Medical Devices Connectivity Market

Medical Devices Connectivity Market Size, Share & Trends Analysis Report, By Component (Solution, Services) By Technology (Wired, Wireless, Hybrid), By End-User (Hospitals, Ambulatory Care Centers, Other), Forecast Period (2022-2030)

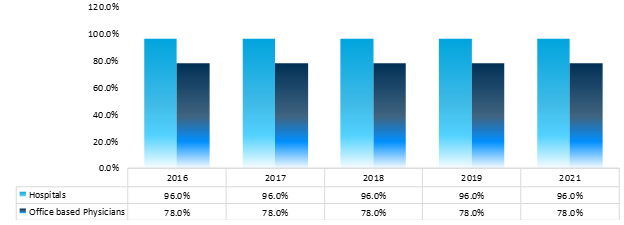

Medical devices connectivity market is anticipated to grow at a significant CAGR of 18.5% during the forecast period. The growing digitalization of healthcare infrastructure, high integration of IoT medical devices in healthcare settings, and high demand for connected medical devices is a key factor driving the growth of the global medical devices connectivity market. The rising implementation of EHRs and health information exchange systems along with the high demand for telemedicine technologies is further contributing to the market growth. According to HealthIT.Gov, as of 2021, nearly 4 in 5 office-based physicians (78%) and nearly all non-federal acute care hospitals (96%) adopted a certified EHR. This marks substantial 10-year progress since 2016 when 96% of hospitals and 78% of physicians had adopted an EHR.

Percentage of National Hospitals & Office-Based Physicians that Adopted EHRs

Source: HealthIT.Gov

The key market players are actively involved in new product launches and collaborations to expand their presence in the market. For instance, in October 2021, Royal Philips launched device drivers that enable integration and interoperability, Philips Capsule Medical Device Information Platform (MDIP). Philips Capsule MDIP integrated into the Philips HealthSuite Platform, installed in more than 3,000 healthcare facilities globally. Philips Capsule MDIP captures streaming clinical data and transforms it into actionable insights for patient care management, aiming to improve collaboration between care teams, streamline clinical workflows, and increase productivity. Such ongoing market developments are promoting the global market growth. However, the high cost of connectivity solutions restrains the growth of the global medical devices connectivity market. The rising implementation of 5G technologies in the medical device connectivity services is anticipated to offer lucrative opportunities to the market growth.

Segmental Outlook

The global medical devices connectivity market is segmented based on component, technology, and end-user. Based on component, the market is segmented into solution and services. Based on technology, the market is segmented into wired, wireless, and hybrid. Based on end-user, the market is segmented into hospitals, ambulatory care centers, and others.

Hospitals Held Considerable Share in Global Medical Devices Connectivity Market

Hospitals held considerable share in the global medical devices connectivity market based on end-user. The high market share can be attributed to the presence of large patient pool, high purchasing power of hospitals to purchase advanced medical device connectivity solutions, decreasing margins in hospitals, and rising focus on delivery high patient safety with care. Additionally, the high integration remote patient monitoring devices in hospitals for the continuous monitoring of patients is anticipated to drive the growth of this market segment.

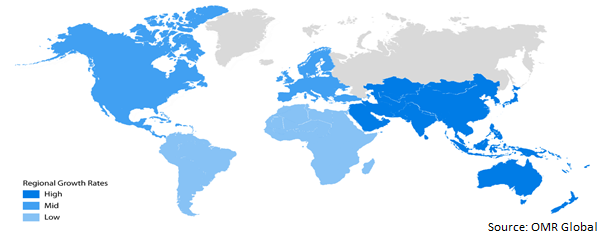

Regional Outlook

The global medical devices connectivity market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period.

