Lycopene Market

Lycopene Market Size, Share & Trends Analysis Report by Form (Beadlets, Oil Suspension, Powder, and Emulsion), by Source (Natural, and Synthetic), and by Application (Dietary Supplements, Food and Beverages, Personal Care Products, and Pharmaceuticals) Furthermore by Property (Health Ingredient, and Coloring Agent) for the Forecast Period (2023-2030)

Lycopene market is expected to witness substantial growth, with a projected CAGR of 5.9% during the forecast period. The market's growth is attributed to growing demand for advanced capabilities across the globe. Nowadays consumers are seeking for the plant has the potential to revolutionise the food industry by producing high-quality, safe, and cost-effective food ingredients. For Instance, in January 2022, Lycored, launched a processing plant in Branchburg, NJ for its carotenoids, vitamins, minerals, amino acids, and genuine food components. This new factory allows the firm to maximize quality, potency, and shelf-stability of its chemicals while expanding output capacity dramatically. It has superior milling, mixing, drying, and coating capabilities, as well as several customizable options.

Segmental Outlook

The lycopene market is segmented based on form, source, application, and property. Based on form, the market is anticipated into beadlets, oil suspension, powder, and emulsion. By source, the market is anticipated into Natural, and Synthetic. By application, the market is anticipated into dietary supplements, food and beverages, personal care products, and pharmaceuticals. Furthermore by property, the market is segmented into health ingredient, and coloring agent. Among these segments, the natural sub-segment is anticipated to hold a significant market share. The demand for organic products is increasing, manufacturers in a variety of industries are working to create organic products that meet consumer demands. As a result, some manufacturers have developed organic products.

The Powder Sub-Segment is Anticipated to Hold a Prominent Share of the Global Lycopene Market

The growth of the powder sub-segment is attributed to the growing demand for FruHis, a fruit compound, boosts lycopene in the treatment of prostate gland enlargement across the globe. Prostate cancer is on the rise among consumers. Most individuals across the globe suffer from prostate problems. According to National Institutes of Health, although the high incidence rates of prostate cancer, the majority of cases are discovered when the cancer is contained to the prostate. In the USA, the 5-year survival rate for males with prostate cancer is approximately 98%. Accordingly market players are coming up with new products to cater the demand for lycopene. For instance, in November2022, According to Natural Ingredients The fruit compound d-Fructose- l-histidine (FruHis) can boost lycopene efficacy and reduce the growth hormone FruHis, that can boost lycopene efficacy and reduce the growth hormone 'IGF-1' to improve symptoms of prostate gland enlargement. Lycopene performed, in fact, cause a 13.2% reduction in TPSA, whereas FruHis had no effect. Administration of both compounds, on the other hand, reduced levels by 13 to 30.3%, and the same pattern was observed for all other parameters tested.

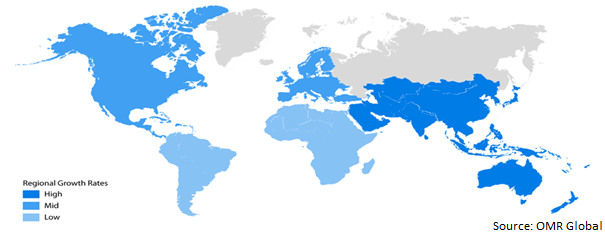

Regional Outlooks

The global lycopene market is analysed across key regions, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East and Africa, and Latin America). Among these, the European region is projected to witness prominent growth among the market during forecast period. Meanwhile, the North America region is expected to experience substantial market growth, attributed to demand for rising regional consumer preference for healthy food options.

Global Lycopene Market Growth, by Region 2023-2030

The Asia-Pacific Region is Anticipated to Hold a Significant Share in the Global Lycopene Market

Among all the regions, the Asia-Pacific regions is expected to hold a considerable share of the market. The regional market growth is attributed to the increasing demand for Research and development across the region. The development of new technologies and varied formulations has recently attracted the attention of researchers. According to National Institute of Health, Lycopene, one of the primary carotenoids, is the most potent antioxidant found in food. RONS generation as a defence mechanism against infection brought on by the ischemia-reperfusion syndrome, the metabolism of the parasite, and the metabolism of antimalarial medications were highlighted as the key mechanisms causing oxidative stress during malaria in this review. The benefits of lycopene on a number of illnesses for which oxidative stress is thought to be a contributing factor are additionally addressed along with information on its mode of action and a case for its supplementation in malaria based on scientific data.

