Meat Alternatives Market

Global Meat Alternatives Market Size, Share & Trends Analysis Report by Product Type (Tofu, Textured Vegetable Protein, Tempeh, Seitan, Quorn, and Others), and by Source (Soy-based Meat Alternatives, Wheat-based Meat Alternatives, Mycoprotein Meat Alternatives, and Others) (Forecast Period (2021-2027)

The global meat alternatives market is anticipated to grow at a significant CAGR of 7.2% during the forecast period. The increasing vegan population due to the shift of consumers interest towards both vegetarian and vegan diet is rising the demand for plant-based ingredients and alternatives to animal protein. For instance, the 2021 vegan statistics for the UK reveal that the number of vegans in the country increased from 150,000 in 2014, to 720,000 in 2020.

Consumers are continuing to seek substitute for meat which is in turn making the companies in the meat alternative market to increase their product portfolio by introducing vegan and plant-based products in the market. This is one of the major factors propelling to the demand for meat alternatives. For instance, in 2020, ADM launched of Arcon T textured pea proteins, Prolite MeatTEX textured wheat protein and Prolite MeatXT non-textured wheat protein expanding its protein portfolio.

Impact of COVID-19 Pandemic on Global Meat Alternatives Market

COVID-19 pandemic had impacted the mental and physical wellbeing of people worldwide which has made consumers more concerned about their health. Thus, the consumer has raised the spending on health food products has been seen during the pandemic. Moreover, the meat alternative products witnessed a surge in demand as a result of shortage of meat products in retail stores. For instance, according to the statement released by Pivot Food Investment, COVID-19 pandemic resulted in an estimated $13.6B to $14.6B in losses for the cattle/beef industry.

Segmental Outlook

The global meat alternatives market is segmented based on the product type and source. Based on the product type, the market is segmented into tofu, textured vegetable protein (TVP), tempeh, seitan, quorn, and others. The other product type includes natto, quinoa, and lupine. Based on the source, the market is sub-segmented into soy-based meat alternatives, wheat-based meat alternatives, mycoprotein meat alternatives, and other sources of meat alternatives such as pea protein. The above-mentioned segments can be customized as per the requirements

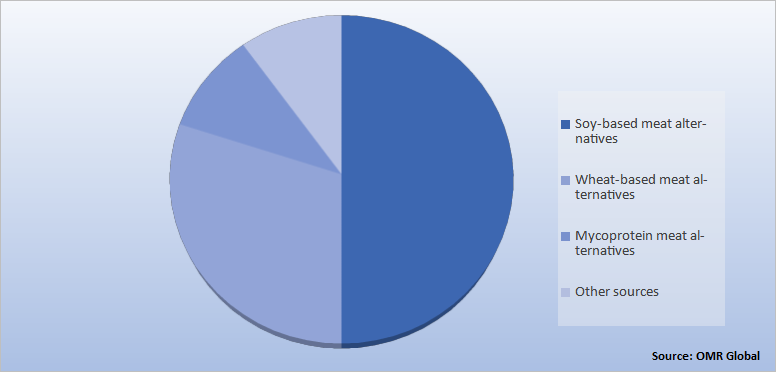

Global Meat Alternatives Market Share by Source, 2020 (%)

The Soy-Based Meat Alternatives Segment is Expected to Hold the Prominent Share in the Global Meat Alternatives Market

Based on the source, the soy-based meat alternatives segment holds the major share in 2020. Soy protein is the mostly used source of plant protein in the food industry as it is among the most nutritious, versatile, economical, and reliable sources of protein for food and beverage innovation. Soy and soy-based foods are widely used nutritional solutions for vegetarians as they provide high protein content and versatility in the production of milk substitutes. Due to numerous proven health benefits provided by soy protein is strongly augment the growth of soy-based meat alternatives. For instance, according to Physicians Committee for Responsible Medicine (PCRM) eating whole soy foods may reduce the risk of breast cancer and several other types of cancer, fibroids, and even inflammation. Soy is helpful for bone health, heart health, and menopausal symptoms. These benefits come from food made from whole soy like tofu, tempeh, edamame, soy milk, and miso.

Regional Outlooks

The global meat alternatives market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for region or country level as per the requirement.

