries, Inc., LION Corp., Procter & Gamble, Reckitt Benckiser Group PLC, and 3M among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In February 2025, Procter & Gamble launched Dawn PowerSuds, a liquid dish soap designed to tackle modern cooking messes. The soap also features instant-drying action, longer-lasting bubbles, and a mess-free EZ-Squeeze bottle. Additionally, Dawn collaborated with rapper Charlie Curtis-Beard, who created a fun new track Double the Suds, available on social media platforms.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquid soap market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Liquid Soap Market Sales Analysis – Product | Source | Distribution Channel | End-User ($ Million)

• Liquid Soap Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Liquid Soap Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Liquid Soap Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Liquid Soap Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Liquid Soap Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Liquid Soap Market Revenue and Share by Manufacturers

• Liquid Soap Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. GOJO Industries, Inc.

4.3.1.1. Overview

4.3.1.2. Product Portfolio

4.3.1.3. Financial Analysis (Subject to Data Availability)

4.3.1.4. SWOT Analysis

4.3.1.5. Business Strategy

4.3.2. LION Corp.

4.3.2.1. Overview

4.3.2.2. Product Portfolio

4.3.2.3. Financial Analysis (Subject to Data Availability)

4.3.2.4. SWOT Analysis

4.3.2.5. Business Strategy

4.3.3. Procter & Gamble

4.3.3.1. Overview

4.3.3.2. Product Portfolio

4.3.3.3. Financial Analysis (Subject to Data Availability)

4.3.3.4. SWOT Analysis

4.3.3.5. Business Strategy

4.3.4. Reckitt Benckiser Group PLC

4.3.4.1. Overview

4.3.4.2. Product Portfolio

4.3.4.3. Financial Analysis (Subject to Data Availability)

4.3.4.4. SWOT Analysis

4.3.4.5. Business Strategy

4.3.5. 3M Co.

4.3.5.1. Overview

4.3.5.2. Product Portfolio

4.3.5.3. Financial Analysis (Subject to Data Availability)

4.3.5.4. SWOT Analysis

4.3.5.5. Business Strategy

4.4. Top Winning Strategies by Market Players

4.4.1. Merger and Acquisition

4.4.2. Product Launch

4.4.3. Partnership And Collaboration

5. Global Liquid Soap Market Sales Analysis by Product ($ Million)

5.1. Hand Wash

5.2. Body Wash

5.3. Face Wash

5.4. Dish Wash

6. Global Liquid Soap Market Sales Analysis by Source ($ Million)

6.1. Natural/ Organic

6.2. Conventional

7. Global Liquid Soap Market Sales Analysis by Distribution Channel ($ Million)

7.1. Supermarkets/Hypermarkets

7.2. Convenience Stores

7.3. Online Sales Channel

7.4. Others

8. Global Liquid Soap Market Sales Analysis by End-User ($ Million)

8.1. Residential

8.2. Commercial

8.3. Hotels & Restaurants

8.4. Hospitals

8.5. Others

9. Regional Analysis

9.1. North American Liquid Soap Market Sales Analysis – Product | Source | Distribution Channel | End-User |Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Liquid Soap Market Sales Analysis – Product | Source | Distribution Channel | End-User |Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Liquid Soap Market Sales Analysis – Product | Source | Distribution Channel | End-User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Liquid Soap Market Sales Analysis – Product | Source | Distribution Channel | End-User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. BluemoonBodycare

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Colgate-Palmolive Co.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Ecosystem Laboratoire

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. EVYAP

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Forever Living Products, L.L.C.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Hyapur Deutschland

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Ivory

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. KAO Chemicals

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Kimberly-Clark Corp.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. KIMIRICA

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. LAFCO NY

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. L'Occitane Group

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Lush Retail Ltd.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. NEST

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Osiyanbeauty

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Pompeii Street Soap Co.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Quimi Romar SL

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Shore Soap Company, LLC

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. The Body Shop International Ltd.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. The Caldrea Co.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

1. Global Liquid Soap Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Liquid Hand Wash Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Liquid Body Wash Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Liquid Face Wash Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Liquid Dish Wash Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Liquid Soap Market Research And Analysis By Source, 2024-2035 ($ Million)

7. Global Natural/Organic Liquid Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Conventional Liquid Soap Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Liquid Soap Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

10. Global Liquid Soap In Supermarkets/Hypermarkets Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Liquid Soap In Convenience Stores Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Liquid Soap In Online Sales Channel Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Liquid Soap In Other Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Liquid Soap Market Research And Analysis By End-User, 2024-2035 ($ Million)

15. Global Liquid Soap For Residential Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Liquid Soap For Commercial Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Liquid Soap For Hotels & Restaurant Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Liquid Soap For Hospitals Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Liquid Soap For Others Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Liquid Soap Market Research And Analysis By Geography, 2024-2035 ($ Million)

21. North American Liquid Soap Market Research And Analysis By Country, 2024-2035 ($ Million)

22. North American Liquid Soap Market Research And Analysis By Product, 2024-2035 ($ Million)

23. North American Liquid Soap Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

24. North American Liquid Soap Market Research And Analysis By Source, 2024-2035 ($ Million)

25. North American Liquid Soap Market Research And Analysis By End-User, 2024-2035 ($ Million)

26. European Liquid Soap Market Research And Analysis By Country, 2024-2035 ($ Million)

27. European Liquid Soap Market Research And Analysis By Product, 2024-2035 ($ Million)

28. European Liquid Soap Market Research And Analysis By Source, 2024-2035 ($ Million)

29. European Liquid Soap Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. European Liquid Soap Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

