Medication Management System Market

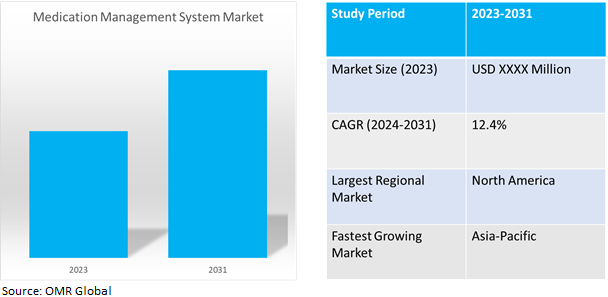

Medication Management System Market Size, Share & Trends Analysis Report by Product Type (Computerized Physician Order Entry, Clinical Decision Support System Solutions, Electronic Medication Administration Record, Inventory Management Solutions, and Others). by Mode of Delivery (Web-based, Cloud-based, and On-premise). and by End-User (Pharmacies and Retail Drug Outlets, and Hospitals and Clinics). Forecast Period (2024-2031). Update Available - Forecast 2025-2035

Medication management system market is anticipated to grow at a significant CAGR of 12.4% during the forecast period (2024-2031). The global medication management system market is driven by factors such as increasing medication errors, growing geriatric populations, and rising chronic disease burden. These factors drive the adoption of medication management systems to automate dispensing, administration, and monitoring processes, reduce adverse drug events, optimize treatment for elderly patients, and enhance patient outcomes. Technological advancements such as electronic health records, AI, and robotics drive innovation in these systems. Compliance with regulatory requirements, such as HIPAA and EU MDR, ensures medication safety and management. Prioritizing patient safety and quality of care drives the adoption of these systems. Healthcare digitalization and interoperability promote the integration of these systems with other healthcare IT platforms. Cost containment pressures and patient empowerment also contribute to the growth of the market.

Market Dynamics

Growing Number of Prescriptions and Expenditure on Medications

The rising global prescription volume and medicine spending underscore the need for efficient medication management systems to streamline workflows, enhance safety, and optimize medication utilization, ultimately improving patient outcomes. According to the IQVIA, in 2020, there were a total of 6.3 billion prescriptions dispensed, showing a modest growth rate of 1.7% after accounting for the use of 90-day prescriptions for chronic therapies. Additionally, US medicine spending experienced a slight increase of 0.8% on a net price basis, reaching $359.0 billion. This increase highlights the widening gap between list or invoice prices and manufacturer net revenues.

Technological Advancements In Healthcare Technology

The continuous progress in healthcare technology, including EHRs, clinical decision support systems, and telemedicine platforms is fueling the development of advanced medication management solutions that offer improved features and seamless integration to drive market growth. According to the World Health Organization (WHO), in September 2023, in the healthcare industry, patient injury is a major problem that influences 10.0% of patients and results in over 3 million fatalities each year from improper treatment. Even greater rates are seen in low- to middle-income nations, where 4 out of every 100 deaths are attributed to subpar care. More than half of cases are preventable, with drugs being the primary cause. Patient damage is frequently caused by adverse events, including drug errors, dangerous surgical procedures, and infections linked to healthcare. Better results and significant cost savings can result from investing in measures to lessen injuries to patients, such as patient engagement.

Market Segmentation

Our in-depth analysis of the global medication management system market includes the following segments by product type, mode of delivery and end-user:

- Based on product type, the market is sub-segmented into computerized physician order entry, clinical decision support system solutions, electronic medication administration records, inventory management solutions, and others (medication dispensing systems, and pharmacy automation systems).

- Based on the mode of delivery, the market is bifurcated into web-based, cloud-based, and on-premise.

- Based on end-user, the market is sub-segmented into Pharmacies, and Retail Drug Outlets, and Hospitals and Clinics.

Clinical Decision Support System Solutions is Projected to Emerge as the Largest Segment

Based on the product type, the global medication management system market is sub-segmented into computerized physician order entry, clinical decision support system solutions, electronic medication administration records, inventory management solutions, and others. Among these, the clinical decision support system solutions sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes AI and ML advancements are driving the development of AI-powered CDSS solutions, enabling the analysis of large datasets to generate personalized treatment recommendations and clinical insights. For instance, in February 2024, Elsevier Health launched ClinicalKey AI, a clinical decision support tool that combines trusted medical content with artificial intelligence to assist clinicians at the point of care. The solution offers high-quality curated content and constantly refreshed evidence-based research, ensuring optimal patient experiences in clinics and hospitals. ClinicalKey AI was developed in collaboration with Cone Health and the University of New Mexico and has been used by over 30,000 physicians across the US.

Cloud-based Sub-segment to Hold a Considerable Market Share

The increasing demand for data-driven insights and personalized medicine is driving the adoption of cloud-based platforms for detailed analysis of health-related data for medication management. For instance, in March 2023, Fujitsu introduced a cloud-based platform that securely collects and uses health-related data for digital transformation in the medical field. The platform conforms to the HL7 FHIR framework and enables detailed analysis in medical practice, clinical research, and drug development, with potential applications in individualized healthcare.

