Luxury Apparel Market

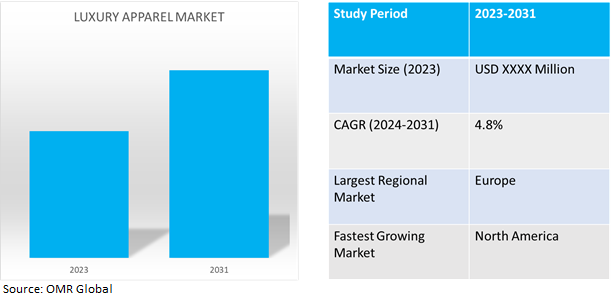

Luxury Apparel Market Size, Share & Trends Analysis Report by Product Type (Clothing, Footwear, Bags/ Handbags, and Accessories), by End-User (Men and Women), and by Distribution Channel (Offline Retail and Online Retail) Forecast Period (2024-2031)

Luxury apparel market is anticipated to grow at a CAGR of 4.8% during the forecast period (2024-2031).Luxury apparels are known for their unique designs and wearing such unique and innovative designs allows individuals to stand out from the crowd. The rising perception among customers that luxury goods contribute to better social acceptance, is driving the market demand.

Market Dynamics

Growing Millennial and Gen Z Acceptance

Luxury fashion items are becoming more and more popular. Millennials and gen z are among the fastest-growing consumer groups in the premium fashion items market. This generation seek out luxury items as part of the experience and are well aware of the different luxury fashion brands that are available on the market. Long-term revenue growth for premium brands is also possible with these generations. Thus, the market for premium fashion goods is being driven more and more by millennials and gen z.

Rapid expansion of E-commerce platforms to boost market growth

The degree of convenience that e-commerce retailing offers customers is the primary driver of its growth in sales. Customers can check and purchase goods around-the-clock. They also find it simple to select the brands they want and to choose from a large selection of clothes and related accessories that suit their tastes and demands. Online platforms are more convenient for customers and offer a wider selection of possibilities. Direct-to-consumer (D2C) platforms are becoming more and more common in luxury commerce as a result of consumer demand for genuine goods in the face of counterfeiting risks. Major businesses are starting their own websites more frequently in an effort to enhance the online buying experience for customers and give them confidence that the things they are purchasing are genuine and of high quality.

Market Segmentation

Our in-depth analysis of the global luxury apparel market includes the following segments by end-user, product type and distribution channel of luxury apparel:

- Based on product type, the market is sub-segmented into clothing (formal, casual, sports, innerwear), footwear, bags and accessories (caps, watches, sunglasses, belts).

- Based on the end-user, the market is divided into men and women.

- Based on the distribution channel, the market is divided into offline retail and online retail.

Female fashion to Emerge as the Largest Segment

The female segment has dominated the market as the fashion industry strongly focuses on female fashion. The diversity in the product offering for females attracts and creates a wider consumer base. Additionally, the growing influence of social media and fashion bloggers is fueling the desire among women to stay updated with the latest trends, leading to increased demand for fashion-forward clothing. Thus driving the growth of this market segment.

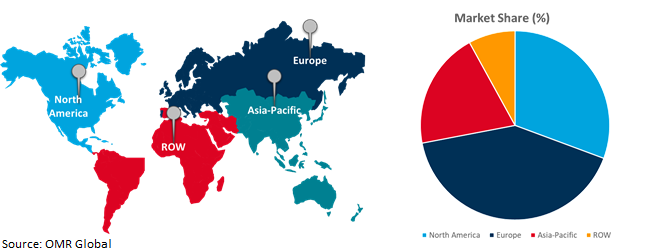

Regional Outlook

The global luxury apparel market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe Holds Major Market Share

Europe holds the major market share as it has a rich history of craftsmanship. Many iconic luxury brands have originated in European countries such as France. Some European cities are known as fashion capital of the world such as Paris and Milan. It is a major destination of some of the most renowned designing schools, boutiques and designer brands such as Louis Vuitton, Christian Dior, Givenchy and Marc Jacobs. Many fashion events also take place in these places such as Paris Fashion Week which is the most famous fashion show where top luxury brands from all over the globe showcases their collection. It also serves as a networking opportunity for industry professionals, including designers, buyers, and media. All these factors have made Europe the largest market for luxury apparels.

