Microarray Market

Microarray Market Size, Share & Trends Analysis by Type (DNA Microarrays, Protein Microarray, Peptide Microarray, Tissue Microarray, and Others), By Application (Diagnosis & Prognosis, Pharmacogenomics & Theragnostic, Drug Discovery, and Others), Forecast Period (2025-2035)

Industry Overview

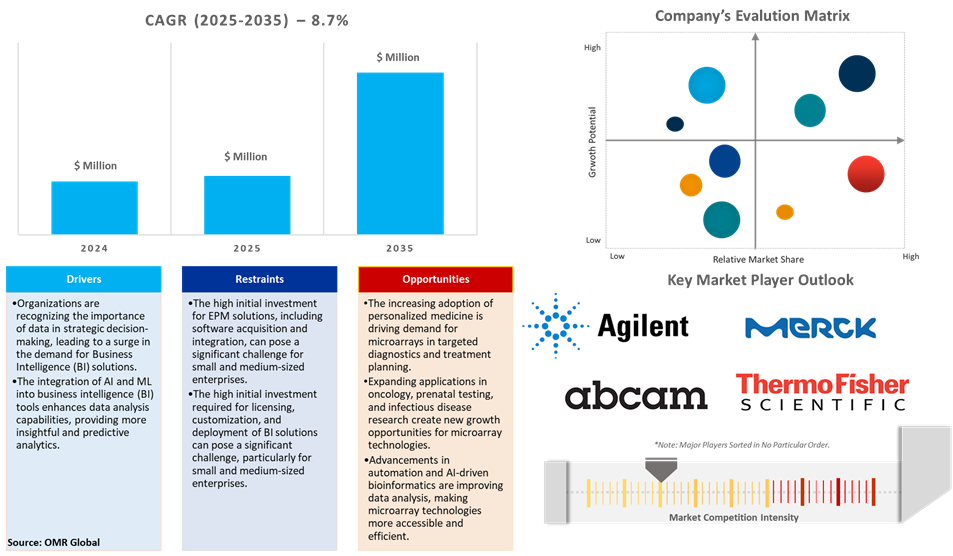

Microarray market was valued at $5.8 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2035. Microarrays are one of the powerful technologies for the analysis of gene expression that can be used for various experimental purposes. The developments of microarrays have enhanced the results of genetic testing. Microarrays are used in a variety of applications, including gene discovery, disease diagnosis, drug discovery, and toxicological research. The rising incidences of cancer are the major factor contributing to the growth of the market. Moreover, the increasing prevalence of various chronic diseases and the rise of the usage of microarray technology for the diagnosis of such infectious diseases are also contributing to the growth of the microarray market. The growing regulatory approvals to push clinical adoption of advanced diagnostic solutions are expected to drive the global microarray market during the forecast period. For instance, in April 2025, AliveDx announced the submission of FDA 510(k) for MosaiQ AiPlex CTDplus Multiplex Microarray in the U.S. This advanced diagnostic technology aims to enhance the detection of connective tissue diseases while simplifying laboratory workflows.

Market Dynamics

Technological Advancements in Microarrays

The continuous improvements in microarray technologies to enhance data analysis, faster turnaround times, and shorter cycle is expected to increase adoption in research and clinical settings. The modern microarrays have higher sensitivity and specificity, allowing precise identification of rare gene expressions and minute genetic variations. For instance, in December 2024, LinkZill announced the launch of TruArray, a TFT-DNA synthesis technology High-Throughput Oligonucleotide Microarray Chip. The microarray offers high customization flexibility and exceptional synthesis accuracy. Its rapid turnaround, strong uniformity, and broad application scope make it ideal for research, diagnostics, and synthetic biology.

Expansion in Biotechnology and Life Sciences

The increasing integration of microarrays in biotechnology and life sciences is expected to bolster the growth of the market during the forecast period. The recent advancements in microarray technology significantly contribute to biomarker discovery enhancing early disease detection and personalized medicine. For instance, in June 2024, University of Michigan researchers identified a 15-gene signature associated with clear cell renal cancer recurrence. This biomarker enables more precise risk stratification, potentially guiding tailored surveillance and treatment strategies for patients.

Market Segmentation

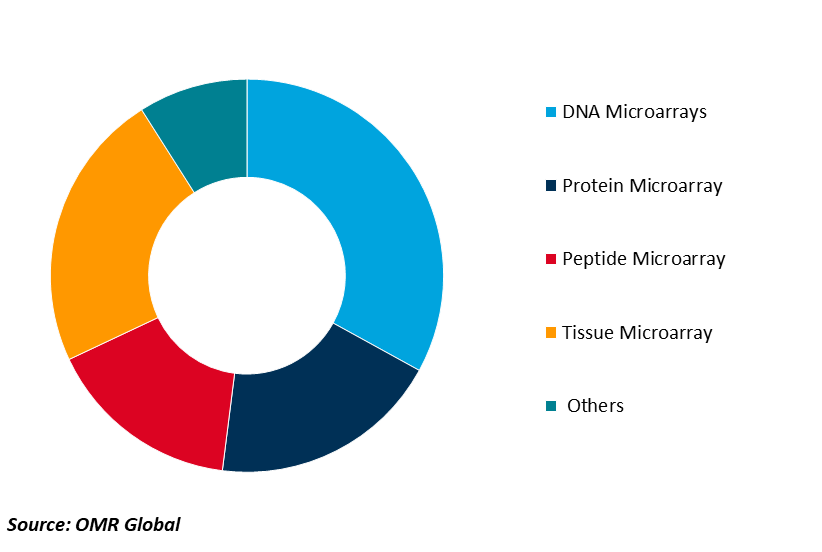

- Based on the Type, the market is segmented into DNA Microarrays, Protein Microarray, Peptide Microarray, Tissue Microarray, and Others.

