Motor Monitoring Market

Motor Monitoring Market Size, Share & Trends Analysis Report by Offerings (Hardware, and Software and Services), by Deployment (Cloud-Based and On-Premises), and by End-Users (Automotive, Oil and Gas, Power Generation, Metal and Mining, and Others) Forecast Period (2025-2035)

Industry Overview

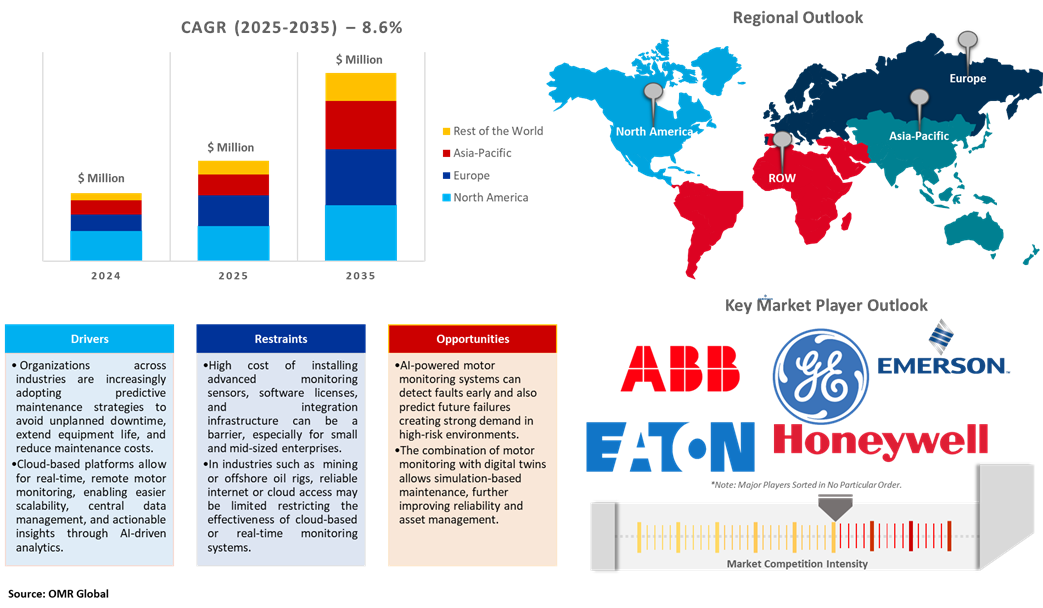

Motor monitoring market was valued at $2,485 million in 2024 and is projected to reach $6,110 million by 2035, growing at a CAGR of 8.6% from 2025 to 2035. The motor monitoring industry's growth is driven by the increasing industrial automation, boom in cloud computing, demand for condition monitoring, government pushes for industry 4.0, and growth of AI, ML, and cloud platforms. In May 2023, OMRON Corporation planned to launch its K7DD-PQ Series of advanced motor condition monitoring devices, starting in March 2023 in Japan and then globally in April 2023. The series was the latest addition to OMRON’s condition monitoring devices that automate the monitoring of abnormalities on the manufacturing site in place of human workers. The K7DD-PQ numerically tracks trends in the deterioration and wear of servomotors, machine tools, and other equipment, to reduce inspection effort and prevent unexpected failure.

Market Dynamics

Integration with Digital Twin Technology

Electric machines play a key role in modern society, especially in industrial operations. It is used as the driving force for pumps, fans, compressors, conveyor belts, electric vehicles, and other devices, electric machines are responsible for consuming the total energy generated globally. Among these machines, the induction motor is the most widely used in industry. Induction motors are subjected to mechanical stress (e.g., vibration), thermal (heat), and electromagnetic stresses during operation. In the absence of proper maintenance, the motor progressively wears out, and, eventually, a disruptive failure occurs. The technology of monitoring systems has been positively affected by the emerging concept of digital twins. In practice, faults are found by combining condition monitoring for the rotor with fault analysis using the physical, and digital twin of the rotor. Companies such as ANSYS and GE engineers built simulation-based digital twins to monitor the maximum temperature and torque of the turbine’s motor coils to save time and money in the operation of offshore wind turbines.

