Microfluidics Market

Microfluidics Market Size, Share & Trends Analysis By Component (Microfluidic Chips, Micro Pumps, Microneedles, Microfluidic Actuators, Microvalves, Microchannels, Microwells, And Others), By Material (Polymer, Silicon, Glass, Other Materials), By Application (Lab-On-A-Chip, Organs-On-Chips, Continuous Flow Microfluidics, Optofluidics, Acoustofluidics, Electrophoresis) And Forecast Period (2025-2035)

Industry Overview

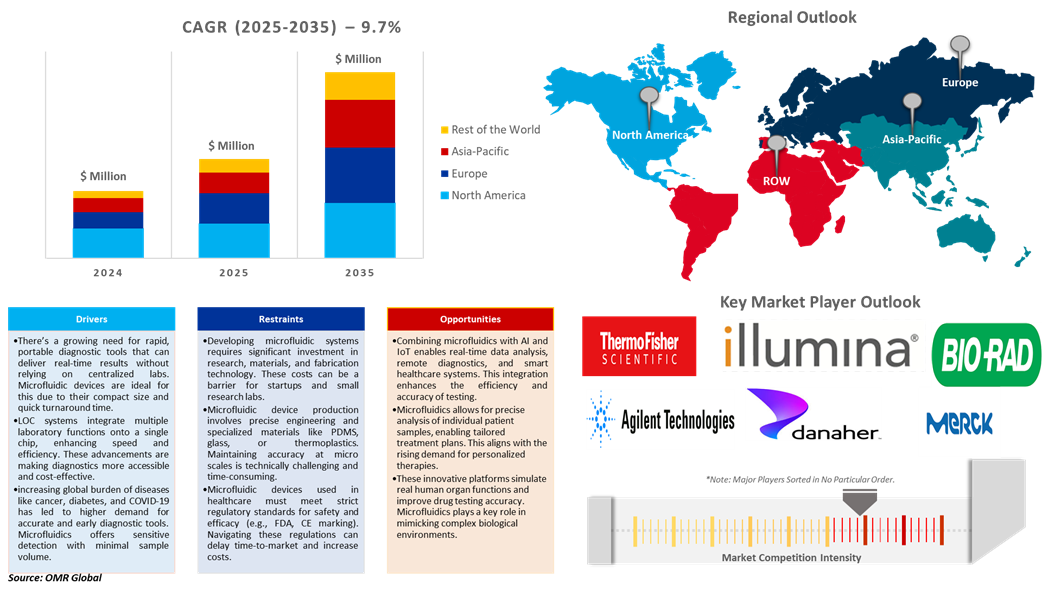

Microfluidics market was valued at $24,590 million in 2024 and is projected to reach $67,685 million by 2035, with a growing CAGR of 9.7% during the forecast period (2025-2035). Microfluidics are tools that can process micro or nano volumes of fluids to control chemical, biological, and physical changes. In recent years, research in microfluidics devices has risen significantly. The surge of usage of ICs in electronic devices has given significant growth to the microfluidics market globally. In the diagnosis industry, paper-based microfluidics is emerging as an effective multiplexable point-of-care platform. It has its potential application in the quantitative analysis of veterinary medicine, environmental monitoring, and food safety. Thus, it generates huge opportunities for market growth in the future. The complex regulatory standards are the major restraining factor for the global microfluidic market.

Market Dynamics

Rising Demand for Point-of-Care (POC) Diagnostics

The demand for point-of-care (POC) diagnostics has surged significantly in recent years, driven by the need for rapid, accessible, and user-friendly healthcare solutions. Microfluidic POC equipment can rapidly detect diseases at a low cost. This technology can be used to detect diseases in underdeveloped areas to reduce the effects of disease and improve the quality of life in these areas. Moreover, the process of analysis can be completely automated, eliminating human interference, preventing pollution, and allowing for efficient repeating of experiments. This capability is particularly valuable in managing infectious diseases, chronic illnesses, and emergency conditions where timely diagnosis can drastically impact treatment outcomes.

