Nicotine Pouches Market

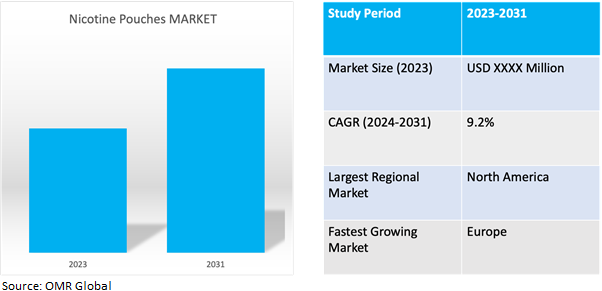

Nicotine Pouches Market Size, Share & Trends Analysis Report by Type (Flavoured and Unflavoured), by Product (Tobacco Derived and Synthetic), and by Distribution Channel (Online and Offline) Forecast Period (2024-2031)

Nicotine pouches market is anticipated to grow at a considerable CAGR of 9.2% during the forecast period (2024-2031). Nicotine Pouches refers to the industry encompassing the production, distribution, and consumption of nicotine pouch products globally. Nicotine pouches are a relatively new category of tobacco-free oral products containing nicotine, flavourings, and other ingredients and are designed to provide a smoke-free and discreet alternative to traditional tobacco products such as cigarettes and chewing tobacco.

Market Dynamics

Rapid Growth and Strategic Moves: The Evolution of the Nicotine Pouch Market

The market for nicotine pouches has experienced significant growth in recent years, driven by factors such as increasing awareness of the health risks associated with smoking, changing consumer preferences towards smokeless alternatives, and innovations in product formulations and marketing strategies. For instance, in May 2022, In May 2022, Philip Morris finalized an agreement to purchase Swedish Match, a prominent European manufacturer of oral nicotine pouches, that has been reported a sum of $16.0 billion. The acquisition entails Swedish Match accepting a cash offer of SEK106 ($9.98) per share, equating to an overall valuation of approximately SEK 161.2 billion ($15.2 billion). This strategic acquisition represents a substantial step for Philip Morris into the oral nicotine pouch market, poised to enhance the company's standing within the industry.

The Rising Growth of Flavored Nicotine Pouches

The expansion of flavoured nicotine pouches offers an array of enticing flavours, from traditional mint and menthol to exotic fruit and spice, appealing to a broad spectrum of consumers. Flavours play a crucial role in masking the bitterness of nicotine, making the pouches more enjoyable for new and experienced users alike. Additionally, flavoured options enhance the overall user experience, contributing to consumer satisfaction and brand loyalty. With regulatory environments often more lenient compared to unflavoured tobacco products, manufacturers capitalize on this opportunity to differentiate their brands and meet the growing demand for variety and personalization among modern consumers. For instance, in November 2023, Health Canada approved Imperial Tobacco Canada Ltd., for the sale of flavoured nicotine pouches, under conditions allowing legal distribution to individuals of any age, including children, and without imposition of advertising restrictions.

Market Segmentation

Our in-depth analysis of the global nicotine pouches market includes the following segments by type, product, and distribution channel:

- Based on type, the market is sub-segmented into flavoured and unflavoured.

- Based on product, the market is sub-segmented into tobacco derived and synthetic.

- Based on distribution channel, the market is sub-segmented into online and offline.

Tobacco Derived is Projected to Emerge as the Largest Segment

Based on the product, the global nicotine pouches market is sub-segmented into tobacco derived and synthetic. Among these, the tobacco derived sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth is the high familiarity and acceptance of tobacco-derived nicotine among consumers. Tobacco-derived nicotine pouches often provide a sensation similar to traditional tobacco products, making them more appealing to consumers who are transitioning from smoking or seeking an alternative nicotine delivery method. Additionally, some consumers perceive tobacco-derived nicotine as a more natural option compared to synthetic nicotine. For instance, in November 2020, British American Tobacco plc. completed the acquisition of Dryft Sciences, LLC (Dryft), a US-based company specializing in Modern Oral products, thus expanding its modern oral portfolio in the United States. This strategic acquisition significantly broadened British American Tobacco plc.'s product offerings from 4 to 28 variants, providing nicotine users with an extensive range of doses and flavours. The expanded portfolio is designed to cater to diverse customer preferences and trends, ensuring accessibility to a comprehensive selection of nicotine pouch options.

Flavoured Sub-segment to Hold a Considerable Market Share

The flavoured sub-segment holds the major market share due to a wide variety of flavour options, ranging from fruity to minty and many other flavours that offer varied taste preferences for consumers. Beyond merely masking the bitterness of nicotine, these flavours elevate the overall user experience, fostering greater enjoyment and sustained product usage. Moreover, flavoured nicotine pouches serve as a gateway for new users, easing the transition into smoke-free alternatives and expanding the market reach. From a strategic standpoint, the provision of diverse flavours enables manufacturers to carve out distinct brand identities, fostering consumer loyalty amidst a competitive landscape. This market segment's prominence reflects a growing consumer demand for variety, innovation, and enhanced product accessibility in the realm of nicotine pouches.