Increasing Government Investment and Digital Infrastructure

Government initiatives to modernize industrial operations are playing a pivotal role in driving the demand for advanced motor monitoring systems. According to the International Trade Administration (ITA), Japan’s strong focus on upgrading its manufacturing sector is emerging as a significant macroeconomic driver for this market. As part of its FY2022 budget (April 2022 – March 2023), the Japanese government allocated $1.62 billion to support SMEs in modernizing manufacturing equipment, developing digital infrastructure, and improving operational efficiency. These incentives can boost demand for condition monitoring and predictive maintenance systems, including motor monitoring technologies. Moreover, Japanese manufacturing companies alone spent $890 million on digital infrastructure, a figure projected to rise to $4.1 billion by 2030, reflecting rapid digital transformation. This shift is crucial in improving manufacturing productivity and aligns with the increasing need for smart motor monitoring systems that support data-driven maintenance and energy optimization.

Market Segmentation

- Based on the Offerings, the market is segmented into hardware, software, and services.

- Based on the Deployment, the market is segmented into cloud-based and on-premises.

- Based on the end-user, the market is segmented into automotive, oil and gas, power generation, metal and mining, and others.

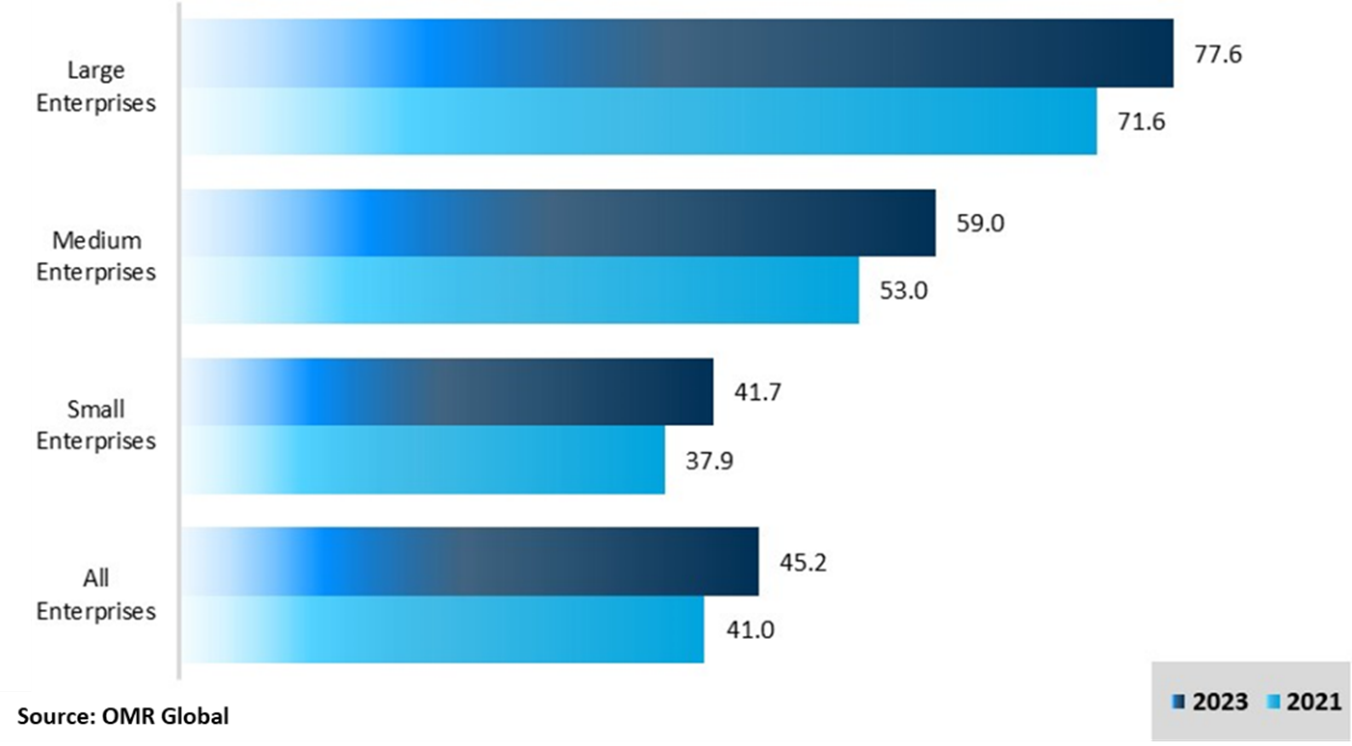

Cloud-Based Motor Monitoring Segment to Lead the Market with the Largest Share

The rising adoption of cloud computing services across European Union (EU) enterprises is acting as a key enabler for the growth of the cloud-based motor monitoring market. In 2023, 45.2% of EU enterprises utilized cloud computing services, marking a 4.2% point increase from 2021. While cloud usage initially focused on basic functions such as email hosting and data storage, a significant 75.3% of cloud-using enterprises have now transitioned toward more sophisticated services such as hosting enterprise databases, deploying security applications, and utilizing computing platforms for application development and analytics. This shift reflects a broader trend where enterprises prefer accessing scalable, third-party computing power over investing in and maintaining their IT infrastructure. Modern motor monitoring platforms offer cloud-based condition monitoring, AI-powered analytics, and remote diagnostics, which align well with the cloud-first strategies of European businesses. Moreover, cloud infrastructure supports seamless fleet-wide motor monitoring, allowing companies to track motor performance across distributed facilities through centralized dashboards enhancing predictive maintenance capabilities and minimizing downtime.

