Microprinting Market

Global Microprinting Market Size, Share & Trends Analysis Report by Type (Monochrome Microprinting and Color Microprinting), By Substrate Type (Paper, Plastic, and Metal), By End-User (BFSI, Packaging, Government, Education, Healthcare, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global Microprinting market is projected to grow at a significant CAGR of over 5% during the forecast period. The market growth is mainly driven by the increasing application of microprinting in the BFSI sector due to the policies and regulations in the industry and growing government initiatives for enhancement of security printing techniques coupled with increasing document forging across the globe. For instance, in 2018, around 1,000 fake travel documents were detected at Dubai International Airport by Dubai's General Directorate of Residency & Foreign Affairs (GDRFA). These cases of document forging increase the demand of microprinting in government applications that further contribute to the microprinting market growth.

Counterfeiting practices are particularly rampant in passports, identity cards, postage stamps, banknotes, stock certificates, and product authentication. Microprinting prevents tampering and forgery of the aforementioned instruments. The key end-user verticals in the microprinting industry include BFSI, passport industry, personal ID industry, birth certificates issuing, driving license industry, and ticketing industry.

Segmental Outlook

The global microprinting market is classified on the basis of type, substrate type, and end-user. Based on type, the market is bifurcated into monochrome microprinting and color microprinting. The color microprinting segment is projected to have a significant share in the market due to the high adoption of color microprinting in banknotes and stamps.

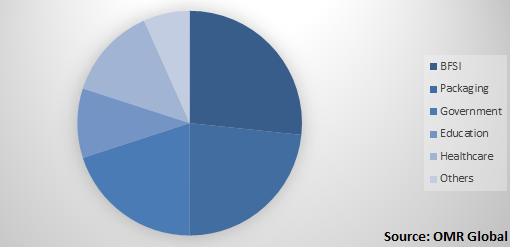

Based on the substrate type, the market is further divided into paper, plastic, and metal. The paper substrate for microprinting is expected to hold a significant share in the market due to the growing inclination towards paper-based printing technologies owing to its high performance and cost-effectiveness. On the basis of application, the market is segregated into BFSI, packaging, government, education, healthcare, and others (corporate).

Global Microprinting Market Share by Application, 2018(%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global microprinting market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Canon Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. HP Development Co. L.P.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Matica Technologies AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Videojet Technologies, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Xerox Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Microprinting Market by Type

5.1.1. Monochrome

5.1.2. Color

5.2. Global Microprinting Market by Substrate Type

5.2.1. Paper

5.2.2. Plastic

5.2.3. Metal

5.3. Global Microprinting Market by End-User

5.3.1. BFSI

5.3.2. Packaging

5.3.3. Government

5.3.4. Education

5.3.5. Healthcare

5.3.6. Others (Corporate)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Brady Corp.

7.2. Canon Inc.

7.3. Control Print Ltd.

7.4. Data Carte Concepts Inc.

7.5. Domino Printing Sciences PLC

7.6. Evolis

7.7. HP Development Company, L.P.

7.8. Matica Technologies AG

7.9. Ricoh Company, Ltd.

7.10. SAFEChecks

7.11. Source Technologies

7.12. The Flesh Co.

7.13. Trelleborg AB

7.14. Videojet Technologies, Inc.

7.15. William Frick & Co.

7.16. Xeikon, a division of Flint Group

7.17. Xerox Corp.

7.18. Zebra Technologies Corp.

1. GLOBAL MICROPRINTING MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL MONOCHROME MICROPRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL COLOR MICROPRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MICROPRINTING MARKET RESEARCH AND ANALYSIS BY SUBSTRATE TYPE, 2018-2025 ($ MILLION)

5. GLOBAL PAPER MICROPRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL PLASTIC MICROPRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL METAL MICROPRINTING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL MICROPRINTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

9. GLOBAL MICROPRINTING IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL MICROPRINTING IN PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL MICROPRINTING IN GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL MICROPRINTING IN EDUCATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL MICROPRINTING IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL MICROPRINTING IN OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL MICROPRINTING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. NORTH AMERICAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY SUBSTRATE TYPE, 2018-2025 ($ MILLION)

19. NORTH AMERICAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

20. EUROPEAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

22. EUROPEAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY SUBSTRATE TYPE, 2018-2025 ($ MILLION)

23. EUROPEAN MICROPRINTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC MICROPRINTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC MICROPRINTING MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC MICROPRINTING MARKET RESEARCH AND ANALYSIS BY SUBSTRATE TYPE, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC MICROPRINTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

28. REST OF THE WORLD MICROPRINTING MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

29. REST OF THE WORLD MICROPRINTING MARKET RESEARCH AND ANALYSIS BY SUBSTRATE TYPE, 2018-2025 ($ MILLION)

30. REST OF THE WORLD MICROPRINTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL MICROPRINTING MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL MICROPRINTING MARKET SHARE BY SUBSTRATE TYPE, 2018 VS 2025 (%)

3. GLOBAL MICROPRINTING MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL MICROPRINTING MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

7. UK MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD MICROPRINTING MARKET SIZE, 2018-2025 ($ MILLION)