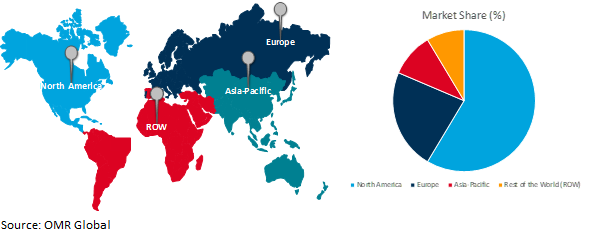

Regional Outlook

The global nicotine pouches market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European Investment Surge: The Rising Tide of Nicotine Pouches in Response to Health Consciousness

European countries are increasingly investing in the global nicotine pouches market due to the growing demand for smoke-free alternatives to traditional tobacco products, driven by heightened health consciousness among consumers, there is a ripe market for nicotine pouches. The regulatory environment in Europe is evolving to support harm reduction strategies, making it more conducive for the sale and distribution of nicotine pouches compared to conventional tobacco products. For instance, UK nicotine pouches have been driven by factors such as increasing awareness of alternative nicotine products, shifting consumer preferences, and the desire to quit or reduce smoking and many consumers in Germany are turning to nicotine pouches as a potentially less harmful alternative to traditional tobacco products. The market has seen a growing emphasis on health and wellness aspects, including products labelled as "nicotine-free" or with reduced levels of harmful substances.

Global Nicotine Pouches Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to increasing consumer awareness of the health risks associated with traditional tobacco products such as demand for smoke-free alternatives, with nicotine pouches and also has benefited from a regulatory environment that is relatively favourable towards harm reduction strategies, facilitating market entry and growth. For instance, in January 2021, Rush unveiled its introduction of non-tobacco oral nicotine pouches in the US market, offering two widely favoured strengths of 3mg or 7mg, along with an enticing selection of four distinct flavours: mint-sanity, waterblast, cinabuzz, and citrus.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global nicotine pouches market include Philip Morris Products S.A., Imperial Brands Plc, Bat, Altria Group, Inc., Haypp Group and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in June 2023, Imperial Brands, a global tobacco and nicotine business, announced the acquisition of a range of nicotine pouches from TJP Labs, marking its entry into the US modern oral market. The acquisition will enable ITG Brands, Imperial’s US operation, to offer American consumers 14 product variants known for their strong performance in consumer testing. The range will be relaunched in 2024 under a new brand, supported by ITG Brands' US sales force. TJP Labs will continue to manufacture the pouches under contract for ITG Brands. The transaction, valued at £65 ($82.1) million initially with additional deferred sums, aligns with Imperial's focus on next-generation products and capital allocation policy. Imperial aims to expand its next-generation product offerings in the US market and foster a long-term partnership with TJP Labs.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global nicotine pouches market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Philip Morris Products S.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Imperial Brands PLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. British American Tobacco (BAT)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Nicotine Pouches Market by Type

4.1.1. Flavored

4.1.2. Unflavored

4.2. Global Nicotine Pouches Market by Product

4.2.1. Tobacco Derived

4.2.2. Synthetic

4.3. Global Nicotine Pouches Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Altria Group, Inc.

6.2. GN Tobacco Sweden AB

6.3. Gotlandssnus AB

6.4. HAYPP Group

6.5. House of Smoke, Inc.

6.6. Japan Tobacco Inc.

6.7. NextGen Laboratories

6.8. Nicopods ehf.

6.9. Nordic Snus AB

6.10. ON! Nicotine Pouches (Northerner Scandinavia Inc.)

6.11. Skruf Snus AB (Skruf)

6.12. Snusdaddy

6.13. Swedish Match AB

6.14. Swisher International Group Inc.

6.15. Triumph Tobacco Alternatives LLC

6.16. Vapor Tobacco Manufacturing, LLC

6.17. Velo GmbH (Velo)

1. GLOBAL NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL FLAVORED NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL UNFLAVORED NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

5. GLOBAL TOBACCO DERIVED NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SYNTHETIC NICOTINE POUCHESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

8. GLOBAL NICOTINE POUCHES ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NICOTINE POUCHES OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

14. NORTH AMERICAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL,2023-2031 ($ MILLION)

15. EUROPEAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

18. EUROPEAN NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

23. REST OF THE WORLD NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. REST OF THE WORLD NICOTINE POUCHES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL NICOTINE POUCHES MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL FLAVORED NICOTINE POUCHES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL UNFLAVORED NICOTINE POUCHES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL NICOTINE POUCHES MARKET SHAREBY PRODUCT, 2023 VS 2031 (%)

5. GLOBAL TOBACCO DERIVED NICOTINE POUCHES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SYNTHETIC NICOTINE POUCHESMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL NICOTINE POUCHES MARKET SHARE BY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

8. GLOBAL NICOTINE POUCHES FOR ONLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL NICOTINE POUCHES FOR OFFLINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NICOTINE POUCHES MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

13. UK NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA NICOTINE POUCHES MARKET SIZE, 2023-2031 ($ MILLION)