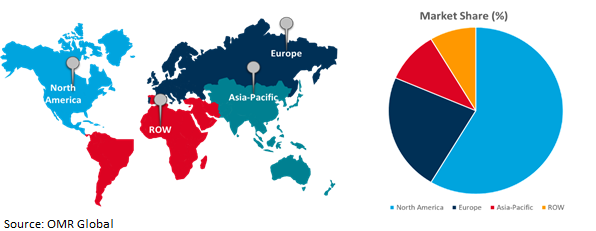

Regional Outlook

The global medication management system market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growth of the Pharmaceutical Industry In the Aisa-Pacific Region

The demand for medication management systems, such as pharmacy automation, inventory management, and prescription management software, has been boosted by the rise of the pharmaceutical business in India. These systems are needed to streamline procedures in healthcare institutions. According to the Economic Times, in Janurary 2024, In the fiscal year of 2023, India's pharmaceutical imports accounted for a significant amount of $7.9 billion. The majority of these imports, approximately 85.0% to 90.0%, were comprised of bulk drugs (55.0%) and pharmaceutical formulations (30.0% to 35.0%).

Global Medication Management System Market Growth by Region 2024-2031

North America Holds Major Market Share

The global medication management system market is expanding owing to the growing demand for safe, effective solutions for home healthcare, providing patients with convenient, user-friendly tools for injectable medication management. For instance, in March 2022, Hamilton Beach Brands and HealthBeacon developed the Smart Sharps Bin, a digital health tool for managing injectable medications at home. The device offers intelligent reminders, tracking adherence, 24/7 customer care, and safe disposal of used syringes through the US Postal Service's mail-back program.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global medication management system market include Cerner Corp., Epic Systems Corp., GE HealthCare Technologies Inc., McKesson Corp., and Omnicell, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive. For instance, in March 2021, BD acquired GSL Solutions to improve inventory management, regulatory compliance, and patient safety in retail pharmacies, addressing market consolidation, increasing prescriptions, and changing controlled substance regulations.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global medication management system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Becton, Dickinson and Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE HealthCare Technologies Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Siemens Healthineers Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Medication Management System Market by Product Type

4.1.1. Computerized Physician Order Entry

4.1.2. Clinical Decision Support System Solutions

4.1.3. Electronic Medication Administration Record

4.1.4. Inventory Management Solutions

4.1.5. Others (Medication Dispensing Systems, and Pharmacy Automation Systems)

4.2. Global Medication Management System Market by Mode of Delivery

4.2.1. Web-based

4.2.2. Cloud-based

4.2.3. On-premise

4.3. Global Medication Management System Market by End User

4.3.1. Pharmacies and Retail Drug Outlets

4.3.2. Hospitals and Clinics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. A-S Medication Solutions.

6.2. athenahealth, Inc.

6.3. Baxter International, Inc.

6.4. Becton, Dickinson and Co.

6.5. Cerner Corp.

6.6. eClinicalWorks, LLC

6.7. Epic Systems Corp.

6.8. Fresenius Kabi AG

6.9. InterSystems Corp.

6.10. McKesson Corp.

6.11. Medical Information Technology, Inc.

6.12. Omnicell, Inc.

6.13. PharMerica Corp.

6.14. QuadraMed Corp.

6.15. Swisslog Healthcare AG

6.16. Terumo Group

6.17. Veradigm LLC

6.18. Wolters Kluwer N.V.

1. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL COMPUTERIZED PHYSICIAN ORDER ENTRY MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CLINICAL DECISION SUPPORT SYSTEM SOLUTIONS MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ELECTRONIC MEDICATION ADMINISTRATION RECORD MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL INVENTORY MANAGEMENT SOLUTIONS MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER PRODUCT TYPE MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2023-2031 ($ MILLION)

8. GLOBAL WEB-BASED MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CLOUD-BASED MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ON-PREMISE MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

12. GLOBAL MEDICATION MANAGEMENT SYSTEM IN PHARMACIES AND RETAIL DRUG OUTLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL MEDICATION MANAGEMENT SYSTEM IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

19. EUROPEAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2023-2031 ($ MILLION)

22. EUROPEAN MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

27. REST OF THE WORLD MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY MODE OF DELIVERY, 2023-2031 ($ MILLION)

30. REST OF THE WORLD MEDICATION MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY END USER, 2023-2031 ($ MILLION)

1. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL COMPUTERIZED PHYSICIAN ORDER ENTRY MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CLINICAL DECISION SUPPORT SYSTEM SOLUTIONS MEDICATION MANAGEMENT SYSTEM MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ELECTRONIC MEDICATION ADMINISTRATION RECORD MEDICATION MANAGEMENT SYSTEM MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL INVENTORY MANAGEMENT SOLUTIONS MEDICATION MANAGEMENT SYSTEM MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER PRODUCT TYPE MEDICATION MANAGEMENT SYSTEM MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY MODE OF DELIVERY, 2023 VS 2031 (%)

8. GLOBAL WEB-BASED MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CLOUD-BASED MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ON-PREMISE MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY END-USER, 2023 VS 2031 (%)

12. GLOBAL MEDICATION MANAGEMENT SYSTEM IN PHARMACIES AND RETAIL DRUG OUTLETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MEDICATION MANAGEMENT SYSTEM IN HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL MEDICATION MANAGEMENT SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

17. UK MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA MEDICATION MANAGEMENT SYSTEM MARKET SIZE, 2023-2031 ($ MILLION)