- Based on the Application, the market is segmented into Diagnosis & Prognosis, Pharmacogenomics & Theragnostic, Drug Discovery, and Others.

DNA Microarrays Segment to Lead the Market with the Largest Share

The market for DNA microarrays is increasing owing to the adoption of personalized medicine, cancer research, and infectious disease testing. DNA microarrays can detect thousands of genetic variations and are considered an essential tool for genomic research, clinical diagnostics, and drug discovery. The growing importance of genetic testing and prenatal testing is expected to propel the growth of the market during the forecast period. For instance, in November 2023, Variantyx launched IriSight CNV Analysis. IriSight CNV Analysis is a whole genome-based test designed to detect chromosomal abnormalities linked to clinical symptoms in a fetus or pregnancy, potentially indicating a genetic disorder or risk of pregnancy loss.

Global Microarray Market Share by Type, 2024 (%)

Diagnosis & Prognosis: A Key Segment in Market Growth

Among application segments, the diagnosis and prognosis are expected to drive the market growth significantly owing to the rising prevalence of genetic and chronic disease, technological advancements to enhance diagnostic accuracy and speed, and continuous regulatory support and approvals by regulatory bodies. The increasing FDA approvals for microarray diagnostic kits for clinical accuracy and to increase in adoption in hospitals and laboratories are expected to grow the market at a substantial growth rate. For instance, in August 2024, Illumina announced that the company had got approval from the Food and Drug Administration (FDA) for its vitro diagnostic (IVD) TruSight™ Oncology (TSO) comprehensive test and its first two companion diagnostic (CDx) indications. The approved Illumina's TruSight Oncology Comprehensive (TOC) a microarray-based in vitro diagnostic can interrogate more than 500 genes to profile a patient's solid tumor. It helps to increase identifying an immuno-oncology biomarker or clinically actionable biomarkers that enable targeted therapy options or clinical trial enrollment.

Regional Outlook

The global microarray market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Innovation, Research, and Funding for Microarray in North America

North America is projected to have a significant share in the global microarray market due to factors such as the presence of a well-developed genetic research sector, continuous strategic initiatives by key market players, and increasing institutional and government funding. For instance, in August 2023, Thermo Fisher Scientific launched a new chromosomal microarray. The microarray is designed to improve cytogenetic research lab productivity, efficiency, and profitability. The CytoScan™ HD Accel array can inspect the whole human genome and assist with improved coverage in more than 5,000 critical genome regions.

Asia-Pacific Region Holds Significant Market Share in the Microarray Market

Asia-Pacific holds a significant share owing to an increase in funding from the government in the healthcare sector, rising awareness towards personalized and precision medicines, and increasing various genome sequencing projects in the following region. In addition, the strategic initiatives by the key companies in the region such as Agilent Technologies Inc, F. Hoffmann-La Roche Ltd, bioMerieux S.A., and Bio-Rad Laboratories Inc., among others are expected to propel the market growth during the forecast period. For instance, in September 2024, PacBio announced the HiFi Solves sub-fertility consortium in Asia Pacific. Utilizing PacBio HiFi long-read sequencing, the consortium, led by KK Women’s and Children’s Hospital (KKH) in Singapore, is pioneering the use of PacBio HiFi long-read sequencing to enhance the diagnosis and treatment of subfertility and recurrent miscarriages (RPL). HiFi sequencing offers more than traditional methods like karyotyping, chromosomal microarray, and whole-exome sequencing. It offers a comprehensive, high-resolution approach that identifies complex chromosomal rearrangements and sub-microscopic abnormalities that other technologies may miss.

