Metabolic Disorder Therapeutics Market

Global Metabolic Disorder Therapeutics Market Size, Share & Trends Analysis Report, By Therapy (Drug Therapy, Gene Therapy, Cellular Transplantation, Enzyme Replacement Therapy, and Others), By Disease (Obesity, Diabetes, Lysosomal Storage Disease, Hypercholesterolemia, and Others) and Forecast, 2020-2026

The global metabolic disorder therapeutics market is estimated to grow at a CAGR of 7.8% during the forecast period. The rising prevalence of chronic diseases and rising awareness regarding metabolic disorders is contributing to the growth of the market. As per the World Health Organization (WHO), global obesity has approximately tripled since 1975. In 2016, over 1.9 million adults, aged 18 years and more were overweight and among these, 650 million were obese. In 2016, 39% of adults aged 18 years and more were overweight and 13% were obese. A metabolic disorder is closely associated with obesity, overweight, and inactivity. It is also associated with the condition referred to as insulin resistance.

Obesity and overweight are significant risk factors for the development of metabolic syndrome. As per Diabetes UK, obesity is expected to account for 80-85% of the risk of developing type 2 diabetes. Metabolic syndrome is one of the major public health threats and is associated with increased risk of type-2 diabetes, non-alcoholic fatty liver disease (NAFLD), and heart disease, which can lead to liver cancer and liver fibrosis. Therefore, increasing obese population leads to an increased risk of developing metabolic syndrome in the obese population. This, in turn, drives the demand for therapies used for metabolic disorders such as enzyme replacement therapy, drug therapy, and gene therapy.

There is an increasing focus on drug development to combat metabolic syndrome. For instance, in October 2019, Yale University developed a new drug that reduces a host of abnormalities linked with metabolic syndrome. The university reports that drugs administered to non-human primates safely decrease bad cholesterol (LDL) and plasma triglycerides and reverses liver insulin resistance, and NAFLD, which are the key driver of type-2 diabetes and heart disease. In October 2019, the scientists at Yale University developed a time-released version of the drug that particularly targets cells in the liver, which are responsible to mediate several associated metabolic abnormalities linked with Type 2 diabetes and metabolic syndrome.

The researchers reported that the modification increased the safety and efficacy of the drug by 100-fold. The study was financed by grants from the Gilead Sciences and the US Public Health Services of the National Institutes of Health. The development of new therapies for metabolic disorders will eventually increase the reliability, safety, and efficacy of the treatment for patients with metabolic disorders. This, in turn, will further propel the growth of the market. Additionally, an increasing number of clinical trials for metabolic disorders will further accelerate the opportunity for the introduction of novel potential therapies.

Market Segmentation

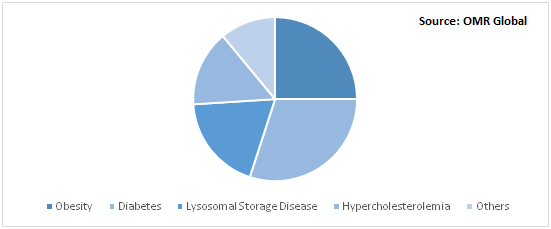

The global metabolic disorder therapeutics market is segmented based on type and disease. Based on type, the market is classified into drug therapy, gene therapy, cellular transplantation, enzyme replacement therapy, and others. Based on disease, the market is classified into obesity, diabetes, lysosomal storage disease, hypercholesterolemia, and others.

Diabetes to Hold Potential Share in the Market

Diabetes mellitus is simply known as diabetes in which the pancreas doesn’t produce adequate insulin to control the amount of sugar or glucose in the blood. It is a group of metabolic disorders that normally resulting from inadequate production of type 1 diabetes (hormone insulin) or an ineffective response of cells to insulin (type 2 diabetes). Currently, insulin-sensitizing drugs, including thiazolidinediones and metformin, are part of the treatment of type 2 diabetes and can also be utilized in patients suffering from metabolic syndrome. Metformin is an oral drug utilized to reduce blood glucose concentrations among patients with type-2 diabetes, primarily in patients who are obese and as well as those patients with normal renal function. Therefore, the increasing prevalence of diabetes is in turn, is driving the demand for these metabolic therapies.

