Microfinance Market

Global Microfinance Market Size, Share & Trends Analysis Report by Service Type (Group and Individual Micro Credit, Insurance, Leasing, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global microfinance market is growing at a significant CAGR of around 14.8% during the forecast period (2020-2026). Microfinance industry serves the low-income and more overlooked sections of the society. In the recent years, the microfinance industry has reached out a number of small borrowers with significant assistance from the government. Therefore, a modest growth in the global microfinance industry is seen in the last decade. The growth is supported by the continuous establishment of microfinance institutions across the globe. The World Bank estimated that over 7,000 microfinance institutions are operating across the globe, serving nearly 16 million low-income people in emerging economies, such as India and Bangladesh.

Along with the growth of the microfinance institutions, the government support for women empowerment in rural areas is further offering growth to the microfinance industry. According to the Convergences World Forum, nearly 80% of the borrowers of microfinance were females in 2018. For instance, Grameen Bank in Bangladesh, women account for over 94% of all the loan borrowers, as per the Global Development Research Center (GDRC). Such factors offer a significant market capitalization for the microfinance industry during the forecast period. However, the outbreak of COVID-19 pandemic has significantly affected the microfinance industry. it can be seen that the revenue of the industry is threatened as the customers are affected by the global macroeconomic collapse, social distancing, and other COVID-19 norms to control the pandemic. Therefore, many microfinance institutions have suspended repayments, owing to which, there is no income coming-in to the industry.

Segmental Outlook

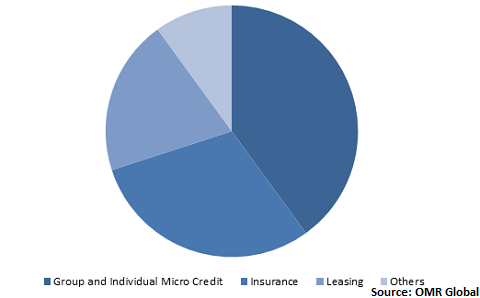

The microfinance market is classified on the basis of the services offered by the industry, which includes group and individual micro credit, insurance, leasing, and others. Among these services, the group and individual micro credit contributes major share in the microfinance market. The major factors that can be accredited for the dominance of the group and individual micro credits industry include the business loans to small and medium enterprises. In addition, it includes salary loans to the employee having low income, and individual cashflow solutions for the micro-entrepreneurs. Moreover, the group and individual micro credit industry is estimated to project a considerable CAGR during the forecast period. This growth is backed by the rising initiatives by the government in driving the micro, small, and medium enterprises (MSME) in emerging economies, such as India.

Global Microfinance Market Share by Service Type, 2019 (%)

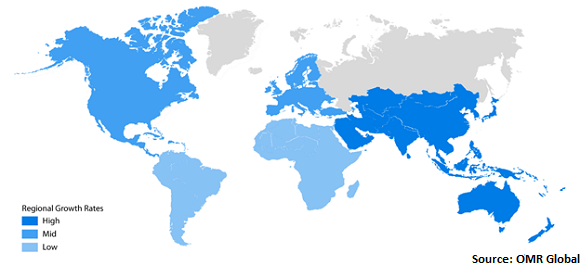

Regional Outlook

The global microfinance market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America and Europe are expected to project a considerable growth in the global microfinance market during the forecast period. In Europe, the major countries that contributes in the regional market growth includes Germany, UK, and Switzerland. In North America, the US contributes majorly in the North American microfinance market. The microfinance industry attains a small share from the North American region; there were projections made by the financial bodies, such as Federal Reserve System of the US, regarding the exemplary growth and opportunity to the microfinance in the US during the forecast period. Kiva and Accion International are among the leading microfinance institutes in the US.

Global Microfinance Market Growth, by Region 2020-2026

Asia-Pacific contributes significantly in the global microfinance market

Asia-Pacific holds a significant share in the global microfinance market. In Asia-Pacific, India has the largest microfinance market globally, followed by Bangladesh. The Government of India (GoI) is continuously striving in the promotion of financial annexation in the banking sector through initiatives that are targeted primarily to bring the India’s underbanked population under the banking array. The Government of India has introduced several reforms to regulate, liberalise, and enhance the finance sector of the country. The Government and Reserve Bank of India (RBI) have taken several measures to facilitate easy access to finance for Micro, Small and Medium Enterprises (MSMEs). These measures include unleashing Credit Guarantee Fund Scheme for Micro and Small Enterprises, along with issuing guideline to banks regarding collateral requirements and setting up a Micro Units Development and Refinance Agency (MUDRA).

Market Players Outlook

The key players in the microfinance market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global microfinance market include Accion International, Bandhan Bank Ltd., Bangladesh Rural Advancement Committee (BRAC), Grameen Bank, Jamii Bora Bank, Kiva Microfunds, and National Bank for Agriculture and Rural Development (NABARD). These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in March 2020, Bandhan Bank Ltd. launched 125 new outlets across 15 states in India. Though such expansion, the bank is seeing opportunities and setting up its presence in the largest microfinance market across the globe.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microfinance market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Microfinance Market by Service Type

5.1.1. Group and Individual Micro Credit

5.1.2. Insurance

5.1.3. Leasing

5.1.4. Others (Micro Investment Funds)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Accion International

7.2. Adie

7.3. Asirvad Micro Finance Ltd. (Manappuram Finance Ltd.)

7.4. Bajaj Finance Ltd.

7.5. Bancamía S.A.

7.6. Banco do Nordeste do Brasil SA

7.7. Bandhan Bank Ltd.

7.8. Bangladesh Rural Advancement Committee (BRAC)

7.9. BSS Microfinance Ltd.

7.10. CreditAccess Grameen Ltd.

7.11. Equitas Small Finance Bank Ltd.

7.12. Fusion Microfinance

7.13. Grameen Bank

7.14. ICICI Bank

7.15. Jamii Bora Bank

7.16. Kiva Microfunds

7.17. microStart SCRL

7.18. National Bank for Agriculture and Rural Development (NABARD)

7.19. PT Bank Rakyat Indonesia Tbk

7.20. Qredits Microfinanciering Nederland

7.21. Ujjivan Financial Services Ltd.

1. GLOBAL MICROFINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2019-2026 ($ MILLION)

2. GLOBAL GROUP AND INDIVIDUAL MICRO CREDIT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL LEASING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MICROFINANCE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN MICROFINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN MICROFINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2019-2026 ($ MILLION)

9. EUROPEAN MICROFINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. EUROPEAN MICROFINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC MICROFINANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC MICROFINANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

13. REST OF THE WORLD MICROFINANCE MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL MICROFINANCE MARKET SHARE BY SERVICE TYPE, 2019 VS 2026 (%)

2. GLOBAL MICROFINANCE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

5. UK MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD MICROFINANCE MARKET SIZE, 2019-2026 ($ MILLION)