Market Players Outlook

The major companies serving the global lycopene market include BASF SE, Informa PLC, DDW, Inc., Dhler GmbH, E.I.D. Parry Ltd and others. The market players are considerably contributing to market growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2022, Institute of Food Technologists (IFT) Expo in Chicago, Lycored, derived colour and taste-enhancing ingredients for food and beverages, will be showcasing its range of superstable red, orange, gold, and yellow hues and real food ingredients.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global lycopene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Market Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Allied Biotech Corp

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Divis Laboratories Ltd

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Vidya Herbs Pvt. Ltd

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Lycopene by Form

4.1.1. Beadlets

4.1.2. Oil suspension

4.1.3. Powder

4.1.4. Emulsion

4.1.5. Powder

4.2. Global Lycopene by Source

4.2.1. Natural

4.2.2. Synthetic

4.3. Global Lycopene by Application

4.3.1. Dietary supplements

4.3.2. Food and beverages

4.3.3. Personal care products

4.3.4. Pharmaceuticals

4.4. Global Lycopene by Property

4.4.1. Health Ingredient

4.4.2. Coloring Agent

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. BASF SE

6.2. Informa PLC

6.3. DDW, Inc.

6.4. Dhler GmbH

6.5. E.I.D. Parry Ltd

6.6. Farbest Brands

6.7. Hindustan Mint and Agro Products Pvt. Ltd.,

6.8. Hunan Sunshine Bio-Tech Co., Ltd

6.9. DSM

6.10. Licofarma S.r.l.

6.11. Lycored Corp.

6.12. Pioneer Enterprise

6.13. Plamed Green Science Group

6.14. SV International LTD

6.15. San-Ei Gen F.F.I., Inc

6.16. Kingsci Biotechnology Co., Ltd

6.17. Wellgreen Technology Co. Ltd

6.18. Xian Pincredit Biotech Co Ltd

6.19. Zhejiang ICP Bei

1. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY FORM, 2022-2030 ($ MILLION)

2. GLOBAL BEADLETS LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL OIL SUSPENSION LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL POWDER LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL EMULSION LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

7. GLOBAL NATURAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL SYNTHETIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY APPLICATION 2022-2030 ($ MILLION)

10. GLOBAL LYCOPENE FOR DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL LYCOPENE FOR FOOD AND BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL LYCOPENE FOR PERSONAL CARE PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL LYCOPENE FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY PROPERTY 2022-2030 ($ MILLION)

15. GLOBAL LYCOPENE BY HEALTH INGREDIENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL LYCOPENE BY COLORING AGENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY FORM, 2022-2030 ($ MILLION)

20. NORTH AMERICAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

21. NORTH AMERICAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. NORTH AMERICAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY PROPERTY, 2022-2030 ($ MILLION)

23. EUROPEAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. EUROPEAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY FORM, 2022-2030 ($ MILLION)

25. EUROPEAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

26. EUROPEAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

27. EUROPEAN LYCOPENE MARKET RESEARCH AND ANALYSIS BY PROPERTY, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY FORM, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. ASIA-PACIFIC LYCOPENE MARKET RESEARCH AND ANALYSIS BY PROPERTY, 2022-2030 ($ MILLION)

33. REST OF THE WORLD LYCOPENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

34. REST OF THE WORLD LYCOPENE MARKET RESEARCH AND ANALYSIS BY FORM, 2022-2030 ($ MILLION)

35. REST OF THE WORLD LYCOPENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2022-2030 ($ MILLION)

36. REST OF THE WORLD LYCOPENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

37. REST OF THE WORLD LYCOPENE MARKET RESEARCH AND ANALYSIS BY PROPERTY, 2022-2030 ($ MILLION)

1. GLOBAL LYCOPENE MARKET SHARE BY FORM, 2022 VS 2030 (%)

2. GLOBAL BEADLETS LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL OIL SUSPENSION LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL POWDER LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL EMULSION LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL LYCOPENE MARKET SHARE BY SOURCE, 2022 VS 2030 (%)

7. GLOBAL NATURAL LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL SYNTHETIC LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL LYCOPENE MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

10. GLOBAL LYCOPENE FOR DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL LYCOPENE FOR FOOD AND BEVERAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL LYCOPENE FOR PERSONAL CARE PRODUCTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL LYCOPENE FOR PHARMACEUTICALS PRODUCTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL LYCOPENE MARKET SHARE BY PROPERTY, 2022 VS 2030 (%)

15. GLOBAL LYCOPENE BY HEALTH INGREDIENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL LYCOPENE BY COLORING AGENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL LYCOPENE NUTRACEUTICALS AND PHARMACEUTICALS ONLINE RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL LYCOPENE COSMETICS AND PERSONAL CARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. GLOBAL LYCOPENE MARKET SHARE BY REGION, 2022 VS 2030 (%)

21. US LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

22. CANADA LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

23. UK LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

24. FRANCE LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

25. GERMANY LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

26. ITALY LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

27. SPAIN LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF EUROPE LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

29. INDIA LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

30. CHINA LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

31. JAPAN LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

32. SOUTH KOREA LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

33. REST OF ASIA-PACIFIC LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)

34. REST OF THE WORLD LYCOPENE MARKET SIZE, 2022-2030 ($ MILLION)