Microfluidics and Smart Technologies

The integration of microfluidics and emerging smart technologies, such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), into wearable devices offers great potential for accurate and non-invasive monitoring and diagnosis. Microfluidics has been incorporated into wearable sensors, allowing medical experts to continuously acquire specific high-quality data from patients. Combining microfluidic wearable sensors with other wearable technologies, such as gyroscopes, accelerometers, and temperature sensors, real-time bodily fluids can be analyzed with continuous tracking. These integrated devices offer high throughput, high sensitivity, and low power consumption. Wearable sensors that attach to the skin surface can measure temperature, heart rate, blood sugar, and other vitals more accurately than other wearables, making them an attractive option for monitoring health. Microfluidics can also be used for on-site therapy and precise delivery of drugs or pharmaceuticals.

Market Segmentation

- Based on the components, the market is segmented into microfluidic chips, micro pumps, microneedles, and other components (microfluidic actuators, microvalves, microchannels, microwells, and others).

- Based on the material, the market is segmented into polymer, silicon, glass, and other materials.

- Based on the application, the market is segmented into lab-on-a-chip, organs-on-chips, continuous flow microfluidics, optofluidics, acoustofluidics, electrophoresis, and others.

The Polymer Segment Held the Major Share in the Global Microfluidics Market

Based on material, the polymer segment holds the major share in the global microfluidics market. Polydimethylsiloxane (PDMS) is the most popularly used polymer in the market, however, it has hydrophobicity challenges associated with it that make it unfunctional in aqueous solutions. Novel PDMS is now introduced in the market as a solution to hydrophobicity problems. This material has ease of fabrication and is economically affordable which makes it popular. Glass is the second most popularly used material in the microfluidics market as it is an amorphous material. Additionally, it can work on elevated temperatures and organic solvents as well. For processing microfluidic devices made of glass photolithography and wet & dry etching methods are used.

The Lab-On-A-Chip Segment Held a Considerable Share of the Market

Based on application, the lab-on-a-chip segment held a considerable share in the market as it provides high-speed detection of DNA and RNA amplifications which makes it useful in the molecular biology industry. The organs-on-chips segment is expected to grow fastest during the forecast period as it can mimic various biological processes including peristalsis, infection, and breathing. These types of chips are widely used for the discovery of medical drugs. Various international institutions including NCATS, FDA, and NIH are now focusing the drug trials on human tissue chips rather than animal models for the welfare of animals.

Regional Outlook

The global microfluidics market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). The UK is the major contributor to the European microfluidics market. The increasing funding and advancement in technology are the major driving factors for the market in the region. For instance, MicrofluidX had received seed funding of $1.8 million from UKI2S, Longwall Ventures, and Cambridge Angels for the development of the microfluidic platform for gene and cell therapies economically.

North America Held the Major Share in the Global Microfluidics Market

North America held the major share of the global microfluidics market. The well-established healthcare system, increasing demand for PoC testing, growing academic & government investments in genomics & proteomics research, and the higher adoption of novel therapeutics among the general population are the major driving factors for the market growth in the region. The University of Illinois at Urbana-Champaign in 2020 had demonstrated a prototype of a rapid COVID-19 molecular test and an instrument to read results on mobile phones. North America is followed by Europe in terms of market share.

Market Players Outlook

The major companies serving the global microfluidics market include Agilent Technologies, Inc., Danaher Corp., Bio-Rad Laboratories, Inc., Merck KGaA, Illumina, Inc., Thermo Fisher Scientific, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In December 2024, Syensqo, partnered with Emulseo, for microfluidic technology. Under this agreement, Emulseo will include Syensqo’s advanced solution, Golden PFPE in its Fluo-Oil range of products to provide its customers with an essential component in creating reliable and performant droplet-based microfluidic analyses.