Market Players Outlook

The major companies operating in the global microarray market include Agilent Technologies, Inc., Abcam Plc, Illumina, Inc., SCHOTT AG, and Thermo Fisher Scientific, Inc. among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In August 2023, Thermo Fisher Scientific launched a new chromosomal microarray to improve cytogenetic research lab productivity, efficiency, and profitability with a two-day turnaround time. Applied Biosystems CytoScan HD Accel array delivers insights on chromosomal variants across prenatal, postnatal, and oncology research applications, analyzing the whole human genome with enhanced coverage in over 5,000 critical regions.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microarray market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Microarray Market Sales Analysis – Type | Application ($ Million)

• Microarray Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Microarray Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Microarray Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Microarray Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Microarray Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Microarray Market Revenue and Share by Manufacturers

• Microarray Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Agilent Technologies, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Abcam Plc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Illumina, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. SCHOTT AG

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Thermo Fisher Scientific, Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Microarray Market Sales Analysis by Type ($ Million)

5.1. DNA Microarray

5.2. Protein Microarray

5.3. Peptide Microarray

5.4. Tissue Microarray

5.5. Others

6. Global Microarray Market Sales Analysis by Application ($ Million)

6.1. Diagnosis & Prognosis

6.2. Pharmacogenomics & Theragnostic

6.3. Drug Discovery

6.4. Others

7. Regional Analysis

7.1. North American Microarray Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Microarray Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Microarray Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Microarray Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Abcam Plc

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Agilent Technologies, Inc.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Arrayit Corp.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Aurora Biomed Inc.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Bio-Rad Laboratories, Inc.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. bioMérieux SA

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Danaher Corp.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. DiaSorin S.p.A

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. GeneDx, LLC

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. F. Hoffmann-La Roche Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Illumina, Inc.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Indevr, Inc.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Merck KGaA

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Meso Scale Diagnostics, LLC.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Microarrays Inc.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Molecular Devices, LLC

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Origene Technologies, Inc.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Pantomics, Inc.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. PerkinElmer, Inc.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. QIAGEN GmbH

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. RayBiotech, Inc.

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. SCHOTT AG

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. Takara Bio, Inc.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Thermo Fisher Scientific, Inc.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. TissueArray.com

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

1. Global Microarray Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global DNA Microarrays Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Protein Microarrays Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Peptide Microarrays Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Tissue Microarray Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Others Microarray Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Microarray Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Microarray For Diagnosis & Prognosis Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Microarray For Pharmacogenomics & Theragnostic Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Microarray For Drug Discovery Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Microarray For Others Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Microarray Market Research And Analysis By Geography, 2024-2035 ($ Million)

13. North American Microarray Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Microarray Market Research And Analysis By Type, 2024-2035 ($ Million)

15. North American Microarray Market Research And Analysis By Application, 2024-2035 ($ Million)

16. European Microarray Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Microarray Market Research And Analysis By Type, 2024-2035 ($ Million)

18. European Microarray Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Asia-Pacific Microarray Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Asia-Pacific Microarray Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Asia-Pacific Microarray Market Research And Analysis By Application, 2024-2035 ($ Million)

22. Rest Of The World Microarray Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Rest Of The World Microarray Market Research And Analysis By Type, 2024-2035 ($ Million)

24. Rest Of The World Microarray Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Microarray Market Share By Type, 2024 Vs 2035 (%)

2. Global DNA Microarrays Market Share By Region, 2024 Vs 2035 (%)

3. Global Protein Microarrays Market Share By Region, 2024 Vs 2035 (%)

4. Global Peptide Microarray Market Share By Region, 2024 Vs 2035 (%)

5. Global Tissue Microarray Market Share By Region, 2024 Vs 2035 (%)

6. Global Others Microarray Market Share By Region, 2024 Vs 2035 (%)

7. Global Microarray Market Share By Application, 2024 Vs 2035 (%)

8. Global Microarray For Diagnosis & Prognosis Market Share By Region, 2024 Vs 2035 (%)

9. Global Microarray For Pharmacogenomics & Theragnostic Market Share By Region, 2024 Vs 2035 (%)

10. Global Microarray For Drug Discovery Market Share By Region, 2024 Vs 2035 (%)

11. Global Microarray For Others Market Share By Region, 2024 Vs 2035 (%)

12. Global Microarray Market Share By Region, 2024 Vs 2035 (%)

13. US Microarray Market Size, 2024-2035 ($ Million)

14. Canada Microarray Market Size, 2024-2035 ($ Million)

15. UK Microarray Market Size, 2024-2035 ($ Million)

16. France Microarray Market Size, 2024-2035 ($ Million)

17. Germany Microarray Market Size, 2024-2035 ($ Million)

18. Italy Microarray Market Size, 2024-2035 ($ Million)

19. Spain Microarray Market Size, 2024-2035 ($ Million)

20. Russia Microarray Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Microarray Market Size, 2024-2035 ($ Million)

22. India Microarray Market Size, 2024-2035 ($ Million)

23. China Microarray Market Size, 2024-2035 ($ Million)

24. Japan Microarray Market Size, 2024-2035 ($ Million)

25. South Korea Microarray Market Size, 2024-2035 ($ Million)

26. ASEAN Microarray Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Microarray Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Microarray Market Size, 2024-2035 ($ Million)

29. Latin America Microarray Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Microarray Market Size, 2024-2035 ($ Million)

FAQS

The size of the Microarray market in 2024 is estimated to be around $5.8 billion.

North America holds the largest share in the Microarray market.

Leading players in the Microarray market include Agilent Technologies, Inc., Abcam Plc, Illumina, Inc., SCHOTT AG, and Thermo Fisher Scientific, Inc. among others.

Microarray market is expected to grow at a CAGR of 8.7% from 2025 to 2035.

Advancements in genomics, rising demand for personalized medicine, and increasing chronic diseases drive the Microarray market growth.