Global Medical Devices Connectivity Market Growth by Region 2023-2030

North America Held Considerable Share in the Global Medical Devices Connectivity Market

The presence of advanced healthcare IT infrastructure, high penetration of connected medical devices along with high healthcare expenditure is a key contributor to the high share of the regional market. The presence of key market players across the region that are continuously working towards this segment is further contributing to the regional market growth. For instance, in April 2023, Medical artificial intelligence (AI) solution company Vuno has received a US patent for its AI-based medical image analysis technology. This patent pertains to a technology aimed at simplifying the process of correcting lesion areas identified by medical personnel during the examination of medical images such as X-rays, magnetic resonance imaging scans and computerised tomography (CT) scans in clinical environments.

Market Players Outlook

The major companies serving the global medical devices connectivity market include Capsule Technologies, Inc., Cerner Corp., Cisco Systems Inc., GE Healthcare, and Infosys Ltd. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2022, BD (Becton, Dickinson and Company) a \medical technology company, and Biocorp (Paris:ALCOR), a medical device and delivery systems manufacturer based in France have signed an agreement with the aim of using connected technology to track adherence for self-administered drug therapies, like biologics. Biocorp’s Injay is a simple and cost-effective connected solution designed to monitor the use of pre-fillable syringes in clinical studies or routine care. Through NFC technology and specific sensors to identify the product, it can confirm a complete injection and easily transfer that information to a smartphone.

Additionally, in June 2021, Max Healthcare, one of the largest healthcare providers in India with over 15 super specialty hospitals, diagnostics and integrated home care services, has launched an artificial intelligence (AI) powered device integrated patient monitoring framework. Max Healthcare has launched the service in collaboration with digital health solutions provider MyHealthcare.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medical devices connectivity market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Capsule Technologies, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cerner Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cisco Systems Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. GE Healthcare

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Infosys Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medical Devices Connectivity Market by Component

4.1.1. Solutions

4.1.2. Services

4.2. Global Medical Devices Connectivity Market by Technology

4.2.1. Wired

4.2.2. Wireless

4.2.3. Hybrid

4.3. Global Medical Devices Connectivity Market by End-User

4.3.1. Hospitals

4.3.2. Ambulatory Care Centers

4.3.3. Others (Clinics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ascom Holdings AG

6.2. Bridge-Tech Medical

6.3. Dragerwerk AG& CO. KGAA

6.4. Hil-Rom Holdings, Inc.

6.5. Ihealth Lab

6.6. Infosys Ltd.

6.7. Koninklijke Philips N.V.

6.8. Lantronix, Inc.

6.9. Medicollector LLC

6.10. NantHealth, Inc.

6.11. S3 Connected Health

6.12. Silex technology

6.13. Spectrum Medical Ltd.

6.14. Stryker Corp.

6.15. Wipro Ltd.

1. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL MEDICAL DEVICES CONNECTIVITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL MEDICAL DEVICES CONNECTIVITY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

5. GLOBAL WIRED MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL WIRELESS MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL HYBRID MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

9. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR AMBULATORY CARE CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. NORTH AMERICAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. NORTH AMERICAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

15. NORTH AMERICAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

17. EUROPEAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. EUROPEAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

19. EUROPEAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

20. EUROPEAN MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

21. ASIA-PACIFIC MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

25. REST OF THE WORLD MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. REST OF THE WORLD MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

27. REST OF THE WORLD MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

28. REST OF THE WORLD MEDICAL DEVICES CONNECTIVITY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

2. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

3. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY END-USER, 2022 VS 2030 (%)

4. GLOBAL MEDICAL DEVICES CONNECTIVITY SOLUTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL MEDICAL DEVICES CONNECTIVITY SERVICE MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL WIRED MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL WIRELESS MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL HYBRID MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR AMBULATORY CARE CENTERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL MEDICAL DEVICES CONNECTIVITY FOR OTHER MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL MEDICAL DEVICES CONNECTIVITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. US MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

14. CANADA MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

15. UK MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

16. FRANCE MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

18. ITALY MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

19. SPAIN MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF EUROPE MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

21. INDIA MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

22. CHINA MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

23. JAPAN MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

24. SOUTH KOREA MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF ASIA-PACIFIC MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD MEDICAL DEVICES CONNECTIVITY MARKET SIZE, 2022-2030 ($ MILLION)