Global Luxury Apparel Market Growth by Region 2024-2031

North America is the Fastest Growing Luxury Apparel Market

The North America region is the fastest growing luxury apparel market. It has a larger base of fashion-conscious consumers who follow the most recent trends in the market for clothes, watches, handbags, and other luxury items. Luxury items are more appealing to consumers than quick fashion accessories because of their unique designs, durability, comfort, and beauty. Consumer behavior is influenced by social media influencers who market luxury brands recently launched collections in an effort to attract clients. North America is a unique market for luxury retail and it continues to be one of the most popular places for luxury travel. The luxury market in North America has grown overall, and the emerging trends has helped it to develop even more.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Luxury Apparel market include Dior SE, Ralph Lauren Corp., Giorgio Armani S.p.A., Burberry ltd., Dolce & Gabbana S.r.l., Prada S.p.A., Kate Spade LLC. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,

- In April 2023, Coach introduced various sustainability-focused initiative. They launched a whole new brand built on the idea of working toward zero waste. Coachtopia, a new line of apparel and accessories, which is made up of recycled materials.

- In August 2023, Gucci and JD.com announced a digital partnership and launched official Gucci flagship store. The flagship store includes a full range experience of Gucci brand services, within a seamless and secure digital ecosystem.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global luxury apparel market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Dior SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ralph Lauren Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Giorgio Armani S.p.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Luxury Apparel Market by Product Type

4.1.1. Clothing (Formal, Casual, Sports, Innerwear)

4.1.2. Footwear

4.1.3. Bags/ Handbags

4.1.4. Accessories (Caps, Watches, Sunglasses, Belts)

4.2. Global Luxury Apparel Market by End-User

4.2.1. Men

4.2.2. Women

4.3. Global Luxury Apparel Market by Distribution Channel

4.3.1. Offline Retail

4.3.2. Online Retail

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3.1 Phillip Lim

6.2. Burberry Group plc

6.3. CHANEL

6.4. Dolce & Gabbana S.r.l

6.5. Guccio Gucci S.p.A.

6.6. Hermes International

6.7. Kate Spade LLC.

6.8. Prada S.p.A.

6.9. PVH Corp. (Calvin Klein)

6.10. Tapestry Inc. (Coach)

6.11. Valentino S.p.A.

6.12. Yves Saint Laurent SAS

1. GLOBAL LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CLOTHING AS LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FOOTWEAR AS LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BAGS/ HANDBAGS AS LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ACCESORIES AS LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL LUXURY APPAREL FOR MEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL LUXURY APPAREL FOR WOMEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

10. GLOBAL LUXURY APPAREL BY OFFLINE RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL WOMEN LUXURY APPAREL BY ONLINE RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL WOMEN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. NORTH AMERICAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

17. EUROPEAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. EUROPEAN LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

25. REST OF THE WORLD LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

28. REST OF THE WORLD LUXURY APPAREL MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL LUXURY APPAREL MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL CLOTHING AS LUXURY APPAREL MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FOOTWEAR AS LUXURY APPAREL MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BAGS/ HANDBAGS AS LUXURY APPAREL MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ACCESORIES AS LUXURY APPAREL MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL LUXURY APPAREL MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL LUXURY APPAREL FOR MEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL LUXURY APPAREL FOR WOMEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL LUXURY APPAREL MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

10. GLOBAL LUXURY APPAREL BY OFFLINE RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LUXURY APPAREL BY ONLINE RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL LUXURY APPAREL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

15. UK LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA LUXURY APPAREL MARKET SIZE, 2023-2031 ($ MILLION)