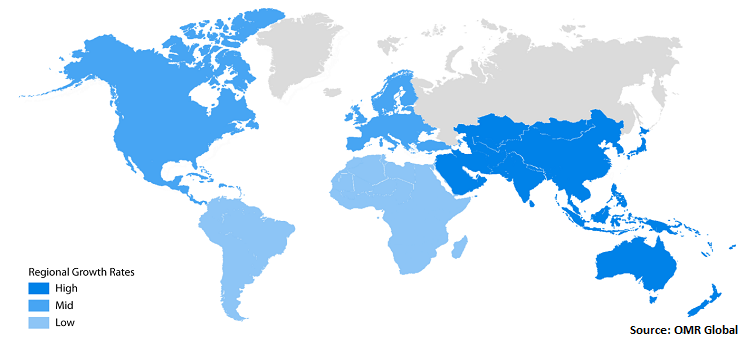

Global Meat Alternatives Market Growth, by Region, 2021-2027

The North America Region Holds the Major Share in the Global Meat Alternatives Market

The North America is expected to hold the largest market share of meat alternative market owing to the new innovations by the US companies in bringing plant-based food to meet the demand of the US consumers. The innovative offerings by the US companies for consumers who seek plant-based protein foods is positively driving the growth of meat alternatives in the region. For instance, in September 2021, Franklin Farms, a division of Keystone Natural Holdings launched new line of chickpea products to its portfolio of plant-based offerings. This new line of tofu is made from chickpeas provides consumers soy-free options that are low-fat and allergen-free. Further adding to the growth of meat alternative market in the US, in May 2021, House Foods, the Japanese tofu maker, announced to build a facility in the US state of Kentucky. House Foods plans to construct a 350,000 sq. ft facility on 30 acres in south-west Louisville to produce tofu and other food products for customers throughout the country.

Market Players Outlook

The major companies serving the global Meat Alternatives Market include A&B Ingredients, Inc, DuPont de Nemours, Inc., Keystone Natural Holdings, Morinaga Nutritional Foods, Inc., The Tofoo Company Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2021, InnovoPro has launched first ever texturized vegetable protein (TVP) made from chickpeas. TVP is used as a base for making meat alternatives such as burgers, nuggets, and sausages.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global Meat Alternatives Market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Meat Alternatives Market

• Recovery Scenario of Global Meat Alternatives Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. A&B Ingredients, Inc

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. DuPont de Nemours, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Keystone Natural Holdings

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Morinaga Nutritional Foods, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. The Tofoo Company Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Meat Alternatives Market by Product Type

4.1.1. Tofu

4.1.2. Textured vegetable protein (TVP)

4.1.3. Tempeh

4.1.4. Seitan

4.1.5. Quorn

4.1.6. Others (Natto, quinoa, and lupine)

4.2. Global Meat Alternatives Market by Source

4.2.1. Soy-based Meat Alternatives

4.2.2. Wheat-based Meat Alternatives

4.2.3. Mycoprotein Meat Alternatives

4.2.4. Others (Pea protein)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. All Organic Treasures GmbH

6.2. Archer Daniels Midland Co.

6.3. Axiom Foods, Inc.

6.4. Batory Foods

6.5. BENEO GmbH

6.6. Cauldron Foods

6.7. Cargill

6.8. Conagra Brands, Inc.

6.9. Crespel&Deiters GmbH & Co. KG

6.10. Hain Celestial Group, Inc.

6.11. House Foods America Corp.

6.12. IMARC

6.13. InnovoPro

6.14. Kerry Group plc

6.15. Loveseitan Ltd.

6.16. Meatless

6.17. MGP

6.18. Nasoya Foods USA

6.19. PURIS

6.20. Roquette Frères

6.21. Sonic Biochem

6.22. The Nisshin OilliO Group, Ltd.

6.23. Tofurky Company, Inc

6.24. VBites Foods Limited

6.25. Wilmar International Ltd

1. GLOBAL MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

2. GLOBAL TOFU MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL TEXTURED VEGETABLE PROTEIN (TVP) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL TEMPEH MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL SEITAN MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL QUORN MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2020-2027 ($ MILLION)

9. GLOBAL SOY-BASED MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL WHEAT-BASED MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL MYCOPROTEIN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL OTHER MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2020-2027 ($ MILLION)

17. EUROPEAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. EUROPEAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

24. REST OF THE WORLD MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

25. REST OF THE WORLD MEAT ALTERNATIVES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL MEAT ALTERNATIVES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL MEAT ALTERNATIVES MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL MEAT ALTERNATIVES MARKET, 2021-2027 (%)

4. GLOBAL MEAT ALTERNATIVES MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL TOFU MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL TEXTURED VEGETABLE PROTEIN (TVP) MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL TEMPEH MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL SEITAN MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL QUORN MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL OTHERS MEAT ALTERNATIVES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL MEAT ALTERNATIVES MARKET SHARE BY SOURCE, 2020 VS 2027 (%)

12. GLOBAL SOY-BASED MEAT ALTERNATIVES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL WHEAT-BASED MEAT ALTERNATIVES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL MYCOPROTEIN MEAT ALTERNATIVES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL OTHER MEAT ALTERNATIVES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL MEAT ALTERNATIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. US MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

19. UK MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

20. FRANCE MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

22. ITALY MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

23. SPAIN MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF EUROPE MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

25. INDIA MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

26. CHINA MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

27. JAPAN MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD MEAT ALTERNATIVES MARKET SIZE, 2020-2027 ($ MILLION)