Enterprises Buying Cloud Computing Services, EU, 2021 and 2023 (%)

Metal and Mining: A Key Segment in Market Growth

Mining companies are under increasing pressure to improve overall equipment effectiveness and utilize existing assets, requiring condition monitoring to enhance reliability. When implemented correctly, these types of solutions provide substantial benefits, with production rates increased by 5%-8%. Implementing condition monitoring technologies for electric motors enhances overall equipment effectiveness. Emerson’s condition monitoring solutions help mining, metals, and minerals operations, and improve the reliability of its critical assets. For instance, Arabian Cement Company (ACC) deployed Emerson’s AMS 6500 Online Machinery Health Monitor, enabling 24/7 real-time monitoring of the gearbox. This solution allowed the mill to operate safely for 17 days, after which the system detected a worsening condition, prompting a timely shutdown. Inspection revealed a total bearing cage failure, but damage was minimized. The system prevented catastrophic failure and also helped optimize maintenance schedules and reduce unplanned downtime, demonstrating the value of continuous motor health monitoring in the metals and mining sector.

Regional Outlook

The global motor monitoring market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Automotive Industry in China

The growing automotive industry in China fuels the demand for motor monitoring solutions. It ensures optimal performance, reduces unplanned downtime, and enhances equipment reliability across production lines. According to the European Union, in 2022, the EU automotive industry’s domestic value added for non-EU consumers reached $82.8 billion, reflecting a 54% increase since 2010. The scale and pace of production require reliable, high-performance electric motors in assembly lines, robotics, and material handling systems. This further amplifies the demand for cloud-connected, sensor-driven motor monitoring technologies.

North America Region Dominates the Market with Major Share

Among all regions, North America is expected to hold a significant market share during the forecast period owing to an increase in demand for electric vehicles and rising investment in infrastructure development in various end-user industries. According to Internal Energy Agency (IEA), in the US, new electric car registrations totalled 1.4 million in 2023, increasing by more than 40% compared to 2022. This surge in EV adoption results in higher demand for electric motors and, consequently, for real-time motor condition monitoring solutions to ensure optimal performance, prevent breakdowns, and enhance energy efficiency.