Global Metabolic Disorder Therapeutics Market Share by Disease, 2019 (%)

Regional Analysis

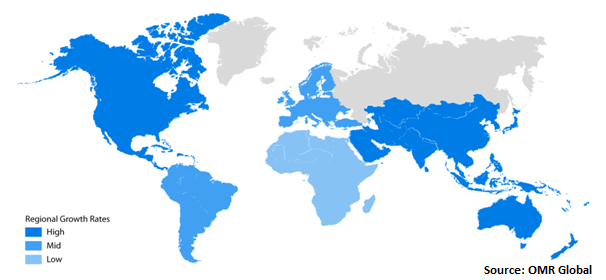

Geographically, North America is expected to hold a potential share in the market owing to the rising prevalence of metabolic disorders and considerable awareness regarding health in the region. Additionally, significant development of metabolic disorder therapies is supporting to encourage market growth. The availability of funds to develop new innovative therapies is the major cause of the rising number of clinical trials and drug launches in the region. Asia-Pacific is estimated to grow at a significant CAGR during the forecast period, owing to the increasing prevalence of obesity and diabetes in the region. A large number of obese population has been witnessed in China. Effective treatment of obesity is required to reduce the associated risk of developing severe conditions, which in turn, is escalating the market growth.

Global Metabolic Disorder Therapeutics Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include AbbVie, Inc., Novo Nordisk A/S, Sanofi SA, Boehringer Ingelheim GmbH, and AstraZeneca plc. Partnerships and collaborations, product launches, and mergers and acquisitions are considered as a vital strategy adopted by the market players to increase their competitiveness. For instance, in March 2020, Eli Lilly and Co. declared the global licensing and research partnership with Sitryx, a biopharmaceutical company engaged in the development of therapeutics in immuno-inflammation and immuno-oncology. Under the partnership, the companies will study up to four new preclinical targets that are identified by Sitryx that could result in potential new medicines for autoimmune diseases. Lilly will make a $10 million equity investment in Sitryx and Sitryx will get an upfront payment of $50 million.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global metabolic disorder therapeutics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. AbbVie, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Novo Nordisk A/S

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Sanofi S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Boehringer Ingelheim GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. AstraZeneca plc

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Metabolic Disorder Therapeutics Market by Therapy

5.1.1. Drug Therapy

5.1.2. Gene Therapy

5.1.3. Cellular Transplantation

5.1.4. Enzyme Replacement Therapy

5.1.5. Others

5.2. Global Metabolic Disorder Therapeutics Market by Disease

5.2.1. Obesity

5.2.2. Diabetes

5.2.3. Lysosomal Storage Disease

5.2.4. Hypercholesterolemia

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie, Inc.

7.2. Actelion Pharmaceuticals, Ltd.

7.3. Agios Pharmaceuticals, Inc.

7.4. Alexion Pharmaceuticals, Inc.

7.5. Amgen, Inc.

7.6. AstraZeneca plc

7.7. Biocon, Ltd.

7.8. BioMarin Pharmaceutical, Inc.

7.9. Boehringer Ingelheim GmbH

7.10. Bristol-Myers Squibb Co.

7.11. Cipla, Inc.

7.12. CymaBay Therapeutics, Inc.

7.13. Dracen Pharmaceuticals, Inc.

7.14. Eli Lilly and Co.

7.15. Intra-Cellular Therapies, Inc.

7.16. Merck KGaA

7.17. Novo Nordisk A/S

7.18. Orchard Therapeutics plc

7.19. Pfizer, Inc.

7.20. Sanofi S.A.

7.21. Shire Pharmaceuticals Group plc

7.22. Sigilon Therapeutics, Inc.

7.23. Silence Therapeutics

1. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY THERAPY, 2019-2026 ($ MILLION)

2. GLOBAL DRUG THERAPY FOR METABOLIC DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GENE THERAPY FOR METABOLIC DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CELLULAR TRANSPLANTATION FOR METABOLIC DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ENZYME REPLACEMENT THERAPY FOR METABOLIC DISORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

8. GLOBAL METABOLIC DISORDER THERAPEUTICS FOR OBESITY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL METABOLIC DISORDER THERAPEUTICS FOR DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL METABOLIC DISORDER THERAPEUTICS FOR LYSOSOMAL STORAGE DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL METABOLIC DISORDER THERAPEUTICS FOR HYPERCHOLESTEROLEMIA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL METABOLIC DISORDER THERAPEUTICS FOR OTHER METABOLIC DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY THERAPY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

17. EUROPEAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY THERAPY, 2019-2026 ($ MILLION)

19. EUROPEAN METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY THERAPY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY THERAPY, 2019-2026 ($ MILLION)

24. REST OF THE WORLD METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

1. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET SHARE BY THERAPY, 2019 VS 2026 (%)

2. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET RESEARCH AND ANALYSIS BY DISEASE, 2019-2026 ($ MILLION)

3. GLOBAL METABOLIC DISORDER THERAPEUTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD METABOLIC DISORDER THERAPEUTICS MARKET SIZE, 2019-2026 ($ MILLION)