31. Asia-Pacific Liquid Soap Market Research And Analysis By Country, 2024-2035 ($ Million)

32. Asia-Pacific Liquid Soap Market Research And Analysis By Product, 2024-2035 ($ Million)

33. Asia-Pacific Liquid Soap Market Research And Analysis By Source, 2024-2035 ($ Million)

34. Asia-Pacific Liquid Soap Market Research And Analysis By End-User, 2024-2035 ($ Million)

35. Asia-Pacific Liquid Soap Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

36. Rest Of The World Liquid Soap Market Research And Analysis By Country, 2024-2035 ($ Million)

37. Rest Of The World Liquid Soap Market Research And Analysis By Product, 2024-2035 ($ Million)

38. Rest Of The World Liquid Soap Market Research And Analysis By Source, 2024-2035 ($ Million)

39. Rest Of The World Liquid Soap Market Research And Analysis By End-User, 2024-2035 ($ Million)

40. Rest Of The World Liquid Soap Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

1. Global Liquid Soap Market Share Analysis By Product, 2024 Vs 2035 (%)

2. Global Liquid Hand Wash Soap Market Share By Region, 2024 Vs 2035 (%)

3. Global Liquid Body Wash Soap Market Share By Region, 2024 Vs 2035 (%)

4. Global Liquid Face Wash Soap Market Share By Region, 2024 Vs 2035 (%)

5. Global Liquid Dish Wash Soap Market Share By Region, 2024 Vs 2035 (%)

6. Global Liquid Soap Market Share By Source, 2024 Vs 2035 (%)

7. Global Natural/Organic Liquid Soap Market Share By Region, 2024 Vs 2035 (%)

8. Global Conventional Liquid Soap Market Share By Region, 2024 Vs 2035 (%)

9. Global Liquid Soap Market Research And Analysis By Distribution Channel, 2024 Vs 2035 (%)

10. Global Liquid Soap In Supermarkets/Hypermarkets Market Share By Region, 2024 Vs 2035 (%)

11. Global Liquid Soap In Convenience Stores Market Share By Region, 2024 Vs 2035 (%)

12. Global Liquid Soap In Online Sales Channel Market Share By Region, 2024 Vs 2035 (%)

13. Global Liquid Soap In Other Market Share By Region, 2024 Vs 2035 (%)

14. Global Liquid Soap Market Research And Analysis By End-User, 2024 Vs 2035 (%)

15. Global Liquid Soap For Residential Market Share By Region, 2024 Vs 2035 (%)

16. Global Liquid Soap For Commercial Market Share By Region, 2024 Vs 2035 (%)

17. Global Liquid Soap For Hotels & Restaurant Market Share By Region, 2024 Vs 2035 (%)

18. Global Liquid Soap For Hospitals Market Share By Region, 2024 Vs 2035 (%)

19. Global Liquid Soap For Others Market Share By Region, 2024 Vs 2035 (%)

20. Global Liquid Soap Market Share By Region, 2024 Vs 2035 (%)

21. Us Liquid Soap Market Size, 2024-2035 ($ Million)

22. Canada Liquid Soap Market Size, 2024-2035 ($ Million)

23. Uk Liquid Soap Market Size, 2024-2035 ($ Million)

24. France Liquid Soap Market Size, 2024-2035 ($ Million)

25. Germany Liquid Soap Market Size, 2024-2035 ($ Million)

26. Italy Liquid Soap Market Size, 2024-2035 ($ Million)

27. Spain Liquid Soap Market Size, 2024-2035 ($ Million)

28. Russia Liquid Soap Market Size, 2024-2035 ($ Million)

29. Rest Of Europe Liquid Soap Market Size, 2024-2035 ($ Million)

30. India Liquid Soap Market Size, 2024-2035 ($ Million)

31. China Liquid Soap Market Size, 2024-2035 ($ Million)

32. Japan Liquid Soap Market Size, 2024-2035 ($ Million)

33. South Korea Liquid Soap Market Size, 2024-2035 ($ Million)

34. ASEAN Economies Liquid Soap Market Size, 2024-2035 ($ Million)

35. Australia And New Zealand Liquid Soap Market Size, 2024-2035 ($ Million)

36. Rest Of Asia-Pacific Liquid Soap Market Size, 2024-2035 ($ Million)

37. Latin America Liquid Soap Market Size, 2024-2035 ($ Million)

38. Middle East And Africa Liquid Soap Market Size, 2024-2035 ($ Million)

FAQS

The size of the Liquid Soap market in 2024 is estimated to be around $24,850 million.

Asia Pacific holds the largest share in the Liquid Soap market.

Leading players in the Liquid Soap market include GOJO Industries, Inc., LION Corp., Procter & Gamble, Reckitt Benckiser Group PLC, and 3M among others.

Liquid Soap market is expected to grow at a CAGR of 4.6% from 2025 to 2035.

Growing hygiene awareness and demand for convenient, eco-friendly personal care products are driving the liquid soap market growth.