Market Players Outlook

The major companies operating in the motor monitoring market include ABB Group, Eaton Corp., Emerson Electric Co., General Electric Co., and Honeywell International, Inc. among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In October 2024, Siemens launched SIMOCODE M-CP, a motor management product series, specially tailored for motor control centers (MCC). The new product series complements the existing SIMOCODE portfolio and is designed to optimally meet the requirements of motor control centers.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global motor monitoring market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Motor Monitoring Market Sales Analysis – Offerings | Deployment | End-Users ($ Million)

• Motor Monitoring Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Motor Monitoring Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Motor Monitoring Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Motor Monitoring Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Motor Monitoring Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Motor Monitoring Market Revenue and Share by Manufacturers

• Motor Monitoring Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. ABB Group

4.3.1.1. Overview

4.3.1.2. Product Portfolio

4.3.1.3. Financial Analysis (Subject to Data Availability)

4.3.1.4. SWOT Analysis

4.3.1.5. Business Strategy

4.3.2. Eaton Corp.

4.3.2.1. Overview

4.3.2.2. Product Portfolio

4.3.2.3. Financial Analysis (Subject to Data Availability)

4.3.2.4. SWOT Analysis

4.3.2.5. Business Strategy

4.3.3. Emerson Electric Co.

4.3.3.1. Overview

4.3.3.2. Product Portfolio

4.3.3.3. Financial Analysis (Subject to Data Availability)

4.3.3.4. SWOT Analysis

4.3.3.5. Business Strategy

4.3.4. General Electric Co.

4.3.4.1. Overview

4.3.4.2. Product Portfolio

4.3.4.3. Financial Analysis (Subject to Data Availability)

4.3.4.4. SWOT Analysis

4.3.4.5. Business Strategy

4.3.5. Honeywell International, Inc.

4.3.5.1. Overview

4.3.5.2. Product Portfolio

4.3.5.3. Financial Analysis (Subject to Data Availability)

4.3.5.4. SWOT Analysis

4.3.5.5. Business Strategy

4.4. Top Winning Strategies by Market Players

4.4.1. Merger and Acquisition

4.4.2. Product Launch

4.4.3. Partnership And Collaboration

5. Global Motor Monitoring Market Sales Analysis by Offerings ($ Million)

5.1. Hardware

5.2. Software and Services

6. Global Motor Monitoring Market Sales Analysis by Deployment ($ Million)

6.1. Cloud-Based

6.2. On-Premises

7. Global Motor Monitoring Market Sales Analysis by End-Users ($ Million)

7.1. Automotive

7.2. Oil and Gas

7.3. Power Generation

7.4. Metal and Mining

7.5. Others

8. Regional Analysis

8.1. North American Motor Monitoring Market Sales Analysis – Offerings | Deployment | End-Users |Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Motor Monitoring Market Sales Analysis – Offerings | Deployment | End-Users |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Motor Monitoring Market Sales Analysis – Offerings | Deployment | End-Users |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Motor Monitoring Market Sales Analysis – Offerings | Deployment | End-Users |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Advanced Technology Services, Inc.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Balluff GmbH

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Banner Engineering Corporation

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Iris Power LP

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. KCF Technologies, Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Mitsubishi Electric Corp.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. National Instruments Corp.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. NVMS

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. NXP Semiconductors

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. OMRON Corporation

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Parker Hannifin Corp

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Phase IV Engineering, Inc.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Rockwell Automation, Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Schneider Electric SE

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Siemens AG

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. SKF

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. TE Connectivity

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. TMEIC

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Turck India Automation Pvt. Ltd.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. WEG Group

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

1. Global Motor Monitoring Market Research And Analysis By Offerings, 2024-2035 ($ Million)

2. Global Motor Monitoring Hardware Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Motor Monitoring Software And Services Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Motor Monitoring Market Research And Analysis By Deployment, 2024-2035 ($ Million)

5. Global Cloud-Based Motor Monitoring Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global On-Premises Motor Monitoring Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Motor Monitoring Market Research And Analysis By End-User, 2024-2035 ($ Million)

8. Global Motor Monitoring For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Motor Monitoring For Oil And Gas Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Motor Monitoring For Power Generation Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Motor Monitoring For Metal And Mining Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Motor Monitoring For Other Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Motor Monitoring Market Research And Analysis By Region, 2024-2035 ($ Million)

14. North American Motor Monitoring Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Motor Monitoring Market Research And Analysis By Offerings, 2024-2035 ($ Million)