- In September 2023, InSphero announced that the company is making its 3D in vitro products available to researchers in the European Union market more easily by signing a distribution agreement with Darwin Microfluidics. Darwin Microfluidics offers expertise in biotechnology, microfluidics, lab-on-a-chip, and organ-on-chip technology.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microfluidics market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Microfluidics Market Sales Analysis – Component | Material | Application | ($ Million)

• Microfluidics Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Microfluidics Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Microfluidics Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Microfluidics Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Microfluidics Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For Global Microfluidics Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Microfluidics Market Revenue and Share by Manufacturers

• Microfluidics Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Thermo Fisher Scientific, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Agilent Technologies, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Merck KGaA

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Danaher Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Illumina, Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Microfluidics Market Sales Analysis by Component ($ Million)

5.1. Microfluidic Chips

5.2. Micropumps

5.3. Microneedles

5.4. Other Components (Microfluidic Actuators, Microvalves, Microchannels,

Microwells, and other)

6. Global Microfluidics Market Sales Analysis by Material ($ Million)

6.1. Polymer

6.2. Silicon

6.3. Glass

6.4. Other Materials

7. Global Microfluidics Market Sales Analysis by Application ($ Million)

7.1. Lab-on-a-chip

7.2. Organs-on-chips

7.3. Continuous Flow Microfluidics

7.4. Optofluidics

7.5. Acoustofluidics

7.6. Electrophoresis

8. Regional Analysis

8.1. North American Microfluidics Market Sales Analysis – Component | Material | Application | ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Microfluidics Market Sales Analysis – Component | Material | Application | ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Microfluidics Market Sales Analysis – Component | Material | Application | ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Microfluidics Market Sales Analysis – Component | Material | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Agilent Technologies, Inc.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. bioMérieux

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Bio-Rad Laboratories, Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. biosurfit SA

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Bruker Spatial Biology, Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Controlled Fluidics, LLC

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Danaher Corp.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Darwin Microfluidics.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Elveflow

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. F. Hoffmann-La Roche Ltd

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Fluidic Sciences

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Fluigent S.A.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Illumina, Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Merck KGaA

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. microfluidic ChipShop GmbH

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Micronit B.V.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. PerkinElmer

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Qiagen NV

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. RAN Biotechnologies, Inc.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Thermo Fisher Scientific, Inc.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. uFluidix Inc.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Unchained Labs.

1.1.1. Quick Facts

1.1.2. Company Overview

1.1.3. Product Portfolio

1.1.4. Business Strategies

1. Global Microfluidics Market Research And Analysis By Component, 2024-2035 ($ Million)

2. Global Microfluidic Chips Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Micro Pumps Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Microneedles Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Other Microfluidic Components Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Microfluidics Market Research And Analysis By Material, 2024-2035 ($ Million)

7. Global Polymer Microfluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Silicon Microfluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Glass Microfluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Other Microfluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Microfluidics Market Research And Analysis By Application, 2024-2035 ($ Million)

12. Global Lab-On-A-Chip Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Organs-On-Chips Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Continuous Flow Microfluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Optofluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Acoustofluidics Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Electrophoresis Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Microfluidics Market Research And Analysis By Geography, 2024-2035 ($ Million)

19. North American Microfluidics Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Microfluidics Market Research And Analysis By Component, 2024-2035 ($ Million)

21. North American Microfluidics Market Research And Analysis By Material, 2024-2035 ($ Million)

22. North American Microfluidics Market Research And Analysis By Application, 2024-2035 ($ Million)

23. European Microfluidics Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European Microfluidics Market Research And Analysis By Component, 2024-2035 ($ Million)

25. European Microfluidics Market Research And Analysis By Material, 2024-2035 ($ Million)

26. European Microfluidics Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Asia-Pacific Microfluidics Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific Microfluidics Market Research And Analysis By Component, 2024-2035 ($ Million)