16. North American Motor Monitoring Market Research And Analysis By Deployment, 2024-2035 ($ Million)

17. North American Motor Monitoring Market Research And Analysis By End-User, 2024-2035 ($ Million)

18. European Motor Monitoring Market Research And Analysis By Country, 2024-2035 ($ Million)

19. European Motor Monitoring Market Research And Analysis By Offerings, 2024-2035 ($ Million)

20. European Motor Monitoring Market Research And Analysis By Deployment, 2024-2035 ($ Million)

21. European Motor Monitoring Market Research And Analysis By End-User, 2024-2035 ($ Million)

22. Asia-Pacific Motor Monitoring Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Asia-Pacific Motor Monitoring Market Research And Analysis By Offerings, 2024-2035 ($ Million)

24. Asia-Pacific Motor Monitoring Market Research And Analysis By Deployment, 2024-2035 ($ Million)

25. Asia-Pacific Motor Monitoring Market Research And Analysis By End-User, 2024-2035 ($ Million)

26. Rest Of The World Motor Monitoring Market Research And Analysis By Country, 2024-2035 ($ Million)

27. Rest Of The World Motor Monitoring Market Research And Analysis By Offerings, 2024-2035 ($ Million)

28. Rest Of The World Motor Monitoring Market Research And Analysis By Deployment, 2024-2035 ($ Million)

29. Rest Of The World Motor Monitoring Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Motor Monitoring Market Share By Offerings, 2024 Vs 2035 (%)

2. Global Motor Monitoring Hardware Market Share By Region, 2024 Vs 2035 (%)

3. Global Motor Monitoring Software And Services Market Share By Region, 2024 Vs 2035 (%)

4. Global Motor Monitoring Market Share By Deployment, 2024 Vs 2035 (%)

5. Global Cloud-Based Motor Monitoring Market Share By Region, 2024 Vs 2035 (%)

6. Global On-Premises Motor Monitoring Market Share By Region, 2024 Vs 2035 (%)

7. Global Motor Monitoring Market Share By End-User, 2024 Vs 2035 (%)

8. Global Motor Monitoring For Automotive Market Share By Region, 2024 Vs 2035 (%)

9. Global Motor Monitoring For Oil And Gas Market Share By Region, 2024 Vs 2035 (%)

10. Global Motor Monitoring For Power Generation Market Share By Region, 2024 Vs 2035 (%)

11. Global Motor Monitoring For Metal And Mining Market Share By Region, 2024 Vs 2035 (%)

12. Global Motor Monitoring For Other Market Share By Region, 2024 Vs 2035 (%)

13. Global Motor Monitoring Market Share By Region, 2024 Vs 2035 (%)

14. US Motor Monitoring Market Size, 2024-2035 ($ Million)

15. Canada Motor Monitoring Market Size, 2024-2035 ($ Million)

16. UK Motor Monitoring Market Size, 2024-2035 ($ Million)

17. France Motor Monitoring Market Size, 2024-2035 ($ Million)

18. Germany Motor Monitoring Market Size, 2024-2035 ($ Million)

19. Italy Motor Monitoring Market Size, 2024-2035 ($ Million)

20. Spain Motor Monitoring Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Motor Monitoring Market Size, 2024-2035 ($ Million)

22. India Motor Monitoring Market Size, 2024-2035 ($ Million)

23. China Motor Monitoring Market Size, 2024-2035 ($ Million)

24. Japan Motor Monitoring Market Size, 2024-2035 ($ Million)

25. South Korea Motor Monitoring Market Size, 2024-2035 ($ Million)

26. Australia and New Zealand Motor Monitoring Market Size, 2024-2035 ($ Million)

27. ASEAN Motor Monitoring Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Motor Monitoring Market Size, 2024-2035 ($ Million)

29. Rest Of The World Motor Monitoring Market Size, 2024-2035 ($ Million)

FAQS

The size of the Motor Monitoring market in 2024 is estimated to be around $2,485 million.

North America holds the largest share in the Motor Monitoring market.

Leading players in the Motor Monitoring market include ABB Group, Eaton Corp., Emerson Electric Co., General Electric Co., and Honeywell International, Inc. among others.

Motor Monitoring market is expected to grow at a CAGR of 8.6% from 2025 to 2035.

The motor monitoring market is driven by rising adoption of predictive maintenance, IoT integration, and demand for energy-efficient operations.