29. Asia-Pacific Microfluidics Market Research And Analysis By Material, 2024-2035 ($ Million)

30. Asia-Pacific Microfluidics Market Research And Analysis By Application, 2024-2035 ($ Million)

31. Rest Of The World Microfluidics Market Research And Analysis By Country, 2024-2035 ($ Million)

32. Rest Of The World Microfluidics Market Research And Analysis By Component, 2024-2035 ($ Million)

33. Rest Of The World Microfluidics Market Research And Analysis By Material, 2024-2035 ($ Million)

34. Rest Of The World Microfluidics Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Microfluidics Market Share By Component, 2024 Vs 2035 (%)

2. Global Microfluidic Chips Market Region By Geography, 2024 Vs 2035 (%)

3. Global Micro Pumps Market Region By Geography, 2024 Vs 2035 (%)

4. Global Microneedles Market Region By Geography, 2024 Vs 2035 (%)

5. Global Other Microfluidic Components Market Region By Geography, 2024 Vs 2035 (%)

6. Global Microfluidics Market Share By Material, 2024 Vs 2035 (%)

7. Global Polymer Microfluidics Market Region By Geography, 2024 Vs 2035 (%)

8. Global Silicon Microfluidics Market Region By Geography, 2024 Vs 2035 (%)

9. Global Glass Microfluidics Market Region By Geography, 2024 Vs 2035 (%)

10. Global Other Microfluidics Market Region By Geography, 2024 Vs 2035 (%)

11. Global Microfluidics Market Share By Application, 2024 Vs 2035 (%)

12. Global Lab-On-A-Chip Market Region By Geography, 2024 Vs 2035 (%)

13. Global Organs-On-Chips Market Region By Geography, 2024 Vs 2035 (%)

14. Global Continuous Flow Microfluidics Market Region By Geography, 2024 Vs 2035 (%)

15. Global Optofluidics Market Region By Geography, 2024 Vs 2035 (%)

16. Global Acoustofluidics Market Region By Geography, 2024 Vs 2035 (%)

17. Global Electrophoresis Market Region By Geography, 2024 Vs 2035 (%

18. Global Microfluidics Market Share By Geography, 2024 Vs 2035 (%)

19. US Microfluidics Market Size, 2024-2035 ($ Million)

20. Canada Microfluidics Market Size, 2024-2035 ($ Million)

21. UK Microfluidics Market Size, 2024-2035 ($ Million)

22. France Microfluidics Market Size, 2024-2035 ($ Million)

23. Germany Microfluidics Market Size, 2024-2035 ($ Million)

24. Italy Microfluidics Market Size, 2024-2035 ($ Million)

25. Spain Microfluidics Market Size, 2024-2035 ($ Million)

26. Rest Of Europe Microfluidics Market Size, 2024-2035 ($ Million)

27. India Microfluidics Market Size, 2024-2035 ($ Million)

28. China Microfluidics Market Size, 2024-2035 ($ Million)

29. Japan Microfluidics Market Size, 2024-2035 ($ Million)

30. South Korea Microfluidics Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Microfluidics Market Size, 2024-2035 ($ Million)

32. Latin America Microfluidics Market Size, 2024-2035 ($ Million)

33. Middle East and Africa Microfluidics Market Size, 2024-2035 ($ Million)

FAQS

The size of the Microfluidics market in 2024 is estimated to be around $24,590 million.

North American holds the largest share in the Microfluidics market.

Leading players in the Microfluidics market include Agilent Technologies, Inc., Danaher Corp., Bio-Rad Laboratories, Inc., Merck KGaA, Illumina, Inc., Thermo Fisher Scientific, Inc., and others.

Microfluidics market is expected to grow at a CAGR of 9.7% from 2025 to 2035.

The Microfluidics Market is growing due to rising demand for point-of-care diagnostics, miniaturized lab technologies, and advancements in drug delivery and healthcare research.